Graphene Battery Market Report Scope & Overview:

The Graphene Battery Market Size was estimated at USD 149.35 Million in 2023 and is expected to arrive at USD 1120.07 Million by 2032 with a growing CAGR of 25.09% over the forecast period 2024-2032. This report provides a unique perspective on the Graphene Battery Market by analyzing production output trends across key regions, market utilization rates, and R&D investments driving innovation. It offers insights into export/import dynamics, highlighting trade flows and regional dependencies. The study also examines supply chain efficiency and raw material availability, crucial for scaling up graphene battery production. Additionally, it explores technological advancements in energy storage, emerging strategic partnerships, and government policy impacts on commercialization. A special focus is given to pilot projects and real-world applications, offering a forward-looking view of market adoption.

To Get more information on Graphene Battery Market - Request Free Sample Report

Graphene Battery Market Dynamics

Drivers

-

The growing EV demands high-performance, fast-charging, and durable batteries, making graphene batteries a key solution for enhanced energy storage.

The growing demand for electric vehicles (EVs) is a major driver for the graphene battery market, as the shift toward sustainable mobility requires advanced energy storage solutions. The widely used conventional lithium-ion batteries have drawbacks like slow charging, limited longevity, and thermal instability. Graphene batteries/ Graphene batteries have emerged as a solid alternative with greater energy density, super-fast charging, and increased longevity. These benefits lend themselves well to EV applications due to increased driving range and reduced charging times. With governments worldwide calling for stricter emissions regulations and offering incentives to adopt EVs, automakers are investing in next-generation battery technologies. At the same time, the emergence of self-sufficient and low-emission EV fleets adds to the demand for dependable and high-efficiency energy storage capabilities. By overcoming major issues related to manufacturing and energy density, and with the growing energy and research efforts from leading companies, the commercialization of graphene batteries for EVs will be accelerating the global shift towards electric mobility.

Restraint

-

The high production cost of graphene batteries is due to complex manufacturing processes, expensive raw materials, and a lack of large-scale production infrastructure.

The high production costs of graphene batteries stem from the complex and resource-intensive manufacturing processes required to produce high-quality graphene. Traditional production methods, such as chemical vapor deposition (CVD) and exfoliation, are costly, labour-intensive, and demand specialized machinery, posing challenges with large-scale manufacturing. Moreover, incorporation of graphene as battery electrodes requires complex processing which also adds to the cost. Sufficiently high-purity graphene with consistent structured properties must also be used, further adding to the cost of the fabrication process. Unlike conventional lithium-ion batteries, which will take advantage of established production infrastructure, graphene batteries are still too costly to be commercially viable on a large scale. Absence of mass production facilities and economies of scale exacerbates the affordability. That limits the ability of manufacturers to make a competitive market for graphene batteries in price-sensitive industries, including consumer electronics and electric vehicles. Nevertheless, with intensive research into cost-effective synthesis methods, including the reduction of graphene oxide and advanced mechanisms of electrode fabrication, prices may fall and the further advancement in commercialization could be achieved in the future.

Opportunities

-

Graphene batteries' lightweight, high-energy density, and thermal stability make them ideal for electric aviation, UAVs, and space applications.

The expansion of graphene batteries in electric aviation and space applications is driven by their lightweight nature, high energy density, and superior performance compared to traditional lithium-ion batteries. In aerospace, weight reduction is key to increasing fuel efficiency and extending flight range. With low mass, graphene batteries are perfect energy storage systems for electric planes, drones, and unmanned aerial vehicle (UAV) applications. Furthermore, their fast charging capabilities and thermal stability make them suitable for performance at higher altitudes, where conditions can cause adverse effects on batteries. In addition, the use of graphene batteries in space applications would provide with durability, longevity, reliable power supply for satellites and deep-space missions. Adding to their allure is their resistance to radiation and capability to function in inhospitable environments. With ongoing developments in the field of graphene battery technology, space and aerospace industries are predicted to embrace these energy storage solutions for longer flight durations, better safety measures, and enhanced operational performance.

Challenges

-

Limited awareness of graphene batteries' benefits and high costs hinder their widespread adoption across industries.

Limited awareness and adoption of graphene batteries remain significant challenges, as many industries and consumers are still unfamiliar with their advantages over traditional lithium-ion batteries. Graphene batteries have superior energy density, shorter charging times, lower self-heating effect, longer lifespan, better yield and recharge conditions, yet they should only be temporarily used, states the firm. Limited Education Around Graphene, As a new and advanced material, the benefits of graphene are not widely known among businesses and end-users, resulting in reluctance to invest in and utilize it. Moreover, due to the high production cost and being less available compared to the traditional vaccine, it is still slow to penetrate the market. Without significant educational outreach, marketing efforts, and demonstrable benefits for the long term, industries are likely to remain reliant on traditional battery solutions. It calls for awareness campaigns, partnerships with research institutions, and pilot projects shared with real-world examples for overcoming this. They may be adopted more quickly in electric cars, consumer electronics, and renewable energy storage as knowledge about graphene batteries increases.

Graphene Battery Market Segmentation Analysis

By Type

The Lithium-ion Graphene Battery segment dominated with a market share of over 52% in 2023, due to its extensive use in electric vehicles (EVs), consumer electronics, and energy storage systems. High energy density, high conductivity, and fast-charging performance make these batteries suitable for the energy demands of today. Because graphene technology further improves thermal management, cycle life, and overall efficiency of lithium-ion batteries, these improved properties provide a way for higher lithium-ion battery market penetration in high-performance applications. Market growth is supported by the increasing demand for renewable energy storage solutions and electric vehicles (EVs). Also, the advancements in battery technology and reducing production skills help in maintaining the missile's share. The maintainers of the lithium-ion graphene battery market share, continue with the ongoing investments in R&D and large-scale production.

By Application

The Automotive segment dominated with a market share of over 32% in 2023, due to the growing demand for high-performance, fast-charging, and durable batteries in electric vehicles (EVs). As the world moves towards more sustainable means of transportation, EV manufacturers are looking for cutting-edge energy storage solutions that improve efficiency and range. Its additional active surface area for interaction leads to greater conductivity, higher energy density, and faster charging times, ideal for use in today's electric vehicles. Still, these batteries offer better thermal management, making them less prone to overheating and providing them a long life. Improved graphene battery technology will enable lighter, more compact power sources, further enhancing the overall performance of vehicles. With government and automakers fueling the EV race, graphene batteries are ushering in the future of electric mobility.

Graphene Battery Market Regional Outlook

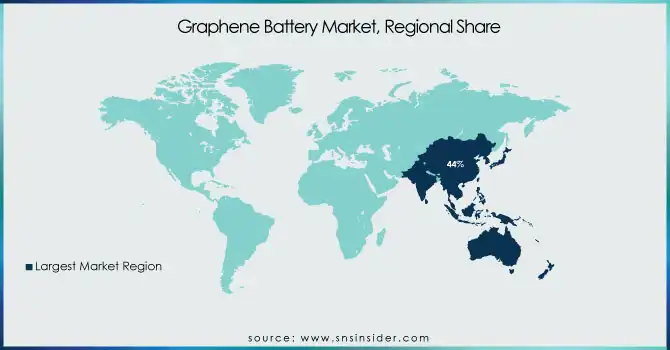

Asia-Pacific region dominated with a market share of over 44% in 2023, primarily due to the strong presence of industries such as consumer electronics, electric vehicles (EVs), and energy storage. Countries like China, Japan, and South Korea are ahead in graphene research and technological developments, as well as large-scale battery production. There are significant government initiatives in place in China for graphene-based energy solutions, in addition to extensive supply chain support, making them a strong competitor in the space. Japan and South Korea also play a role via extensive R&D and partnerships with battery makers. Its market leadership is bolstered by high demand for the company's technologies in the utility and automotive sectors, with the rapid industrialization of the region and investments in generation next energy storage technologies. Asia-Pacific leads the group in the total graphene battery industry, as its applications grow in EVs and renewable energy storage.

Europe is experiencing rapid growth in the graphene battery market due to its strong focus on sustainable energy solutions, government incentives for electric vehicles, and advancements in battery technology. Countries like Germany, the U.K., and France, which are driving research, innovation, and the widespread implementation of graphene-based energy storage systems. Supportive policies and substantial investment in renewable energy projects are also fostering market growth. Europe is already leading the way with technological breakthroughs and industrialization as the demand for efficient and environmentally-friendly batteries soars. With the proactive measures taken by the region, along with government regulations supporting their development, the integration of graphene batteries is becoming popular among electric vehicles and renewable energy systems, hence being the fastest-growing market in the segment.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Graphene Battery Market

-

Graphenea Group (Graphene Oxide, Reduced Graphene Oxide)

-

Huawei Technologies Co., Ltd. (Graphene-enhanced Lithium-ion Batteries)

-

XG Sciences, Inc. (XG Leaf Graphene Nanoplatelets for Batteries)

-

Targray Group (Graphene Battery Materials, Conductive Additives)

-

Nanotech Energy (Graphene Supercapacitors, Graphene Batteries)

-

Vorbeck Materials Corp. (Vor-x Graphene Conductive Inks, Energy Storage Solutions)

-

Hybrid Kinetic Group Ltd. (Graphene-based EV Batteries)

-

Graphene NanoChem (Graphene-based Energy Storage Materials)

-

Log 9 Materials Scientific Private Limited (Rapid Charging Graphene Batteries, Aluminum Fuel Cells)

-

Cabot Corporation (Graphene-based Conductive Additives for Lithium-ion Batteries)

-

Samsung SDI (Next-Gen Graphene-enhanced Li-ion Batteries)

-

Grabat Graphenano Energy (Graphenano Grabat Batteries)

-

Global Graphene Group (Graphene-enhanced Li-ion Batteries, Nanocarbons)

-

Nanotek Instruments, Inc. (Graphene-based Supercapacitors, Hybrid Energy Storage)

-

ZEN Graphene Solutions Ltd. (Graphene-based Battery Anodes, Conductive Coatings)

-

Talga Group Ltd. (Talnode-C Graphene Battery Anode Materials)

-

First Graphene Ltd. (PureGRAPH Graphene Additives for Batteries)

-

Skeleton Technologies (Graphene-based Supercapacitors)

-

Real Graphene USA (Graphene Power Banks, Fast-charging Graphene Batteries)

-

Northern Graphite Corporation (Graphene-based Anode Materials for Lithium-ion Batteries)

Suppliers for (Graphene-assisted lithium-ion batteries with improved heat resistance and longer lifespan) on the Graphene Battery Market

-

Samsung SDI Co., Ltd.

-

Huawei Technologies Co., Ltd.

-

Log 9 Materials

-

Cabot Corporation

-

Grabat Graphenano Energy

-

Nanotech Energy

-

XG Sciences, Inc.

-

Global Graphene Group

-

Vorbeck Materials Corp.

-

Graphenea Group

RECENT DEVELOPMENT

In December 2023: Nanotech Energy announced plans to launch its 150 MW graphene battery production plant in California, U.S., by early 2024. This initiative aims to strengthen the company's market presence in the graphene battery industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 149.35 Million |

| Market Size by 2032 | USD 1120.07 Million |

| CAGR | CAGR of 25.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Lithium-ion Graphene Battery, Graphene Supercapacitor, Lithium Sulphur Graphene Battery, Others • By Application (Automotive, Consumer Electronics, Power, Industrial Robotics, Aerospace & Defense, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Graphenea Group, Huawei Technologies Co., Ltd., XG Sciences, Inc., Targray Group, Nanotech Energy, Vorbeck Materials Corp., Hybrid Kinetic Group Ltd., Graphene NanoChem, Log 9 Materials Scientific Private Limited, Cabot Corporation, Samsung SDI, Grabat Graphenano Energy, Global Graphene Group, Nanotek Instruments, Inc., ZEN Graphene Solutions Ltd., Talga Group Ltd., First Graphene Ltd., Skeleton Technologies, Real Graphene USA, Northern Graphite Corporation. |