Induction Furnace Market Report Scope & Overview:

Get a Sample Report on Induction Furnace Market - Request Free Sample Report

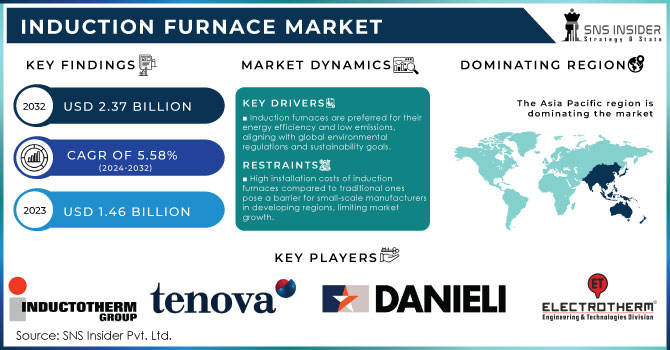

The Induction Furnace Market Size was esteemed at USD 1.46 billion in 2023 and is supposed to arrive at USD 2.37 billion by 2032 with a growing CAGR of 5.58% over the forecast period 2024-2032.

The induction furnace market is characterized by its innovative approach to melting and refining metals using electromagnetic induction. This technology relies on alternating current to produce a magnetic field, which generates heat within the metal itself, allowing for efficient and precise melting. Induction furnaces can reach melting temperatures of up to 1,600 degrees Celsius, making them particularly suitable for steelmaking and the production of non-ferrous metals. One of the key advantages of induction furnaces is their energy efficiency; they can operate at up to 90% energy efficiency, significantly lower than the typical efficiency rates of traditional melting methods such as electric arc furnaces or gas-fired furnaces, which can reach only about 60-70% efficiency. Additionally, the induction heating process minimizes emissions, with studies showing that it can reduce greenhouse gas emissions by up to 30% compared to conventional methods.

This environmentally friendly aspect is crucial as industries increasingly focus on sustainability and regulatory compliance. The versatility of induction furnaces allows them to handle a variety of materials, including ferrous and non-ferrous metals, scrap metal, and alloys. They can also be adapted for different melting capacities, catering to small-scale operations with capacities as low as 25 kg and large-scale production needs exceeding several tons per batch. The ability to recycle scrap metal efficiently enhances their appeal, with estimates suggesting that induction furnaces can recycle up to 90% of scrap material. As industries evolve, the demand for induction furnaces is expected to grow, driven by advancements in technology and increasing applications in sectors such as automotive and aerospace. Notably, smart manufacturing and Industry 4.0 principles are influencing the market, with manufacturers integrating automation and data analytics into their melting processes to enhance efficiency. Overall, the induction furnace market is positioned for growth, aligning with modern production demands and sustainability goals.

Induction Furnace Market Dynamics

DRIVERS

-

Induction furnaces are favored for their energy efficiency and low emissions, aligning with global environmental regulations and sustainability goals in industries like metalworking and steel production.

Induction furnaces have become a preferred choice for industries due to their superior energy efficiency and lower carbon emissions compared to traditional furnace technologies like electric arc furnaces (EAFs) and gas-fired furnaces. These furnaces use electromagnetic induction to heat metals, which significantly reduces energy waste and provides precise temperature control, resulting in faster melting times and minimized heat loss. This energy efficiency is especially crucial as global industries strive to reduce operational costs and carbon footprints in line with increasingly stringent environmental regulations.

Governments and environmental bodies across the world are implementing stricter emission regulations to curb industrial pollution. The European Union’s Emissions Trading System (EU ETS) and China's carbon neutrality goal by 2060 are pushing industries to adopt cleaner technologies. Induction furnaces, which generate minimal emissions compared to other methods, are gaining favor as industries work to comply with such regulations. Additionally, their lower energy consumption contributes to reduced operational costs, making them an attractive long-term investment for manufacturers. According to a report from the International Energy Agency (IEA), the global industrial sector accounted for over 24% of CO₂ emissions in 2022, with the metal and steel production sectors being major contributors. Induction furnaces, which can reduce energy consumption by up to 30%, are viewed as a critical solution to decarbonize these sectors. As global pressures to achieve net-zero emissions intensify, industries are likely to continue shifting toward induction furnace technologies for both environmental and economic benefits.

-

Advancements in furnace technology, like enhanced automation, IoT-enabled monitoring, and advanced temperature control, are driving market growth by improving efficiency, reducing costs, and enhancing quality control.

Advancements in Furnace Technology have played a crucial role in driving the growth of the induction furnace market. Continuous innovation, such as enhanced automation and the integration of IoT-enabled monitoring systems, has significantly improved the efficiency and effectiveness of furnace operations. Automation reduces the reliance on manual labor, streamlining processes and minimizing errors, which in turn helps industries save on labor costs. IoT-enabled monitoring allows real-time tracking of furnace performance, energy consumption, and process parameters, leading to predictive maintenance, reduced downtime, and overall optimization of production cycles.

Moreover, advancements in temperature control systems have greatly improved the precision of melting and alloying processes. This precision not only enhances the quality of the final products but also reduces material wastage. For example, modern induction furnaces can achieve temperature variations within ±1°C, making them ideal for industries that demand stringent metallurgical specifications, such as automotive and aerospace sectors. Studies have shown that automated induction furnaces can boost operational efficiency by up to 30%, while IoT integration has been linked to a reduction of unplanned downtime by 15-20%.

These technological innovations are also in line with growing environmental and energy efficiency standards. Automated systems help optimize energy consumption, reducing greenhouse gas emissions and contributing to sustainable production practices. As industries continue to focus on achieving high-quality output while cutting operational costs, advancements in induction furnace technology will remain a critical driver of market growth and competitiveness.

RESTRAIN

-

The high installation and setup costs of induction furnaces compared to traditional furnaces pose a significant barrier for small-scale manufacturers in developing regions, hindering market growth.

High Initial Investment Costs represent a significant challenge in the adoption of induction furnaces, particularly for small-scale manufacturers and industries in developing regions. The installation and setup costs for these advanced melting systems can be considerably higher than those associated with traditional furnaces, such as cupola or gas-fired furnaces. The expense includes not only the furnace itself but also associated equipment, electrical infrastructure, and safety systems. For example: the cost of a medium-sized induction furnace can range from USD 100,000 to USD 500,000, whereas traditional furnaces may be significantly cheaper, often requiring investments below USD 100,000.

This financial barrier can deter small manufacturers from transitioning to induction furnaces, as they often operate on tighter budgets and may prioritize immediate operational costs over long-term efficiency gains. Furthermore, the financial constraints are exacerbated in developing regions, where access to capital can be limited. Many small manufacturers may lack the resources for upfront investment, which restricts their ability to adopt advanced technologies that could enhance productivity and reduce energy consumption. Consequently, this reluctance can stall the overall growth of the induction furnace market. To alleviate these financial burdens, some companies offer financing solutions or leasing options, but the need for substantial upfront capital remains a critical barrier. Addressing these high initial investment costs is essential to encourage broader adoption of induction furnace technology across various sectors.

Induction Furnace Market Segmentation Overview

By Type

The Coreless Induction Furnace segment dominated the market share over 62.05% in 2023, primarily due to its versatility and efficiency in handling a variety of materials. Coreless induction furnaces are especially popular in foundries for melting metals, offering the ability to quickly heat and melt ferrous and non-ferrous materials. Their design allows for faster melting times and reduced energy consumption, making them cost-effective and environmentally friendly. With advancements in technology, coreless induction furnaces are becoming increasingly efficient, further solidifying their position in the market.

By Capacity

The 1-100 Ton segment dominated the market share over 42.05% in 2023. This capacity range is particularly favored in steel and metal foundries, where the demand for medium-sized furnaces remains strong. Highlighting its versatility and efficiency in melting a variety of metals, including steel and aluminum. The ability to handle large batches while maintaining consistent temperatures makes these furnaces a preferred choice among manufacturers.

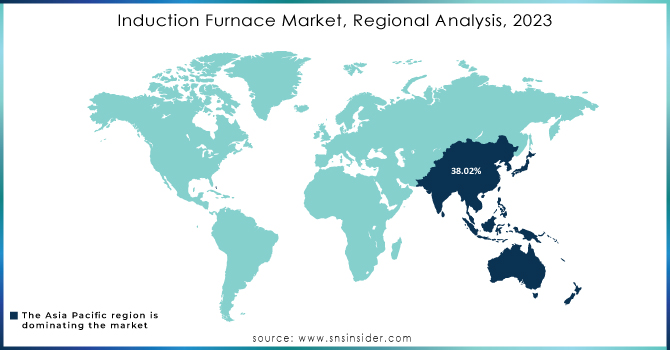

Induction Furnace Market Regional Analysis

Asia-Pacific region dominated the market share over 38.02% in 2023. China produces over 50% of the world’s steel, with India ranking second in steel and emerging as a leader in aluminum production. Australia is also a key contributor to global metal exports. This industrial prowess, combined with the region’s expanding infrastructure and automotive sectors, fuels demand for induction furnaces. Political backing, such as China’s Belt and Road Initiative, further enhances the region’s metal processing capabilities. In India, increased investments in manufacturing and metal refineries are bolstering the induction furnace market, with the country’s aluminum production growing at a significant pace to meet domestic and global demand.

North America is witnessing a consistent rise in induction furnace adoption, primarily due to its industrial sectors. The U.S. automotive industry produced nearly 10 Billion vehicles in 2022, each requiring high volumes of metal components, often smelted using induction technology. Similarly, the aerospace sector, which contributes over USD150 billion annually to the U.S. economy, relies on precise and energy-efficient metal melting processes. The push for sustainability is also evident, as regulations like the U.S. Clean Air Act drive industries to lower emissions, promoting the use of cleaner furnace technologies. While energy-efficient, the initial cost of induction furnace setups remains a challenge, though innovations in automation and smart furnace systems are helping mitigate this issue.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Induction Furnace Market

Some of the major key players of Induction Furnace Market

-

Electrotherm (Induction Melting Furnaces)

-

Danieli Group (Induction Furnaces for Steel Plants)

-

SMS Elotherm GmbH (Induction Hardening Systems)

-

Meltech Ltd (Induction Heating and Melting Furnaces)

-

Tenova SpA (Induction Melting Furnaces for Metals)

-

Doshi Technologies Pvt. Ltd (Induction Melting Furnaces)

-

IHI Machinery and Furnace Co., Ltd (Induction Heating Equipment)

-

JP Steel Plantech Co. (Induction Heating and Melting Systems)

-

ECM Technologies(Vacuum Induction Melting Furnaces)

-

Agni Electrical Pvt. Ltd (Induction Melting and Heating Systems)

-

Pees Induction Equipment’s Pvt. Ltd (Induction Melting Furnaces)

-

Magnalenz (Induction Melting Furnaces)

-

Inductotherm Group (Induction Melting and Heating Furnaces)

-

Amelt Corporation (Induction Melting Furnaces for Metals)

-

ABP Induction Systems GmbH (Coreless and Channel Induction Furnaces)

-

Radyne Corporation (Induction Heating and Melting Solutions)

-

Nabertherm GmbH (Induction Melting and Heating Furnaces)

-

EGES (Induction Melting Furnaces for Foundries)

-

OTTO Junker GmbH (Induction Melting and Casting Systems)

-

Shiva Electrical Engineering Co. (Induction Melting Furnaces)

List of Suppliers

-

Thermtronix Corporation

-

EFD Induction

-

Ambrell Corporation

-

Fuji Electric Co., Ltd

-

Ajax TOCCO Magnethermic Corporation

-

Inductoheat Inc.

-

SAFED Combustion Solutions

-

Pioneer Furnaces Pvt. Ltd

-

Modtech Engineering

-

Mittal Engineering Industries

RECENT DEVELOPMENT

-

In 2024: Tenova Goodfellow Inc. launched a new induction furnace model focused on sustainability and energy efficiency. This new technology is designed to decrease carbon emissions in the metal processing sector.

-

In 2024: Dongkuk Steel Mill entered into an agreement with Tenova Goodfellow Inc., a subsidiary of Tenova renowned for pioneering sustainable solutions for the green transition in the metals industry. This contract encompasses the provision and installation of Tenova’s NextGen System aimed at enhancing furnace efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.46 billion |

| Market Size by 2032 | USD 2.37 billion |

| CAGR | CAGR of 5.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Coreless Induction Furnace, Channel Induction Furnace) • By Capacity (Up To 1 Ton, 1-100 Ton, More Than 100 Ton) • By End Use (Steel, Aluminum, Copper,Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Electrotherm, Danieli Group, SMS Elotherm GmbH, Meltech Ltd, Tenova SpA, Doshi Technologies Pvt. Ltd, IHI Machinery and Furnace Co., Ltd, JP Steel Plantech Co., ECM Technologies, Agni Electrical Pvt. Ltd, Pees Induction Equipment’s Pvt. Ltd, Magnalenz, Inductotherm Group, Amelt Corporation, ABP Induction Systems GmbH, Radyne Corporation, Nabertherm GmbH, EGES, OTTO Junker GmbH, Shiva Electrical Engineering Co. |

| Key Drivers | • Induction furnaces are favored for their energy efficiency and low emissions, aligning with global environmental regulations and sustainability goals in industries like metalworking and steel production. • Advancements in furnace technology, like enhanced automation, IoT-enabled monitoring, and advanced temperature control, are driving market growth by improving efficiency, reducing costs, and enhancing quality control. |

| RESTRAINTS | • The high installation and setup costs of induction furnaces compared to traditional furnaces pose a significant barrier for small-scale manufacturers in developing regions, hindering market growth. |