Liquid Packaging Market Report Scope & Overview:

Get E-PDF Sample Report on Liquid Packaging Market - Request Sample Report

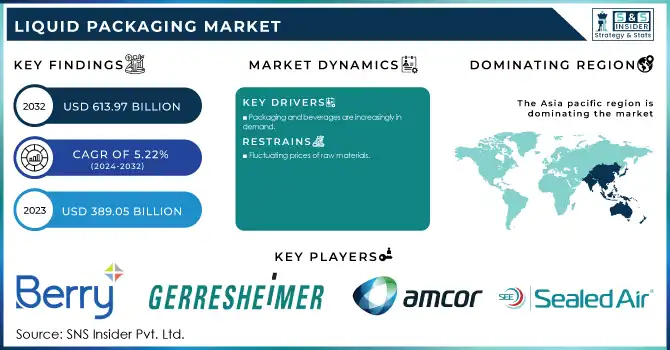

The Liquid Packaging Market was valued at USD 389.05 billion in 2023 and is expected to reach USD 613.97 billion by 2032 and grow at a CAGR of 5.22% during the forecast period.

Technological developments in the packaging industry are expected to be a major factor that will boost growth of the liquid packaging market over the forecast period. In addition, the growth of the liquids market is projected to be fuelled by attractive brand presentation with innovative packaging types. In addition, in order to mitigate the growth of the liquid packaging market, the cost efficiency is further estimated.

The biggest segment, with more than 80% of the world's market share in 2022, is rigid liquid packaging. In order to package a wide variety of liquids, including beverages, food products and personal care products, rigid liquid packaging is used.

Flexible packaging, with its advantages of lightness, portability and durability, is a segment experiencing the highest growth rate. A number of liquids, such as beverages, foodstuffs and pharmaceuticals, are packed in flexible liquid packaging.

MARKET DYNAMICS

KEY DRIVERS:

-

Packaging and beverages are increasingly in demand

The demand for the liquid packaging is being driven by growing consumption of beverages such as water, juices, soft drinks and alcohol.

-

In order to ensure the secure transportation and storage of liquid products, an increase in online shopping and home delivery services is creating a demand for packaging

RESTRAIN:

-

Fluctuating prices of raw materials

Raw materials used to make liquid packaging, such as petroleum and plastics, are subject to frequent fluctuations in prices. The profitability for liquid packaging manufacturers may be affected.

-

The liquid packaging is often made of plastic, which is a nonbiodegradable material. This issue is a major concern for the environment, which has resulted in an increase in regulations on use of plastics packaging

OPPORTUNITY:

-

In emerging markets, increasing demand for liquids packaging

Emerging markets, like Asia Pacific and Latin America, are experiencing a rapid increase in demand for fluid packaging. This is mainly due to the increased disposable incomes and growth of urbanisation in these regions.

-

The demand for liquid packaging is being fueled by the growth of the online food delivery services market

CHALLENGES:

-

Stringent government regulations to reduce the use of plastic is a major challenge for liquid packaging manufacturers

IMPACT OF RUSSIAN UKRAINE WAR

Severe economic sanctions, including a ban on US oil imports from Russia, were imposed during the outbreak of the war. After touching $100 a barrel very quickly, the price of oil is now rising and it's obvious that turpentine prices are going up.

In March, PE suppliers increased prices by 4 cents a pound and are anticipating another increase of 6 cents in the second quarter of 2022. In addition, the suppliers of PP increased their prices in pounds by up to 10 cents per pound with a further possible increase of 4 cents for Q2 2022. The disruption of the supply chain, which has caused large quantities of plastic to be stored on pallets awaiting export, is continuing to create bottlenecks in shipping channels. The recent increase in pallet prices is merely making the existing astronomical shipping costs worse, and resin manufacturers are suffering from this pressure.

The price of paper was around 70,000 per tonne before the war broke out in Ukraine in February, and now it's around 1,00,000 per tonne. As Trade Economics has reported, a strong rise in aluminium and paper was observed as well. By 4 March, the price of aluminium had been as low as US$2,885 a tonne before the start of the conflict in late February and it was already climbing to USD$3,825.2, up by almost 40% since then.

IMPACT OF ONGOING RECESSION

Developing countries, like the US and Europe, are expected to be hardest hit by the recession. Inflation and interest rates are increasing in these countries, which is affecting consumer expenditure and business investment.

The demand for liquid packaging in the food and beverages sector is projected to increase by a compound annual growth rate of 5.2 % over the forecast period. But, given the recession, it is estimated that this growth will be below last year's. During the forecast period, demand for fluid packaging in the pharmaceutical sector is projected to increase at a compound annual growth rate of 6.5%. In view of the fact that the pharmaceutical industry is considered recession proof, this growth is expected to be relatively resilient in times of economic downturn.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Metal

-

Glass

-

Paperboard

-

Others

By Packaging Type

-

Flexible

-

Rigid

By Packaging Technology

-

Blow Molding

-

Form Fill Seal Technology

-

Aseptic Liquid Technology

By End User

-

Food & Beverages

-

Pharmaceutical

-

Personal Care

-

Industrial

-

Others

REGIONAL ANALYSIS

The Asia Pacific region accounts for more than 40% of the world's liquid packaging market in 2023. The growth of the Liquid Packaging Market in this region can be attributed to increased demand for packaging goods and beverages, a rise in disposable incomes along with increasing urbanization. Due to the rising usage of liquids in food and beverages, Asia Pacific accounts for a major part of the Liquid Packaging Market. In addition, the growth of the region's packaging market will continue to be supported by an increasing use of carton packs in industry and institutional applications as well as ease of raw material availability when they are made into boxes for liquids.

The North American market accounts for over 30% of global liquid packaging volume in 2023 and ranks as the second largest. The increasing demand for convenient and ready to eat liquid foods in the region, as well as e.g., a growing online commerce sector, rising disposable income are expected to drive growth of the regional packaging market.

Europe, accounting for more than 20% of the global market share in 2023, is the 3rd largest liquid packaging market. The rising demand for green packaging solutions, as well as an increase in the market for delivery of food by electronic means, is underpinning the growth of the liquid packaging market in this region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Liquid Packaging market are Berry Global Group Inc, Gerresheimer AG, Amcor Plc, Sealed Air Corporation, Constantia Flexibles, Sonoco Products Company, Proampac LLC, Mondi Plc, Reynolds Group Holdings Ltd, Smurfit Kappa Group Plc and other players.

RECENT DEVELOPMENT

-

UFlex, an Indian flexible packaging producer has announced that it plans to double the capacity of its aseptic liquid bottle plant in Sanand, Gujarat. The capacity of the plant is increased from 3.5 billion to 7 billion packs per year through this project.

| Report Attributes | Details |

| Market Size in 2023 | US$ 389.05 Bn |

| Market Size by 2032 | US$ 613.97 Bn |

| CAGR | CAGR of 4.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Metal, Glass, Paperboard, Others) • by Packaging Type (Flexible, Rigid) • by Packaging Technology (Blow Molding, Form Fill Seal Technology, Aseptic Liquid Technology) • by End User (Food & Beverages, Pharmaceutical, Personal Care, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Berry Global Group Inc, Gerresheimer AG, Amcor Plc, Sealed Air Corporation, Constantia Flexibles, Sonoco Products Company, Proampac LLC, Mondi Plc, Reynolds Group Holdings Ltd, Smurfit Kappa Group Plc |

| Key Drivers | • Packaging and beverages are increasingly in demand • In order to ensure the secure transportation and storage of liquid products, an increase in online shopping and home delivery services is creating a demand for packaging. |

| Key Restraints | • Fluctuating prices of raw materials • The liquid packaging is often made of plastic, which is a nonbiodegradable material. This issue is a major concern for the environment, which has resulted in an increase in regulations on use of plastics packaging. |