Vehicles Intelligence Battery Sensor Market Size & Trends:

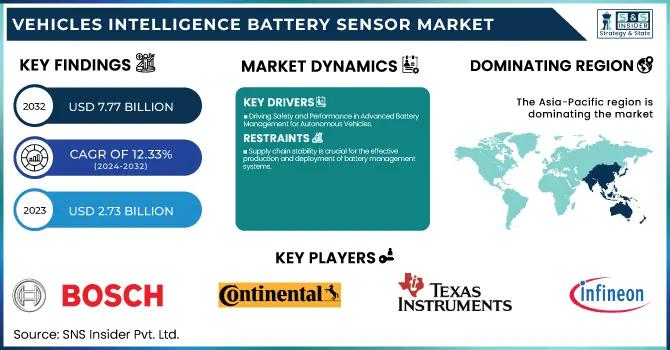

The Vehicles Intelligence Battery Sensor Market Size was valued at USD 2.73 Billion in 2023 and is expected to reach USD 7.77 Billion by 2032, growing at a CAGR of 12.33% from 2024-2032. This growth is attributed to the growing adoption rates of electric vehicles (EVs), which require sophisticated battery management systems to improve performance and ensure safety. Further, increasing investitures in innovative battery technologies for research and development enhances the market growth. Additionally, strict vehicle emissions and safety standards are also increasing manufacturers' stand for advance battery sensor solution, fueling demand in the market.

To Get more information on Vehicles Intelligence Battery Sensor Market - Request Free Sample Report

Vehicles Intelligence Battery Sensor Market Dynamics:

Drivers:

-

Driving Safety and Performance in Advanced Battery Management for Autonomous Vehicles

The emergence and growth potential of autonomous driving technologies has led to a surge in the popularity of battery management. To support autonomous vehicle performance and safety, these automobiles have been integrated into sensor technologies using dynamic designs tailored to minimize drag and increase energy efficiency. According to research, the integration of sensor technologies is critical to the development of self-driving cars. Waymo is actively testing fully autonomous vehicles in several U.S. cities. Autonomous vehicles can also play a significant role in reducing the high number of accidents that are human-induced. Companies are working tirelessly to develop advanced sensors to make batteries more efficient and autonomous. With humans accounting for a staggering 93% of most accidents, intelligent vehicle integrated systems can help significantly reduce the accident rate. The Insurance Institute for Highway Safety estimates that crashes and injuries can be reduced by 33% with system reductions to crash rates and energy supply. Furthermore, innovative sensor integration, including optical mouse sensors in vehicle navigation, illustrates the potential for improved accuracy and functionality within battery management systems. As the demand for autonomous vehicles continues to rise, the need for advanced battery sensors becomes increasingly vital to meet performance and safety standards.

Restraints:

-

Supply chain stability is crucial for the effective production and deployment of battery management systems.

The battery management market is increasingly vulnerable to supply chain disruptions, which can significantly impact its growth and stability. This market relies on various critical components and materials, such as lithium, cobalt, and nickel, which are essential for battery production. Shortages of these materials, often exacerbated by geopolitical tensions, trade restrictions, and the ongoing effects of global pandemics, can lead to production delays and increased costs. Manufacturers face the challenge of securing a stable supply of these essential resources while navigating fluctuating market prices. Additionally, disruptions in logistics and transportation further complicate the timely delivery of components. As demand for advanced battery management systems grows, addressing these supply chain vulnerabilities will be crucial for sustaining market momentum and ensuring the reliability of battery technologies.

Opportunities:

-

The potential for advancements in electric vehicle cybersecurity and battery longevity presents significant opportunities for enhancing vehicle safety and sustainability.

The rapid adoption of electric vehicles (EVs) not only transforms the automotive landscape but also creates significant market opportunities in cybersecurity and battery management. With the growing involvement of EVs in complex digital ecosystems, addressing cybersecurity measures to protect vehicle safety and user privacy becomes paramount. 83% of charging stations run modified software and lack proper security updates, highlighting the vulnerability of charging infrastructure to cyberattacks and the need for advanced security solutions. Standardized security frameworks such as ISO 27001 compliance have led to an 84% reduction in successful breaches, presenting a unique opportunity for cybersecurity firms to develop solutions specifically for the EV sector. With consumers focusing more on connectivity and battery performance, businesses that address these two needs will find themselves in a position of strength as the EV market continues to grow.

Challenges:

-

The Impact of Battery Degradation on Electric Vehicle Performance and Longevity

Battery degradation in electric vehicles significantly impacts performance, as it is influenced by factors such as temperature fluctuations, charging habits, and driving patterns. Over time, these factors can lead to reduced efficiency and diminished range, limiting the vehicle's overall functionality and convenience for users. For instance, extreme temperatures can accelerate the chemical reactions within the battery, leading to faster wear and tear. Additionally, poor charging habits, such as frequent fast charging or deep discharges, can further exacerbate degradation. As a result, compromised safety may also arise, as the integrity of the battery diminishes. Understanding these effects is crucial for optimizing battery management strategies and ensuring the longevity and reliability of electric vehicles in the long term.

Vehicles Intelligence Battery Sensor Market Segmentation Outlook:

By Vehicle Type

The passenger cars segment dominated the Vehicle Battery Management Market in 2023, capturing approximately 69% of the total revenue. This significant share highlights the increasing demand for advanced battery technologies as consumers seek enhanced performance, safety, and efficiency in personal transportation. With the rapid adoption of electric vehicles (EVs) and the integration of smart technologies, the need for effective battery management systems has become crucial. These systems ensure optimal battery performance, longevity, and safety by monitoring factors such as state of charge, temperature, and health. Moreover, the shift towards more environmentally friendly vehicles and stringent regulations regarding emissions are driving innovations in battery management solutions. As the automotive industry continues to evolve, the passenger cars segment is poised for sustained growth, bolstered by technological advancements and consumer preferences.

The commercial vehicle segment is poised to be the fastest-growing sector in the Vehicle Intelligence Battery Sensor Market during the forecast period from 2024 to 2032. The growing demand for advanced solutions for battery management systems in commercial vehicles is a direct result of a growing need for better safety measures as well as more improved levels of efficiency and battery life. Due to the growing need to maximize fleet performance and reduce operational costs for companies, intelligent battery sensor integration is essential. Battery monitoring is now possible with these sensors which can real-time check battery health, optimize charging cycles, and extend battery life.

By Technology

The Hall-Effect sensor segment is poised to dominate The Vehicle Intelligence Battery Sensor Market, accounting for approximately 59% of the market share in 2023. These sensors play a crucial role in measuring the current flowing through the battery, enabling accurate monitoring of battery performance and efficiency. Employing the Hall-Effect principle, such sensors are capable of sensing magnetic fields and translating them into electrical signals that can be monitored as live data for battery health. This feature is critical in optimizing battery management systems, enhancing safety, and prolonging battery life. As electric vehicles gain popularity and prisons need properly implemented battery management systems, Hall-Effect sensors are set to lead the sector, enabling enhancements to the intelligence and performance of the vehicles.

The MEMS (Micro-Electro-Mechanical Systems) sensor segment is the fastest-growing sector in the vehicle intelligence battery sensor market, projected to experience significant expansion from 2024 to 2032. MEMS sensors offer several advantages, including miniaturization, high sensitivity, and enhanced accuracy, making them ideal for monitoring various battery parameters such as temperature, voltage, and current. As the automotive industry shifts towards more advanced battery management systems to support the growing demand for electric vehicles, the adoption of MEMS technology is expected to rise. These sensors facilitate better performance tracking and predictive maintenance, contributing to improved efficiency and safety.

By Application

The Battery Management System (BMS) segment holds the largest revenue share in the Vehicle Intelligence Battery Sensor Market, accounting for approximately 50% in 2023. BMS plays a critical role in optimizing the performance, safety, and longevity of battery systems in electric vehicles. It monitors key parameters such as voltage, current, temperature, and state of charge to ensure the battery operates within safe limits. By managing the charging and discharging processes, a BMS helps to prevent overcharging and overheating by controlling the charging and discharging processes, both of which can cause battery degradation or faults. The growing need for efficient battery management systems is fueling investments and innovation across this segment as you strive to improve overall vehicle performance and reliability, in tandem with the rising consumer and industry demand for electric vehicles.

The Start-Stop System segment is anticipated to be the fastest-growing segment in the vehicle intelligence battery sensor market during the forecast period from 2024 to 2032. This technology significantly improves fuel efficiency by automatically shutting off the engine during idling and restarting it when needed, thus reducing emissions and enhancing overall vehicle performance. As consumer demand for environmentally friendly and energy-efficient vehicles increases, the adoption of Start-Stop Systems is expected to rise rapidly. Additionally, advancements in battery sensor technologies will further support the effectiveness of these systems, making them an essential component for modern electric and hybrid vehicles aiming to optimize energy consumption and reduce operational costs.

Vehicles Intelligence Battery Sensor Market Regional Analysis:

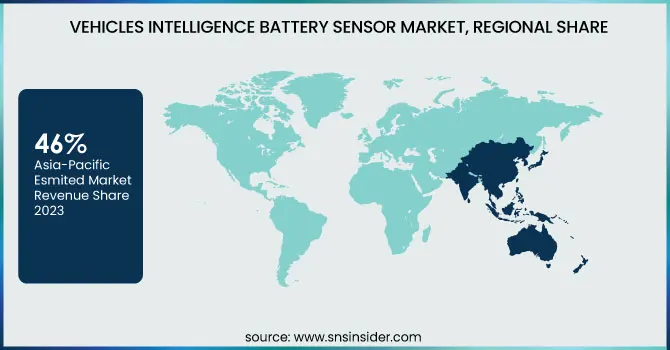

The Asia-Pacific region is leading the Vehicle Intelligence Battery Sensor Market, contributing around 46% of total revenue in 2023. This dominance comes from the growing electric vehicle (EV) production and related adoption in countries such as China, Japan, and South Korea as well as high demand for advanced battery management systems and sensors. A strong auto-manufacturing base and existing supply chain for battery parts are also advantages for the region. Various government-driven electric mobility initiatives and stringent environment regulations are yet another drive for the demand of intelligent battery solutions as manufacturers consider achieving higher vehicle efficiency and reducing emissions. Furthermore, growing technological advancements such as artificial intelligence and IoT integration in battery sensors are facilitating advances in intelligent battery management systems, which augurs well for the continued growth and innovation in this region.

North America is rapidly emerging as the fastest-growing region in the vehicle battery market for the 2024 to 2032 forecast period. The rapid growth of EVs adoption along with major investment in battery technology are among these key factors. Leading the charge are the United States and Canada, where automakers are ramping up efforts to produce more electric and hybrid vehicles in response to rising consumer demand and stricter emissions standards. Not to mention, this region is also a development of new battery technology like solid-state batteries and enhanced lithium-ion technologies that boast better energy density, safety and charge time. Government incentives, such as tax credits for EV purchases and funds for charging infrastructure, provide additional strength to market expansion. Additionally, partnerships between automakers and technology firms are fostering innovations in battery management systems, improving vehicle performance and longevity.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major players in Vehicles Intelligence Battery Sensor Market along with product:

-

Robert Bosch GmbH (Germany) [Battery Management Systems, Sensors]

-

Continental AG (Germany) [Battery Sensors, Electronic Control Units]

-

Texas Instruments Incorporated (USA) [Analog and Digital Signal Processors, Battery Management Solutions]

-

Denso Corporation (Japan) [Battery Management Systems, Sensor Technologies]

-

HELLA GmbH & Co. KGaA (Germany) [Battery Sensors, Automotive Lighting and Electronics]

-

Infineon Technologies AG (Germany) [Microcontrollers, Battery Management ICs]

-

TE Connectivity (Switzerland) [Connectors, Battery Monitoring Systems]

-

STMicroelectronics (Switzerland) [Microcontrollers, Sensors, and Battery Management Solutions]

-

Johnson Controls Inc. (USA) [Battery Systems, Energy Storage Solutions]

-

NXP Semiconductors (Netherlands) [Microcontrollers, Battery Management ICs]

-

Vishay Intertechnology, Inc. (USA) [Resistors, Capacitors, and Battery Monitoring Solutions]

-

Microchip Technology Inc. (USA) [Microcontrollers, Battery Management ICs]

-

Hitachi Astemo, Ltd. (Japan) [Automotive Electronics, Battery Management Systems]

-

Integrated Silicon Solution Inc. (USA) [Battery Management ICs, Memory Solutions]

-

AVL (Austria) [Powertrain Engineering, Battery Management Systems]

-

Amphenol Corporation (USA) [Connectors, Battery Monitoring Systems]

List of suppliers providing raw materials and components in the Vehicle Intelligence Battery Sensor Market:

-

3M Company

-

DuPont

-

Avery Dennison Corporation

-

LG Chem

-

Umicore

-

Cabot Corporation

-

Heraeus

-

Honeywell International Inc.

-

Mitsubishi Materials Corporation

-

Hitachi Chemical Company

-

Nippon Chemi-Con Corporation

Recent Development

-

January 07 - 10, Bosch is presenting its most recent developments in software and AI-powered solutions that amplify everyday life, especially in the automotive battery sector. This includes education regarding how innovative software can also assist with battery management systems, availability, energy efficiency, and user experience with electric vehicle technology.

-

On October 21, 2024, announced its latest embedded breakthroughs in motor control, AI and sensor technologies focusing on energy efficiency and performance. Eye catching developments include the Motor Control + Edge AI Washing Machine, former of which uses Field-Oriented Control and Nano Edge AI technology for improved energy and water efficiency with double-digit improvements over standard machines.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.73 Billion |

| Market Size by 2032 | USD 7.77 Billion |

| CAGR | CAGR of 12.33 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Cars, Commercial Vehicles) • By Technology(Hall-Effect Sensor, MEMS Sensor, Optical Sensor) • By Application(Battery Management System, Start-Stop System, Regenerative Braking System, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), Continental AG (Germany), Texas Instruments Incorporated (USA), Denso Corporation (Japan), HELLA GmbH & Co. KGaA (Germany), Infineon Technologies AG (Germany), TE Connectivity (Switzerland), STMicroelectronics (Switzerland), Johnson Controls Inc. (USA), NXP Semiconductors (Netherlands), Vishay Intertechnology, Inc. (USA), Microchip Technology Inc. (USA), Hitachi Astemo, Ltd. (Japan), Integrated Silicon Solution Inc. (USA), AVL (Austria), Amphenol Corporation (USA). |