Hi-Fi System Market Size & Trends:

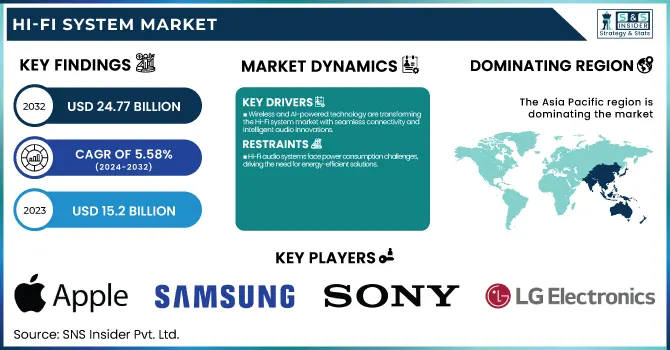

The Hi-Fi System Market size was valued at USD 15.2 Billion in 2023, and expected to reach USD 24.77 Billion by 2032, growing at a CAGR of 5.58% during 2024-2032. driven by continuous innovation and R&D investments. This list of the latest Hi-Fi music systems available in 2023, all of which feature smart and AI technologies, reflects the trend of improved user experience to sound profiles and voice assistants, with AI being used in real-time, enriching audio in the most appropriate way.

To Get more information on Hi-Fi System Market - Request Free Sample Report

Moreover, improvements to power consumption efficiency are driving purchasing decisions, with consumers favouring energy efficient devices with longer battery life. While our existing report, “Future Audio: Six Trends That Will Transform the Sound Experience,” analyzes the general market and trends until October 2022, the present study serves to analyze patent filling and innovation trends covering wireless audio transmission, lossless sound processing, and immersive spatial audio technologies. The average lifespan and replacement cycle of Hi-Fi systems is 3-6 years, as technology has evolved rapidly, spurring frequent upgrades. The U.S. market is anticipated to experience steady and substantial growth from 2023 to 2032. Starting at 2.17 in 2023, it is projected to reach 4.02 by 2032, reflecting a compound annual growth rate (CAGR) of 7.06%. This growth demonstrates a consistent upward trajectory, with an average annual increase of 0.16 to 0.18, driven by rising demand and broader adoption. Innovations in digital signal processing, AI-powered noise cancellation, and sustainable audio solutions continue to fuel significant investments in advanced R&D by global tech companies. As these companies scale their production and expand their consumer base, the entire market is expected to benefit from the growing reach and enhanced capabilities of these technologies.

Hi-Fi System Market Dynamics:

Drivers:

-

Wireless and AI-powered technology are transforming the Hi-Fi system market with seamless connectivity and intelligent audio innovations.

Advances in Bluetooth technology, Wi-Fi connectivity, and AI-powered capabilities have become a key driver behind the growing demand for wireless and smart audio devices, which offer seamless connections, high-quality sound, and enhanced user experiences. Consumers are increasingly gravitating toward wire-free setups that work seamlessly with smart home ecosystems, voice assistants, and multi-room audio solutions. These advanced audio playback devices use AI algorithms for adaptive sound optimization, personalized audio settings, and intelligent noise cancellation, perfect for both home and professional use. High-resolution music streaming services and wireless technology are further speeding up adoption. Moreover, ongoing improvements to battery performance and energy-saving technologies are increasing appeal of the products.

Restraints:

-

Hi-Fi audio systems face power consumption challenges, driving the need for energy-efficient solutions.

High-performance Hi-Fi audio systems deliver superior sound quality but often come with high power consumption, raising concerns about energy efficiency. As consumers and industries prioritize sustainability, the demand for energy-efficient audio solutions is increasing. Many traditional Hi-Fi setups, especially those with powerful amplifiers, large speakers, and advanced processing units, require substantial energy, leading to higher electricity costs and environmental impact. Manufacturers are now focusing on developing energy-efficient components, including low-power amplifiers, smart standby modes, and eco-friendly materials. Innovations like Class-D amplifiers and AI-driven power optimization are addressing these concerns, ensuring high-fidelity sound without excessive energy usage.

Opportunities:

-

Eco-Friendly Innovation Driving the Future of Hi-Fi Systems

Driven by growing environmental awareness and strict energy regulations, manufacturers are focusing on creating eco-friendly Hi-Fi systems with reduced power consumption, efficient amplifiers, and sustainable materials. Innovations like Class-D amplifiers, which maximize efficiency while minimizing heat output, and low-power wireless technologies such as Bluetooth LE and Wi-Fi 6 are enhancing energy savings. Additionally, the adoption of biodegradable speaker components and solar-powered audio solutions is gaining momentum. As consumers increasingly prioritize sustainability, demand for green Hi-Fi technology is rising, encouraging companies to enhance energy efficiency without sacrificing audio performance.

Challenges:

-

Ensuring seamless integration and overcoming compatibility challenges in Hi-Fi systems

Expensive Hi-Fi systems are also a sticking point in smart home ecosystems, as integration can take away the magic of the sound experience. Incompatible wireless standards such as Bluetooth, Wi-Fi, and Zigbee cause conflicts in connectivity, making it challenging for devices to communicate effectively. Users want seamless integration with smart assistants such as Alexa, Google Assistant, and Siri, but different protocols and firmware inconsistencies can make for connectivity headaches. Frequent software updates across various platforms can also hinder functionality, necessitating ongoing firmware patching. Moreover, the absence of universal industry standards is causing manufacturers to duplicate the production of their products, leading to increased production costs and complexity. This challenges consumers with setup and troubleshooting, causing frustration and slowing adoption. These challenges can only be addressed by implementing standardized protocols, improving software compatibility, and developing user-friendly interfaces, all requiring significant investments from companies. With the growing number of smart homes and the need for flawless compatibility between these devices the future growth of the Hi-Fi System Market will highly depend on compatibility.

Hi-Fi System Market Segmentation Outlook:

By System

In 2023, the product segment dominated the Hi-Fi System Market, accounting for approximately 74% of total revenue. This growth is fueled by the growing demands of the users in the market for products like wireless speakers, soundbars, and home theater systems. In more recent developments, innovative enhancements, such as AI powered audio experience optimization and formats that play without data and are found in smart home systems, have also contributed to the growth of this market. Premium sound quality as well as durability and energy efficiency are making high-end audio solutions appealing to top brands. The increasing disposable income and the trend towards immersive audio experience are lifting the adoption rate to high numbers. Demand for the high-fidelity sound systems that can make audio playback sound well beyond the ordinary is now on the rise thanks to the growth of streaming services. To meet the needs of consumers, from audiophiles interested in lossless audio, to casual listeners searching for comfort and mobility, companies are concentrating on extending product portfolios.

The device segment is the fastest-growing category in the Hi-Fi System Market over the forecast period from 2024 to 2032, driven by rapid advancements in wireless technology, AI integration, and smart home compatibility. Consumers are increasingly shifting towards portable and wireless audio solutions, including Bluetooth-enabled speakers, high-resolution headphones, and multi-room audio systems that offer seamless connectivity and superior sound quality. The rising demand for smart and AI-powered audio devices, which optimize sound based on user preferences and room acoustics, further accelerates growth. Additionally, the proliferation of streaming services and high-fidelity audio formats has heightened the need for advanced playback devices that deliver an immersive listening experience. Manufacturers are focusing on compact, energy-efficient designs with enhanced battery life and seamless integration with IoT ecosystems.

By Connectivity Material

The wired segment dominated the Hi-Fi System Market with the largest revenue share of approximately 68% in 2023, as it offers better audio quality, reliability, and low latency over wireless solutions. While both types of audio systems have their advantages, wired systems are favored by audiophiles and professional users for their ability to deliver high-fidelity sound without interference, making them a solid choice for home theaters, studio setups, and high-end audio applications. Technological improvements in Ultra-High Fidelity (UHF) audio formats, amplifiers and high-end wired headphones are continuing to help promote the growth of the segment. They also provide better durability and longevity as the performance is consistent without maintenance. Although the future points to wireless technology, many users still prefer wired connections for their stable transmissions, lack of compression loss, and compatibility with legacy audio devices. As a result, the wired segment maintains strong market dominance, particularly in high-end consumer audio and professional audio applications, despite the growing popularity of wireless alternatives.

The wireless segment is projected to be the fastest-growing in the Hi-Fi System Market over the forecast period 2024-2032, as the increasing consumer preference towards preferring same configuration Hi-Fi systems in homes with more connectivity and Multi-Sense integration. With the explosion of Bluetooth, Wi-Fi, and AI-driven sound systems, these systems provide unfettered connectivity, multi-room music, and even high-resolution streaming without any cable limitations. This trend is driving demand for portable and smart speakers, soundbars, and wireless headphones — especially among tech-savvy consumers and urbanites looking for clean, flexible sounds. Low-latency wireless transmission, less power-hungry batteries and voice assistant compatibility make adoption all the more seamless. Moreover, codec advancements like aptX HD and LDAC have sytematically improved the sound reproduction of wireless Hi-Fi audio, although wired sound quality is still considered better as compared to the wireless options.

By Application

The residential segment dominated the Hi-Fi System Market with a revenue share of approximately 64% in 2023, driven by the growing demand for premium audio quality for home entertainment. Consumers are investing in high-end audio sound systems, including high-fidelity speakers, amplifiers and home theater setups, to enhance their music, gaming and streaming experiences. Increasing smart home technologies and the deployment of wireless audio products have propelled expansion and consumers prefer integration with voice assistants and other IoT-enabled products. Moreover, the transition to work-from-home and hybrid work setups has increased expenditure on home entertainment systems, resulting in a higher demand for high-quality audio solutions. Technological advancements such as AI-driven sound optimization, high-resolution audio formats, and multi-room audio setups are further attracting consumers to upgrade their home audio systems.

The automotive segment is projected to be the fastest-growing in the Hi-Fi System Market from 2024 to 2032, driven by increasing demand for premium in-car audio experiences. The growth is driven by investment in infotainment systems, AI-fuelled sound enhancement, and the rising adoption of electric and luxury vehicles. With consumers wanting high quality audio, automakers are teaming with high-end audio companies to develop immersive surround sound systems. Hi-Fi systems in the automotive sector is also one of the most important growth areas in the market, especially with regard to the growth in connected cars and autonomous driving.

Hi-Fi System Market Regional Analysis:

Asia Pacific dominated the Hi-Fi System Market with a revenue share of approximately 64% in 2023, driven by rapid urbanization, rising disposable income, and increasing demand for premium home entertainment solutions. Countries like China, Japan, and South Korea are leading contributors due to their strong consumer electronics industries, advanced manufacturing capabilities, and high adoption rates of smart and wireless audio systems. The region is booming e-commerce sector further accelerates sales, making Hi-Fi systems more accessible to a broader audience. Additionally, the expansion of smart homes and the integration of AI-driven sound technologies are fueling market growth. The presence of key manufacturers, along with rising investments in R&D for energy-efficient and high-performance audio devices, strengthens Asia Pacific’s market dominance. As consumer preferences shift towards high quality, immersive audio experiences, the demand for Hi-Fi systems in residential, commercial, and automotive applications continues to surge, solidifying the region’s leadership in the global market.

North America is projected to be the fastest-growing region in the Hi-Fi System Market from 2024 to 2032. The market also benefits from the presence of big players such as Sonos and Bose, as well as Apple, and strong consumer spending on high-end entertainment systems will drive the growth of this market. The region is growing prevalence of smart speakers, soundbars, and home theater systems, as well as mainstream demand for immersive audio experiences, also drive growth. Moreover, growing demand arising from the evolving automotive sector, specifically the development of high-end in-car audio systems, is positively affecting sales. Market trends are also affected by government regulations encouraging energy efficiency and sustainability in electronic devices. The popularity of music streaming services and high-resolution audio formats boosts the need for high-fidelity sound systems, positioning North America as a key growth hub for the Hi-Fi System Market over the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the in Hi-Fi System Market along with product:

-

Samsung Electronics Co. (South Korea) – Wireless speakers, soundbars, high-fidelity home audio systems

-

Sony Corporation (Japan) – Hi-Fi stereo systems, wireless speakers, turntables, amplifiers, AV receivers

-

Apple Inc. (US) – HomePod series, AirPods (high-fidelity wireless earphones)

-

Bose Corporation (US) – Home audio systems, Hi-Fi wireless speakers, soundbars, premium headphones

-

Sennheiser Electronic GmbH & Co. KG (Germany) – High-end headphones, audiophile-grade earphones, wireless Hi-Fi systems

-

LG Electronics (South Korea) – Hi-Fi audio systems, wireless speakers, soundbars

-

Panasonic Corporation (Japan) – Hi-Fi stereo systems, turntables, amplifiers, wireless speakers

-

DEI Holdings, Inc. (US) – High-end home theater systems, Hi-Fi speakers

-

Yamaha Corporation (Japan) – AV receivers, Hi-Fi amplifiers, premium sound systems

-

Koninklijke Philips N.V. (Netherlands) – Hi-Fi audio systems, Bluetooth speakers, soundbars

-

Onkyo Corporation (Japan) – High-fidelity stereo systems, AV receivers, amplifiers, turntables

-

Sonos, Inc. (US) – Wireless Hi-Fi home audio systems, smart speakers, premium soundbars

Recent Development:

-

July 10, 2024 – Samsung Galaxy Z Fold6 and Z Flip6 Elevate Galaxy AI to New Heights Samsung unveiled the Galaxy Z Fold6 and Z Flip6 at Galaxy Unpacked 2024, integrating Galaxy AI with their innovative foldable designs. The new models enhance communication, productivity, and creativity with AI-powered features optimized for their versatile form factors.

-

January 24, 2025 – Sony announces the end of recordable Blu-ray disc production, Sony confirmed it will cease production of recordable Blu-ray discs by February 2025, marking a significant shift away from physical media as digital formats continue to dominate.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 15.20 Billion |

| Market Size by 2032 | USD 24.77 Billion |

| CAGR | CAGR of 5.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By System (Product(Speaker & Soundbar, CD player, DVD player, Blu-ray player, Network media player, Turntable, Headphone & Earphone, Microphone), Device(DAC, Amplifier, Preamplifier, Receiver)) • By Connectivity Material (Wired(Ethernet Cable, Audio Cable), Wireless(Bluetooth, Wi-Fi, AirPlay, Others) • By Application(Residential, Automotive, Commercial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung Electronics Co. (South Korea), Sony Corporation (Japan), Apple Inc. (US), Bose Corporation (US), Sennheiser Electronic GmbH & Co. KG (Germany), LG Electronics (South Korea), Panasonic Corporation (Japan), DEI Holdings, Inc. (US), Yamaha Corporation (Japan), Koninklijke Philips N.V. (Netherlands), Onkyo Corporation (Japan), Sonos, Inc. (US). |