Telerehabilitation Market Size & Overview:

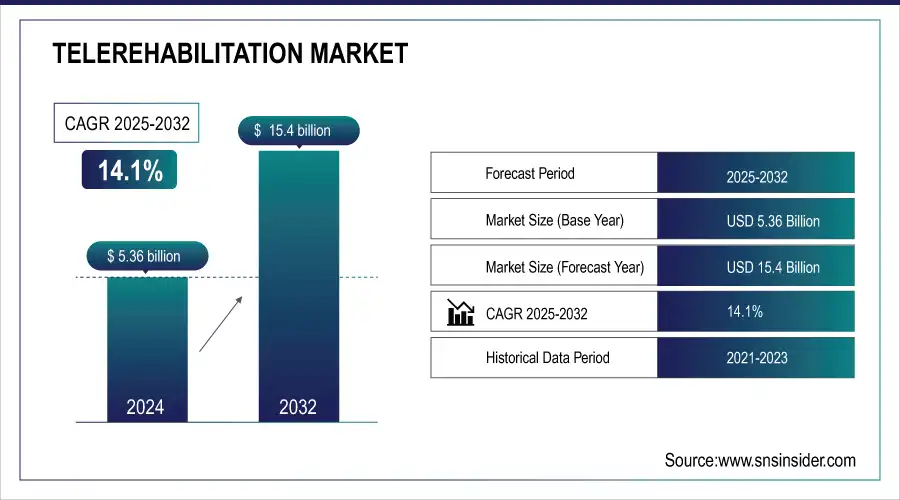

The Telerehabilitation Market Size was valued at USD 5.36 billion in 2025E and is expected to reach USD 15.4 billion by 2033, growing at a CAGR of 14.1% over the forecast period 2026-2033.

A rise in chronic diseases, an aging population, and the demand for cost-effective healthcare have contributed to substantial growth in the telerehabilitation market. Telehealth, and telerehabilitation specifically, has become a topic of interest in recent years, remotely, making remote care the choice of many providers and consumers of healthcare. The availability of rehabilitation services is becoming an increasing necessity the CDC says that 6 in 10 American adults have a chronic disease, and 4 in 10 suffer from two or more chronic diseases.

Telerehabilitation Market Size and Forecast:

-

Market Size in 2025E: USD 5.36 Billion

-

Market Size by 2033: USD 15.4 Billion

-

CAGR: 14.1% from 2026 to 2033

-

Base Year: 2024

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Telerehabilitation Market - Request Sample Report

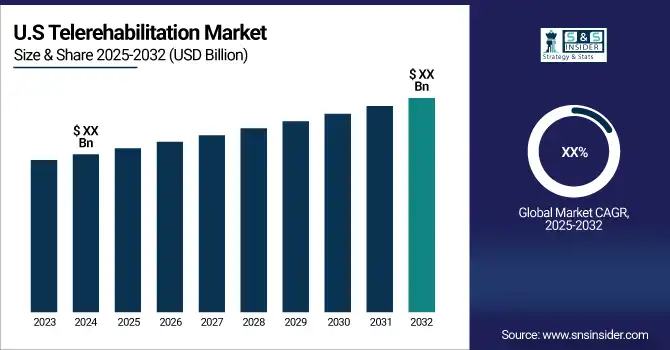

The U.S. Telerehabilitation market size was valued at an estimated USD 2.45 billion in 2025 and is projected to reach USD 7.10 billion by 2033, growing at a CAGR of 13.9% over the forecast period 2026–2033. Market growth is driven by increasing adoption of remote healthcare services, rising prevalence of chronic conditions and mobility impairments, and growing demand for convenient, cost-effective rehabilitation solutions. Expanding use of telehealth platforms, wearable sensors, and AI-powered rehabilitation monitoring tools is accelerating market expansion. Additionally, supportive reimbursement policies, advancements in digital health infrastructure, and growing acceptance of virtual physical, occupational, and speech therapy further strengthen the growth outlook of the U.S. telerehabilitation market during the forecast period.

Key Trends in the Telerehabilitation Market:

-

Rising adoption of virtual physical therapy and remote monitoring for patient rehabilitation.

-

Integration of AI and machine learning for personalized therapy plans.

-

Increased use of wearable sensors and IoT devices to track patient progress remotely.

-

Expansion of cloud-based platforms enabling secure teleconsultations and data management.

-

Rising investments by healthcare providers in digital health and telehealth infrastructure.

-

Focus on chronic disease management and post-operative recovery using remote interventions.

-

Collaboration between hospitals, clinics, and digital health startups to enhance service reach.

Additionally, it is predicted by the World Health Organization (WHO) that the population aged 60 and over is expected to almost double from 900 million to 2.1 billion by 2050– leading to even higher demand for rehabilitation services. To meet this increasing demand during the pandemic, policymakers around the world are starting to implement telehealth-supportive policies. The U.S. Centers for Medicare & Medicaid Services (CMS), for example, has enacted some telehealth coverage expansions during the public health emergency, covering telerehabilitation services. As part of its Digital Single Market strategy, the European Commission has also introduced initiatives to foster digital health solutions, including telerehabilitation. These government initiatives, along with technological advancements including wearable devices, artificial intelligence, and virtual reality, are providing potential growth opportunities for the telerehabilitation market.

Telerehabilitation Market Drivers:

-

Continuous improvements in digital technologies enhance the quality and accessibility of telerehabilitation services.

-

A growing preference for home-based care, especially among the elderly and those with chronic diseases, is propelling the adoption of telerehabilitation.

-

Patients are increasingly looking for healthcare services that are handy and easy to get.

The increasing demand for Remote Healthcare Services is one of the primary growth variables responsible for accelerating the progress of the Telerehabilitation Market. As digital health technologies improve, patients are more frequently looking for care they can receive at home as we continue to experience the impact of the COVID-19 pandemic, and other global health issues. Research published in Telemedicine and e-Health in 2020 indicated that almost 60% of patients preferred distance rehabilitation services to face-to-face appointments because of the convenience, time saved on travel, and the higher access to niche care. The number of patients utilizing telerehabilitation services has continued to increase ever since, especially in rural areas where accessibility to physical rehabilitation centers can be challenging, and this trend has carried into 2024.

The American Physical Therapy Association stated that the adoption of telehealth for rehabilitation in the U.S. was increased by 75% during the pandemic. Telerehabilitation has become especially attractive to older people and people with chronic conditions, offering the convenience of home-based rehabilitation and scheduling flexibility. Actually, the 2023 study conducted by the National Institute of Health proved that telerehabilitation for the management of stroke recovery was adopted over 40% more in comparison to 2020, indicating the change in the health care delivery pattern. Apart from this, with the increasing adoption of telerehabilitation in the service portfolio of many healthcare providers, this demand is anticipated to register further growth in the future, thereby fuelling the digital rehabilitation tools market in the coming years.

Telerehabilitation Market Restraints:

-

The handling of sensitive patient information through digital platforms raises concerns about data security and privacy.

-

Navigating complex regulations across different regions can impede the implementation and expansion of telerehabilitation services.

-

Inadequate internet connectivity and technological infrastructure in certain areas can limit access to telerehabilitation services.

Data security and privacy concerns are one of the major restraining factors for the telerehabilitation market. As telerehabilitation is based on providing communication platforms for sensitive patient-related information, there are increased risks associated with illegal access, hacking, and data breaches. Protection of Personal Health Information (PHI) is of utmost importance not only for therapeutically enabling personal health safety but also for regulatory compliance for countries, namely HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR (General Data Protection Regulation) in Europe, as it may affect future of all health-related practices through patient trust. Encrypted communications, ensuring data is stored securely, and meeting both local and international data protection laws present a large hurdle to healthcare providers and telehealth companies. Furthermore, if patients have a concern about the infringement of their privacy, they may show resistance to the adoption of telerehabilitation. Continuous investment in effective cybersecurity and transparency around privacy practices to address these concerns comes with increased operational costs for providers.

Telerehabilitation Market Segmentation Analysis:

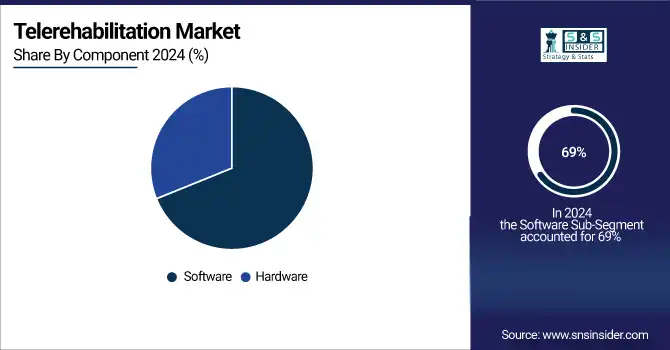

By Component, Software Segment Leads Telerehabilitation Market in 2025

In 2025, the software segment held the highest revenue 69% share of the market. The growth in the usage of telehealth platforms and the advancement of sophisticated rehabilitation software solutions have contributed to this dominance. The major factors that are driving the growth of the software segment are the demand for interfaces, data analytics capabilities, and integration in and with healthcare systems. According to the Office of the National Coordinator for Health Information Technology (ONC), 96% of hospitals and 78% of office-based physicians in the United States had adopted certified electronic health record (EHR) technology by 2024, indicating a strong foundation for telerehabilitation software integration. Moreover, the U.S. Food and Drug Administration (FDA) has proactively promoted digital health technologies (including SaMD), thereby further stimulating the development of innovative telerehabilitation software solutions. The FDA has also launched initiatives such as the Digital Health Center of Excellence, established in early 2024, intending to promote responsible and high-quality digital health ingenuity among stakeholders to help stakeholders advance health care. As a result of this regulatory support, there has been a rise in the number of FDA-cleared Digital Therapeutics and rehabilitation software solutions. In addition to that, NIST has also created guidelines for telehealth software security and interoperability, which can feel comfortable in the hands of telerehabilitation software reliability and adoption.

By Services, Clinical Therapy Segment Holds Largest Revenue Share in 2025

In 2025, the largest revenue share of the market was held by the clinical therapy segment. The dominance can be explained by the increasing need for remote therapy services such as physical therapy, occupational therapy, and speech-language pathology. Government initiatives and the reimbursement policy are offering growth in the clinical therapy segment. The American Physical Therapy Association (APTA) points out that the U.S. Department of Veterans Affairs (VA) has been at the forefront of telerehabilitation, delivering over 2.6 million telehealth encounters in fiscal year 2023 with nearly half spent in clinical therapy services. The Centers for Medicare & Medicaid Services (CMS) has also expanded coverage for telehealth services, including physical therapy, occupational therapy. For example, a survey by AOTA found that 87% of occupational therapists used telehealth during the pandemic, compared to just 2% before the pandemic. In addition, several research projects on telerehabilitation have been funded by the National Institutes of Health (NIH), indicating the government's support for clinical therapy services delivered remotely.

By Application, Orthopedics Dominates Telerehabilitation Market with 30% Share in 2025

In 2025, orthopedics managed to maintain the largest share of 30% of the overall market. Much of this market share is due to the high prevalence of musculoskeletal disorders and the demand for remote rehabilitation services after orthopedic surgery or after orthopedic injuries. Musculoskeletal conditions affect over one in two adults in the United States, impacting close to 126.6 million Americans, according to U.S. Bone and Joint Initiative. According to the American Academy of Orthopaedic Surgeons (AAOS), the use of telemedicine for every type of care including orthopedic care has soared, with at least one practice reporting a 50-fold increase in virtual visits during the pandemic. Government support has also helped with the growth of orthopedic telerehabilitation. National Institute of Arthritis and Musculoskeletal and Skin Diseases (NIAMS)/NIH funded studies on the development and testing of telerehabilitation interventions for arthroplasty and other orthopedic conditions. Additionally, the U.S. Department of Defense has invested in telerehabilitation programs for service members with orthopedic injuries, demonstrating the government's recognition of the importance of remote rehabilitation services in this field.

By Therapy, Physical Therapy Segment Accounts for 42% Revenue in 2024

In 2025, the largest revenue share of 42% was attributed to the physical therapy segment. This growth is driven by robust demand for PT services and the successful transition of PT services to delivery models that are amenable to delivery remotely. However, as reported by the Bureau of Labor Statistics, employment of physical therapists is projected to grow 21% from 2020 to 2030, much faster than the average for all occupations which indicates a significant demand for physical therapy services. 47% of outpatient physical therapy clinics were engaging in telehealth services, versus just 2% before the pandemic. This acceleration was facilitated by government measures like the CARES Act which broadened Medicare telehealth coverage for physical therapy services. The Centers for Medicare & Medicaid Services (CMS) reported that in April 2020, 43.5% of Medicare fee-for-service primary care visits were provided through telehealth, compared with less than 1% before the public health emergency in February 2020. The National Institutes of Health (NIH) has also funded numerous studies on telerehabilitation for physical therapy, including a 2019 study that found telerehabilitation to be as effective as traditional in-person care for patients recovering from total knee arthroplasty.

Telerehabilitation Market Regional Analysis:

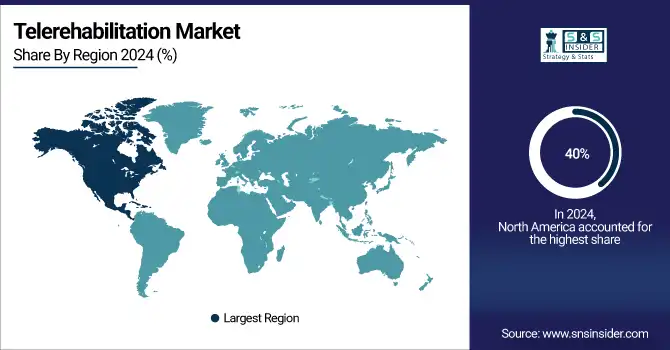

North America Dominates Telerehabilitation Market in 2025

In 2025, North America dominates the telerehabilitation market with an estimated 40% share, fueled by widespread adoption of digital healthcare platforms and strong government reimbursement policies. The increasing need for remote therapy services, including physical, occupational, and speech-language therapy, drives demand across hospitals, outpatient clinics, and home-care settings. Technological advancements in AI-enabled rehabilitation software, wearable devices, and cloud-based telehealth platforms further enhance service delivery. Together, these factors create a supportive ecosystem that accelerates the adoption of telerehabilitation solutions, ensuring sustained market growth in the region.

Need any customization research on Telerehabilitation Market - Enquiry Now

-

United States Leads North America’s Telerehabilitation Market

The U.S. dominates due to its mature telehealth infrastructure, robust reimbursement frameworks, and high patient acceptance of remote therapy. Hospitals, outpatient clinics, and rehabilitation centers rapidly integrated virtual platforms during and after the pandemic. Strong investments by technology vendors and startups in AI-enabled, remote monitoring solutions, combined with government-backed initiatives and extensive clinical research, support adoption in orthopedics, neurology, and chronic care. These factors ensure the U.S. maintains leadership in North America’s telerehabilitation market in 2025.

Asia Pacific is the Fastest-Growing Region in Telerehabilitation Market in 2025

The Asia Pacific Telerehabilitation Market is projected to grow at a CAGR of 16.5% from 2026 to 2033, fueled by rapid industrialization and the expansion of digital-health infrastructure. Increasing adoption of telemedicine in hospitals, clinics, and community health centers is driving demand for remote rehabilitation solutions. Government-backed smart-hospital initiatives, rising chronic disease prevalence, and growing patient awareness further accelerate market penetration. Investments in AI-enabled platforms, wearable devices, and cloud-based rehabilitation systems support scalable, cost-effective care, positioning Asia Pacific as the fastest-growing region in the global telerehabilitation market.

-

China Leads Asia Pacific’s Telerehabilitation Market

China dominates due to its large patient base, growing chronic-disease burden, and rapid deployment of telemedicine platforms in hospitals and community clinics. Government-backed smart-hospital initiatives and policies promoting telehealth accelerate adoption. Domestic technology providers are delivering scalable telerehabilitation solutions integrating AI, wearable monitoring, and cloud platforms. Combined with cost-effective production and rapid urbanization, China has become the regional hub for telerehabilitation innovation, adoption, and export, securing its leading position in Asia Pacific.

Europe Telerehabilitation Market Insights, 2025

Europe shows steady growth in 2025, driven by strong healthcare digitization, public health policies, and rising demand for remote therapy solutions across orthopedics, neurology, and chronic-care management. Germany’s advanced healthcare infrastructure and focus on digital-health integration accelerate adoption, resulting in higher deployment of telerehabilitation solutions.

-

Germany Leads Europe’s Telerehabilitation Market

Germany dominates due to its leadership in healthcare technology, regulatory support for telemedicine, and strong clinical research initiatives. Hospitals and rehabilitation centers are increasingly integrating virtual platforms for physical therapy, occupational therapy, and speech-language pathology. German innovation in digital therapeutics, combined with robust insurance reimbursement frameworks, ensures widespread adoption. These factors position Germany as the primary driver of Europe’s telerehabilitation market in 2025.

Middle East & Africa and Latin America Telerehabilitation Market Insights, 2025

The telerehabilitation market in the Middle East & Africa and Latin America is growing steadily in 2025, supported by expanding telehealth adoption, infrastructure modernization, and rising awareness of remote therapy benefits. Smart-city initiatives in Saudi Arabia and the UAE are boosting demand in the Middle East. In Latin America, Brazil and Mexico lead adoption, driven by growing chronic-care needs and hospital investments in virtual rehabilitation platforms. Increasing urbanization, industrialization, and foreign technology investments further strengthen market growth across both regions.

Competitive Landscape for the Telerehabilitation Market:

American Well (Amwell)

American Well (Amwell) is a U.S.-based leader in telehealth and digital care solutions, specializing in virtual consultations, chronic care management, and telerehabilitation platforms. The company designs and operates secure, HIPAA-compliant software enabling patients to access healthcare services remotely from desktops, tablets, and mobile devices. Amwell collaborates with hospitals, health systems, and insurers to integrate its telehealth solutions into existing clinical workflows. Its role in the telerehabilitation market is significant, as it enables remote therapy sessions, patient monitoring, and digital engagement, improving accessibility, efficiency, and continuity of care for patients with chronic or rehabilitative needs.

-

In 2024, Amwell expanded its telerehabilitation offerings by launching enhanced physical and occupational therapy modules, integrating AI-driven patient progress tracking and remote assessment tools.

Teladoc Health, Inc.

Teladoc Health is a U.S.-based telehealth pioneer providing virtual healthcare services, including telerehabilitation, chronic condition management, and behavioral health. The company operates a comprehensive digital platform connecting patients with licensed clinicians for remote consultations and therapy. Teladoc partners with employers, insurers, and healthcare systems to deliver integrated, scalable virtual care solutions. Its role in the telerehabilitation market is crucial, as it enables cost-effective delivery of therapy, continuous patient monitoring, and personalized care plans, helping patients recover efficiently while reducing the need for in-person visits.

-

In 2024, Teladoc Health introduced advanced telerehabilitation programs with wearable sensor integration for real-time patient tracking and AI-based progress analytics.

Koninklijke Philips N.V.

Philips is a Netherlands-based global leader in healthcare technology, specializing in digital health solutions, medical devices, and connected care platforms. Its telerehabilitation offerings include remote monitoring, virtual therapy, and AI-driven patient engagement tools for hospitals and home care. Philips operates globally, providing end-to-end solutions that integrate hardware, software, and analytics to optimize recovery and patient outcomes. Its role in the telerehabilitation market is central, enabling remote, data-driven therapy for chronic and post-acute patients, improving adherence, and reducing hospital readmissions.

-

In 2024, Philips launched a next-generation telerehabilitation platform combining wearable sensors, virtual coaching, and analytics to support orthopedic and cardiac recovery.

Hinge Health, Inc.

Hinge Health is a U.S.-based digital health company specializing in musculoskeletal (MSK) telerehabilitation, including physical therapy and chronic pain management programs. The company develops app-based solutions combined with wearable sensors, virtual coaching, and personalized therapy plans. Hinge Health partners with employers, health plans, and health systems to deliver scalable remote care. Its role in the telerehabilitation market is significant, as it offers accessible, evidence-based MSK therapy programs that reduce pain, improve mobility, and lower healthcare costs.

-

In 2024, Hinge Health expanded its telerehabilitation portfolio to include AI-guided exercises and real-time patient engagement dashboards for MSK and orthopedic care.

Telerehabilitation Market Key Players:

-

American Well (Amwell)

-

Teladoc Health, Inc.

-

Koninklijke Philips N.V.

-

Hinge Health, Inc.

-

Doctor On Demand (Included Health)

-

NeoRehab

-

MIRA Rehab Limited

-

Jintronix

-

C3O Telemedicine

-

Bosch Healthcare Solutions GmbH

-

Care Innovations LLC

-

Cloud Physio

-

Medvivo Group

-

Sword Health

-

ATI Physical Therapy

-

Agile Virtual PT

-

BenchMark PT

-

Coviu

-

BTS Bioengineering

-

Bio-sensing Solutions SL

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 5.36 Billion |

| Market Size by 2033 | USD 15.4 Billion |

| CAGR | CAGR of 14.1% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Therapy (Physical Therapy, Occupational Therapy, Others) • By Services (Clinical Assessment, Clinical Therapy) • By Application (Cardiovascular, Orthopedic, Neurology, Pediatric, Others) • By End-use (Healthcare Facilities, Homecare Setting) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Philips Healthcare, Telespine, Medtronic, Telerehab, Cerner Corporation, Fitbit (by Google), RehabGuru, InTouch Health, American Well (Amwell), Visi Mobile |