Menstrual Health Apps Market Size & Trends

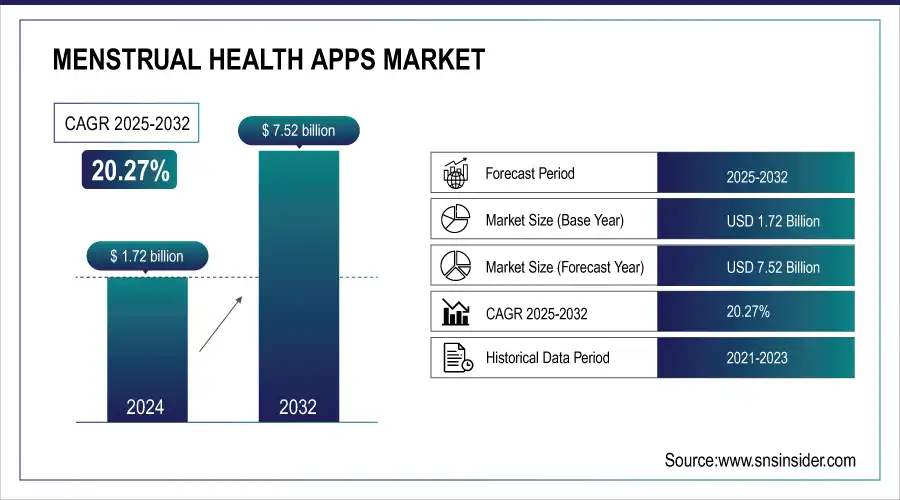

The Menstrual Health Apps Market size was USD 1.72 billion in 2024 and is expected to reach USD 7.52 billion by 2032, growing at a CAGR of 20.27% over 2025-2032.

To Get more information On Menstrual Health Apps Market - Request Free Sample Report

Increasing menstrual health awareness, increasing smartphone penetration, and increasing preference toward personalized digital health solutions for women are three factors contributing to the growth of the global menstrual health apps market. An increasing number of users actively seeking digital apps to track their periods, fertility, and reproductive health is driving the demand. Almost 65 percent of girls and women in the developed world, ages 15 to 45, track their periods on digital platforms, according to a 2024 report from the WHO. This signifies an increase in mobile health services. Femtech startups and leading tech-health companies are also stoking innovation with higher R&D budgets.

For instance, Clue and Flo Health are investing heavily in AI-powered platforms that offer wearable device integration, hormonal learning, and predictive analysis. Due to strong healthcare digitization, rising venture capital investments, and supportive regulatory discussions surrounding femtech, the U.S. market for menstrual health apps is particularly thriving. Additionally, global menstrual health apps market growth is driven by the necessity for enhanced access to data on reproductive health, rising awareness campaigns, and the incorporation of telehealth and mental health functionalities into these apps.

For instance, Apple's iOS 17 update included advanced menstrual health monitoring features in its Health app, including cycle deviation alerts based on heart rate and temperature, highlighting how large tech companies are seeing the opportunity in the menstrual health apps market.

On the supply side, a competitive market is developing, with the Glow, Ovia Health, and Natural Cycles broadening their service portfolios. In parallel, collaborations between health care organizations and tech companies are refining app precision and clinical utility. Regulatory oversight has also intensified. The FDA's approval of Natural Cycles’s digital birth control means the regulation of other reproductive health-focused apps should follow suit, thus forcing a flood of developers to meet health standards to have access to a larger market. Femtech raised over $1.2 billion in venture investment in 2023, and from the sum, it’s clear that investors believe in femtech’s long-term growth. On top of that, R&D spend is going up, with Clue and the industry also investing in medical-grade algorithm development, privacy-enhanced analytics, and friction-free connectivity to telehealth ecosystems.

In 2024, Flo Health teamed up with Fitbit to align menstrual health data with fitness and sleep metrics, allowing comprehensive health tracking—this is the definition of cross-industry collaboration.

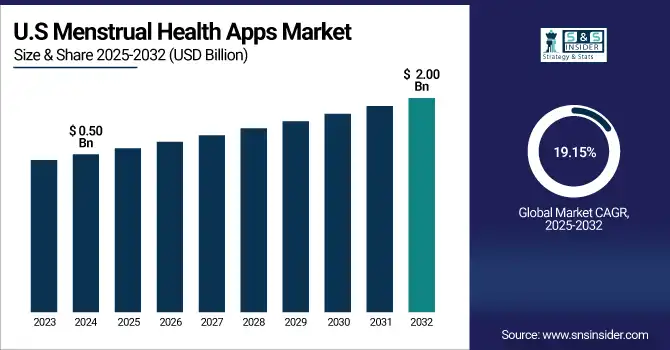

The U.S. menstrual health apps market was valued at USD 0.50 billion in 2024 and is projected to reach USD 2.00 billion by 2032, expanding at a compound annual growth rate (CAGR) of 19.15% from 2025 to 2032. The U.S. has captured the region, fueled by the presence of major players of menstrual health apps such as Glow, Clue, and Flo Health, and increased R&D spending on femtech. Strong app monetization, encouragement from regulators in digital health solutions, and integration with employer health benefits combine to create a strong market. The role of Canada is growing in relevance, thanks to the emergence of telehealth integration and privacy-respecting menstrual tracking mobile apps. The U.S. is also supported by favorable insurance environments, along with the emerging wellness app subscription trend, which supports continuing menstrual health app market growth.

Menstrual Health Apps Market Dynamics

Drivers:

-

Increasing Femtech Investments and Rising Digital Health Adoption Fuel Market Growth

The menstrual health apps market growth is mainly fueled by growing investment in femtech, growing interest in personalized health management, and the development of digital health infrastructure. Femtech startups globally received more than USD 1.3 billion in investments in 2023, reflecting a strong boost in investor confidence, as reported by PitchBook. Increasing demand for self-monitoring tools by women for ovulation, fertility, and menstrual cycle tracking propels the market's growth. Furthermore, increased telehealth integration has made these platforms more user-friendly, and at this time, they track menstrual health and give virtual consultations, so that users have a smooth experience.

Daye and Grace Health are the companies leading the way in using AI-based menstrual cycle predictions. According to Rock Health 2024 Digital Health Funding, more and more menstrual health app businesses are also raising their R&D investment, pushing towards biometrics integration and clinical-grade analytics.

In addition, government recognition, such as the European Union's MDR categorizing period tracking apps as medical device software, is also further validating their clinical usefulness, paving the way for reimbursement and use within formal healthcare organizations. All these trends together underlie a robust menstrual health apps market analysis, indicating ongoing adoption and innovation.

Restraints:

-

Data Privacy Concerns and Lack of Clinical Validation Hamper Market Growth

Although important progress has been made, the menstrual health apps market is subject to principal constraints, most importantly concerning data confidentiality, sparse regulatory understanding, and varying clinical verification. One of the major issues arises out of the processing of personal health information, most notably in jurisdictions with weak data privacy legislation.

According to a 2023 Mozilla study, 80% of menstrual health apps did not meet minimum data privacy standards, leaving user information at risk to third-party advertisers or without encryption. These loopholes in privacy are impeding user trust, which is delaying wider market adoption.

Furthermore, although there are medical-grade certifications for some apps, the majority still haven't had peer-reviewed clinical validation, which reduces their function within formal healthcare settings. For instance, many offer cycle prediction without incorporating hormonal information or medical history, which can cause inaccuracies. This is slowing down adoption by clinicians and regulators.

In addition, the lack of concerted guidelines from organizations such as the FDA or EMA for generic cycle-tracking devices (apart from use with contraceptives) leaves developers in regulatory limbo. All these pose a challenge to the trends in the menstrual health apps market, hindering credibility and institutional integration. Irregular user retention and dependence on self-reported data also contribute to inaccuracies and personalization of insights, curbing the potential of the market regardless of high introductory demand.

Menstrual Health Apps Market Segmentation Analysis

By Platform

The Android segment led the menstrual health apps market globally in 2024 with a total revenue menstrual health apps market share of 72.9%. Android's leadership is due to the high penetration of android smartphones globally, especially in developing regions where affordable devices are ubiquitous. Android being open-source gives developers greater latitude in app development and modification to suit regional requirements, enhancing users' accessibility and engagement. Furthermore, most menstrual health app businesses focus more on android releases to access a larger audience base, particularly in nations with high market penetration.

Conversely, the iOS segment will be the most rapidly growing due to the growing demand in developed economies and superior in-app purchase rates from iOS consumers. Apple's emphasis on adding women's health features directly into the Health app, such as menstrual tracking and fertility information, is improving user experience and driving adoption. The platform's increased privacy standards also resonate with data security-conscious users, further validating iOS as a rising trend in the menstrual health apps market influence.

By Applications

The period cycle tracking segment dominated the menstrual health apps market in 2024, with a 64.5% share of revenues. This is due to the core requirement of menstruating women to track the regularity of their cycle, forecast the onset of their period, and cope with attendant symptoms. The category has also increased in popularity as the point of entry for new users, particularly young teenagers and young adults looking for digital resources for simple reproductive health management. Additionally, wearability and cycle anomaly notification integration have rendered tracking more engaging and trustworthy.

Conversely, the fertility and ovulation management segment is anticipated to be the most dynamic, driven by an increasing global emphasis on reproductive planning, delayed childbearing, and growing awareness of infertility. This segment is on the rise as a result of sophisticated features like AI-based ovulation forecast, basal temperature synchronization, and hormone level monitoring, which are increasingly being embraced by apps such as Mira and Premom. The increasing need for non-invasive fertility tracking solutions is also increasing this segment's demand in the overall menstrual health apps market analysis.

Menstrual Health Apps Market Regional Insights

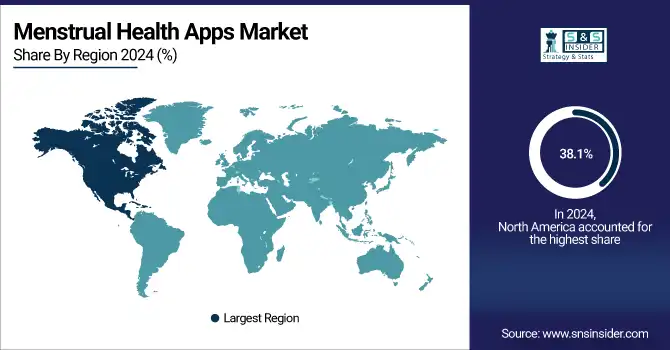

North America's menstrual health apps market led the global market in 2024, accounted for a 38.1% menstrual health apps market share, primarily due to the robust digital health infrastructure, improved smartphone penetration, and growing consumer awareness about women's health.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe is expanding into the second-fastest growing region in the global menstrual health apps market. As femtech innovations become more adopted, awareness about reproductive health increases. This expansion results from that increased awareness along with growing femtech adoption. This trend is being spearheaded by Germany and the UK, with their governments investing in mental wellness and digital health education. The Digital Healthcare Act in Germany makes health apps reimbursable, which encourages user adoption. Meanwhile, in France, apps are becoming more integrated into national women’s health programs, especially postnatal care. In the UK, the use of fertility and cycle-tracking apps has surged among women in the 20–40 age range, and NHS partnerships with app developers have been responsible for scaling up use. These dynamics are a reflection of an evolved market influenced by regulatory favorability, innovation, and an established user base requiring comprehensive health solutions, adding to continued menstrual health apps market trends throughout the region.

Asia Pacific is the most rapidly growing menstrual health apps market due to increasing smartphone penetration, enhanced awareness of menstrual health, and rising urbanization. India and China are leading the charge, fostered by governmental menstrual health awareness campaigns and enhanced digital connectivity. India is witnessing rapid growth in its user base due to free access models and application localization in local languages, which is making solutions available in rural and semi-urban regions. In China, high use of wearables and digital health literacy are driving popularity for combined apps based on hormonal tracking and menstruation-related mental health. Japan and South Korea are also seeing more usage among working females, with high-end apps providing AI-driven cycle tracking and stress-reducing features. Such advancements indicate a fast-paced menstrual health apps market analysis, indicating huge prospects in this market.

Key Players in the Menstrual Health Apps Market

Leading menstrual health apps companies in the market comprise Flo Health Inc., Glow Inc., Biowink GmbH, Planned Parenthood Federation of America Inc., Ovia Health, MagicGirl, Procter & Gamble, Simple Design Ltd., Clue by BioWink, Kindara, and Natural Cycles.

Recent Developments in the Menstrual Health Apps Market

-

In February 2025, Laiqa introduced an AI-powered women's wellness app, covering a wide spectrum of health needs from periods to menopause, offering personalized support and holistic care for users at every stage of reproductive health.

-

In December 2024, Asan launched a free period tracking app designed to offer users insights into their menstrual cycles along with an environmental impact tracker, aiming to raise awareness about sustainable menstrual health practices.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.72 billion |

| Market Size by 2032 | USD 7.52 billion |

| CAGR | CAGR of 20.27% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Android, iOS) • By Applications (Fertility & Ovulation Management, Menstrual Health Management, and Period Cycle Tracking) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Flo Health Inc., Glow Inc., Biowink GmbH, Planned Parenthood Federation of America Inc., Ovia Health, MagicGirl, Procter & Gamble, Simple Design Ltd., Clue by BioWink, Kindara, and Natural Cycles. |