Micro Inverter Market Size & Trends:

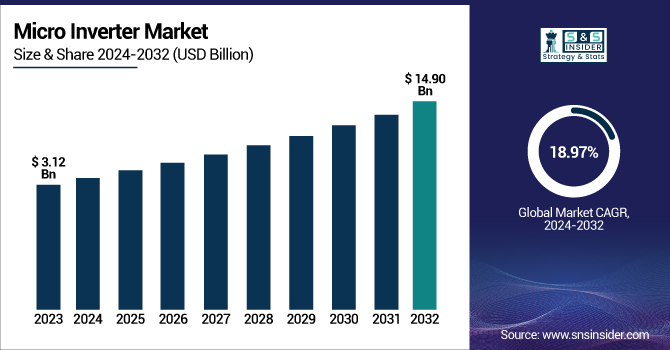

The Micro Inverter Market was valued at USD 3.12 Billion in 2023 and is projected to reach USD 14.90 Billion by 2032, growing at a CAGR of 18.97% from 2024 to 2032. Key drivers for this market include technological advancements that are enhancing inverter efficiency and performance, contributing to higher energy conversion rates. The growing integration with energy storage systems is another major factor, as it enables more reliable and sustainable solar energy solutions, especially in off-grid and backup power applications.

To Get more information on Micro Inverter Market - Request Free Sample Report

Additionally, the durability and long lifespan of micro inverters make them more attractive to consumers, offering lower maintenance and higher reliability compared to traditional inverters. The market is also witnessing an increasing demand for customization and modular solutions, allowing for scalable solar energy systems that can be easily expanded as needed.

In the U.S., the micro inverter market was valued at USD 0.61 Billion in 2023 and is expected to reach USD 2.94 Billion by 2032, growing at a CAGR of 19.07%, driven by similar technological innovations and increasing adoption of residential and commercial solar systems.

Micro-Inverter Market Dynamics:

Drivers:

-

SMA's Innovative Grid-Scale Battery Inverter for Enhanced Efficiency in Large-Scale Storage Projects

SMA has introduced its new Sunny Central Storage UP-S inverter, designed for large-scale energy storage projects. This inverter features advanced silicon carbide (SiC) MOSFET technology, ensuring high power conversion efficiency and grid-forming capabilities. Supporting up to 4,600 kVA without power derating at 95°F, the inverter boasts an efficiency of over 99.2%, which reduces battery capacity requirements. Its dynamic grid support is ideal for peak demand periods, offering enhanced grid stability. The inverter’s robust power stack topology provides fault ride-through capabilities, and it uses SMA’s OptiCool air cooling system for optimal performance. With overload capabilities for grid-forming applications and minimized harmonic emissions, the inverter is compatible with complex grid conditions. SMA has successfully launched the device in the U.S. after its success in Australia, strengthening its position in the utility-scale solar and storage market.

Restraints:

-

Compatibility with Existing Solar Systems May Require Upgrades or Replacements

Compatibility issues can be a significant restraint in the adoption of micro inverters. These inverters may not always be compatible with existing solar systems, especially older setups that were designed for string inverters. As a result, homeowners or businesses may need to replace or upgrade their entire solar infrastructure to integrate micro inverters, which can be costly and time-consuming. This requirement for system modifications can discourage potential customers from switching to micro inverters, as the additional investment may not seem worthwhile. Furthermore, the process of ensuring compatibility with other system components, such as energy storage or monitoring systems, adds complexity to the installation and integration, further limiting the widespread adoption of micro inverters.

Opportunities:

-

Growing Demand for Off-Grid and Backup Power Fuels Micro Inverter Market Expansion

The rising demand for off-grid and backup power solutions is a significant driver of growth in the micro inverter market. As more consumers seek reliable energy sources in remote areas and during power outages, micro inverters are increasingly being adopted for off-grid solar applications. These inverters provide an efficient and flexible solution, enabling solar panels to operate independently from the grid, making them ideal for locations where access to reliable grid power is limited. Additionally, in areas prone to frequent power outages, micro inverters ensure continuous power generation, offering a dependable backup power system. With advancements in energy storage technologies and a growing emphasis on energy independence, the demand for micro inverters is expected to increase, particularly for residential, commercial, and industrial users seeking energy security and sustainability.

Challenges:

-

Efficiency Limitations of Micro Inverters in Large-Scale Commercial and Industrial Systems

In large-scale commercial and industrial solar systems, micro inverters may not provide the same level of cost-effectiveness or efficiency as central inverters. While micro inverters are advantageous in residential setups, their performance in larger installations is often less optimized. Micro inverters are installed on each individual solar panel, which increases system complexity and overall costs. In contrast, central inverters handle power conversion for multiple panels at once, reducing hardware and operational expenses. The large number of micro inverters needed for expansive systems can complicate maintenance and increase long-term service costs. As a result, larger installations often prefer central inverters, which offer greater efficiency and easier management, making them a more suitable choice for commercial and industrial applications where scalability and cost efficiency are critical.

Microinverter Industry Segment Analysis:

By Type

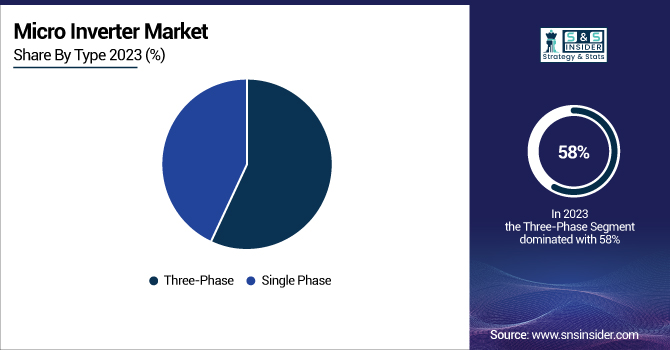

The Three-Phase segment holds the largest share of the micro inverter market, accounting for approximately 58% of the total revenue in 2023. This dominance can be attributed to the higher efficiency and power output that three-phase inverters offer compared to single-phase inverters. Three-phase inverters are more suitable for commercial and industrial applications, where larger power capacities and grid stability are required. Their ability to manage higher energy loads makes them ideal for systems with multiple solar panels or larger installations. Additionally, three-phase inverters provide better performance in terms of reduced energy losses and improved power distribution, making them a preferred choice for customers seeking reliability and optimal performance in large-scale solar applications.

The Single-Phase segment is expected to witness the fastest growth in the micro inverter market from 2024 to 2032. This growth is driven by the increasing demand for residential solar installations, where single-phase inverters are more suitable due to their lower cost and simpler design. Single-phase systems are easier to install and maintain, making them a popular choice for homeowners seeking efficient and affordable solar solutions. Additionally, as more individuals and small businesses adopt solar energy, the affordability and simplicity of single-phase inverters make them an attractive option, further contributing to their rapid market growth during the forecast period.

By Power Rating

Above 500 W segment dominates the micro inverter market, capturing around 45% of the total revenue in 2023. This segment's dominance is driven by the increasing demand for higher power output in both commercial and large residential solar applications. Inverters with a power rating above 500 W offer enhanced efficiency and the ability to handle larger solar systems, making them ideal for installations that require greater energy generation. Their ability to support multiple panels and provide optimal performance in diverse conditions further solidifies their preference for large-scale solar projects, boosting their market share significantly.

The Between 250 to 500 W segment is the fastest-growing in the micro inverter market from 2024 to 2032. This growth is driven by the rising demand for mid-range power solutions in residential and small commercial applications. These inverters offer an ideal balance between cost and performance, providing efficient energy conversion for medium-sized solar installations. Their ability to handle moderate energy loads while maintaining high efficiency makes them a popular choice for homeowners and small businesses looking for reliable, affordable solar systems. As solar adoption continues to grow in these sectors, the demand for inverters in this power range is expected to increase rapidly during the forecast period.

By End-User

The Residential segment dominates the micro inverter market, capturing around 55% of the total revenue in 2023. driven by the rapid uptake of solar energy in home applications, with homeowners seeking efficient, cost-effective energy solutions. Micro inverters are most often deployed in residential solar systems due to their benefits of module-level monitoring, enhanced energy harvesting, and straightforward installation. Also, a drive toward energy independence, along with government subsidies and the plummeting prices of solar panels, have all contributed to an explosion of residential solar installations. In addition, palatable independence is offered to homeowners based on unconditional reward with the use of micro inverters, which is the key factor driving this segment growth, but makes the residential segment market leader globally.

The Commercial segment is the fastest-growing in the micro inverter market from 2024 to 2032. This growth is driven by the increasing adoption of solar energy in commercial buildings, where businesses are seeking to reduce energy costs and enhance sustainability. Micro inverters provide benefits like improved energy efficiency, scalability, and module-level monitoring, which are essential for optimizing the performance of larger solar installations. As more establishments that are commercial invest in renewable energy solutions, the demand for micro inverters is expected to rise, especially due to their ability to offer better system performance and safety compared to traditional inverters. This trend will continue as commercial sectors prioritize energy independence and cost savings.

Micro Inverter Market Regional Insights:

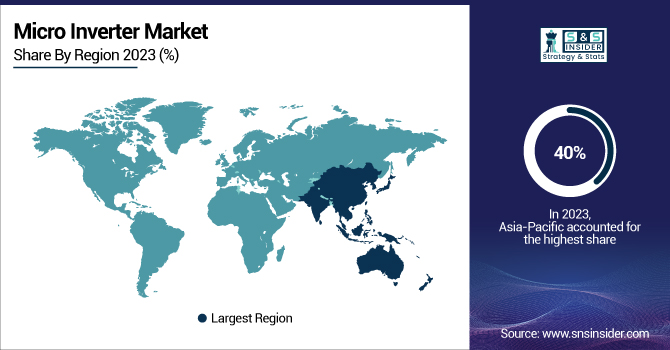

The Asia-Pacific region dominates the micro inverter market, accounting for approximately 40% of the total revenue in 2023. This significant market share can be attributed to the region's rapid adoption of solar energy, particularly in countries like China, India, and Japan, which are leading the global solar power installation efforts. The growing demand for renewable energy solutions in both residential and commercial sectors, supported by government incentives and favorable policies, has boosted the adoption of micro inverters. Additionally, technological advancements, lower installation costs, and increasing awareness about energy efficiency contribute to the market's growth in this region. As Asia-Pacific continues to lead the global transition towards sustainable energy, the demand for micro inverters is expected to remain strong, solidifying its dominant position in the market.

The North America region is the fastest-growing market for micro inverters over the forecast period from 2024 to 2032. This growth is driven by the increasing adoption of solar energy systems, particularly in the United States and Canada, where the push for renewable energy is supported by favorable government policies, tax incentives, and sustainability goals. Additionally, the rise in demand for off-grid and backup power systems, coupled with the integration of micro inverters in residential, commercial, and industrial applications, contributes to the region's rapid expansion. Technological advancements, cost reductions, and the need for energy-efficient solutions further fuel the growth of the micro inverter market in North America, positioning it as a key player in the global renewable energy transition.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in Micro Inverter Market are:

-

Enphase Energy (U.S.): Enphase IQ Series Microinverters (IQ7, IQ7+, IQ7X)

-

Altenergy Power Systems, Inc. (China): APS YC600, YC1000

-

Hoymiles (China): HM-500, HM-600, HM-700 Series

-

Deye Inverter (China): Deye Hybrid Micro Inverters

-

Chilicon Power, LLC (U.S.): Chilicon Micro Inverter

-

AEconversion GmbH & Co. KG (Germany): AEconversion Micro Inverters (AE3 series)

-

Envertech (China): Envertech EV Series Micro Inverters

-

Zhejiang Benyi New Energy Co, Ltd. (China): BYD Micro Inverters

-

Solar Panel Plus (U.S.): Micro Inverter Systems (various models compatible with solar panels)

-

CyboEnergy (U.S.): CyboInverter Micro Inverter System

-

Sparq Systems (Canada): Sparq Micro Inverters

-

Sungrow (China): Sungrow SG5KTL-M and other hybrid inverters

-

HiQ Solar (U.S.): HiQ Solar Micro Inverters

Key players in the supply of raw materials and components for the Micro Inverter Market:

-

Nexperia (Netherlands)

-

Infineon Technologies (Germany)

-

STMicroelectronics (Switzerland)

-

Texas Instruments (U.S.)

-

ON Semiconductor (U.S.)

-

Vishay Intertechnology (U.S.)

-

Littelfuse (U.S.)

-

Macom Technology Solutions (U.S.)

-

Rohm Semiconductor (Japan)

-

Toshiba Corporation (Japan)

Recent News:

-

21 March 2025, The first phase of the world’s largest micro-inverter solar farm has been installed at the NIRAS-Belgoprocess nuclear site in Dessel, Flanders, featuring almost 4,000 solar panels It is expected to produce a minimum of 2000 MWh per year, 48 T annual reduction of CO2, and increased safety with micro-inverters.

-

March 12th, 2025: SolaX Power is gearing up to introduce its new range of solar micro-inverters specifically designed for smaller homes located on rooftops across India as part of PM Surya Ghar programme. However, the company remained pending on final certification approvals of the new product.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.12 Billion |

| Market Size by 2032 | USD 14.90 Billion |

| CAGR | CAGR of 18.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Single Phase, Three Phase) • By Power Rating (Below 250 W, Between 250 to 500 W, Above 500 W) • By End-User (Residential, Commercial, Industrial and Electric Utility) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Enphase Energy (U.S.), Altenergy Power Systems, Inc. (China), Hoymiles (China), Deye Inverter (China), Chilicon Power, LLC (U.S.), AEconversion GmbH & Co. KG (Germany), Envertech (China), Zhejiang Benyi New Energy Co, Ltd. (China), Solar Panel Plus (U.S.), CyboEnergy (U.S.), Sparq Systems (Canada), Sungrow (China), and HiQ Solar (U.S.). |