Healthcare BPO Market Overview & Growth Analysis

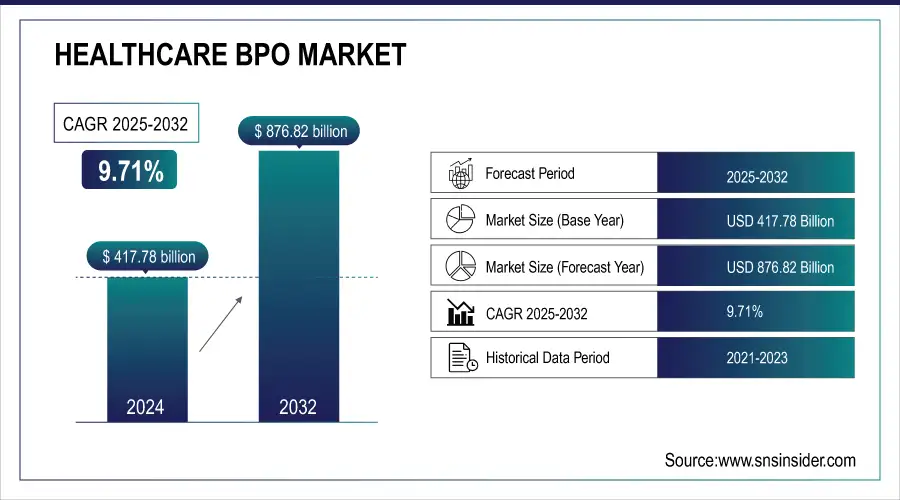

The Healthcare BPO Market was valued at USD 417.78 billion in 2025E and is expected to reach USD 876.82 billion by 2033, growing at a CAGR of 9.71% from 2026-2033.

The healthcare BPO market is witnessing strong growth driven by rising demand for affordable healthcare, digital transformation, and specialized outsourcing solutions. Cloud-based BPO services enable global delivery at lower costs, while regulatory shifts and value-based care models push organizations toward outsourcing for efficiency. Growing adoption of telemonitoring, electronic health records, and claims processing due to chronic diseases further supports expansion. Strategic collaborations, such as Genpact with GE HealthCare and McKesson, highlight the role of AI and automation in enhancing operations. Despite challenges like data security risks and control concerns, outsourcing remains vital for cost reduction and improved patient care.

Healthcare BPO Market Size and Forecast:

-

Market Size in 2025E: USD 417.78 Billion

-

Market Size by 2033: USD 876.82 Billion

-

CAGR: 9.71% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Healthcare BPO Market - Request Sample Report

Healthcare BPO Market Trends

-

Rising need to reduce operational costs is driving healthcare organizations to outsource non-core processes.

-

Increasing adoption of digital technologies, automation, and AI is enhancing efficiency in BPO services.

-

Growing demand for medical billing, coding, claims processing, and revenue cycle management is fueling market growth.

-

Expansion of cloud-based BPO solutions is enabling scalability and secure global service delivery.

-

Focus on regulatory compliance and data security is shaping outsourcing strategies.

-

Rising pressure to improve patient care quality and streamline workflows is boosting adoption.

-

Partnerships between healthcare providers and BPO vendors are fostering specialized, value-added service offerings.

The U.S. Healthcare BPO market size was valued at an estimated USD 165.20 billion in 2025 and is projected to reach USD 345.80 billion by 2033, growing at a CAGR of 8.6% over the forecast period 2026–2033. Market growth is driven by increasing outsourcing of administrative, revenue cycle management, telehealth, and IT services by healthcare providers to improve efficiency, reduce operational costs, and enhance patient care. Rising adoption of digital healthcare solutions, stringent regulatory compliance requirements, and the growing need for streamlined data management are accelerating market expansion. Additionally, advancements in AI, cloud computing, and analytics, along with strategic partnerships between healthcare providers and BPO service vendors, further strengthen the growth outlook of the U.S. healthcare BPO market during the forecast period.

Healthcare BPO Market Growth Drivers and Restraints

Driver: Rising Pressure to Reduce Healthcare Costs Drives Healthcare BPO Market Growth

The primary growth driver for the healthcare BPO market is the rising pressure to curb increasing healthcare costs. As the cost of healthcare continues to rise, organizations are compelled to manage and contain such costs. Outsourcing non-core functions such as medical billing, claims processing, and other administrative activities to specialized BPO service providers has become an effective means to enjoy considerable cost savings. Outsourcing can help healthcare organizations reduce their costs on labor, space, and resource management, thus allowing them to focus more on core activities such as patient care and innovation in the clinical fields. Offshore outsourcing amplifies these savings with lower labor costs in other regions besides increasing efficiency and productive operation. Structural factors also include a shift toward value-based care, more emphasis on care management, and higher cost-sharing with patients which are slowing the growth of healthcare spending. The health insurance exchanges in the United States have also increased competition and hence put pressure on the payer margins, forcing them to outsource because they need to optimize their costs. Besides, governmental efforts in implementing BPO strategies and the implementation of cloud-based solutions increase the security of data and help increase the demand for healthcare BPO services. Increasing chronic diseases and population aging further add to the requirement for efficient management of patient and claim records and fuel the growth of the market. This is ultimately pushing healthcare providers toward outsourcing solutions and means to ensure cost-effectiveness and high standards of service in an increasingly competitive landscape.

Restraint: Hidden Outsourcing Costs, Compliance Challenges, and Regulatory Complexities Significantly Restrain the Growth Trajectory of the Healthcare BPO Market

The healthcare BPO market faces major restraints due to hidden outsourcing costs and the complexity of regulatory compliance. Unexpected expenses often arise during vendor selection, process transition, integration, and the implementation of stringent security measures. Additionally, compliance with international data privacy and healthcare regulations, such as HIPAA and GDPR, adds layers of complexity and cost. These factors can erode the anticipated financial benefits of outsourcing, reducing its appeal for healthcare providers. As a result, the overall market growth trajectory slows, despite rising demand, as organizations weigh cost savings against compliance burdens and hidden operational risks.

Healthcare BPO Market Segmentation Analysis

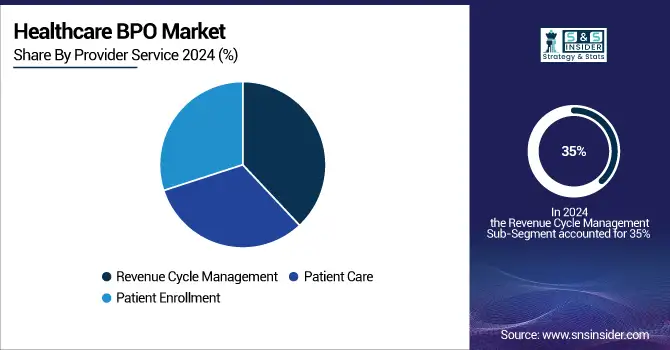

By Provider Service: Revenue Cycle Management led while Patient Care is expanding fastest

In 2025, the largest share in the healthcare BPO market was captured by Revenue Cycle Management, at about 35%. The reason for RCM's dominance is its direct impact on financial stability because it encompasses processes critical to billing, claim submission, and revenue generation, which helps providers maximize reimbursements and minimize denials.

The fastest-growing segment within Provider Services is Patient Care at 11% through 2033. This sector is growing fast because attention to improving patient experiences and outcomes is becoming more stringent. The outsourcing of various Patient Care activities, which include telehealth services as well as remote monitoring activities, allows providers to refocus on core medical responsibilities while ensuring that patient interfaces are continuous and of maximum quality.

By Payer Service: Claims Management dominated while Analytics & Fraud Management is fastest-growing

The Claims Management segment under Payer Services led the healthcare BPO market in 2025 with a market share of approximately 30%. This is because streamlined claims processing is critical for payers to improve accuracy, reduce errors, and shorten payment cycles, especially when managing large volumes of claims. Claims Management also addresses the growing demands for fraud detection and cost control, making it a core outsourced function.

Analytics & Fraud Management would emerge as the fastest-growing segment within Payer Services with an expected CAGR of 12% between 2026 and 2033. Growth will be driven by an increase in the use of data analytics for fraud prevention and cost optimization, enabling healthcare organizations to better the processes for decision-making while achieving better patient outcomes.

Healthcare BPO Market Regional Analysis

North America Healthcare BPO Market

North America dominated the healthcare BPO market in 2025, driven by widespread EHR adoption under HIPAA 5010 compliance, which standardized electronic processes like billing and claims. The presence of numerous healthcare providers, payers, and pharmaceutical companies with complex regulatory demands further fuels outsourcing. Strong healthcare infrastructure, advanced technology adoption, and high regulatory compliance needs make the region a hotspot for specialized BPO services. This combination positions North America as the leading and strategically vital market for healthcare BPO growth.

Need any customization research on Healthcare BPO Market - Enquiry Now

Asia Pacific Healthcare BPO Market

Asia Pacific is projected to grow at the fastest rate in the healthcare BPO market in the forecasted period 2026-2033, driven by cost-effective outsourcing, expanding healthcare infrastructure, and rapid digital adoption. The region offers a skilled workforce, lower operational costs, and rising demand for electronic health records and telemedicine. Increasing chronic disease prevalence and supportive government initiatives further boost outsourcing adoption, positioning Asia Pacific as a key hub for healthcare BPO growth and international service delivery.

Europe Healthcare BPO Market

Europe holds a significant position in the healthcare BPO market, supported by advanced healthcare systems, strict regulatory frameworks, and the rising need for cost efficiency. The region emphasizes compliance with GDPR and data security, driving demand for specialized outsourcing services. Growing adoption of digital health solutions, electronic health records, and telemonitoring also fuels market expansion, making Europe a strong contributor to the overall healthcare BPO industry’s development.

Middle East & Africa and Latin America Market Insights

The Middle East & Africa and Latin America healthcare BPO markets are growing steadily, supported by improving healthcare infrastructure, rising demand for affordable services, and increasing adoption of digital health solutions. Outsourcing helps providers manage costs while expanding access to care. Although challenges such as regulatory complexity and data security concerns exist, growing investments and partnerships are strengthening outsourcing adoption, positioning both regions as emerging opportunities in the healthcare BPO industry.

Healthcare BPO Market Competitive Landscape

Infosys BPM

Infosys BPM plays a vital role in the healthcare BPO market by delivering cost-effective, technology-driven outsourcing solutions. Leveraging automation, analytics, and AI, the company supports healthcare providers, payers, and pharmaceutical firms with services like claims processing, patient engagement, and regulatory compliance. Its strong expertise in digital transformation enhances operational efficiency and customer experience. With a focus on innovation and compliance, Infosys BPM strengthens its position as a trusted partner in global healthcare outsourcing.

-

2025: Infosys BPM launched Agentic AI “AI agents” for finance and accounting, enabling healthcare clients to automate workflows, enhance accuracy, reduce cycle times, and improve user experiences across shared services.

-

2024: Infosys BPM opened its second delivery center in Aguadilla, Puerto Rico, expanding bilingual BPM support and offering HIPAA-compliant services for healthcare payers and providers needing efficient nearshore outsourcing solutions.

Sutherland

Sutherland is a key player in the healthcare BPO market, offering end-to-end solutions that enhance operational efficiency, compliance, and patient engagement. The company leverages AI, automation, and analytics to streamline processes such as claims management, revenue cycle management, and patient support services. With a global delivery network and expertise in digital transformation, Sutherland helps healthcare providers and payers reduce costs, improve care quality, and adapt to evolving regulatory and market demands effectively.

-

2025: Sutherland expanded partnership with Google Cloud to deliver industry-specific AI solutions; regulated industries like healthcare benefit from patented Sentinel AI and secure remote-work capabilities for compliant, efficient operations.

R1 RCM

R1 RCM is a leading player in the healthcare BPO market, specializing in revenue cycle management solutions that drive efficiency, compliance, and financial performance for healthcare providers. The company leverages technology, automation, and analytics to streamline billing, claims, and patient financial services. Its strong partnerships with large health systems and continuous innovation position R1 RCM as a trusted outsourcing partner, supporting providers in optimizing operations and adapting to evolving regulatory and market challenges.

-

2024: R1 RCM completed its acquisition by TowerBrook and CD&R, becoming private; earlier announced plan followed strategy to accelerate tech-led revenue cycle transformation for providers.

-

2024: R1 RCM agreed to acquire Providence’s Acclara modular services business for USD 675M plus warrants, broadening end-to-end RCM offerings and deepening large health-system partnerships.

Key Players by Service Offering

1. IT & Consulting Services (End-to-End Solutions)

-

NTT Data Corporation

-

Tata Consultancy Services (TCS)

-

Wipro

2. Revenue Cycle Management (RCM) & Financial Services

-

R1 RCM

-

Firstsource Solutions

-

GeBBS Healthcare Solutions

-

Omega Healthcare

3. Claims Processing & Payer Services

-

IQVIA

-

Genpact

-

Sutherland Global

-

Mphasis

4. Data Analytics & Fraud Management

-

Infosys BPM

-

Sykes Enterprises

-

Parexel International

-

IQVIA

5. Pharmaceutical & Clinical Services

-

Lonza

-

Parexel International

-

IQVIA

6. Patient Care & Engagement Services

-

UnitedHealth Group

-

Xerox Corporation

-

Sykes Enterprises

7. Customer Relationship Management (CRM) & Support Services

-

Sutherland Global

-

WNS (Holdings) Limited

-

Invensis Technologies

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 417.78 Billion |

| Market Size by 2033 | US$ 876.82 Billion |

| CAGR | CAGR of 9.71% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Payer Service (Claims Management, Integrated Front-end Services & Back-office Operations, Member Management, Billing & Accounts Management, Analytics & Fraud Management, HR) • By Provider Service (Revenue Cycle Management, Patient Care, Patient Enrollment) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture, Cognizant, IBM Corporation, Infosys BPM, NTT Data Corporation, Tata Consultancy Services (TCS), Wipro, R1 RCM, Firstsource Solutions, GeBBS Healthcare Solutions, Omega Healthcare, IQVIA, Genpact, Sutherland Global, Mphasis, Sykes Enterprises, Parexel International, Lonza, UnitedHealth Group, Xerox Corporation, WNS (Holdings) Limited |