Premade Pouch Packaging Market Report Scope & Overview:

Get More Information on Premade Pouch Packaging Market - Request Free Sample Report

The Premade Pouch Packaging Market Size was USD 10.8 billion in 2023 & is projected to reach USD 16.47 billion by 2032 growing at a CAGR of 4.8% by 2024 to 2032

Premade pouches are conquering the market with their consumer-centric approach. Effortless opening mechanisms like tear notches and zippers make them a breeze to use, while their lightweight design translates to reduced costs for transportation and storage. Sustainability is another feather in their cap, as the industry increasingly embraces eco-friendly materials in pouch production. This aligns perfectly with the growing environmental consciousness of both consumers and businesses. Premade pouches can adapt to a wide range of products, from food and beverages to cosmetics and pharmaceuticals, offering manufacturers a packaging solution that maximizes shelf space and caters to diverse needs. However, one potential hurdle remains, achieving optimal protection for certain products.

The premade pouch industry is experiencing a revolution. Intelligent packaging is taking center stage, with QR codes and RFID technology being incorporated to boost traceability, empower consumers with interactive experiences, and deliver rich product information at their fingertips. Sustainability is a cornerstone trend, with the development and adoption of eco-friendly materials for premade pouches flourishing. Japan's pharmaceutical market is ripe for growth. Generic drugs dominate at nearly 81% of prescriptions, and the country imports a significant amount of pharmaceuticals. With a rapidly aging population requiring new treatments, this demand is expected to climb even higher, fueling positive growth in the market.

MARKET DYNAMICS

KEY DRIVERS:

-

The growing demand for convenience in everyday life is a key driver shaping consumer preferences across various industries

The packaging industry is getting a makeover, with a focus on creating a positive brand experience and prioritizing consumer comfort. This translates to a surge in flexible packaging, especially pouches. These user-friendly pouches are a win-win for both brands and consumers. Brands benefit from the potential for stronger brand loyalty thanks to the premium feel of flexible packaging.

-

Pre-made pouches' wide product compatibility across industries makes them a versatile packaging choice

RESTRAINE:

-

One potential drawback of pre-made pouches is their limited barrier properties compared to some rigid packaging options

-

Concerns about the environmental impact of production processes and potential limitations in the recyclability of certain pouch materials

OPPORTUNITY:

-

The production of PET jars and bottles is a highly profitable venture within the plastics and polymer industry

-

Stand-out packaging is key in today's crowded shelves. It needs to be both eye-catching and appealing to consumers

Customers are drawn to brands that offer unique and creative packaging, like Roots and Agrostreet. This packaging goes beyond aesthetics it's durable, convenient, and even customizable for different occasions. With the e-commerce boom fueled by COVID-19, eye-catching packaging is a strategic weapon for brands to grab attention and retain customers in the competitive online marketplace.

CHALLENGES:

-

Pouch adoption faces a hurdle as competition from cheap, familiar rigid containers

-

New equipment and production lines for pouches can be a budget barrier for some companies considering the switch

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine war has created a ripple effect through the premade pouch packaging market. Disruptions in the supply chain, production halts, and rising material costs pose significant challenges for pouch manufacturers. This could lead to higher prices, product shortages, and even a shift towards alternative packaging solutions in the short term. Over 300 major western packaging companies have exited Ukraine and Russia. Karpatneftekhim, Ukraine's largest PET plant, has shut down operations. The price of aluminum, a key material in premade pouches, has surged due to the war. The price of kraft pulp, another material used in premade pouches, has also increased significantly.

IMPACT OF ECONOMIC SLOWDOWN

The severity and duration of the economic slowdown will play a significant role in its impact on the market. The relative price competitiveness of premade pouches compared to alternative packaging options will be crucial. The ability of the premade pouch industry to innovate and develop cost-effective solutions will influence its success during an economic downturn. The growth of e-commerce often continues even during economic slowdowns. Premade pouches can be a good fit for e-commerce due to their lightweight nature and efficient use of space, potentially leading to increased demand.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Paper

-

Foil

-

Multi-layer

Plastic pouches reign supreme in the premade pouch market. This dominance stems from their triple threat of affordability, versatility, and lightweight design. They cater to various industries with their customizable shapes, sizes, and attractive printability. Plus, compared to other materials, plastic keeps production and transportation costs down.

By Closure Type

-

Tear Notch

-

Zipper

-

Spout

-

Flip Lid

Tear notches reign supreme in the world of pouch closures, claiming the dominant market share and expected to maintain their lead. This dominance is fueled by a powerful trio of advantages such as simplicity, convenience, and affordability. The ingenious tear notch design eliminates the need for fumbling with extra tools or utensils consumers simply tear along a designated perforation to access the contents. This user-centric approach perfectly aligns with the growing trend of consumers prioritizing convenience in their packaging choices.

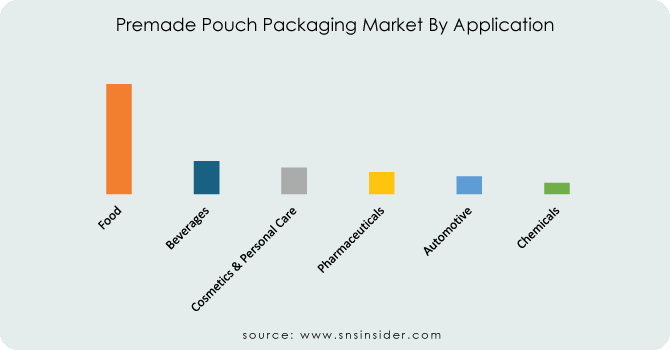

By Application

-

Food

-

Beverages

-

Cosmetics & Personal Care

-

Pharmaceuticals

-

Automotive

-

Chemicals

The food industry reigns supreme in the premade pouch market, holding a dominant 52% share and projected for continued growth. This dominance is fueled by the convenience and versatility pouches offer. From keeping fresh-cut vegetables crisp to showcasing snacks enticingly, pouches cater to a variety of food applications. They promote portion control for single-serve meals, reduce packaging waste, and enhance portability all while maximizing consumer convenience. Pouches can handle diverse textures, from liquids like yogurt to solid snacks like nuts, and their resealable closures add another layer of user-friendliness. Compared to rigid containers, pouches are lighter, easier to store and transport, ultimately creating a superior experience for food consumers.

Get Customized Report as per your Business Requirement - Request For Customized Report

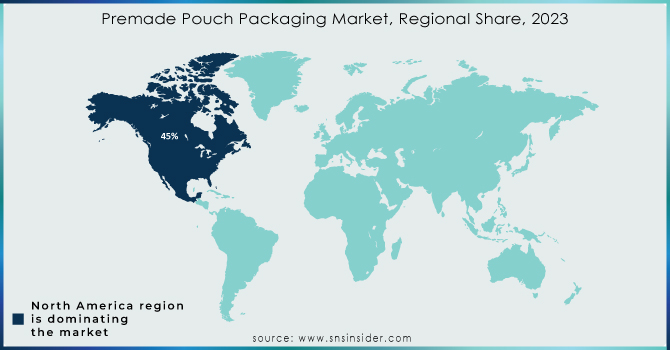

REGIONAL ANALYSIS

North America reigns supreme in the premade pouch market, boasting a dominant share of 45% and projected for further growth. This dominance is fueled by a powerful combination of strong economies with high consumer buying power, a growing preference for convenient and portable packaging, and the e-commerce boom. Additionally, North American consumers' increasing focus on sustainability is driving demand for eco-friendly pouch materials, making this region a leader in adopting innovative and responsible packaging solutions.

Germany leads the European pre-made pouch market, while Russia and Spain are poised for the fastest growth. This surge is fueled by Europe's rising demand for packaged food and innovative pouch features like easy-open, resealable closures, making them a convenient and user-friendly choice for consumers. China's booming population, fondness for packaged food, and rising disposable income make it a prime market for pre-made pouches in Asia. Early adoption of recyclables and a robust healthcare system further solidify China's position as a major player.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

Latin America

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some of the major players in the Premade Pouch Packaging Market are Berry Global, Amcor, Mondi Group, Sealed Air (Cryovac), Constantia Flexibles, Sonoco Products, Huhtamaki, C-P Flexible Packaging, Tyler Packaging, Viking Masek, Accredo Packaging, Karlville, General Packer And Others Players.

RECENT DEVELOPMENTS

-

German company Sihl, known for their facestock expertise, launched Artysio in June 2022. This innovative film is designed for pre-made stand-up pouches that can be individually printed, making it suitable for both "print and pack" and "pack and print" production processes.

-

Mondi, a major player, announced an investment in July 2022 to expand its offerings in sustainable pet food packaging solutions. This commitment goes a step further with a planned EUR 65 million investment across three European consumer flexible packaging plants. This expansion aims to boost production capacity and cater to the growing demand for eco-friendly pet food packaging solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.8 Bn |

| Market Size by 2032 | US$ 16.47 Bn |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Paper, Foil, Multi-Layer) • By Closure Type (Tear Notch, Zipper, Spout, Flip Lid) • By Application (Food, Beverages, Cosmetics & Personal Care, Pharmaceuticals, Automotive, Chemicals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Berry Global, Amcor, Mondi Group, Sealed Air (Cryovac), Constantia Flexibles, Sonoco Products, Huhtamaki, C-P Flexible Packaging, Tyler Packaging, Viking Masek, Accredo Packaging, Karlville, General Packer |

| Key Drivers | • The growing demand for convenience in everyday life is a key driver shaping consumer preferences across various industries • Pre-made pouches' wide product compatibility across industries makes them a versatile packaging choice |

| Key Restraints | • One potential drawback of pre-made pouches is their limited barrier properties compared to some rigid packaging options • Concerns about the environmental impact of production processes and potential limitations in the recyclability of certain pouch materials |