Propanol Market Report Scope & Overview:

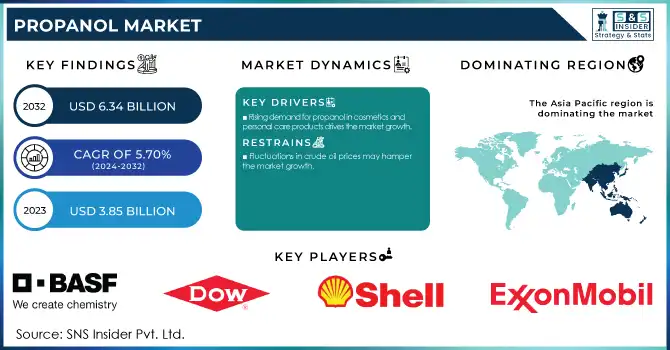

The Propanol Market size was valued at USD 3.85 Billion in 2023 and is expected to reach USD 6.34 Billion by 2032, growing at a CAGR of 5.70% over the forecast period of 2024-2032.

Get More Information on Propanol Market - Request Sample Report

The report addresses the latest price trends, supply chain challenges, and investment activities, offering valuable insights into the ongoing shifts and future potential of the propanol market. It provides insights into the current market size and future projections, analyzing production and consumption patterns across various sectors, including pharmaceuticals, cosmetics, paints, coatings, and industrial cleaning. The report also explores the competitive landscape, featuring major players like ExxonMobil, Shell Chemicals, Dow Inc., and BASF SE, among others, emphasizing their strategic developments, product offerings, and market dominance.

Propanol Market Dynamics

Drivers

-

Rising demand for propanol in cosmetics and personal care products drives the market growth.

The growing preference of consumers for high, premium-quality personal care products further increase the market growth. The trend of natural and organic cosmetics drives the demand for propanol to prepare cosmetics, which reduce harm compared to conventional synthetic alternatives. Due to growth of middle-class population in in emerging markets in the following years, demand for personal care and beauty products is increasing and thus propanol consumption. These trends underscore the growing importance of propanol for the global cosmetics sector and drive market growth. Factors such as the high demand for propanol in the cosmetic and personal care industry act as major growth indicators for the propanol market. Propene-1-ol, and notably isopropyls, has often been applied as a solvent, emulsifier, and preservative agent in cosmetic pathways like lotions, creams, shampoos, and deodorants. Moreover, it becomes an important factor for stability of product, solubility of ingredients as well as sensory aspect for consumers. With the growing international beauty and personal care industry there is a greater demand for functional as well as aesthetic beneficial ingredients. For instance, as per the report by U.S. Bureau of Economic Analysis (BEA), the beauty and personal care industry in the U.S. reached nearly USD 90 billion in 2022 and is anticipated to continue growing 4-5% a year.

Restraint

-

Fluctuations in crude oil prices may hamper the market growth.

Propanol market is majorly restrained by fluctuations in the prices of crude oil as it is used to manufacture propanol. It is produced mainly from propylene, a petroleum refining by-product, but most isopropanol is made from propylene. Fluctuations in crude oil prices lead to fluctuations in propanol production prices, resulting in instable prices of propanol. Higher crude prices can push up manufacturing cost of propanol, again increasing prices for ultimate consumer in the form of higher market prices. The rising costs can lead to demand from propanol-intensive industries like pharmaceuticals, cosmetics and chemicals, to decline as firms try to reduce expenses or might shift to alternative solvents or raw material.

Opportunities

-

Rapidly expanding automotive and construction industry create the opportunity for the market.

The propanol market has a great opportunity from the automotive and construction industry, which is growing very rapidly. Propanol is broadly utilized as a dissolvable for Paints, coatings, and adhesives in the automotive Industry, crucial for the vehicle production and maintenance purposes. Increase in the production of automobiles, particularly in emerging economies such as China, India, and Brazil, has contributed to the demand for high-performance coatings, varnishes and cleaning agents, which in turn, is projected to fuel the consumption of propanol. In addition, increased penetration of electric vehicles (EVs) is also increasing the demand for special coatings and surface treatment solutions driving the steady demand for propanol products.

Likewise, propanol has extensive applications in the construction industry, where it is used for production of paints, varnishes as well as construction chemicals like adhesives and sealants. Increasing Infrastructure Project globally, Urbanization, Smart City projects are driving the demand for these Materials. The construction sector is driven by government funding of housing and commercial construction projects, especially in Asia-Pacific and North America. The propanol market is expected to be a profitable opportunity for manufacturers and suppliers since these end-use- industries are anticipated to grow. Propanol is one of the important chemicals used in coatings, solvents, and cleaning agents.

Challenges

-

Stringent compliance requirements and regulations imposed by regulatory bodies

One of the major these challenges for the propanol market is stringent compliance requirements and regulations imposed by the regulatory bodies. For instance, the Environmental Protection Agency (EPA) in the U.S. and the European Chemicals Agency (ECHA) have established stringent regulations regarding the manufacturing, use, and disposition of chemical solvents, such as propanol. The purpose of these guidelines is to reduce volatile organic compound (VOC) release, provide a safer working environment, and to provide minimal damage to the surrounding environment. Consequently, manufacturers incur huge compliance costs due to cleaner production technology adoption, waste treatment, safety testing, etc., and this adds to production costs, thereby making the whole process expensive.

Moreover, differences in regulatory frameworks from region to region could create a barrier for global players. For instance, if North America and Europe have tough environmental standards and some emerging markets have almost no environmental standards at all, then supply chain disruptions will happen because of varying trade policies.

Propanol Market Segmentation Analysis

By Application

Isopropanol held the largest market share 72% in 2023. Isopropanol is a broad-spectrum solvent, used in the manufacture of pharmaceuticals, cosmetics and personal care products, and industrial cleaning agents. Due to its well-established disinfectant and antiseptic properties, it is an essential component in many hand sanitizers, medical disinfectants, and surface cleaners, especially for healthcare settings. Furthermore, this high volume uses the main actor in the chemical industry isopropanol, which is used as an intermediate in both acetone coatings, and adhesives. Isopropanol is also used in cleaning and degreasing application in automobile and electronics industry which is also experiencing a high growth compared to other end-uses.

The Direct Solvent under the isopropanol segment dominates the propanol market as it covers wide application and is versatile in a number of industries. Propanol, especially isopropanol, is a preferred solvent with ability to dissolve in many kinds of material, low toxicity and fast evaporation rate. And this lattice structure is important for the pharmaceutical and cosmetic industries, because this is activated in the formulation of drugs, sanitizers, and cosmetics. It also works as a good effective solvent for improving the smoothness and durability of coatings in the paints and coatings industry

Propanol Market Regional Outlook

Asia Pacific held the largest market share around 38% in 2023. Propanol is a basic raw material compound in multiple industries including but not limited to paints and coatings sector, pharmaceutical sector and cosmetic sector. Its growing industrial base and rising propensity for using propanol-based products boosted the regional market growth. What is more, huge population growth and urbanization in the Asia Pacific region has resulted in an increase in construction activities. It finds widespread application in construction, particularly in the manufacturing of adhesives, sealants, and coatings. The construction industry booming in the region also reinforced the hold of Propanol Market. Asia Pacific governments have taken steps to nurture development across different sectors that may depend on propanol.

Europe is the fastest growing region in the forecast period. Germany is among the most significant contributors in this region with the maximum market share. The European Propanol market is driven by its consumer base across various sectors including pharmaceuticals, cosmetics, paints, and coatings, significantly. This wide array of applications has been responsible for the wonderful place achieved by region in Propanol Market. Propanol in Europe is mainly driven by the stiff environmental sustainability and safety regulations and standards within the region. European Nations have enforced cancerous chemicals such as Propanol to be used and disposed of in a responsible manner.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

ExxonMobil (Isopropyl Alcohol, Propyl Acetate)

-

Shell Chemicals (Isopropanol, N-Propanol)

-

Dow Inc. (Isopropyl Alcohol, Propanol PG)

-

Sasol Limited (IPA 99, Propanol 2)

-

BASF SE (Isopropanol, n-Propanol)

-

Tokuyama Corporation (IPA Toku, Propanol-S)

-

Eastman Chemical Company (Eastman Isopropanol, Eastman Propanol)

-

Mitsui Chemicals Inc. (IPA Pure, PropyloChem)

-

Solvay (Isopropanol 99, n-Propanol Ultra)

-

KH Chemicals (Isopropyl Alcohol 70%, Propanol 1)

-

LG Chem (Isopropanol LG, N-Propanol LG)

-

LyondellBasell Industries (Isopropanol Pure, Propanol Plus)

-

Honeywell International Inc. (IPA Tech, PropyloClean)

-

Mitsubishi Chemical Corporation (Isopropyl Alcohol MC, Propanol MC)

-

Royal Dutch DSM (Isopropanol Green, Propanol Bio)

-

Zhejiang Xinhua Chemical Co., Ltd. (Isopropanol XH, Propanol XH)

-

JXTG Holdings, Inc. (IPA Super, N-Propanol Premium)

-

China National Petroleum Corporation (CNPC) (Isopropanol CN, Propanol CN)

-

Celanese Corporation (IPA Industrial, Propanol HP)

-

INEOS Group (Isopropanol Pure, Propanol IN)

Recent Development:

-

In 2024, BASF announced the launch of a new bio-based isopropanol product in 2024. The product is designed to meet the increasing demand for sustainable and eco-friendly solutions in cleaning, cosmetics, and industrial applications.

-

In 2023, Eastman announced that it had enhanced its production line for propanol derivatives, specifically for the cosmetics and pharmaceuticals sectors. This development was driven by the surge in demand for personal care products and hand sanitizers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.85 Billion |

| Market Size by 2032 | USD 6.34 Billion |

| CAGR | CAGR of 5.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (n-propanol- Direct Solvent, Chemical Intermediate, and Others, Isopropanol- Chemical Intermediate, Pharmaceuticals, Direct Solvent, Household and personal care, and Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, 3M Company, BASF SE, Sika AG, H.B. Fuller Company, Arkema Group, Solvay SA, Eastman Chemical Company, Dow Chemical Company, LORD Corporation, Mitsui Chemicals, Inc., Adhesive Technologies, AkzoNobel N.V., Wacker Chemie AG, Bostik, RPM International Inc., Parker Hannifin Corporation, Sonneborn, DIC Corporation, Tesa SE |