Substrate-Like PCB Market Size & Growth:

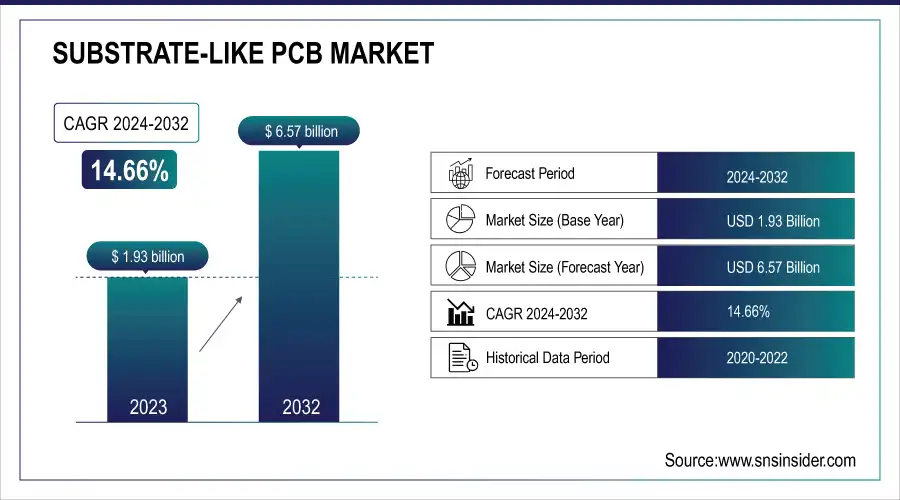

The Substrate-Like PCB Market was valued at USD 1.93 billion in 2023 and is expected to reach USD 6.57 billion by 2032, growing at a CAGR of 14.66% over the forecast period 2024-2032. Demand for compact, high-density circuitry in advanced electronics is causing increased fab utilization for the Substrate-Like PCB (SLP) market. Due to the need for accuracy and yield manufacturers are relying even more on automated optical and X-ray inspection technologies.

Then, in the advanced laser drilling and mSAP processes for fine-line production perspective, we can look for equipment utilization. Further, chipset and 3D IC packaging integration is speeding up given that SLPs deliver the needed interconnect density and structure support for advanced heterogeneous integration and HPC applications. With the rising demand for high-density, compact circuitry in advanced electronics, the U.S. Substrate-Like PCB (SLP) market is expanding in 2024. Fine-line spacing below 25 µm is also a factor, in meeting the needs of compact devices. Now, some leading companies like TTM Technologies and AT&S are ahead of the game by taking a closer look at advanced manufacturing techniques that fulfill the increasing requirements of high-performance electronic applications.

To Get more information on Substrate-Like PCB Market - Request Free Sample Report

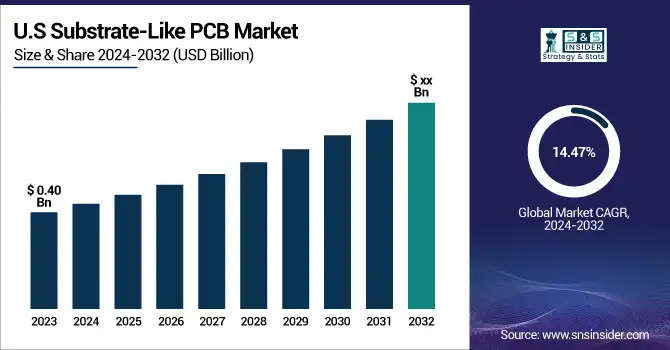

The U.S. Substrate-Like PCB Market is estimated to be USD 0.40 Billion in 2023 and is projected to grow at a CAGR of 14.47%. The growth of the U.S. Substrate-Like PCB (SLP) market can be attributed to the demand for high-performance, high-density compact electronics in consumer electronic products and telecommunication systems. Photo courtesy of Next PCB. The development of 5G technology requires higher data transmission capacity for PCBs.

Substrate-Like PCB Technology Market Dynamics

Key Drivers:

-

Surging Demand for Compact High-Performance Devices Fuels Rapid Growth of Substrate Like PCB Market

Growing demand for small-size, lightweight, and high-performance electronic automation & technology devices is the factor driving the growth of the Substrate-Like PCB (SLP) market. The expanding adoption of SLPs over the past three years in smartphones, particularly by leading smartphone OEMs such as Apple and Samsung because of the capability to carry high-density interconnects (HDI) as well as ideally and in design to enhance signal performance is poised to dramatically drive the market. In addition, the deployment of 5G, the proliferation of wearable technologies, and the continued incorporation of electronics in automobiles are driving demand for small-size, high-frequency PCBs. Improvements in inspection techniques such as Automated Optical Inspection (AOI) and Direct Imaging continue to improve production accuracy, further facilitating the widespread use of SLP usage.

Restrain:

-

Ultrafine Line Fabrication Challenges Restrict Substrates Like PCB Market Growth and Mass Production Efficiency

Technological complexity in the manufacturing of ultrafine line and space PCBs is one of the major restraints to the growth of the substrate-like PCB (SLP) market. This fabrication is characterized by a high degree of precision, and complex technologies, resulting in low manufacturing yields and prolonged development times for sub-25/25 µm designs as well as difficulties in achieving consistency during mass production, due to the critical impact of even minor defects on functionality. This creates a barrier to entry for many smaller manufacturers or new entrants, hindering market growth.

Opportunity:

-

Rising EVs Medical Devices and Smart Manufacturing Unlock Opportunities for Substrate Like PCB Market

The trend towards the scaling up of EVs and autonomous driving increases the need for smaller and more reliable electronic components in automotive systems, therefore providing a significant opportunity for the surface mount packages (SMP) market. Future demand is also expected to be propelled by novel applications in the medical industry like implantable and wearable diagnostic devices (20). Further, the drive towards system automation and smart manufacturing drives to need for high-level PCB in industrial automation and robotics. This demand for ultra-fine line PCBs (<25/25 µm), unlocks additional opportunities for ultra-fine line manufacturers, targeting high-precision electronics and next-gen semiconductor packaging solutions.

Challenges:

-

Skilled Labor Shortage and Integration Challenges Hinder Substrate Like PCB Adoption and Development Speed

The other big problem is the shortage of labor and technical skills needed to handle machines such as direct imaging systems and automated optical shaping machines. In regions where advanced electronics manufacturing is still maturing, this expertise gap can also slow down the adoption rate of SLP technologies. In addition, SLPs can have challenges for OEMs regarding the integration of transitioning through traditional PCB assembly processes due to potential compatibility issues. End-user applications in certain areas, such as automotive and healthcare, continue to evolve at a rapid pace, requiring SLP manufacturers to remain agile to comply with ever-stricter regulatory and performance specifications which only complicates product development and time-to-market strategies.

SLP PCB Market Segment Analysis

By Line

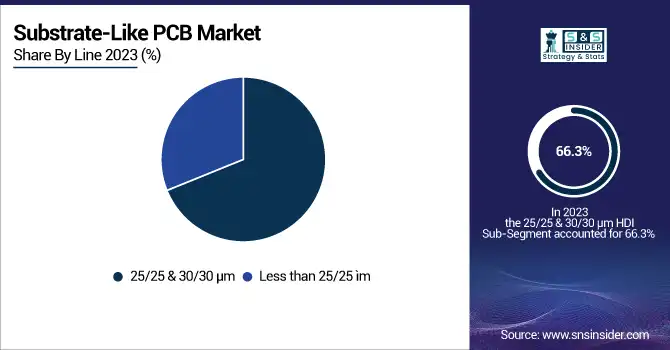

The 25/25 & 30/30 µm segment led in the Substrate-Like PCB (SLP) share at 66.3% globally. It predominantly rules this area, thanks to constant usage and growth in consumer electronics such as smartphones and tablets, thanks to the balance it provides between performance, manufacturability, and cost-efficiency. Such line/space resolutions are mature, already well integrated into existing profusion lines, and far exceed the needs of most current-generation devices.

The segment below 25/25 µm is expected to grow at the fastest CAGR of 25.6% from 2024 to 2032. It can also be attributed to the growing need for high-density interconnects that are miniaturized for newer applications like 5 G-enabled devices, foldable smartphones, wearables, and next-gen automotive electronics. Industrial applications requiring ultra-fine patterning and high circuit density, as consumer devices become slimmer and gain added functionality, are providing robust growth potential in this segment. This will be accompanied by similar growth due to the continued innovation of direct imaging and laser drilling technologies.

By Inspection Technology

Automated Optical Inspection (AOI) had the largest share of the SLP market in 2023, accounting for 53.3%. AOI is a widely used technology that is very effective for capturing defects like shorts, opens, and misalignments in the early stages of the production process. Used at various stages in PCB manufacturing, it allows for consistent quality control and yield enhancement, making it an ideal inspection approach to be used across large-scale production lines, especially in consumer electronics manufacturing.

Direct Imaging is likely to be the fastest-growing segment with a CAGR during the forecast period (2024–2032) Such photomask-free technology with better resolution and alignment capabilities are essential for the manufacturing of the ultra-fine line PCBs (e.g.< 25/25 µm) Direct Imaging Adoption: There is an increasing demand for miniaturization and higher density in circuit design – specifically for applications in 5G devices, IoT, and automotive electronics. This characteristic combined with its high precision makes it the perfect choice for future SLP production.

By Application

Consumer Electronics held the highest share 56.3% of the Substrate-Like PCB (SLP) market in 2023. The ubiquity of SLP integration in smartphones, tablets, smartwatches, and other portable devices has driven this dominance. SLPs have been used by major electronics manufacturers likes as Apple and Samsung to facilitate high-density interconnects that allow for thinner, lighter, and more powerful devices. This also continues to drive consumers in this segment, given the demand for compact and feature-rich electronics continues to grow.

The Automotive segment is anticipated to record the highest CAGR from 2024 to 2032 Increased penetration of EVs, ADAS/AD solutions connected car systems are fueling the need for sophisticated electronic architectures. Automotive use cases like ADAS, infotainment, and power management require reliable features with miniaturization and signal performance characteristics that SLPs offer. With more intelligent, electronic-heavy vehicles, we are experiencing a high-growth segment for high-performance PCBs primarily SLPs in the automotive sector.

Substrate-Like PCB Market Regional Outlook

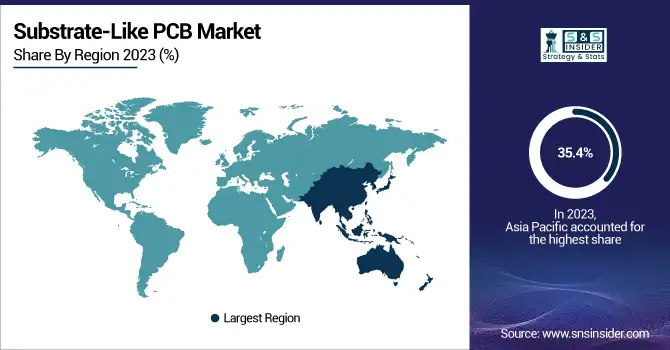

Asia Pacific was the largest Substrate-Like PCB (SLP) market, with a share of 35.4% in 2023, and is expected to maintain the highest growth rate during the forecast period, from 2024 to 2032. This growth is driven by the strong manufacturing ecosystem of the region, increased demand for consumer electronics, and the swift adoption of advanced technologies. China, South Korea, Taiwan, and Japan have evolved to be the epicenters of manufacturing in the world while the leading manufacturers Unimicron, Ibiden, and Samsung Electro-Mechanics have established themselves there. They are pioneering innovation and industrialization of these SLPs for adoption in premium smartphones and tablets and other new tech that incorporates 5G / Internet of Things capabilities. For example, SLPs are sourced from multiple suppliers in Asia by Apple for its iPhone models, whereas in the case of the Galaxy series by Samsung, in-house capabilities are utilized. Also, the expanded EV market in China and the development of automotive electronics in Japan and South Korea have boosted the penetration of SLPs for automotive applications. Asia Pacific remains the hub for SLP development and adoption led by strong government initiatives supporting semiconductor and electronics manufacturing, highly-skilled labor, and matured infrastructure.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the Substrate-Like PCB Market are:

-

Zhen Ding Technology (SLP for iPhone)

-

Compeq Manufacturing (High-Density SLP Boards)

-

Unimicron Technology (SLP for Smartphones)

-

AT&S (Advanced SLP Interconnects)

-

Shennan Circuits (SLP for 5G Modules)

-

Ibiden Co., Ltd. (SLP for Mobile Devices)

-

Kinsus Interconnect Technology (SLP Substrate)

-

TTM Technologies (HDI/SLP Boards)

-

Samsung Electro-Mechanics (SLP for Galaxy Series)

-

Tripod Technology Corporation (SLP for Wearables)

-

Daeduck Electronics (Advanced SLP Layers)

-

LG Innotek (SLP for Camera Modules)

-

Meiko Electronics (SLP for Automotive Applications)

-

Nan Ya PCB Corporation (SLP for Communication Devices)

-

Fujikura Ltd. (SLP for Electronic Modules)

Substrate-Like PCB Market Trends

-

In October 2024, DuPont and Zhen Ding Technology Group signed a strategic cooperation agreement to advance high-end PCB technology, focusing on innovation, smart manufacturing, and sustainability.

-

In June 2024, LG Innotek began mass production of FC-BGA substrates for major U.S. tech firms like Intel and NVIDIA, marking its entry into the AI and high-performance computing market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.93 Billion |

| Market Size by 2032 | USD 6.57 Billion |

| CAGR | CAGR of 14.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Line (25/25 & 30/30 ìm, Less than 25/25 ìm) • By Inspection Technology (Automated Optical Inspection, Direct Imaging, Automated Optical Shaping) • By Application (Consumer Electronics, Computing & Telecommunications, Automotive, Medical, Industrial, Military, Defense, & Aerospace) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zhen Ding Technology, Compeq Manufacturing, Unimicron Technology, AT&S, Shennan Circuits, Ibiden Co., Ltd., Kinsus Interconnect Technology, TTM Technologies, Samsung Electro-Mechanics, Tripod Technology Corporation, Daeduck Electronics, LG Innotek, Meiko Electronics, Nan Ya PCB Corporation, Fujikura Ltd. |