Sustainable Adhesives Market Report Scope & Overview:

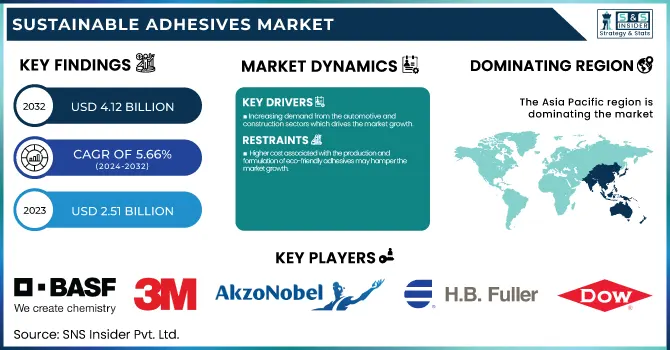

The Sustainable Adhesives Market size was USD 2.51 Billion in 2023 and is expected to reach USD 4.12 Billion by 2032 and grow at a CAGR of 5.66 % over the forecast period of 2024-2032.

To Get more information on Sustainable Adhesives Market - Request Free Sample Report

Growing need for environmental-friendly packaging is one of the major factors that drive the growth of the global sustainable adhesives market. With global consumers and businesses having become more environmentally conscious, the demand for packaging solutions which impact less on the environment. More governments are introducing EPR laws, while consumers are increasingly interested in brands that pursue sustainable practices). Specifically in the production of eco-friendly packaging for industries such as food and beverage, e-commerce, and cosmetics, where manufacturers and brands are choosing recyclable, biodegradable, or compostable materials, adhesives are key to making this shift.

In October 2024, Evonik cut its adhesives division as part of a wide-reaching restructuring effort. The firm also plans to divest its polyester business and cut production of keto acids at its Hanau site, impacting around 260 workers. The operation is intended to concentrate on core businesses, and is expected to realise annual cost savings of €400 million by 2026.

One of the main factors impelling the growth of sustainable adhesives market is the consumer demand for green products. With growing emphasis on environmental issues, consumers are readily considering sustainability in their buying decisions and are looking for products that are low impact on the environment. Changes in consumer behavior are manifested quite glaringly in industries such as packaging, personal care and electronics, where people increasingly favor eco-friendly materials and manufacturing processes. Brands have identified this need and incorporated sustainable options, both in product, such as using non-toxic, biodegradable, renewable resource-based adhesives.

To ensure the credibility of green claims, the Central Consumer Protection Authority (CCPA) issued guidelines in October 2024 to prevent greenwashing and misleading environmental claims.

Sustainable Adhesives Market Dynamics

Drivers

-

Increasing demand from the automotive and construction sectors which drives the market growth.

The automotive industry has long been on a quest to reduce the weight of its vehicles to achieve better fuel economy and abide by strict regulations for the environment. This is important work, as these sustainable adhesives, which will also include bio-based epoxies, are needed for heavy weighting solutions in lightweight materials like composites and plastics, offering strength or durability. Furthermore, with a shift towards electric vehicles (EV) across the automotive sector, sustainable adhesives are being deployed for assembling parts with a lower environmental foot-print, including battery components and interior fittings. The construction sector has been putting more focus on energy-efficient buildings and infrastructure to reduce environmental footprints. Sustainable adhesives with low volatile organic compounds (VOCs) and those derived from renewable resources are gaining acceptance in a wide range of applications including flooring, wall panels, and thermal insulation materials.

These adhesive products comply with green building standards including LEED (Leadership in Energy and Environmental Design) certification, which encourages the use of sustainable materials. As sustainability becomes more important to both industries and both industries are looking to decrease the emissions, waste and environmental impact of their products, the need for sustainable adhesives should also continue to grow. Adobe's latest roadmap highlights this trend which not only propels market growth but also falls in line with global sustainability goals within manufacturing and construction.

Restraint

-

Higher cost associated with the production and formulation of eco-friendly adhesives may hamper the market growth.

One of the major restraints for growth of sustainable adhesives market are the high cost of production and formulation of eco-friendly adhesives. Sustainable adhesives, which tend to be bio-based or come from renewable resources, are also more costly than conventional, petroleum-based adhesives. Natural resins or plant-based polymers form the raw materials for eco-friendly adhesives, and acquiring them can be pricy owing to low availability or the need for extra processing to refine them into binding grade constituents. In addition, the research and development (R&D) requirement for improving these adhesives for performance and durability also increases the cost. Hence, end-use industries, such as packaging, construction, and automotive, where cost is a major factor, are reluctant to adopt the green adhesives and there is a high capital cost involved in technology transfer.

Sustainable Adhesives Market Segmentation

By Type

Recyclable segment held the largest market share around 38% in 2023. They play an important role in fulfilling the environmental as well as functional requirements of numerous industries. A large proportion of global economy and consumers are now focusing on sustainability; thus, recyclability of the products is on the rise and it is imperative that adhesives support recyclability. Recyclable adhesives are highly desirable in both packaging and automotive industries, which are increasingly prioritizing waste reduction and closed-loop systems. These materials can be recycled free of contamination since they can be easily separated in the recycling process (e.g., packaging materials such as paper, cardboard, or plastics). Besides, the use of recyclable adhesives is leveraged with stringent regulatory compliance towards waste disposal practices and circular economy standards, which further proliferates their adoption.

By Raw Material

The water-based segment held the largest market share around 34% in 2023. Water-based adhesives consist predominantly of water as a solvent, providing an impressive reduction in the amount of toxic chemicals and volatile organic compounds (VOCs) that can create air pollution and extensive health issues. They are obviously high on the list for industries like packaging, auto, and construction where regulatory pressure to cut emissions and keep green appears ever-increasing. Furthermore, these types of adhesives provide high strength and versatility and are ideal for a broad range of applications such as bond paper, wood, and plastics. They are also typically lower in toxicity and easier to handle than their solvent based counterparts.

By End-Use Industry

The packaging segment held the largest market share around 42% in 2023. The global trend of environmental consciousness impacting the packaging industry. Manufacturers are gradually shifting towards sustainable materials and adhesives for several packaging applications, as consumer demands for greener products, particularly in the cosmetics industry, rise further. Water-based and recyclable adhesives help make packaging more sustainable by allowing easy recyclability and functionality, reducing garbage, and enhancing the overall sustainability of the packaging life cycle. Packaging is also a big contributor to global waste and waste reduction, and the circular economy initiatives tend to focus on this sector and regulatory policies regarding packaging are taking place. With this, companies from the food and beverage, cosmetics, and e-commerce sectors, among others, are seeking to fulfill these sustainability objectives and, as a result, sustainable packaging solutions are rapidly in demand.

Sustainable Adhesives Market Regional Analysis

Asia Pacific held the largest market share around 44% in 2023. This is attributed to rapid industrialization, increase consumer awareness regarding sustainable development and a large volume of demand for sustainable products in construction, packaging and automotive. It constitutes the largest manufacturing centers in the globe, especially in industries such as automotive, electronics, packaging, and construction, which are being increasingly adopted by sustainable measures. Government regulations and policies to promote green initiatives, and manufacturing in countries such as China, Japan and India are propelling the demand for green materials and adhesives. Another factor has been the rise in middle-class consumers in some of those countries spurring demand for eco-friendly products, especially in packaging and consumer items. Additionally, Asia pacific has also become a major player in global adhesive supply chain, and presence of manufacture and supplier in the region has further made sustainable adhesive solution available at competitive price.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Henkel AG & Co. KGaA (Loctite, Technomelt)

-

3M Company (Scotch-Weld, 3M VHB Tape)

-

BASF SE (MasterBond, Araldite)

-

Sika AG (Sikaflex, SikaBond)

-

H.B. Fuller Company (Fulbon, Advantra)

-

Arkema Group (Sustainable bio-based adhesives, Sartomer)

-

Solvay SA (Technomelt, Primal)

-

Eastman Chemical Company (Eastman Tritan, Eastman Renew)

-

Dow Chemical Company (DOWSIL, DOW Adhesives)

-

LORD Corporation (MasterBond, LORD 830)

-

Mitsui Chemicals, Inc. (Micropak, Bonding agents)

-

Adhesive Technologies (Tectonic, Momentive)

-

AkzoNobel N.V. (Flexbond, Resydrol)

-

Wacker Chemie AG (Elastosil, Wacker Adhesives)

-

Bostik (Bostik Supergrip, Bostik Hot Melt)

-

RPM International Inc. (Rust-Oleum, DAP)

-

Parker Hannifin Corporation (Paroflow, Parker H-Series)

-

Sonneborn (Sonneborn Rubber, Sonneborn Grease)

-

DIC Corporation (DIC Adhesive, Polytex)

-

Tesa SE (Tesa 4965, Tesa 51965)

Recent Development:

-

In March 2024, Henkel and Kraton Corporation joined together to promote sustainability in adhesives, with an emphasis on creating environmentally friendly products that satisfy the rising demand for sustainable goods in a range of sectors.

-

In May 2024, H.B. Fuller Company order to better serve a variety of industries, including automotive, electronics, and aerospace, announced the acquisition of ND Industries Inc., expanding their portfolio with specialty adhesives and fastener locking and sealing solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.51 Billion |

| Market Size by 2032 | USD 4.12 Billion |

| CAGR | CAGR of 5.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Renewable, Recyclable, Biodegradable, Green) •By Raw Material, (Water Based, Plant Based, EVA Based, Acrylic Based) •By End-Use Industry (Packaging, Woodworking, Construction, Medical) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, 3M Company, BASF SE, Sika AG, H.B. Fuller Company, Arkema Group, Solvay SA, Eastman Chemical Company, Dow Chemical Company, LORD Corporation, Mitsui Chemicals, Inc., Adhesive Technologies, AkzoNobel N.V., Wacker Chemie AG, Bostik, RPM International Inc., Parker Hannifin Corporation, Sonneborn, DIC Corporation, Tesa SE |

| Key Drivers | •Increasing demand from the automotive and construction sectors which drives the market growth. |

| Restraints | •Higher cost associated with the production and formulation of eco-friendly adhesives may hamper the market growth. |