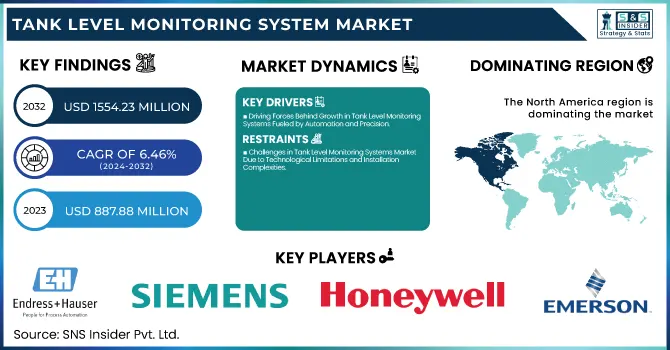

Tank Level Monitoring System Market Size & Growth:

The Tank Level Monitoring System Market was valued at USD 887.88 million in 2023 and is expected to reach USD 1554.23 million by 2032, growing at a CAGR of 6.46% over the forecast period 2024-2032.

To Get more information on Tank Level Monitoring System Market - Request Free Sample Report

As the Internet of Things (IoT) and cloud solutions gain popularity in this digital age, the level monitoring system market is also undergoing significant technological advancements wherein data can be continuously monitored in real time, allowing the user to monitor multiple geographical locations and avoid redundant work, eventually improving operational efficiencies in various verticals. Continuous product innovation and R&D investments are creating advancements in monitoring systems such as accurate, durable, and economical. Reliable Tank Level Measurement accuracy is also important as unreliable data can cause an issue in oil and gas and other industries. Also, there is a growing importance for data transmission frequency; transmission at a higher frequency results in quicker data availability for responses, anticipatory maintenance, and improved decision-making in environments of dynamic activity. These innovations are improving the reliability and usability of the systems.

Tank Monitoring System Market Dynamics

Key Drivers:

-

Driving Forces Behind Growth in Tank Level Monitoring Systems Fueled by Automation and Precision

Tank Level Monitoring System Market is mainly driven by continuous growth in demand for automation & precision in various industrial processes. Advanced monitoring systems are gaining traction in several industries including oil & gas, chemical, and power plants as these industries aim to enhance operational efficiency and safety whilst minimizing downtime. Increased attention to environmental regulations on spill prevention and inventory management contributes to rising demand. Moreover, the increasing demand for remote monitoring services in bulk storage warehouses is further driving the uptake of IoT-compliant sensors and cloud-based monitoring platforms. Other technological developments in radar and ultrasonic systems are also being preferred on the market, for greater accuracy performance in adverse conditions.

Restrain:

-

Challenges in Tank Level Monitoring Systems Market Due to Technological Limitations and Installation Complexities

The Tank Level Monitoring System Market may be hindered by technological restrictions and problematic installation. Although advanced systems like radar-based or ultrasonic sensors provide good precision, their performance is restricted in extreme temperature conditions, pressure fluctuation, and corrosive materials. Moreover, specialized sensors are required for industries dealing with volatiles, or hazardous substances, further complicating the integration of these systems. Making sure that monitoring systems can fit in with existing industrial infrastructure is also an obstacle, especially in older facilities that may be relatively difficult to upgrade.

Opportunity:

-

Opportunities in the Level Monitoring Systems Market Driven by Wireless Solutions AI Analytics and Sustainability

Effective options in the market are the adoption of wireless monitoring systems and intentional sensors having real-time data at the fingertips to have an enhanced decision-making process. Industrialization and the developing ongoing infrastructure in the Asia-Pacific and Latin America drive significant growth potential for the market. Additionally, the use of AI-enabled analytics in combination with monitoring systems is likely to create a new pathway for predictive maintenance management and optimized inventory management. As industries move towards energy conservation and sustainability investing, the companies that offer them solutions will be more powerful in the future.

Challenges:

-

Cybersecurity and Communication Challenges in Tank Level Monitoring Systems Market Hindering Widespread Adoption

The second challenge has to do with the data management and security issues related to connected monitoring systems. IoT and cloud adoption would grow across industries, which would also increase the cyberspace risks and data breach incidents. Cybersecurity frameworks that safeguard sensitive operational data and protect system reliability are difficult to implement for some industries, especially regarding industrial sectors. Moreover, it can be more difficult to guarantee communication between many devices at the same time in large-scale storage facilities, as they will need a large surface covered by a reliable, stable network reference. Overcoming these technical hurdles will be an essential step in scaling up their use and providing consistent and trustworthy system performance.

Tank Level Monitoring System Market Segments Analysis

By Application

The oil & Fuel segment held the largest Tank Level Monitoring System Market share in 2023 and is expected to witness the fastest growth during the forecast period. The extensive use of tank monitoring systems in oil refineries, storage terminals, and distribution networks for appropriate inventory management and loss reduction owing to their dominance during this period. Moreover, the growing global demand for energy and fuel as well as increasing pressure to improve operational efficiency and prevent overfills or leaks is further boosting the requirement for effective monitoring solutions. Moreover, strict government regulations regarding safe storage practices in the oil & fuel industry are encouraging and encouraging stakeholders to adopt new-age monitoring technologies. The escalating investments toward automation, along with the adoption of IoT-enabled sensors and remote monitoring platforms are expected to fuel further growth for this segment.

By Product

in 2023, the Invasive technology segment held the largest share of the Tank Level Monitoring System Market, due to extensive use in oil & gas, chemical, and power plant sectors. Existing systems, such as float & tape gauges and conductivity level sensors, offer cost-effective solutions for traditional applications, making them a fail-safe choice for invasive systems. An example of when to use them would be in a situation where the stored material has to come into contact with the lock itself to be measured accurately.

Non-invasive technology is projected to witness the fastest CAGR from 2024 to 2032. Demand for such contactless sensors including ultrasonic and radar-based ones for accuracy and reliability is driving this growth. Several non-invasive systems are expected to grow in popularity due to improved durability, low maintenance requirements, and better performance in corrosive or hazardous environments.

By Technology

The Radar-based technology segment accounted for the largest share in 2023, and it is anticipated to grow at the fastest CAGR from 2024 to 2032. This growth is primarily attributable to the need for accurate & reliable monitoring solutions in various industries including oil & gas, chemical, and power generation. These radar-based systems work fine even in selected environments with extreme temperatures, changes in pressure, or corrosive materials to make complex industrial applications. The ability to present exact, non-invasive measurements also makes them more interesting, especially for harmful or difficult-to-reach storage sites. Moreover, the growing need for deeper insights provided by IoT integration and wireless connectivity for optimal operational efficiency is further supplementing the adoption of radar-based systems. Radar-based technology is likely to remain a significant growth driver owing to this amalgamation of precision, durability, and development of advanced functionalities.

Tank Level Monitoring System Market Regional Outlook

North America accounted for the largest share of the overall tank Level Monitoring System Market in 2023, owing to the presence of a large number of end-user industries such as oil & gas, chemical, and power generation. High-quality infrastructure in the region along with stringent environmental and safety regulations has prompted the deployment of sophisticated monitoring systems to maintain proper inventory and avoid associated spills or leakages. For example, large refineries for oil in Canada and across the U.S. count on radar- and ultrasonic-based sensors to increase efficiency and reduce risk. Innovative monitoring solutions specifically designed for industrial applications in North America are being offered by companies such as Emerson Electric Co., and Honeywell International Inc.

Rapid industrialization, rising demand for energy, and expanding manufacturing sectors are expected to propel the growth of the Asia-Pacific region, which is projected to achieve the fastest CAGR during the period from 2024 to 2032. China, India & Japan are investing in automation and smart monitoring technologies to enhance Storage management & safety protocols. For instance, IoT-based tank monitoring systems have been incorporated into many chemical plants in China for better resource optimization and real-time data tracking. Asia-Pacific is expected to become one of the markets, predominantly due to the increasing focus on industrial automation and smart solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Tank Level Monitoring System Market are:

-

Emerson Electric Co. (Rosemount 5900S Radar Level Transmitter)

-

Honeywell International Inc. (Primus™ Tank Gauging System)

-

Siemens AG (SITRANS LR250 Radar Level Transmitter)

-

Endress+Hauser Group (Liquiphant M FTL51B)

-

Yokogawa Electric Corporation (DPharp EJA-E Series Differential Pressure Transmitter)

-

VEGA Grieshaber KG (VEGAPULS 64 Radar Level Sensor)

-

KROHNE Group (OPTIFLEX 2200 C Level Measurement)

-

Schneider Electric (Modicon M580 Remote Terminal Unit)

-

ABB Ltd. (ABB Ability™ Tank Master System)

-

RIELLO UPS (Riello UPS Digital Level Monitoring)

-

FloatLevel (FLS 3000 Series)

-

Magnetrol International, Inc. (E3 Level Transmitter)

-

Turck GmbH & Co. KG (LTM 300 Level Monitoring System)

-

Sentry Equipment Corp. (Sentry Type 75 Tank Level Monitor)

-

LEVELPro Systems, Inc. (LevelPro 5000)

Recent Trends

-

In March 2024, Emerson launched the Rosemount 3490 Controller for water and wastewater applications, simplifying level and flow measurements with improved accuracy and ease of use.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 887.88 Million |

| Market Size by 2032 | USD 1554.23 Million |

| CAGR | CAGR of 6.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Oil & fuel, Power Plants, Mining, Chemical, Automotive, Agriculture & Husbandry, Others) • By Product (Invasive, Non-Invasive) • By Technology (Float & Tape gauging, Radar-based, Ultrasonic, Capacitance level monitoring, Conductivity level monitoring, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emerson Electric Co., Honeywell International Inc., Siemens AG, Endress+Hauser Group, Yokogawa Electric Corporation, VEGA Grieshaber KG, KROHNE Group, Schneider Electric, ABB Ltd., RIELLO UPS, FloatLevel, Magnetrol International, Inc., Turck GmbH & Co. KG, Sentry Equipment Corp., LEVELPro Systems, Inc. |