VCSEL Market Report Scope & Overview:

Get more information on VCSEL Market - Request Sample Report

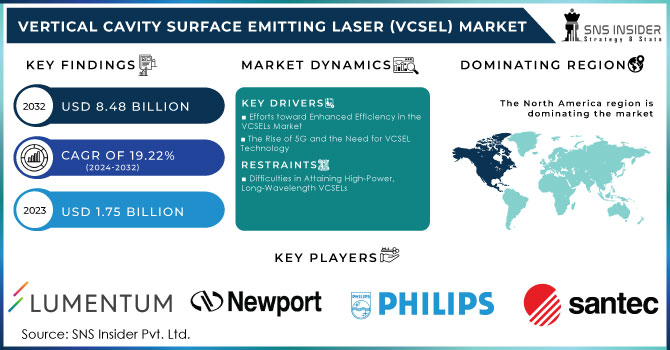

Vertical Cavity Surface Emitting Laser (VCSEL) Market Size was valued at USD 1.75 billion in 2023 and is expected to reach USD 8.48 billion by 2032, and grow at a CAGR of 19.22% over the forecast period 2024-2032.

Vertical Cavity Surface Emitting Laser is the rapidly growing market, as it is needed for current technologies like facial recognition, LiDAR use, and high-speed data transmission. The government is more focused on 5G infrastructure spending due to its importance, and more spectrum is set to be allocated, which enhances the High-speed communication demands are increasing the need for VCSELs. The acceleration while improvements in consumer electronics, automotive technology, and data communication as a whole are speeding up the growth even more. It is used in various industries making it more relatively important, as it is used in vital functions such as facial recognition and high-speed data transmission. One of the leading applications of VCSELs is in relation to 3D depth-perceiving sensors, such as LiDAR systems, for transportation use, in which it is used by automotive manufacturers. It is also used by Apple in smartphones, allowing them to unlock through the use of secure facial recognition. Military budget allocation has also grown worldwide for security purposes, thereby increasing the desire for such an advanced technology, as U.S. Allocated USD 877 billion in defense spending in 2022, leading the world’s spending by over 40%. The effect of this spending growth causes an acceleration in the demand for such technologies, as they have military uses.

The VCSEL market is growing expansively with the development and advancement of VCSEL technology and the Horizon 2020, an EU program. The global Internet infrastructure is integrating VCSEL-based optical transceivers in data centres and communication networks owing to the increasing demand for high-bandwidth internet services. EPIC, the European Photonics Industry Consortium, has highlighted the need to reach bandwidths between 800 Gbit/s and 1.6 Tbit/s by 2025 to meet the needs of the increasing number of consumers and industries. By advancing VCSEL technology, PICadvanced, France, and EFFECT Photonics, the Netherlands, are developing revolutionary VCSEL solutions, such as a multiwavelength NG-PON2 transceivers and a fully integrated coherent PIC. VCSEL is also supported by the €8.1 billion public fund provided by the European Commission under the IPCEI ME/CT and the €13.7 billion private investment. Thus, each of these industry developments is influencing direction of VCSEL technology and its use in varying fields. In summary, these trends underscore the vital role that VCSELS play in shaping the future of connected devices and smart systems.

Market Dynamics

Drivers

-

Efforts toward Enhanced Efficiency in the VCSELs Market

The development of cascaded multi-junction VCSELs has been a major achievement in the quest for power conversion efficiency in semiconductor lasers. The emerging technology has also demonstrated the ability to surpass the efficiency limits in the conventional edge-emitting lasers, thereby paving ways for a spectrum of new applications. An essential advantage of semiconductor lasers is high electro-optical conversion efficiency, which makes them appealing for energy-saving prospects. From the integration of modeling and experiments, multi-junction cascaded VCSELs have demonstrated their potential to attain room temperature efficiency of over 88%, which is superior to the existing VCSEL technology. The technology’s ability has also been indicated by the innovation of 15-junction VCSELs with 74% peak efficiency and a differential quantum efficiency of over 1100%. This attribute is particularly vital in areas that emphasis on ensuring that their line of applications is highly efficient. By instance, the high efficiency plays a great role in data centers that derive their maximum returns from low power costs. Furthermore, in industries such as optical communication and sensing, the use of multi-junction cascaded VCSELs provides a competitive advantage through ensuring that high power is achieved with low energy use.

-

The Rise of 5G and the Need for VCSEL Technology

One of the key factors contributing to the rising demand for VCSELs is the rapid growth of 5G networks due to such initiatives as the U.S. government’s 5G FAST Plan. Optical communication systems, relied upon by 5G networks for ultra-fast data rates and low latency, heavily depend on VCSELs as the primary technology, which will underpin the roll-out of 5G network infrastructure. The technology’s increasing prevalence is further demonstrated by the U.S. government’s technological success in 5G networks deployment and the size of the developed market. The United States, home to over 270 Billion individuals with access to 5G services, is outpacing other countries in the race to lead the world in 5G technology due to its cutting-edge research, innovation, and telecommunications infrastructure, including massive investments in the network infrastructure and radiofrequency spectrum. The wide-spread deployment of 5G technologies will result in a substantial demand for VCSEL producers.

Restraints

-

Difficulties in Attaining High-Power, Long-Wavelength VCSELs

Despite the increased progress in development, the creation of high-power, long-wavelength VCSELs for telecommunications remains a challenging task. One of the most significant market barriers in addressing is the problem of achieving an efficient lasing above 1.3 µm wavelengths. Although progress has already achieved in this field with the implications of InGaAs nitrogen incorporation and a buried-tunnel-junction technology, as of now, the provided approaches require further development to compete with conventional edge-emitting lasers at 1.55 µm. In addition, considerable market barriers, such as cost, reliability, and expandability barriers, may interfere with the widespread implementation long-wavelength VCSELs into telecommunications networks.

-

Achieving a balance between cost-effectiveness and scalability in the production of batteries using VCSEL technology.

Despite the fact that VCSEL technology appears to bring numerous advantages in the realm of battery production, such as lower costs and a smaller machinery requirement, there are several challenges associated with the issue in question that need to be overcome for the technology in question to become ubiquitous. Throughout the studied market, a significant problem appears to be the relatively high investment necessary to create VCSEL-based systems. While the latter can eventually result in decreased costs, the initial investment may be too high for numerous manufacturers to afford, particularly those that merely begin to form a niche in the existing market. The issue calls for a careful blending and customization of the technology in question. Indeed, there is quite a lot of work to be done for VCSEL technology to become an established and inseparable part of the analyzed sector.

Segment Analysis

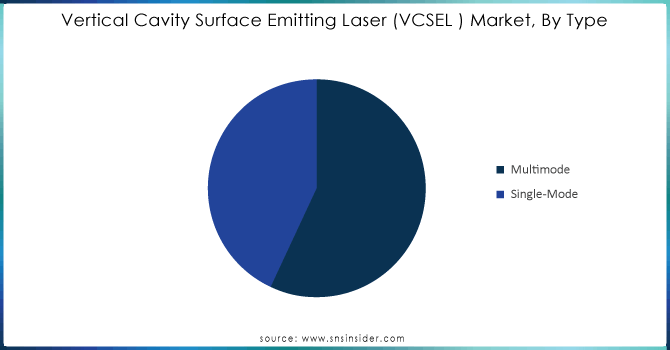

By Type

Based on the Type, Multimode is estimated to dominate with 58% of share in 2023 in the VCSEL Market. Due to their ability to reach high-power densities and enhanced rise times. Multimode VCSELs are greatly used in applications such as Time of Flight, LiDAR, and data center optical transceivers. The simply rising demand for super-fast data propagation in AI and HPC applications is determining companies to influx on enhancing the power and performance of high-power, multimode VCSEL. Few of vendors such as Coherent Corp. and others have been making fantastic development in establishing the most sophisticated multimode VCSELs. The new improvements have increased the bandwidth of new multimode VCSELs, letting the production of optical transceivers can hit a maximum of 1.6 Tbps capacity. This is how the evolving upcoming requirements for new data center surroundings are satisfied by multimode VCSELs.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Material

Based On Material ,Gallium Arsenide (GaAs) is dominate with 65% of share in 2023 in VCSEL Market .Making VCSELs from GaAs, with its slim design, high transparency, and large format, has become increasingly common in TV and computer displays. As a result of the increase in the number of companies working to improve their GaAs-based VCSELs in response to the growing demand for attery at high resolution and increased data rates, the material is excellent for VCSEL manufacturing because it provides the necessary mobility through its electrons and possesses a direct bandgap. Companies are working to expand their manufacturing outputs in order to be competitive. In January 2023, TRUMPF created a new industrial manufacturing platform with a GaAs-based VCSEL product line that was expanded to span a wider range of wavelengths while still being housed in a compact, robust, and cost-effective package.

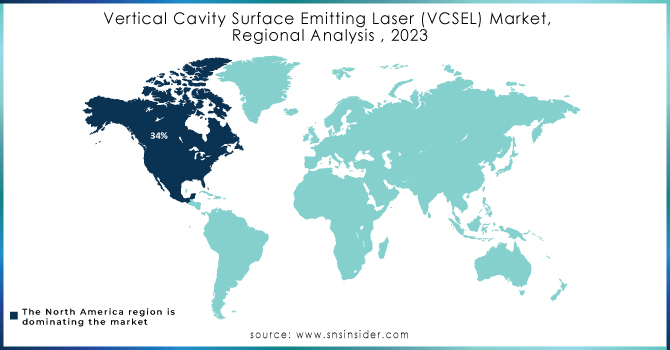

Regional Analysis

North America dominate the VCSEL Market with 34% of share in 2023 North America's The development of 5G technology and heavy investment in the 5G infrastructure in North America significantly impact the VCSEL market. Telecommunication and technology key players such as AT&T, Verizon, T-Mobile, and Nokia are at the forefront of this development. These companies have invested billions in 5G infrastructure and come up with creative ways of ensuring 5G applications meet the set standards. Government programs, for example, the U.S. government’s 5G FAST Plan, have also played a part in the development of 5G technology. The government programs offer financial support and push for the rollout of the 5G technology for such players as Verizon. These companies’ collaboration has been essential in expanding the VCSEL market in North America and making it one of the most important in the development and deployment of 5G. The use of 5G technology in communication and other areas will continue to rise, hence the increasing need for better and more effective VCSELs, which help speed up data transmission and ease of communication.

Asia Pacific is expected to experience the most rapid growth, capturing a 28% market share by 2023. The Asia Pacific VCSEL market is gaining traction, and the growth is striking due to its key inclination to the region’s premium consumer electronics manufacturing market, usage of 5G technology on an immensely huge scale, and a gradually growing need for VCSEL in novel applications like electric vehicles. Leading the innovation and adoption of VCSEL is China as well as to some extent South Korea. They have a solid presence in smartphone manufacturing as well as other consumer electronics. There is an explicit addition of the VCSEL in the 5G infrastructure, and there is a mounting need for fast data transmission, which results in speeding up market penetration. The Government of China, as a part of Manufacturing Research, Development and Innovation 2025 and automotive advancement, play a pivotal role in shaping the size of the Asia Pacific VCSEL market rapidly. Berxel Photonics has taken a considerable effort and is instrumental in expanding the market by producing innovative products with advanced features. The company Berxel Photonics is acknowledged for its proven 800G transceiver and automotive sensor product lines.

KEY PLAYERS:

The key players in the VCSEL market are Santec Corporation, Philips GmbH Photonics, Lumentum Holdings, Newport Corporation, Necsel Laser, AMS Technologies, Broadcom, Finisar Corporation, NeoPhotonics Corporation, TRUMPFand Other Players.

Recent Development

-

In March of 2024, Coherent Corp. from the United States revealed a notable progress in VCSEL technology, increasing bandwidth to back up next-gen optical connections at a speed of 200 Gbps per lane, allowing for 1.6 Tbps optical transceivers. This innovation utilized lithographic-aperture VCSELs, a substantial upgrade from the current oxide-aperture VCSELs that are limited to 100G per lane and a bandwidth of 27 GHz. The upcoming VCSELs will provide smaller, more consistent, and dependable openings.

-

In January 2024, Coherent Corp. (US) launched a new illumination module platform for short- and mid-range LiDAR to improve automotive safety and robotic vision in industrial settings. It allowed for advanced driver assistance systems (ADAS) and depth sensing in robots, providing up to 30 meters of depth sensing in bright daylight with more than 30% power conversion efficiency.

-

In January 2024, TRUMPF (Germany) introduced its newest TruHeat VCSEL laser heating systems designed for surface heating and e-mobility uses. These systems provided effective heat treatment that could be controlled and optimized for thermal design using multi-junction VCSEL arrays. The drying efficiency for battery electrode materials was improved by the 980 nm wavelength.

-

In November 2023, Japan's government revealed plans to dedicate around JPY 2 trillion (USD 13 billion) to enhance its chip industry, signaling its ongoing efforts to regain dominance in the crucial sector. The nation, which was once a top supplier of chip production equipment and materials, has fallen behind in manufacturing in the past few decades and is currently offering incentives to chip manufacturers to increase their capabilities.

-

In September 2023, AMS OSRAM AG and the Malaysian Investment Development Authority (MIDA) declare their joint backing for ongoing investment and growth in Malaysia. Through a Partnership Agreement, MIDA shows strong backing for ams OSRAM's projects in Malaysia.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.75 Billion |

| Market Size by 2032 | USD 8.48 Billion |

| CAGR | CAGR of 19.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Multimode, Single-Mode) • By Material (Gallium Arsenide (Gaas), Gallium Nitride (Gan), Indium Phosphide (Inp), Others) • By Application (Data Communication, Sensing, Industrial Heating, Laser Printing) • By Industry (Consumer Electronics, Automotive, Healthcare, Data Center, Commercial & Industrial, Military) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | VCSEL market are Santec Corporation, Philips GmbH Photonics, Lumentum Holdings, Newport Corporation, Necsel Laser, AMS Technologies, Broadcom, Finisar Corporation, NeoPhotonics Corporation,TRUMPF and Others. |

| Key Drivers |

|

| RESTRAINTS |

|