Transparent Plastic Market Report Scope & Overview:

Get More Information on Transparent Plastic Market - Request Sample Report

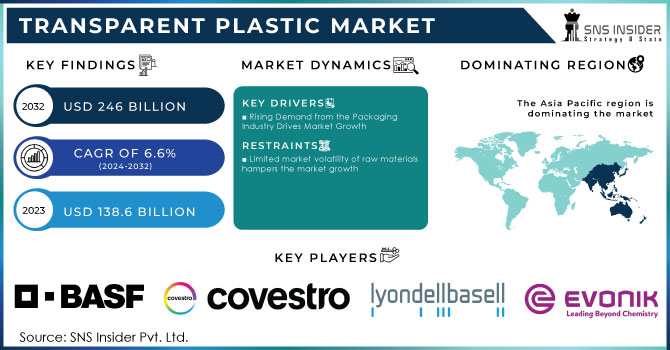

The Transparent Plastic Market Size was valued at USD 138.6 Billion in 2023. It is expected to grow to USD 246 Billion by 2032 and grow at a CAGR of 6.6% over the forecast period of 2024-2032.

Technological advancements in polymer production have led to accelerated growth of the use of transparent plastics not only as packaging materials but also in the automotive and electronic industries. Recent developments in polymer science have seen the manufacture of high-performance polymers that exhibit exceptional optical clarity, impact resistance, and UV stability, making them applicable in even more extreme applications. For instance, PC and PMMA are now used in more electronics including automotive, which increases the consumption and demand for the highly transparent versions.

Chemical recycling is the most breakthrough in this sphere. Unlike mechanical recycling, chemicals break the plastics on the molecular level. As a result, all types of plastic materials can be recycled almost endlessly, without losing their qualities. Moreover, IT made transparent plastics, that used to be less sustainable in terms of recycling, more sustainable and reusable. This advancement can also benefit high-end applications by making them more eco-friendly. For example, Covestro AG provided chemical recycling for the polycarbonate plastics applied in electronics and medical devices in 2021. The quality of these materials is held up, so they can be used again without any compromise.

These innovations benefited from government support through sustainability requirements. For instance, the European Union has initiated the Circular Economy Action Plan which requires EU states to recycle by 2030 more than 55 percent of plastics being put on the market. These efforts should employ advanced recycling technologies, among which categories are chemical. In line with that, California authorities have established a Recycled Content Law requiring plastic beverage containers to contain over 25 percent recycled material by 2025. This requirement pushed companies to adopt innovative recycling methods.

Biodegradable transparent plastics hold one of the significant growth attributed to the rapidly rising demand for sustainable materials in the packaging and agricultural sectors. The latter is especially topical in light of the high consumption rates of single-use plastics. When it comes to ecological analogs, be it have polylactic acid or bio-PET, for example, their property of being transparent and durable is particularly attractive to stakeholders, and the fact that they are biodegradable adds another value. Therefore, the growing popularity of such materials is a consequence of the ongoing trend of sustainable development and the pressing issues of the transitive economy. The adoption of these polymers is facilitated by the already established global commitment to becoming environmentally friendly, and in some regions, the process is fostered by the stringent requirements of environmental protection.

Government regulations are favorable for the demand for biodegradable transparent plastics. A recent example is the European Union’s Single-Use Plastics Directive. This directive requires a ban on single-use plastic items by 2021 and requires that all packaging be made from either recyclable or compostable materials by 2030. In the United States, there is an example of the state of California’s Plastic Pollution Prevention and Packaging Producer Responsibility Act. This act requires that packaging manufacturers increase the recycled and biodegradable content of their products to 75% by 2032. Mainly government initiatives drive the successful demand for biodegradable transparent plastics, and their presence creates a favorable environment for their growth.

Transparent Plastic Market Dynamics

Drivers

-

Rising Demand from the Packaging Industry Drives Market Growth

The packaging industry is expected to be a key source of growth for the transparent plastics market, with around 40% of overall market consumption by 2032. This usage spike is largely fuelled by the general trend toward clear and sturdy materials, especially polyethylene terephthalate. Various reports by the U.S. Plastics Industry Association attribute the surge in demand for PET to bring due to an increase in e-commerce and retail packaging formed to keep goods safe and lightweight. Leading companies have also been adopting and implementing new environment-friendly package design concepts, including the usage of recycled PET. The U.S. Environmental Protection Agency has collected comprehensive recycling data, confirming a positive trend, particularly recycling rate advances in PET bottles. Overall, these trends suggest that the packaging industry will continue to increase its consumption of transparent plastics. The leading forces behind these trends are a shift in the market toward convenience and environmental responsibility.

Restraint

-

Limited market volatility of raw materials hampers the market growth

The limited market volatility of raw materials can significantly hinder growth in the market of transparent plastics. When the costs of the most important raw materials, such as petroleum or natural gas, are low and remain predictable, manufacturers might perceive little incentive to improve their production by implementing new solutions or becoming more efficient. As a result, there will be limited investment in new technologies, innovation, or sustainability, as manufacturers will prioritize keeping their production rates at the same level.

Transparent Plastic Market Segmentation Overview

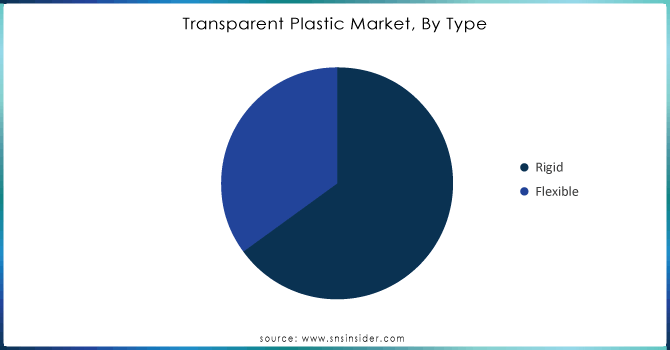

By Type

The rigid segment held the largest market share around 62% in 2023. Such applications as eyewear lenses provide users with a transparent experience and proper protection due to their high durability. Abstract transparent packaging allows customers to see the product, and rigid material is the best barrier to the environment. Such materials will also always be used in the automotive industry, in the form of windows and headlights on cars. Finally, these materials will play a huge role in sterile medical instruments, which must be transparent.

It can be strongly suggested that a flexible segment will grow much faster due to a larger number of available applications. They are used as expanded glass materials for electronic displays, flexible glass packing, and the arms of the eyewear, which should be easily replaced, leave packaging behind, and develop modern flexible cells with their help. They will also be used as a thin protective cover that does not weigh or standardize the car.

Need any customization research on Transparent Plastic Market - Enquiry Now

By Polymer

The Polyethylene Terephthalate segment held the largest market share in 2023. The PET polymer is used extensively in the production of transparent plastics and is the preferred material in the majority of end-use applications. It is primarily utilized for packaging because it allows the production of durable bottles & containers, for food & non-food products. The excellent barrier characteristics of PET are vital for preserving the color, aroma, taste, consistency, and vitamin and nutritive properties of the packaged contents. It is also preferred for this application because the material does not react with food or beverages stored. PET is also used to produce transparent sheets for thermoforming applications, which are subsequently transformed into different types of packaging. The design versatility and utility make PET the preferable material in a wide range of products.

By Application

The packaging segment held the largest share around 38% in 2023. The packaging segment is the most significant in the transparent plastics application segment. One of the key reasons is that packaging is used across all industries. For example, packages are in demand in the production of food and beverages, and non-food consumer goods such as cosmetics and clothing, pharmaceuticals, and other industries. Another reason for the significant size of this segment is that there has been a growing trend for the consumer segments in all industries. As well as the need for packaging, however, desirable clear plastic, as it provides good transparency, is resistant to mechanical stress, and is lightweight. With the development of e-commerce, the issue of proper packaging has become more important than ever. To maximally reduce the risk of product damage, the packaging product should be as clear as possible, so the proportion of transparent plastic packaging is also growing due to this trend. The sustainability trend can also affect this segment, as with time manufacturers can switch to recycled materials and encourage this trend by using eco-friendly or green packaging solutions.

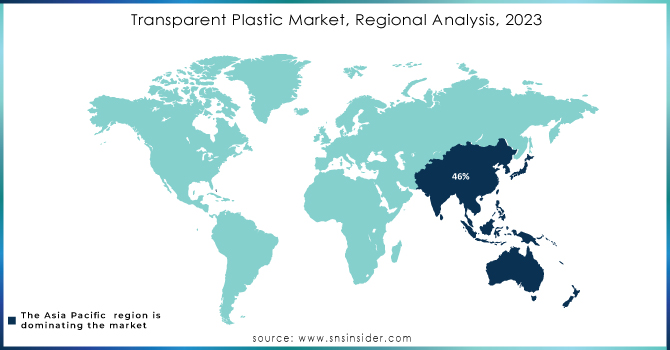

Transparent Plastic Market Regional Analysis

Asia Pacific held the largest share around 46% in 2023. The Asia-Pacific region is the most rapidly growing market for transparent plastics. The mounting industrialization and urbanization of the region, as well as the emerging middle class, are major factors driving the region’s market. The largest manufacturers and consumers in the region are India, China, and Japan, the former of which is the largest manufacturer and consumer worldwide. According to the National Bureau of Statistics of China, in 2022 the country created more than 77 million metric tons of plastic products. Packaging uses consume most of the plastics. In India, the launch of government projects aimed at enhancing the recycling industry and fostering sustainable materials is boosting regional growth.

North America is anticipated to register the fastest region over the forecast period. The United States significantly contributes to these statistics. The U.S. Department of Commerce claims that this industry has contributed around USD 37 billion to the economy. Advanced technologies, a well-developed packaging industry, and a constantly increasing demand for innovative and sustainable packaging are the key drivers. Moreover, government-oriented businesses will improve recycling options and develop the market for recycled transparent plastic.

Key Players in Transparent Plastic Market

-

BASF SE (Ultrason E Transparent)

-

SABIC (LEXAN Polycarbonate Resin)

-

Covestro AG (Makrolon Polycarbonate)

-

LyondellBasell Industries (Hostalen PP Transparent)

-

Eastman Chemical Company (Eastman Tritan Copolyester)

-

Evonik Industries AG (PLEXIGLAS)

-

Arkema S.A. (Altuglas Acrylic)

-

Dow Inc. (DOWLEX Polyethylene Resins)

-

Mitsubishi Chemical Corporation (DIAMIRON Transparent Resin)

-

Teijin Limited (Panlite Polycarbonate Resin)

-

Asahi Kasei Corporation (XYRON Transparent Grades)

-

Chi Mei Corporation (Acrylonitrile Styrene Acrylate (ASA) Transparent Grade)

-

LG Chem (Transparent ABS Resin)

-

DuPont de Nemours, Inc. (Surlyn Transparent Resin)

-

SABIC Innovative Plastics (VALOX Transparent Resin)

-

Plaskolite LLC (OPTIX Acrylic Sheet)

-

3M Company (3M Fluorinated Ethylene Propylene Film)

-

Trinseo S.A. (CALIBRE Polycarbonate Resin)

-

Sumitomo Chemical Co., Ltd. (SUMIPEX PMMA)

-

Toray Industries, Inc. (Amilan Transparent Nylon)

Recent Development:

-

In 2023, Eastman Chemical Company has expanded of its Eastman Tritan™ copolyester production capacity to meet the increasing demand for durable and transparent plastics in the food and beverage packaging sector.

-

In 2023, BASF launched a new line of sustainable transparent plastic solutions, incorporating up to 30% recycled content in its PET products. This new launched helped the company’s commitment to sustainability and reducing carbon emissions.

-

In 2022, Dow Chemical Company has launched a new portfolio of transparent and sustainable materials for packaging applications, focusing on circular economy principles. This included innovations in recyclable flexible films aimed at reducing plastic waste.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 138.6 billion |

| Market Size by 2032 | US$ 246 Billion |

| CAGR | CAGR of 6.6 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Rigid, Flexible) • By Polymer (Polyethylene Terephthalate (PET), Polypropylene (PP), Polystyrene (PS), Polyvinyl Chloride (PVC), Polycarbonate (PC), Polymethyl Methacrylate (PMMA) and Others) • By Application (Packaging, Electrical & Electronics, Consumer Goods, Consumer Goods, Building & Construction, Automotive, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, SABIC., Covestro AG, LyondellBasell Industries Inc., Eastman Chemical Company, Evonik Industries AG y, Arkema S.A., Dow Inc., Mitsubishi Chemical Corporation, Teijin Limited Asahi Kasei Corporation and others. |

| Key Drivers | • Rising Demand from the Packaging Industry Drives the Market Growth. |

| RESTRAINTS | • Limited market volatility of raw materials hampers the market growth |