USB-C Docks and Dock Stations Market Report Scope and Overview:

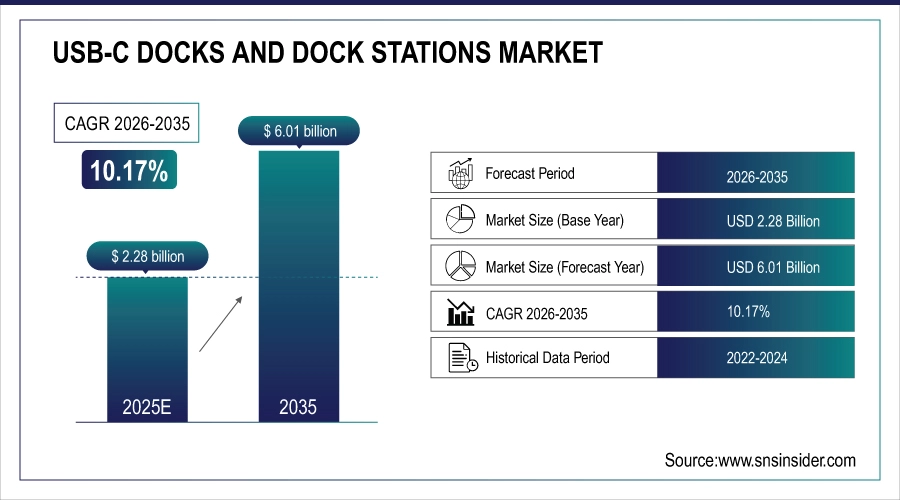

The USB-C Docks and Dock Stations Market size was valued at USD 2.28 billion in 2025 and is expected to reach USD 6.01 billion by 2035, growing at a CAGR of 10.17% over the forecast period of 2026-2035.

The global market is witnessing significant growth driven by developing trends, competitive landscape analysis, and key regions development status. USB-C technology being adopted in more and more devices and industries is facilitating the quick expansion. Further development in the field of connectivity solutions, as well as the increase of remote and hybrid work models worldwide leads to strong demand in compact docking stations. All these factors together support a positive growth scenario for the USB-C docks and docking stations market.

USB-C Docks and Dock Stations Market Size and Forecast:

-

Market Size in 2025: USD 2.28 Billion

-

Market Size by 2035: USD 6.01 Billion

-

CAGR: 10.17% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On USB-C Docks and Dock Stations Market - Request Free Sample Report

USB-C Docks and Dock Stations Market Highlights:

-

USB‑C and Thunderbolt docks are increasingly essential for modern workflows, enabling multi‑display support, fast charging, and expanded connectivity from a single cable connection.

-

Thunderbolt‑equipped docking stations deliver higher bandwidth, multi‑4K display support, and up to 98W+ power delivery compared to standard USB‑C hubs, making them attractive for professionals and power users.

-

Major reviews list a variety of docking solutions across segments — from budget‑friendly USB‑C docks to premium Thunderbolt stations with 15+ ports and 100W+ charging, reflecting diverse consumer needs.

-

Manufacturers are integrating additional features such as Qi wireless charging pads, ergonomic designs, and hybrid functions to differentiate products and add value.

-

The market trend emphasizes high port density and enhanced connectivity (more USB‑A/C, HDMI/DisplayPort, Ethernet) to support multiple peripherals and external displays in hybrid and remote work setups.

-

USB‑C and Thunderbolt docks are evaluated on power delivery, ports, performance, and price, indicating a mature competitive landscape with strong product‑feature focus.

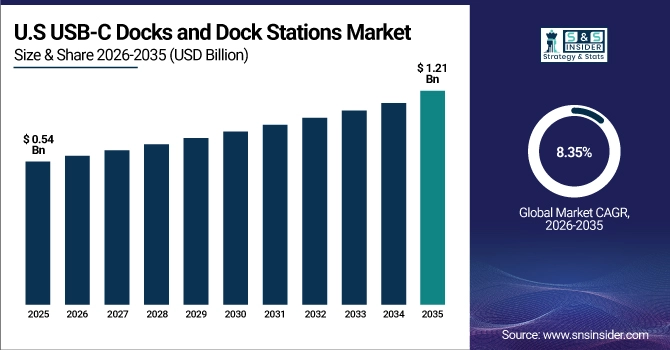

The U.S. USB-C Docks and Dock Stations Market size was USD 0.54 billion in 2025 and is expected to reach USD 1.21 billion by 2035, growing at a CAGR of 8.35 % over the forecast period of 2026–2035.

The US usb-c docks and dock stations market growth is attributed to the increase in demand for better connectivity and transfer of data in every offices and homes. Rising trends of remote working and digital transformation projects in various industries, as well as the demand for multi-functional docking stations that can integrate with several peripherals through USB-C ports, drive market growth in U.S.

According to research, Over 60% of U.S. office workers use multi-port USB-C docks to connect multiple peripherals such as monitors, keyboards, and external storage devices.

USB-C Docks and Dock Stations Market Drivers:

-

Rapid adoption of USB-C technology in consumer electronics and enterprise devices is boosting market demand globally

The expanding compatibility between USB-C ports and systems in computers, mobile devices, gaming systems, and monitors makes the best USB-C docking stations a must-have accessory. Faster data transfer, higher power charging and video output is made possible with this technology, and is much desired. Enterprises and consumers alike are looking for docks that can connect to multiple devices, delivering a seamless experience both in the work area and on the go, improving productivity and end user experience. Rising adoption of USB-C equipped devices in various industries continues to provide an impetus to growth of the global docking station market.

According to research, over 85% of new laptops and mobile devices launched in 2024 are equipped with USB-C ports, reflecting rapid adoption across consumer electronics.

USB-C Docks and Dock Stations Market Restraints:

-

Lack of standardization in USB-C protocols and compatibility issues hinder market growth and consumer confidence

USB-C technology among manufacturers uses different protocols and specifications, which means that not all devices and docks are compatible. The consumers have difficulty in choosing docks compatible with their equipment, which results in dissatisfaction and reluctance to adopt the products. The lack of a common definition adds to the confusion and dispels market fragmentation. Until these doomsday scenarios are past and we do have a standard, compatibility issues will stymie the growth prospects for USB-C docs and dock stations.

USB-C Docks and Dock Stations Market Opportunities:

-

Expansion of smart home and IoT ecosystems creates new demand for versatile USB-C docking stations

With the growing numbers of smart homes and IoT, the demand for hubs & docks which can interoperable multiple smart devices together is on the rise. USB-C docking stations can be used as a hub to connect numerous peripherals, sensors, controllers and communication modules together that help extend their use beyond a PC environment. Rising consumer demand for smart, connected environments drives manufacturers to create innovative, dedicated docking solutions for IoT connectivity resulting in market growth in new and existing technology landscapes and improve user compatibility within connected living ecosystems.

According to research, approximately 60-65% of new smart home hubs and IoT controllers incorporate USB-C or Thunderbolt ports for seamless connectivity.

USB-C Docks and Dock Stations Market Segment Analysis:

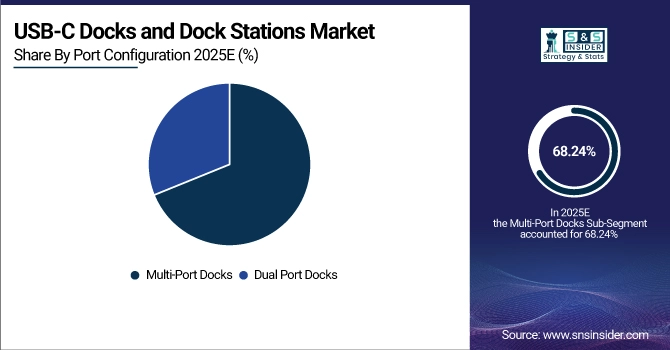

By Port Configuration

Multi-Port Docks segment dominated the USB-C Docks and Dock Stations Market with highest revenue share of 68.24% in 2025, because of their capacities to support a variety of peripherals concurrently. Most people prefer that the dock has versatility and expandability, as people are using monitors more frequently with higher resolution, external hard drives, keyboards, and other USB peripherals. Brands such as StarTech. com have been very strong contenders in this space, extending the plethora of port options for IT pros and enterprise users who have varying connection usage across the board.

The Dual Port Docks segment is projected to grow at the fastest CAGR of 11.37% from 2026 to 2035, fueled by growing usage among casual users and mobile workers. These docks offer a convenient and simple desktop solution for charging and syncing your devices. USB-C Docks and Dock Stations companies like Anker that are leading the way in the production of these small and compact dual-port models that suit students, people on-the-go and those on a budget, and focus more on the convenience than dropping vital features.

By Product Type

The Standard USB-C Docks segment dominated the USB-C Docks and Dock Stations Market in 2025 with a 43.39% revenue share because they are priced right, work well and work with many of the popular laptops and tablets currently on the market. These are the college students, far more expensive or complex when immediate connection demand does not require such a helm, popular! profender! industry The simple plug-and-play capability of their products, as well as their closet simplicity, make them affordable solutions for users looking for simple port expansion, and have given them a strong foothold in both consumer and industrial computing environments.

The Multi-Function Docking Stations segment is expected to grow at the fastest CAGR of 11.10% from 2026 to 2035 because of a growing interest for comprehensive connectivity services. Firms such as Kensington are producing more advanced docking stations that cover charging, data transfer, audio and display that all come in neat little packages. With the rise of hybrid and remote work, users are purchasing hubs that accommodate multiple devices for more productivity out of their overall workspace at home and in the office.

By Connectivity Type

Wired USB-C Docks segment dominated the highest USB-C Docks and Dock Stations Market share of 71.78% in 2025, due to they have better reliability, work at high speed and have greater compatibility. Companies and Power users who demand an always-on connection with Similar graphics performance in both docked and undocked environments. Dell Technologies remains a leader in this space, offering enterprise-grade docking stations designed to support intensive workflows across various professional settings and large-scale IT deployments.

Wireless Docking Stations are anticipated to expand at a CAGR of 11.32% from 2026 to 2035 due to increasing demand for wireless workplaces and greater mobility. These docks are beginning to be popular with contemporary consumers who value a minimalist desktop space and versatility. Manufactures like HP are pushing the boundaries on this front with wireless docking solutions that take advantage of WiGig and Wi-Fi 6, and such solutions are becoming more and more viable for consumers and professionals who want more streamlined, wire-free connectivity with seamless integration between their mobile and smart devices.

By Target User Segment

Business Professionals dominated the USB-C Docks and Dock Stations Market in 2025, accounting for a 58.98% revenue share, as they are quite dependent on high-performance workstations with a large variety of peripheral connectivity. These users often work in hybrid and remote settings and they simply need a reliable, multi-device dock to help maximize time in the new home office. IT environments in business that have standardised IT infrastructure also drive USB-C docks, as they can be used universally and easily deployed, simplifying device management across large workforces.

The Average Consumers segment is forecasted to grow at the fastest CAGR of 11.68% from 2026 to 2035, driven by the rising demand of digital lifestyle, remote education, personal content creation. With consumers investing in tablets, smartphones and light-weight laptops, the appetite for an inexpensive dock that increases a device's capabilities at home is building. Satechi, maker of minimalist and consumer-friendly USB-C accessories, is launching two beautiful and functional docks designed and optimized for home and multimedia applications.

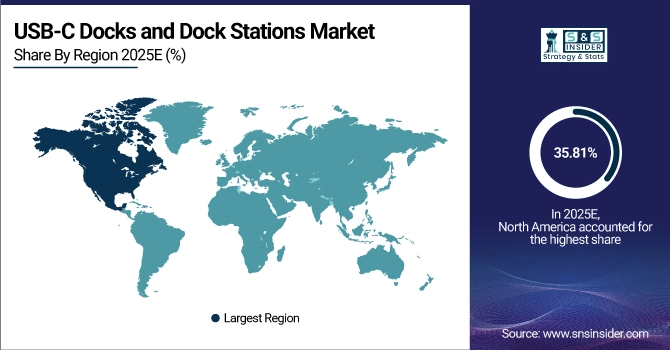

USB-C Docks and Dock Stations Market Regional Analysis:

North America USB-C Docks and Dock Stations Market Trends:

North America dominated the highest revenue share of 35.81% in the USB-C Docks and Dock Stations Market in 2025, owing to large-scale use of trends in computing devices and high demand in enterprise and IT industry. Strong product penetration is also helped by the region’s longstanding tech infrastructure, remote work trends and early adoption of USB-C standards. Furthermore, America's key industry players including Dell and Plugable always lead the way for innovation and availability in the professional, education and consumer markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

The US leads the North American USB-C Docks & Dock Stations Market on account of its developed tech environment, heavy penetration of remote work, and several OEMs. Including a huge demand from consumers for productivity apps for personal and business use.

Asia-Pacific USB-C Docks and Dock Stations Market Trends:

Asia Pacific is projected to grow at the fastest CAGR of 11.45% from 2026 to 2035, driven by fast urbanization, increasing digital literacy and growing technology manufacturing bases in countries from China to South Korea and India. Growing market acceptance of laptops, tablets and smart devices in both consumer and business environments can be expected to result in demand for adaptable docking options. As local players and global OEMs are continuing to invest, it makes sense for these USB-C docks to be more widely available at an affordable price point in a region of a rapidly growing tech savvy population.

China is leading the market due to the large electronics manufacturing base, urban digitalization at a fast pace and high demand for smart devices. Country market leadership is also due in no small part to local tech giants and broadening consumer adoption.

Europe USB-C Docks and Dock Stations Market Trends:

Europe USB-C Docks and Dock Stations Market is growing with the rising need for continuity of connectivity in professional and work from home office spaces. The region’s attention on productivity tools, as well as an increase in tech adoption across education and small businesses, enables market growth to remain consistent. European customers also request as high-quality, multi-functional products, resulting in higher demands for the latest dock solution from not only local but international brands.

In Europe, Spain is leading the USB-C Docks and Dock Stations Market as the digital adoption and remote working trends increased with government support for technology. Growing small and medium businesses are fueling market growth on the country’s transitioning tech stage.

Latin America and Middle East & Africa USB-C Docks and Dock Stations Market Trends:

The Middle East & Africa is led by UAE due to digital infrastructure advancement as well as increasing adoption of smart workspace, whereas in Latin America, Brazil dominates the market on account of surging movement towards digitalization, increasing expansion of IT infrastructure and growing remote work trends, all of which in turn are creating greater demand for USB-C docks and docking stations across both these regions.

USB-C Docks and Dock Stations Market Competitive Landscape:

CalDigit, Inc. is a U.S.-based hardware manufacturer specializing in high‑performance Thunderbolt and USB‑C docking stations, storage solutions, and connectivity products for content creators and professionals. Founded in 2006, the company is known for premium docks with extensive port options and strong build quality, serving global markets from its California headquarters.

-

In May 2025, CalDigit introduced two new Thunderbolt 5 docking stations the TS5 and TS5 Plus. The TS5 Plus offers 20 ports including Thunderbolt 5, USB-C, USB-A, SD/microSD slots, 10Gb Ethernet, and supports up to three 4K displays or dual 8K displays. The TS5 supports dual 4K or single 8K displays. Both models deliver up to 140W power delivery to host devices.

Anker Innovations Co., Ltd. is a Chinese global smart hardware and consumer electronics company founded in 2011 by CEO Steven Yang. Headquartered in Changsha, Hunan, the company is known for fast‑charging technology, USB‑C hubs/docks, power banks, and smart devices sold worldwide.

-

In April 2025, Anker released its first Thunderbolt 5 dock, the Prime TB5 Docking Station. It features a built-in GaN power supply delivering high wattage, eliminating the need for an external power brick. The dock includes 14 ports, supports up to two 8K displays, and offers adjustable ambient LED lighting and smart temperature control.

USB-C Docks and Dock Stations Market Key Players:

-

Dell Technologies Inc.

-

HP Inc.

-

Lenovo Group Limited

-

Anker Innovations Co., Ltd.

-

Belkin International, Inc.

-

Plugable Technologies

-

Targus International LLC

-

StarTech.com Ltd.

-

CalDigit, Inc.

-

Kensington Computer Products Group

-

Microsoft Corporation

-

UGREEN Group Limited

-

Other World Computing (OWC)

-

ORICO Technologies Co., Ltd.

-

Baseus Technology Co., Ltd.

-

Hyper Products Inc.

-

Philips (Koninklijke Philips N.V.)

-

Sabrent

-

PNY Technologies Inc.

-

Moshi (Aevoe Group)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.28 Billion |

| Market Size by 2035 | USD 6.01 Billion |

| CAGR | CAGR of 10.17% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Standard USB-C Docks, Multi-Function Docking Stations, Gaming Docks) • By Port Configuration (Dual Port Docks, Multi-Port Docks) • By Connectivity Type (Wired USB-C Docks, Wireless Docking Stations) • By Target User Segment (Business Professionals, Average Consumers, Gamers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Dell Technologies Inc., HP Inc., Lenovo Group Limited, Anker Innovations Co., Ltd., Belkin International, Inc., Plugable Technologies, Targus International LLC, StarTech.com Ltd., CalDigit, Inc., Kensington Computer Products Group, Microsoft Corporation, UGREEN Group Limited, Other World Computing (OWC), ORICO Technologies Co., Ltd., Baseus Technology Co., Ltd., Hyper Products Inc., Philips (Koninklijke Philips N.V.), Sabrent, PNY Technologies Inc., Moshi (Aevoe Group). |