Automotive Engineering Service Provider Market Report Scope & Overview:

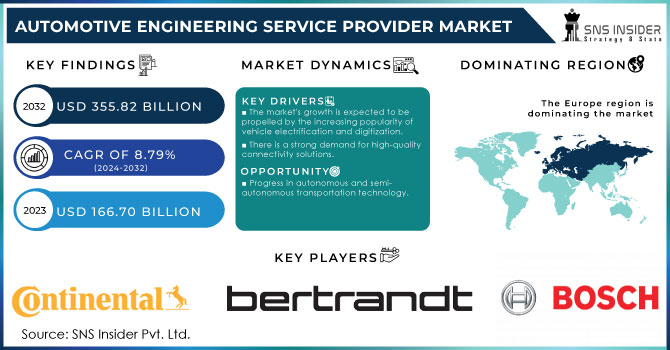

The Automotive Engineering Service Provider Market size was valued at USD 166.70 billion in 2023 and is expected to reach USD 355.82 billion by 2032 and grow at a CAGR of 8.79% over the forecast period 2024-2032.

Get more Information on Automotive Engineering Service Provider Market - Request Sample Report

-

How the current government initiatives are positively shaping the market course?

The Automotive Engineering Service Provider (ESP) market is experiencing major changes due to various important trends. Increasing interest in electric vehicles (EVs) is creating chances for ESPs who specialize in battery technology, powertrain design, and lightweight material integration. Efforts by the government, such as China's significant funding for EV charging infrastructure and the US's backing of domestic battery manufacturing, are helping to speed up this transition even more. An example of this is the U.S. announcing a USD 3.1 billion investment plan for domestic battery production. Stricter global emission regulations are leading to a rising need for ESPs who are skilled in enhancing internal combustion engines (ICE) and creating cleaner technologies such as hybrids.

Additionally, the rise of the autonomous vehicle (AV) industry is leading to a demand for ESPs who specialize in sensor fusion, LiDAR integration, and path planning. This offers a profitable opportunity for ESPs with these skills. In order to succeed in this changing environment, ESPs need to consistently improve their abilities and dedicate substantial resources to research and development (R&D). Being able to adapt and innovate in the rapidly changing automotive industry is essential for taking advantage of the opportunities available in this fast-paced market.

MARKET DYNAMICS:

KEY DRIVERS:

-

The market's growth is expected to be propelled by the increasing popularity of vehicle electrification and digitization.

-

There is a strong demand for high-quality connectivity solutions.

-

Automotive innovation is accelerating with the progression of technology.

-

Enhancing power density and reducing power consumption.

Effective lightweight material design and aerodynamic optimization are becoming more and more important in reducing a vehicle's energy use. Government incentives like India's FAME II program offer subsidies for energy-efficient electric two-wheelers, encouraging the market to move in that direction. Automotive engineering service providers will have a crucial role in shaping a future where electric vehicles have increased range and exceptional efficiency by considering both aspects of the equation.

OPPORTUNITIES:

-

Progress in autonomous and semi-autonomous transportation technology.

-

There is plenty of space for this market to expand with the economy getting better.

-

The possibility for this business is great with the implementation of standardized safety features.

The future of the AESP market is closely tied to the increasing use of standardized safety features in the automotive sector. As governments around the world focus on road safety, the adoption of rules requiring advanced safety technologies like Automatic Emergency Braking (AEB) and Electronic Stability Control (ESC) is becoming more widespread. The General Safety Regulation of the European Union is a clear example of this pattern, with estimates suggesting that more than 25,000 lives could be saved by 2038.

CHALLENGES:

-

Major security challenges are confronted by system manufacturers, OEMs, and engineering service providers.

-

Limitations on IP addresses hinder service providers from using technology on a regular basis.

MARKET SEGMENTATION ANALYSIS:

By Service Type:

The future prospects of the automotive engineering service provider market depend on adopting a segmented strategy that caters to distinct stages of development. The Concept/Research segment, though currently smaller in scale, is anticipated to experience significant expansion with a projected investment surge of 20% by 2025. This growth is driven by heightened innovation priorities among automakers, particularly in areas such as electric vehicles and autonomous driving technologies.

Meanwhile, Design services, which presently command the largest market share at 35%, are forecasted to sustain consistent growth. This is fueled by the ongoing demand for vehicles that are both lightweight and visually appealing. Prototyping services, essential for validating designs, are expected to see a 15% increase in investments, propelled by the increasing accessibility of technologies such as 3D printing and rapid prototyping. System integration, which ensures smooth interaction among components, is anticipated to maintain a stable 20% market share. Similarly, the Testing segment, encompassing virtual simulations and real-world trials, is projected to witness a 10% upsurge, driven by the escalating focus on safety and performance standards. This targeted approach to services will be critical for engineering firms to leverage the evolving automotive landscape and capitalize on emerging opportunities in the market.

By Application:

The path of the Automotive Engineering Service Provider Market relies heavily on the intricate dynamics across various application segments. The foremost contender, Advanced Driver-Assistance Systems (ADAS) and Safety, is poised to dominate, primarily fueled by stringent regulatory measures and the intensifying pursuit of autonomous driving technologies. Industry projections indicate that ADAS & Safety will command a significant share, exceeding 25% of the market by 2032, as per SNS Insider analysis.

Conversely, the advent of Electric Vehicles (EVs) is reshaping the landscape, propelling segments such as Battery Development & Management and Charger Testing into a notable growth trajectory. These segments are anticipated to collectively amass a considerable share, potentially reaching 15% by 2032. In contrast, traditional segments like Powertrain & Exhaust are expected to witness a decline, while Chassis and Connectivity Services are slated for consistent growth owing to their enduring relevance across diverse vehicle categories. Amidst this evolution, there emerge compelling prospects for engineering service providers adept at adapting their competencies to meet the evolving demands of the automotive industry. Seizing upon these opportunities necessitates agility and innovation, positioning firms to capitalize on the shifting preferences and priorities within the automotive sector

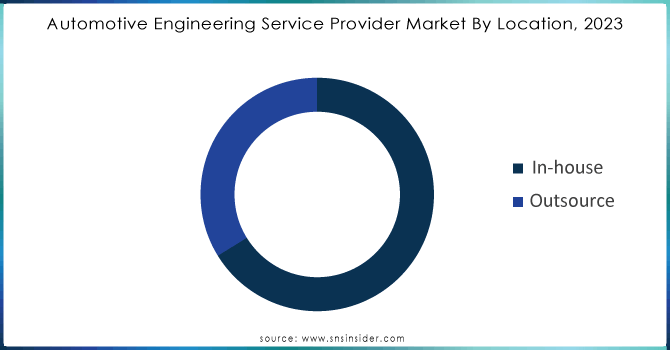

By Location:

The automotive engineering service provider market is bifurcated into two primary segments based on service location: in-house and outsourced. As of 2023, the in-house segment boasted a commanding market share of approximately 67%. This predominance can be attributed to the clustering of service providers around original equipment manufacturers (OEMs) in developed nations, fostering tight-knit collaboration for design, prototyping, and specialized tasks. Nonetheless, projections suggest a forthcoming power shift in the industry landscape.

The outsourced segment, currently holding a 33% market share, is witnessing rapid expansion propelled by several key factors. The escalating intricacy of vehicles, propelled by advancements in electric, autonomous, and connected car technologies, demands specialized expertise often beyond in-house capabilities. This trend underscores the growing significance of outsourced automotive engineering services in meeting the evolving demands of the market.

Get Customized Report as per your Business Requirement - Ask For Customized Report

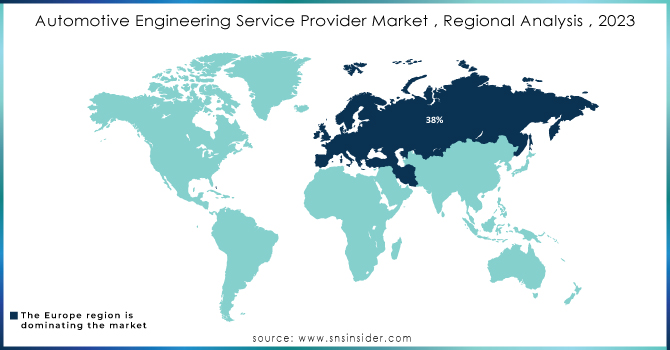

REGIONAL ANALYSIS:

The landscape of the Automotive Engineering Service Provider Market is undergoing a significant transformation, marked by the emergence of regional leaders alongside established industry giants. Presently, Europe commands the largest market share at approximately 38%, leveraging its strong automotive manufacturing heritage and emphasis on cutting-edge technologies. However, the Asia Pacific region is poised for remarkable growth, projected to capture a commanding 48% share by 2032. This growth trajectory is driven by factors such as China's swift adoption of electric vehicles and governmental backing for eco-friendly technologies. Despite being a mature market, North America is expected to maintain a steady 20% share, propelled by ongoing advancements in autonomous driving and connected vehicle solutions. This shift towards regional diversification presents lucrative opportunities for service providers. Companies possessing a global footprint and specialized expertise in meeting diverse market demands will be strategically positioned to capitalize on these emerging trends and thrive in the foreseeable future.

KEY PLAYERS:

Some of the major players in the Automotive Engineering Service Provider Market are Robert Bosch GmbH (Germany), Continental AG (Germany), HARMAN International (USA), AVL LIST GmbH (Germany), Bertrandt (Germany), EDAG Engineering GmbH (Germany), Imaginative Automotive Engineering Services (India), IAV Automotive Engineering, Inc. (Germany), Magna International Inc (Canada), and Contechs (UK) and other players.

Recent Developments:

-

Bosch Engineering: Bosch Engineering, a subsidiary of Robert Bosch GmbH, has been involved in various automotive engineering projects. They have focused on developing advanced driver assistance systems (ADAS), automotive electronics, and software solutions for vehicle control systems.

-

Magna International: Magna International is a global automotive supplier known for its expertise in engineering services. They have been active in developing lightweight vehicle structures, electric vehicle components, and advanced manufacturing processes aimed at improving efficiency and sustainability in the automotive industry.

-

EDAG Engineering: EDAG Engineering is a leading provider of engineering services for the automotive industry. They have worked on innovative vehicle concepts, including electric and autonomous vehicles, and have expertise in vehicle integration, prototyping, and testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 166.70 Billion |

| Market Size by 2032 | US$ 355.82 Billion |

| CAGR | CAGR of 8.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Service Type (Concept/Research, Designing, Prototyping, System Integration, Testing) • by Application (ADAS and Safety, Electrical, Electronics, and Body Controls, Chassis, Connectivity Services, Interior, Exterior, and Body Engineering, Powertrain and Exhaust, Simulation, Battery Development & Management, Charger Testing, Motor Control, Others) • by Location (In-house, Outsourced) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), Continental AG (Germany), HARMAN International (USA), AVL LIST GmbH (Germany), Bertrandt (Germany), EDAG Engineering GmbH (Germany), Imaginative Automotive Engineering Services (India), IAV Automotive Engineering, Inc. (Germany), Magna International Inc (Canada), and Contechs (UK) |

| Key Drivers | •Vehicle electrification and digitization, which are on the rise, are projected to drive the market's growth. •Advanced connectivity solutions are in high demand. |

| RESTRAINTS | •Standard guidelines for engineering service providers are lacking. •The increased level of design complexity has an impact on the final price of the vehicle. |