Mobility Technology Market Report Insights:

Get More Information on Mobility Technology Market - Request Sample Report

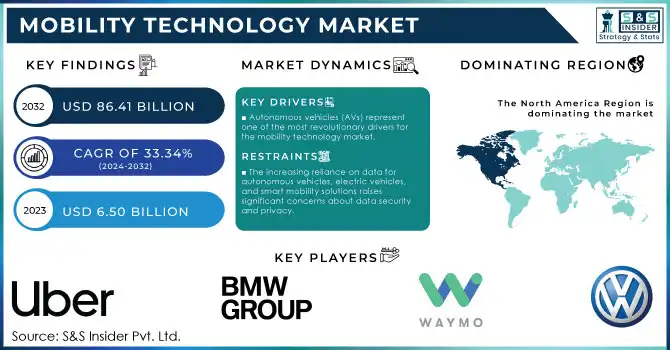

The Mobility Technology Market Size was valued at USD 6.50 Billion in 2023 and is expected to reach USD 86.41 Billion by 2032 and grow at a CAGR of 33.34% over the forecast period 2024-2032.

The mobility technology market is experiencing rapid growth, driven by key innovations that are revolutionizing the movement of goods, people, and services. Several factors are propelling this market forward, including the rising demand for clean transportation solutions, the development of autonomous vehicles, the increasing importance of connected infrastructure, and advancements in electrification. As of 2023, there are over 40 million electric vehicles (EVs) on the road globally, with 1-in-4 new cars sold being electric. EVs are a prime example of the ongoing transformation in the mobility sector, providing a sustainable alternative to traditional internal combustion engine (ICE) vehicles and reducing reliance on fossil fuels. This transition is further supported by the growth of charging infrastructure, the development of energy-efficient batteries, and the integration of renewable energy sources to power these vehicles. This push for cleaner mobility solutions is a significant driver of the mobility technology market's growth, as consumers and manufacturers alike shift toward more environmentally friendly transportation options.

In addition to electrification, connected transportation systems are becoming increasingly important. A 2023 study involving over 2,000 car owners and renters in the US revealed that while drivers are generally open to sharing personal information in exchange for perks like enhanced customization and discounted insurance, most drivers have limited understanding of what constitutes a connected car or what types of data are being collected. With the rise of the Internet of Things (IoT), vehicles, infrastructure, and transportation networks are now able to communicate and collaborate, creating a more efficient and coordinated transportation ecosystem. Smart traffic lights, for example, can adjust in real time based on traffic flow, while vehicles can exchange data to prevent collisions and optimize route planning. This connectivity not only improves the overall driver experience but also enhances the efficiency of transportation networks, making better use of existing infrastructure and reducing congestion.

Mobility Technology Market Dynamics

Drivers

-

Autonomous vehicles (AVs) represent one of the most revolutionary drivers for the mobility technology market.

The development of self-driving cars, trucks, and other transportation modes is poised to drastically change how people and goods move. Several factors are contributing to the rapid advancement of AV technology, including breakthroughs in artificial intelligence (AI), machine learning (ML), sensors, and computing power. AVs can operate without human intervention, potentially reducing the risk of human error, improving road safety, and optimizing traffic flow. They also have the potential to reduce congestion and decrease fuel consumption through more efficient driving patterns. Additionally, autonomous technology facilitates the development of smart cities, where vehicles are part of an interconnected, optimized network. This shift is being driven by major players in the automotive industry, such as Tesla, Waymo, and Uber, who are investing heavily in developing self-driving technology. The promise of a future where people can travel more efficiently and safely is propelling the growth of the mobility sector, making autonomous vehicle technology a cornerstone of this transformation.

-

Consumer preferences are rapidly changing, with a growing demand for on-demand, flexible, and shared mobility services, driving the market growth.

This shift is fueled by advancements in mobile technology and the rise of app-based platforms that allow consumers to book transportation services at the touch of a button. Ride-hailing services like Uber and Lyft have already transformed the way people think about car ownership, and this trend is expected to continue as consumers increasingly seek alternatives to traditional personal vehicle ownership. On-demand mobility services are particularly attractive in urban areas where traffic congestion and parking issues make owning a car less practical. In addition to ride-hailing, other on-demand mobility options such as bike sharing, scooter-sharing, and car-sharing are gaining popularity as convenient and cost-effective transportation solutions. These services offer consumers greater flexibility, allowing them to access transportation when and where they need it without the responsibilities of ownership, such as maintenance and insurance costs.

Restraints

-

The increasing reliance on data for autonomous vehicles, electric vehicles, and smart mobility solutions raises significant concerns about data security and privacy.

Autonomous vehicles, for instance, generate and process vast amounts of data, including real-time traffic information, location data, and even biometric data from passengers. This data is vital for the safe operation of the vehicles but also makes them vulnerable to cyberattacks. Hackers could potentially gain control of autonomous vehicles or disrupt transportation networks, posing serious safety risks. In addition to security concerns, there are privacy issues related to the collection and sharing of personal data, especially as mobility services become more personalized and interconnected. Consumers may be reluctant to use mobility technologies if they feel their data is not adequately protected which can create a huge challenge to overcome for the mobility technology market to overcome.

Mobility Technology Market Segmentation Overview

By Type

In 2023, the Bluetooth segment dominated with a 45% market share in the mobility technology market, as it is crucial for different mobility devices, providing a low-energy, short-distance communication option for linking personal gadgets like smartphones, wearables, and car systems. Bluetooth's success is credited to its capacity to offer smooth connections among various platforms like fitness trackers, smartwatches, and in-car entertainment systems. For instance, Apple and other companies use Bluetooth in their wearable products such as the Apple Watch to enable users to connect their devices to their smartphones for alerts, fitness monitoring, and navigation.

The Mobile Augmented Reality segment is expected to experience the most rapid growth rate during 2024-2032 within the mobility technology market. With the rise of smartphones and powerful mobile processors, AR is quickly growing as it improves real-world settings by adding digital data on top of them. AR technology is revolutionizing mobility solutions by providing real-time navigation support, interactive experiences, and advanced driver assistance systems (ADAS). For example, WayRay, a top player in the AR automotive industry, incorporates AR dashboards and HUDs in cars, offering drivers live navigation and alerts about potential dangers.

By Application

The car segment dominated in 2023, holding a 49% market share, driven by the rising adoption of electric vehicles (EVs), autonomous driving technologies, and advanced infotainment systems. Car manufacturers and tech companies are integrating sophisticated mobility solutions such as connected car platforms, telematics, and electric powertrains. Companies like Tesla, which specializes in EVs and autonomous driving features, and BMW, which is investing heavily in electric mobility and digital technologies, are leading the way.

The medical equipment segment is expected to be the fastest-growing during 2024-2032. The application of mobility technologies in medical devices, particularly in telemedicine, diagnostic equipment, and patient monitoring systems, is expanding rapidly. Technologies like wearable health devices and mobile health apps are revolutionizing patient care by enabling real-time data collection and remote diagnostics. Companies such as Medtronic and Philips are integrating mobility technologies into their medical solutions, enabling better patient outcomes through connectivity and data sharing.

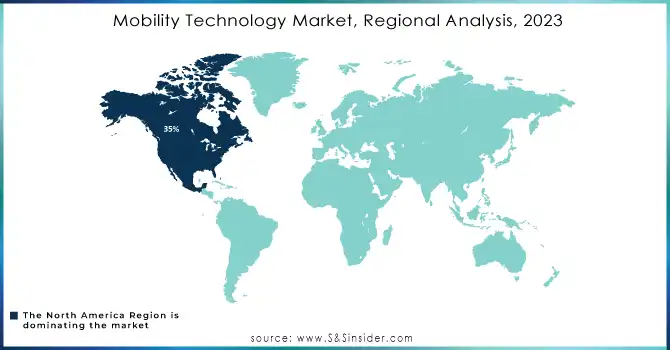

Mobility Technology Market Regional Analysis

North America held the largest market share of 35% and dominated the mobility technology market in 2023. The region benefits from a strong infrastructure, high adoption of advanced technologies, and government initiatives aimed at smart cities, autonomous vehicles, and electric vehicle (EV) development. The presence of major players like Tesla, Uber, and General Motors accelerates innovation in electric and autonomous mobility. Companies like Waymo and Lyft are playing a pivotal role in integrating AI-driven services into urban mobility.

Asia-Pacific is anticipated to become the fastest-growing region in the mobility technology market during 2024-2032, with rapid urbanization and growing technological adoption driving market expansion. Countries like China, Japan, and India are leading the charge due to their focus on developing smart cities, electric vehicles, and autonomous transportation solutions. China’s dominance in EV production, with companies like BYD and NIO, and Japan’s advancements in connected mobility, are crucial contributors. Additionally, India’s growing population and increasing demand for innovative transportation models further boost the market.

Need Any Customization Research On Mobility Technology Market - Inquiry Now

Key Players in Mobility Technology Market

The major players in the Mobility Technology Market are:

-

Tesla (Autopilot, Full Self-Driving)

-

Uber Technologies (Uber Freight, Uber Elevate)

-

BMW Group (BMW iX3, BMW 7 Series)

-

Ford Motor Company (Ford Mustang Mach-E, Ford F-150 Lightning)

-

Waymo (Waymo Driver, Waymo One)

-

General Motors (Chevrolet Bolt EV, GMC Hummer EV)

-

Volkswagen Group (Volkswagen ID.4, Audi e-Tron)

-

Rivian (Rivian R1T, Rivian R1S)

-

NIO Inc. (NIO ES8, NIO EC6)

-

BYD Auto (BYD Tang EV, BYD Qin Pro EV)

-

Li Auto (Li ONE, Li L9)

-

Lucid Motors (Lucid Air, Lucid Gravity)

-

Nissan Motor Corporation (Nissan Leaf, Nissan Ariya)

-

Hyundai Motor Company (Hyundai Ioniq 5, Hyundai Kona Electric)

-

Audi AG (Audi Q4 e-Tron, Audi RS e-Tron GT)

-

Daimler AG (Mercedes-Benz EQC, Mercedes-Benz S-Class)

-

Volvo Cars (Volvo XC40 Recharge, Volvo C40 Recharge)

-

Toyota Motor Corporation (Toyota Mirai, Toyota bZ4X)

-

Zoox (Zoox Autonomous Vehicle, Zoox Autonomous Platform)

-

ChargePoint (ChargePoint Home Flex, ChargePoint Express Plus)

Suppliers providing components to manufacturers:

-

Infineon Technologies (Power semiconductors, Sensors)

-

NXP Semiconductors (Automotive microcontrollers, Radar sensors)

-

Magna International (Electric drive systems, Lightweight materials)

-

Continental AG (Tires, Vehicle safety systems)

-

Bosch (Electric motors, Driver assistance systems)

-

Valeo (Smart headlights, Parking sensors)

-

Aptiv (Autonomous driving systems, Power distribution units)

-

Delphi Technologies (Electric vehicle charging systems, Powertrain systems)

-

LG Chem (Lithium-ion batteries, Battery management systems)

-

Panasonic (Battery cells, Electric vehicle battery packs)

Recent Development

-

August 2024: The "Giga Train," Tesla's debut all-electric train service in Germany, started running. The service offers free transportation from Erkner station to Tesla Süd, catering to Tesla employees and the public.

-

Jule 2024: BMW entered the Indian electric two-wheeler market boldly by introducing the highly anticipated BMW CE 04. This high-end electric scooter, coming fully assembled as a CBU, aims to revolutionize city transportation with its eye-catching design, top-of-the-line technology, and outstanding performance.

-

August 2024: Ford's research vehicle, the fully autonomous Fusion Hybrid, is currently being tested on the streets of Dearborn, MI. Ford may introduce a ride-hailing service similar to Uber before its self-driving cars are ready for public use.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.50 Billion |

| Market Size by 2032 | USD 86.41 Billion |

| CAGR | CAGR of 33.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Bluetooth, Wearable Technology, Mobile Augmented Reality, Wireless Gigabit) • By Application (Electronic Products, Car, Medical Equipment, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Tesla, Uber Technologies, BMW Group, Ford Motor Company, Waymo, General Motors, Volkswagen Group, Rivian, NIO Inc., BYD Auto, Li Auto, Lucid Motors, Nissan Motor Corporation, Hyundai Motor Company, Audi AG, Daimler AG, Volvo Cars, Toyota Motor Corporation, Zoox, ChargePoint |

| Key Drivers | • Autonomous vehicles (AVs) represent one of the most revolutionary drivers for the mobility technology market. • Consumer preferences are rapidly changing, with a growing demand for on-demand, flexible, and shared mobility services, driving the market growth. |

| Restraints | • The increasing reliance on data for autonomous vehicles, electric vehicles, and smart mobility solutions raises significant concerns about data security and privacy. |