Cell Signaling Market Overview:

Get More Information on Cell Signaling Market - Request Sample Report

The Cell Signaling Market Size was valued at USD 5.1 billion in 2023 and is expected to reach USD 9.4 billion by 2032 and grow at a CAGR of 7.1% over the forecast period 2024-2032.

Cancer arises from intricate derangements of cellular signaling pathways and this has translated into a demand for therapeutic agents that selectively target the abnormally activated molecular networks supporting cancer growth. In addition, studying cell signaling can determine particular signal molecules and pathways that are responsible for cancer advancement so this is a competent technique to treat them. It can also be attributed to the increasing progress made in cell signaling research that contributes significantly towards overall market expansion. For example, in June 2021 Thermo Fisher Scientific Inc. announced the launch of Attune CytPix™ Flow Cytometer that combines acoustic focusing flow cytometry technology along with a high-speed camera Features This system is the first to allow simultaneous high-resolution bright field imaging and quantitative fluorescent flow cytometry by high-pixel CCD cameras from a set of cell population, allowing comprehensive analysis on both aspects. With this advancement, scientists are able to dissect the regulatory mechanisms that connect one type of signaling pathway within cells with another; hence they have a better chance of identifying distinct molecules and pathways associated with disease, especially in cancer biology and other complicated disorders.

Increased funding for research by governments will contribute to healthy market growth of the cell signaling. The increasing investment from governments targeting scientific research and biomedical fields has been providing higher funding for studies on cell signaling pathways relevance to health or disease. This included e.g. the 40 cutting-edge stem cell research facilities in some of the flagship health research and educational institutions within February, 2022 or economic relief plan measures for ZIKV affected countries to name a few. The government of India has given approximately 80 million USD over the last years through ICMR for a few project-specific research agenda.

Drivers

- Advancements in biotechnology and molecular biology have driven the market growth.

Advancements in biotechnology and molecular biology have revolutionized the Cell Signaling Market, particularly through innovations in genomics and proteomics. Such approaches have provided new insight into cellular signaling pathways that are key in disease development and treatment. One of the most promising has been CRISPR technology to facilitate specific gene manipulation and pathway reprogramming for targeted therapies. Take 2023, for example; among the major developments we learn about are things like Editas Medicine and CRISPR Therapeutics making big advances in using CRISPR to target specific genetic mutations associated with cancer and blood disorders.

At the same time, new single-cell RNA sequencing technologies have further enabled researchers to investigate cell signaling in more detail than ever before. In recent years, companies like Illumina and 10x Genomics have announced state-of-the-art sequencing platforms that enable the identification of cellular interactions at an unprecedented scale. For example, in 2022 illumina released the NovaSeq X system that increased throughput and accuracy for genomic sequencing allowing new cell signaling pathways discoveries relevant to oncology and immunology.

These developments have been actively supported by governments as well. In fact, data from an NIH report published earlier this year show that funding for U.S. government biotechnology and personalized medicine research has grown 7%, largely driven by grants centered on cell signaling (2021). In the same way, a substantial amount of money (over €3 billion) has been assigned by Horizon 2020 program specifically for biotechnical projects including cell signaling causing an asset to be created in this market. Together, these have contributed to the generation of novel treatments and therapies leading growth in cell signaling sector.

Restrain

- High Costs of Research and Development hamper the market growth.

The high cost linked with development and research will continue to act as a restraint in the Cell Signaling Market. To develop cell signaling technologies and therapies is quite expensive, that happens at all stages from primary research to development of the created technology through clinical trials. Cell signaling is complex and needs a variety of both molecular tools such as CRISPR for editing genes, to technologies elaborated at the resolution, e.g. RNA sequencing platforms for tissue specific expression analyses. One of the challenges with these technologies is that they are rather expensive to develop and soon enough it's lower copy number albeit an already steep costs would discourage biotechnology from both scrubby outfits or research establishments.

Cell Signaling Market Segmentation Analysis

By Type

Endocrine signaling generated the highest revenue of 42.9% in segment by 2023 and is expected to grow at a rapid pace over the forecast period due to increase its applications as well increasing number Endocrine disorders patients & diabetic patient across in all regions. It sends chemicals, called hormones, towards a specific area of the body and makes sure to brain communicates with it. The detection of this element hints at demand for more endocrine signaling. Rising incidences of endocrine dependent diseases like adrenal insufficiency, Cushing's disease, gigantism, hypothyroidism and hyperthyroidism is a one of the major factors which drives the growth.

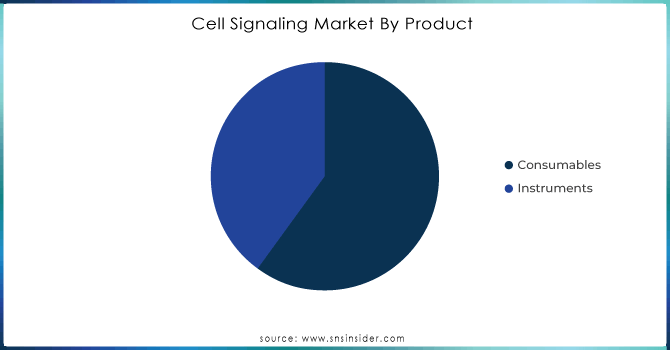

By Product

In 2023, the consumable product segment held the largest market share around 63.5%. Consumable re-buyback accounts for that share. Moreover, an increasing number of advances in genomes and proteomics as well as the rising trend towards personalized medicine along with targeted therapies further propel this market segment. Increasing government and private sector funding of cell-based research is expected to favor the continued growth of the global cell signaling market. Data retrieved from the portal of The National Institutes of Health (NIH) shows that an estimated 45 billion USD was assigned to stem cell research in fiscal year 2021. In March 2020, such funding grants for research on embryonic stem cells & induced pluripotent stem cells increased likewise.

Need any customization research on Cell Signaling Market - Enquiry Now

By Technology

In 2023, the microscopy segment is expected to have a leading position in this market. Signaling Localization is not the only signaling technique where Fluorescence Microscopy has proved useful. Researchers have several different ways to capture the dynamics of protein interactions in space and time under resting or stimulated conditions, allowing us insights into how signaling is transmitted, amplified and integrated within a cell. Lastly, microscopy enables the study of single-cell expression kinetics increasing the level of cell-to-cell heterogeneity and empowerment against gene-expression yet another step-in signaling research. Rising demand for light microscopy is being supported by fruitful findings associated with technological advancements around the world over recent years.

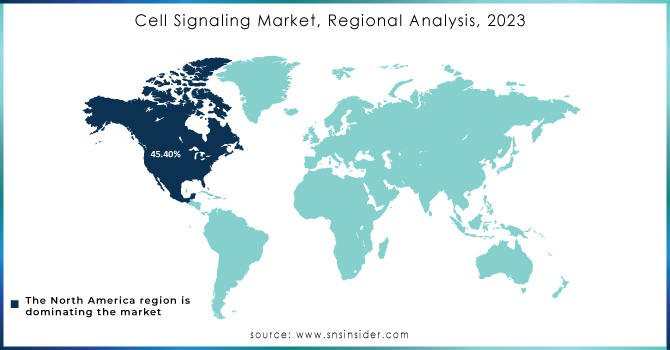

Cell Signaling Market Regional Insights

North America held a leading share of around 45.40 in 2023. Both the increased number of the major producers of these products such as the Thermo Fisher Scientific, the Merck KGaA, and the Cell Signaling Technology Inc., and the rise in the research and development spending by these producers to manufacture more innovative and advanced products is being considered to be a central factor to promote cell signaling industry in this region.

The North American U.S. market accounted for the leading share of the cell signaling market in 2023. Several players are involved in conducting R&D studies with a focus on cell signaling pathways. Excessive production of these pro-inflammatory cytokines enhances acute respiratory distress syndrome and causes extensive tissue damage leading to multi-organ failure and death. Therefore, targeting of the cell signaling pathways such as cytokines lead to a reduced death rate and better results. This is likely to benefit the market for cytokine research.

Key Players:

The major players listed in the Cell Signaling Market are Promega Corporation, PerkinElmer Inc., Merck KGaA, Danaher, Cell Signaling Technology Inc., Bio-Techne Corporation, Bio-Rad Laboratories Inc., Becton, Dickinson and Company, QIAGEN, Thermo Fisher Scientific, Inc. and other players.

Recent Developments:

-

In 2024 - Thermo Fisher Scientific, Thermo Fisher Scientific launched the PhenoCycler-F platform, a groundbreaking technology for multiplexed imaging of cell signaling pathways. This platform allows researchers to simultaneously analyze multiple signaling proteins in single cells, providing unprecedented insights into cellular processes and interactions.

-

In 2023 - Editas Medicine Editas Medicine made significant progress in 2023 with its EDIT-101 gene-editing therapy. This therapy targets specific genetic mutations involved in cell signaling pathways associated with retinal diseases. The therapy’s advancement highlights the application of CRISPR technology in addressing genetic disorders linked to cell signaling.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.8 Billion |

| Market Size by 2032 | US$ 9.4 Billion |

| CAGR | CAGR of7.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Endocrine Signaling, Paracrine Signaling, Autocrine Signaling Others) • By Product (Consumables, Instruments) • By Technology (Flow Cytometry, Microscopy, Western Blotting, ELISA, Others), • By Pathway (AKT Signaling Pathway, AMPK Signaling Pathway, ErbB/HER Signaling Pathway, Other Signaling Pathway) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Promega Corporation, PerkinElmer Inc., Merck KGaA , Danaher, Cell Signaling Technology Inc., Bio-Techne Corporation, Bio-Rad Laboratories Inc., Becton, Dickinson and Company, QIAGEN, Thermo Fisher Scientific, Inc. and other players. |

| Key Drivers | •Advancements in biotechnology and molecular biology have driven the market growth. |

| RESTRAINTS | •High Costs of Research and Development hamper the market growth. |