Consumer Audio Market Size Analysis:

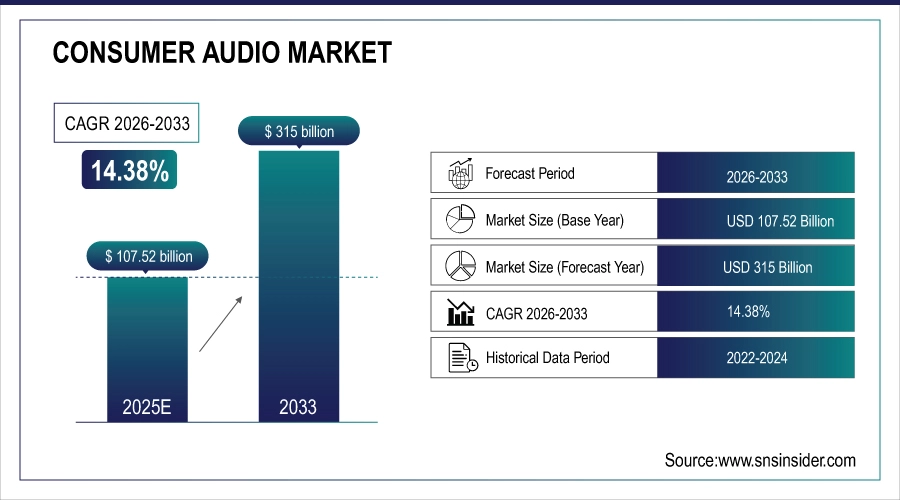

The Consumer Audio Market Size is estimated at USD 107.52 Billion in 2025 and is projected to reach USD 315 Billion by 2033, growing at a CAGR of 14.38% during the forecast period 2025–2033.

The Consumer Audio Market analysis report gives a thorough review of changes in consumer tastes, adoption trends across applications, and advancements in audio technology. Over the course of the forecast period, the market is anticipated to rise significantly due to the growing desire for immersive entertainment, the proliferation of smart devices, the expansion of wireless connectivity, and the growing integration of AI and voice assistants.

The consumer audio industry is rapidly evolving, with over 1.8 billion wireless audio devices expected to ship in 2025, driven by seamless connectivity and enhanced feature sets.

Market Size and Growth Projection:

-

Market Size in 2025E: USD 107.52 Billion

-

Market Size by 2033: USD 315 Billion

-

CAGR: 14.38% from 2025 to 2033

-

Base Year: 2025

-

Forecast Period: 2025–2033

-

Historical Data: 2022–2024

To Get more information on Consumer Audio Markett - Request Free Sample Report

Consumer Audio Market Trends:

-

Proliferation of True Wireless Stereo (TWS) earbuds is dominating personal audio, capturing over 65% of the headphone segment revenue with features like active noise cancellation and spatial audio.

-

Rise of smart and connected speaker systems is integrating deeply with smart home ecosystems, with voice assistant compatibility becoming a standard feature in over 70% of new models.

-

Premiumization and sound quality are driving higher average selling prices, with consumers investing in high-resolution audio, Dolby Atmos, and lossless codec support.

-

Growth of audio-for-gaming is creating a specialized segment, with low-latency wireless headsets and immersive surround sound systems seeing a 25% year-on-year demand increase.

-

Health and fitness integration is boosting demand for sport-oriented, rugged audio wearables with biometric monitoring, accounting for nearly 20% of headset sales.

-

Sustainability is becoming a key purchasing factor, with leading brands launching products using recycled materials and offering repair programs to reduce electronic waste.

U.S. Consumer Audio Market Size Outlook:

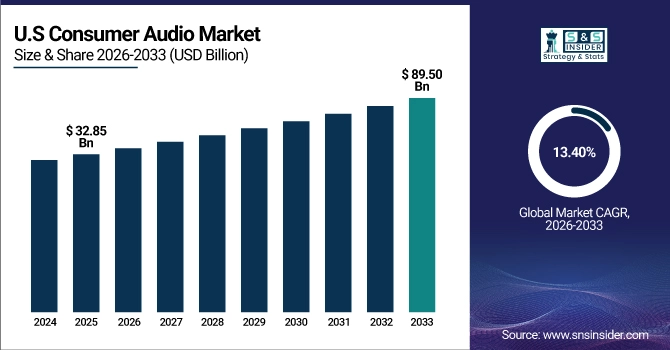

The U.S. Consumer Audio Market is projected to grow from USD 32.85 Billion in 2025E to USD 89.50 Billion by 2033, at a CAGR of 13.40%. High discretionary income, early adoption of wireless and high-end technology, a strong brand presence, and substantial demand from applications in the home entertainment, gaming, and commercial sectors are the main drivers of growth.

Consumer Audio Market Growth Drivers:

-

Explosive Growth in Wireless and Smart Audio Technology Adoption is the Primary Driver for Consumer Audio Market, Enhancing Convenience, and User Experience

The market is being drastically altered by the transition from wired to wireless audio, which is being driven by improvements in Bluetooth and the widespread use of TWS earbuds. Convenience, portability, and smooth interaction with tablets, laptops, and smartphones are top priorities for consumers. At the same time, the growth of smart home ecosystems is increasing demand for voice-activated smart speakers and soundbars that double as hubs for automation and entertainment. The need for both connected intelligence and untethered listening is pushing for constant innovation, accelerating replacement cycles, and growing the overall addressable market for audio equipment.

Wireless audio device shipments are forecast to exceed 2.5 billion units annually by 2027, with Bluetooth LE Audio and multipoint connectivity becoming standard expectations.

Consumer Audio Market Restraints:

-

Market Saturation in Mature Segments and Persistent Supply Chain Volatility for Critical Components Are Key Restraints on Consumer Audio Market Growth

In developed markets, high penetration rates for core items such as entry-level speakers and basic headphones restrict volume growth and drive competition toward feature-based differentiation, which raises R&D expenses. At the same time, the industry is still susceptible to interruptions in the supply of drivers, batteries, and semiconductors, which could result in production delays and increased expenses. These variables may reduce demand in price-sensitive markets and geographical areas by reducing manufacturing profits and raising consumer costs.

Consumer Audio Market Opportunities:

-

Integration of Advanced Computational Audio and Personalized Sound Experiences Presents a Significant Long-Term Opportunity for Market Expansion and Premiumization

Audio equipment can now provide adaptive noise cancellation, real-time sound modification, and hearing augmentation by utilizing powerful chipsets and artificial intelligence algorithms. This makes it possible to create extremely customized audio experiences that are suited to each listener's unique hearing profile, content genre, and ambient conditions. This technology frontier provides companies with opportunities for health-related audio applications, subscription-based software services, and improved product differentiation that can command higher price points and increase brand loyalty.

AI-enhanced audio processing features are projected to be integrated into over 40% of mid-to-high-tier audio products by 2026, creating a new benchmark for performance.

Consumer Audio Market Segmentation Analysis:

-

By Product, Headphones held the largest market share of 38.65% in 2025, while Sound Bars are expected to grow at the fastest CAGR of 16.85% during 2025–2033.

-

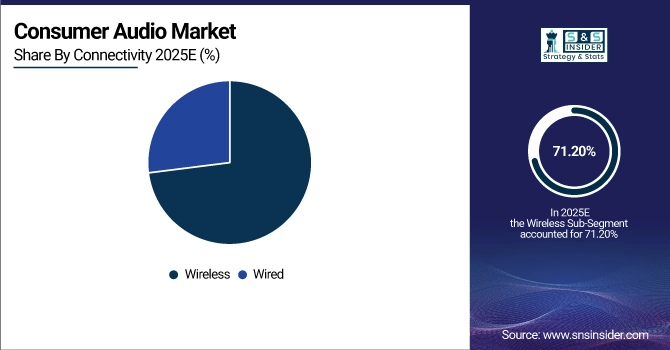

By Connectivity, Wireless accounted for the highest market share of 71.20% in 2025, and is also projected to expand at the fastest CAGR of 15.10% during the forecast period.

-

By Application, Commercial dominated with a 28.45% share in 2025, while Hospitality is expected to grow at the fastest CAGR of 17.25% through 2025–2033.

By Connectivity, Wireless Dominates and Continues Rapid Expansion

The Wireless segment overwhelmingly dominates the market, as convenience and the removal of the audio jack have become industry standards. Technologies, such as Bluetooth 5.3, LE Audio, and proprietary low-latency protocols have resolved historical quality and connection issues, making wireless the default choice for most consumers across all product categories.

Wireless is also the fastest-growing segment, with its share continuously expanding as even traditionally wired niches like high-fidelity audiophile headphones and professional microphones adopt robust wireless solutions. The growth is further accelerated by the complete wireless connection of the TWS earbud and portable speaker categories.

By Product, Headphones Dominate While Sound Bars Expand Rapidly

The Headphones segment, encompassing over-ear, on-ear, in-ear, and TWS models, dominated the market due to ubiquitous personal use, rapid replacement cycles, and continuous innovation in noise cancellation and wireless tech. Over 850 million units were shipped globally in 2025, underpinned by demand for mobile entertainment, remote work, and gaming.

Sound Bars are the fastest-growing segment, driven by the consumer upgrade path from TV speakers to cinematic home audio experiences. Their space-saving design, simplicity, and integration with features like Dolby Atmos and wireless subwoofers fueled growth. Shipments grew by over 22% in 2025, as they became a central component of modern home entertainment setups.

By Application, Commercial Dominates While Hospitality Expands Rapidly

The Commercial application segment, covering office spaces, conference rooms, retail background music, and professional setups, held the largest share. This is driven by the hybrid work model's permanence, requiring high-quality audio for video conferencing, and by audio-as-a-service models in retail and corporate environments for background music and paging.

Hospitality is the fastest-growing application segment. Hotels, resorts, restaurants, and bars are increasingly investing in premium, distributed audio systems to enhance guest experience, create ambiance, and offer in-room high-quality sound solutions. This trend towards audio as a key differentiator in customer service is propelling significant investments in the sector.

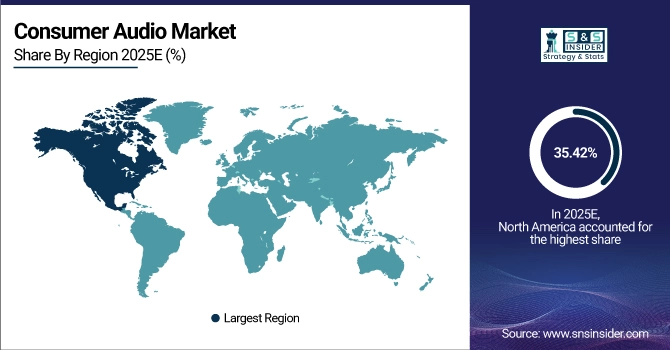

Consumer Audio Market Regional Analysis:

North America Consumer Audio Market Insights:

With a 35.42% market share in 2025, North America led the consumer audio industry due to strong brand presence, early and quick adoption of new and premium technology, and high consumer purchasing power. The region's dominant position is cemented by its developed retail and e-commerce ecosystems as well as the substantial demand from commercial and gaming applications. The unquestionable center of this regional market is the U.S.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

U.S. Consumer Audio Market Insights: The U.S. is the world's largest single-country market, accounting for over 85% of North American revenue. Growth is driven by a tech-savvy consumer base, intense marketing and innovation from Apple, Bose, Sony, and others, and robust demand across all segments, from premium wireless headphones to whole-home audio systems for smart residences.

Asia Pacific Consumer Audio Market Insights:

The fastest-growing region is Asia Pacific, which is expected to develop at an impressive 16.55% CAGR. An enormous and expanding middle class, rising smartphone adoption, a boom in the consumption of digital content, and the existence of a sizable manufacturing and supply chain ecosystem are all factors driving the region's growth. China, India, South Korea, and Japan are among the nations that contribute significantly to both production and consumption.

-

China Consumer Audio Market Insights: China is the largest market in APAC and a global manufacturing hub, contributing approximately 52% of regional demand. It features a highly competitive local brand landscape (Huawei, Xiaomi, and Edifier) in the volume segment, while also being a critical market for international premium brands. Domestic innovation in TWS and smart speakers is particularly notable.

Europe Consumer Audio Market Insights:

The second-largest geographical market is Europe, which is distinguished by strong brand loyalty, substantial sales through specialty audio stores, and a high demand for quality and design. Premium brands, such as Sennheiser, Bang & Olufsen, and Devialet are well-represented in the area. Replacement cycles, smart home integration, and a robust commercial audio industry in Germany, the UK, and France are the main drivers of the industry's consistent growth.

-

Germany Consumer Audio Market Insights: Germany leads the European market with nearly 28% regional demand, supported by high disposable income, engineering appreciation leading to demand for high-fidelity products, and a strong industrial/commercial base that drives demand for professional-grade audio solutions in business and manufacturing applications.

Latin America Consumer Audio Market Insights:

Due to its youthful population, increasing smartphone penetration, and expanding digital entertainment platforms, Latin America exhibits tremendous growth potential. The demand for entry-level and mid-range wireless headphones and portable speakers is strong, despite price sensitivity, with Brazil and Mexico serving as the main growth areas.

Middle East & Africa Consumer Audio Market Insights:

Due to strong disposable income and desire for luxury items, particularly high-end audio, the MEA market is changing, with growth centered in Gulf Cooperation Council nations. Another sizable market is South Africa. Urbanization, growing retail infrastructure, and the growing appeal of streaming services are growth factors.

Consumer Audio Market Competitive Landscape:

Apple Inc.

Apple Inc., which was founded in 1976 and has its headquarters in Cupertino, California, USA, is the global leader in consumer audio, majorly due its Beats by Dre and AirPods brands. Market trends are defined by its smooth ecosystem integration, brand power, ongoing chip innovation (H1, H2), and features like spatial audio.

-

In 2024, Apple launched the next-generation AirPods with enhanced health sensing capabilities and improved adaptive audio, further locking users into its ecosystem.

Sony Corporation

Established 1946 and based in Tokyo, Japan, Sony is a technology conglomerate with a storied audio heritage. Its audio division excels across headphones (WH and WF series), soundbars, home theater systems, and professional audio, renowned for industry-leading noise cancellation and high-resolution audio support.

-

In 2024, Sony expanded its 360 Reality Audio ecosystem and introduced new link-bud style headphones focused on ambient sound awareness for all-day wear.

Samsung Electronics Co., Ltd.

Samsung, a world leader in electronics, was founded in 1969 and has its headquarters in Suwon, South Korea. Its sound portfolio, which includes Galaxy Buds, soundbars from the HW-Q series, and items bearing the Harman Kardon name, is purposefully made to go with its top-selling TVs and smartphones.

-

In 2023, Samsung deepened integration between its Galaxy Buds, TVs, and SmartThings ecosystem, emphasizing seamless switching and personalized sound profiles.

Bose Corporation

Bose, which was founded in 1964 and has its headquarters in Framingham, Massachusetts, USA, is known for its innovative high-end audio products, especially in the area of noise-cancelling technology. Its product line includes smart speakers, home entertainment systems, Frames audio sunglasses, and QuietComfort and Sport headphones.

-

In 2024, Bose launched its next-generation ultra-comfortable headphones with breakthrough noise-cancelling and focus on wellness-oriented audio features.

Consumer Audio Companies are:

-

Apple Inc.

-

Samsung Electronics Co., Ltd.

-

Bose Corporation

-

Sennheiser Electronic GmbH & Co. KG

-

Harman International (Samsung)

-

Google LLC (Nest Audio)

-

Amazon.com, Inc. (Echo/Alexa)

-

JBL (Harman)

-

Shure Incorporated

-

LG Electronics

-

Sonos, Inc.

-

Vizio Holdings Corp.

-

Logitech International S.A.

-

Skullcandy, Inc.

-

V-Moda

-

Master & Dynamic

-

Audio-Technica Corporation

-

Panasonic Holdings Corporation

-

Xiaomi Corporation

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 107.52 Billion |

| Market Size by 2033 | USD 315 Billion |

| CAGR | CAGR of 14.38% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Microphones, Soundbars, Speaker Systems, Headphones, Headsets) • By Connectivity (Wired, Wireless) • By Application (Education, Commercial, Retail, Commercial, Government, Industrial, Hospitality) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Apple Inc., Sony Corporation, Samsung Electronics Co., Ltd., Bose Corporation, Sennheiser Electronic GmbH & Co. KG, Harman International (Samsung), Google LLC (Nest Audio), Amazon.com, Inc. (Echo/Alexa), JBL (Harman), Shure Incorporated, LG Electronics, Sonos, Inc., Vizio Holdings Corp., Logitech International S.A., Skullcandy, Inc., V-Moda, Master & Dynamic, Audio-Technica Corporation, Panasonic Holdings Corporation, Xiaomi Corporation |