Cryocooler Market Size & Growth Trends:

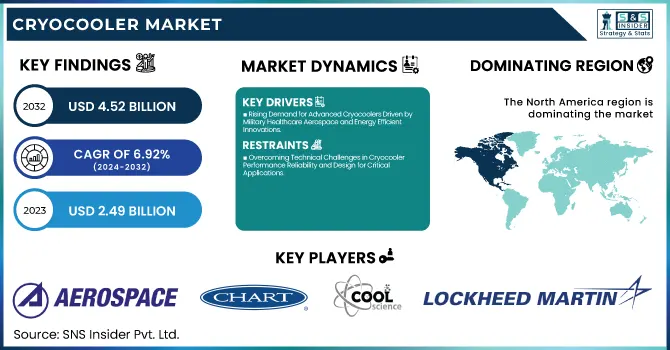

The Cryocooler Market Size was valued at USD 2.49 billion in 2023 and is expected to reach USD 4.52 billion by 2032, growing at a CAGR of 6.92% over the forecast period 2024-2032. Drivers for the growth of Cryocoolers is the increase in energy-efficient technology. Manufacturers are improving to consume less power whilst providing the same performance. Because the cooling capacity of each system varies greatly, this covers everything from devices to entire industrial processes.

To Get more information on Cryocooler Market - Request Free Sample Report

Maintenance interval and longevity are likewise critical factors, newer models can have longer service lives and greater maintenance intervals which can play a great role in reducing life cycle operating costs. The continuous development of the product and continuous innovation characterizes the market and the companies are trying to explore new technologies like Stirling cryocoolers, pulse tube cryocoolers, and alternative helium-free solutions to enhance efficiency and sustainability and to adapt to many different industries.

Cryocooler Market Dynamics

Key Drivers:

-

Rising Demand for Advanced Cryocoolers Driven by Military Healthcare Aerospace and Energy Efficient Innovations

The cryocooler market growth is mainly driven by the rising need for advanced cooling solutions in various applications, such as military & defense, healthcare, and aerospace, particularly in cryogenic systems. This will not only propel the market growth but also create demand for compact, efficient, and reliable cooling solutions for high-performance systems such as infrared sensors, satellite systems, and medical equipment. Furthermore, the development of energy-efficient and relatively cost-effective cryocoolers due to advancements in cryogenic technology is expected to increase its adoption in various sectors. Increasing investments in space exploration, satellite technology, and renewable energy solutions drive the demand for cryogenic coolers to keep up with their performance in extreme environmental conditions.

Restrain:

-

Overcoming Technical Challenges in Cryocooler Performance Reliability and Design for Critical Applications

There are a few technical challenges related to cryocoolers which creates an obstacle on the path of growth in the market. The first issue that stands out is the poor performance of the latter in extreme environmental conditions. A lot of cooling systems could have some type of obstruction from being operated out in the real world when we need them to work effectively because of these grueling environments like areas or high-altitude environments. Additionally, the engineering challenges associated with designing and building cryocoolers that can be installed in extremely sensitive systems, such as medical devices and defense systems, are also substantial. One more open challenge is to maintain long-term reliability and low maintenance requirements in these critical applications.

Opportunity:

-

Exploring Lucrative Cryocooler Market Opportunities in Healthcare Aerospace Power Generation and Green Technologies

The most lucrative cryocooler market opportunities await in healthcare and aerospace. Thermal management of innovative baby devices Because of the expected increase of marketplace diagnosis and remedy calls, the cryocoolers marketplace can shape excessive voltage car gadgets withstanding harsh operating situations. In addition, cryocoolers have tremendous room for development because of their larger use in satellite networks and exploring space. Additionally, the gradual shift toward green and sustainable energy resources has opened up new potential applications of cryocoolers in power generation systems that require efficient cooling technologies for enhanced operational efficiency. These sectors are evolving, namely through innovation in cryogenic systems with new technologies as well as integrated cryocooler technologies enabling higher cryogenic processing capabilities, which will pave the way for new markets.

Challenges:

-

Challenges in Cryocooler Systems Integration Skilled Talent Shortage and Tailored Solutions Slowing Market Growth

The other most important limitation is implementing the cryocoolers with itself systems. In Make Notes Cooling technologies have become so advanced, that they need highly specialized components for systems integration. That often means needing more expertise and increasing development cycles as well as potential compatibility concerns. Additionally, there is a relatively low market of skilled talent for cryocooler systems development and servicing that could dampen the transition of these technologies to its new market sectors. Moreover, the growing need for tailored solutions further complicates matters as it forces manufacturers to spend on specialized R&D and production capabilities, subsequently delaying market penetration in new industries.

Cryocooler Market Segmentation Overview

By Type

The Gifford-McMahon cryocooler type accounted for 30.6% of the cryocooler market in 2023, which can be attributed to its extensive applications in military, aerospace, and healthcare due to its reliable performance, these factors drive the growth of the market. Because of its continuous cooling capability and low temperature in compact systems, it has been a popular choice for high-performance settings.

Stirling cryocoolers are expected to experience the fastest growth in CAGR from 2024 to 2032. It has some advantages over other types of the cycle, including the Stirling cycle due to its higher efficiency, silent operation, and versatility to be applied even for portable systems, as well as using renewable energy. With energy-efficient solutions gaining prominence across industries, the response with miniaturized technologies will feed rapid acceptance of the Stirling cryocooler (featured down picture) particularly into aspirational markets such as medical devices and space exploration, because of its versatility and decreasing cost.

By Heat Exchanger

Due to its high efficiency and effectiveness in maintaining low temperatures, regenerative cryocoolers emerged as the leading type in the global market in 2023, with a share of 56.6%. Continuous cooling is attained in regenerative systems by transferring heat between the refrigerant and the environment using a heat exchanger. This makes it perfect for military, aerospace, and healthcare applications, where reliability and performance matter.

The recuperative cryocooler is expected to experience the fastest growth in CAGR from 2024 to 2032. Recuperative systems that utilize a heat exchanger for higher temperature control and efficiency are more commonly employed in compact and low-maintenance applications. With industries making efforts at embracing energy-efficient and low-cost cooling solutions, recuperative cryocoolers are well placed to gain greater demand shortly, particularly from compact cooling sectors that include renewable energy-related equipment and medical devices, as well as electronics.

By Application

The military & defense sector accounted for the largest share, at 20.5%, of the cryocooler market in 2023. Specifically in the aerospace and defense sector, advancements in cooling systems are required to ensure peak operation for infrared sensors, missile guidance systems, satellite communications, and other critical applications. Cryocoolers are necessary for military equipment to operate and produce reliable performance in extreme military environments to improve the reliability and performance of sensitive components.

Healthcare is expected to grow at the highest CAGR from 2024-2032. This growth is driven by the increasing adoption of cryocoolers in medical devices like MRI machines, cryosurgery equipment, and diagnostic instruments. As medical technology advances, the need for accurate cooling solutions to provide reliable results and improve patient care as well are growing. The increasing demand for compact and energy-efficient cryocoolers in portable medical devices is also significantly contributing to the growth of the healthcare cryocooler market at a global level.

Cryocooler Market Regional Insights

North America was the largest market in 2023, accounting for 36.4%. The region has a leading market in advanced technology sectors such as aerospace, military & defense, and healthcare which is responsible for this. From infrared sensors to missile guidance systems, the U.S. Department of Defense is a substantial cryocooler user. Moreover, U.S. organizations such as Raytheon and Lockheed Martin are largely dependent on cryocoolers for their satellite systems and defense technologies. North America is a major consumer of cryocoolers in the healthcare sector, which is primarily due to the emergence of medical and diagnostic imaging equipment coupled with the rising adoption of advanced cryocooling systems in hospitals and research centers.

Asia Pacific is expected to experience the fastest growth in CAGR from 2024 to 2032. A growing aerospace sector in the region along with the increasing investments in medical technologies will give stronger growth drivers. Meanwhile, cryocooler demand is on the rise, fueled largely by nations such as China and India pouring resources into space exploration and satellite systems. In the healthcare sector, firms like Toshiba and Siemens are developing portable medical devices that need cryocooling. Moreover, the cryocoolers market is anticipated to witness solid growth owing to the continued expansion of various electronics and renewable energy industry verticals in Asia, where most industries tend towards compactness and efficiency of cooling to drive the demand for cryocoolers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Cryocooler Market are:

-

Aerospace Corporation (Microcryocooler)

-

Chart Industries (Microbulk Cryogenic System)

-

Cool Sciences, Inc. (Stirling Cryocooler)

-

Thales Group (Pulse Tube Cryocooler)

-

Lockheed Martin (Vibronic Cryocooler)

-

Sumitomo Heavy Industries (Cryogenic Freezer)

-

Sunpower Inc. (Stirling Engine Cryocooler)

-

Ricor (K508 Cryocooler)

-

Linde Group (Air Separation Unit)

-

Cryomech, Inc. (Helium-Free Cryocooler)

-

Northrop Grumman (Mechanical Cryocooler)

-

Menasco Cryogenics (Cryogenic Cooler)

-

Cambridge Cryogenics (Gas Cycle Cryocooler)

-

Air Products and Chemicals (Cryogenic Air Separation Unit)

-

Ultra Electronics (Pulse Tube Cryocooler)

Recent Trends

-

In January 2024, SHI Cryogenics Group launched the world’s highest-capacity 4K cryocooler, the RJT-100, offering 9.0 W of cooling at 4.2 K. This breakthrough combines Gifford-McMahon and Joule-Thomson technologies, enhancing cooling efficiency for advanced applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.49 Billion |

| Market Size by 2032 | USD 4.52 Billion |

| CAGR | CAGR of 6.92% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Gifford-Mcmahon, Pulse-Tube, Stirling, Brayton, Joule Thomson) • By Heat Exchanger (Regenerative, Recuperative) • By Application (Military & Defense, Healthcare, Power & Energy, Aerospace, Research & Development, Transport, Mining & Metals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aerospace Corporation, Chart Industries, Cool Sciences, Inc., Thales Group, Lockheed Martin, Sumitomo Heavy Industries, Sunpower Inc., Ricor, Linde Group, Cryomech, Inc., Northrop Grumman, Menasco Cryogenics, Cambridge Cryogenics, Air Products and Chemicals, Ultra Electronics. |