ECG Patch and Holter Monitor Market Size

Get More Information on ECG Patch & Holter Monitor Market - Request Sample Report

ECG Patch and Holter Monitor Market Overview

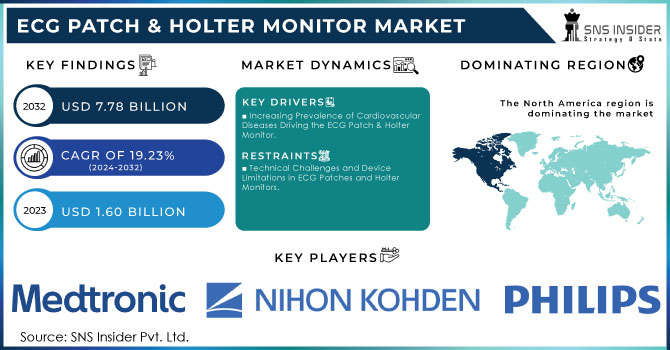

The ECG Patch & Holter Monitor Market size was valued at USD 1.60 Billion in 2023 and is expected to reach USD 7.78 Billion by 2032 and grow at a CAGR of 19.23% over the forecast period 2024-2032.

The ECG patch and holter monitor market is experiencing significant growth due to advancements in wearable technology and increasing demand for continuous cardiac monitoring. These devices are crucial for detecting and managing heart conditions, offering patients and healthcare providers detailed insights into cardiac health. Cardiovascular diseases (CVDs) are the leading cause of death worldwide, making cardiac health a crucial global issue. Every year, around 17.9 million deaths are caused by CVDs, making up 32% of all worldwide fatalities. Around 1.28 billion adults between the ages of 30 and 79 are impacted by hypertension, with almost half of them unaware of their condition, which greatly contributes to this problem. Coronary artery disease (CAD), the most common form of heart disease, affects approximately 18 million individuals worldwide. ECG patches and Holter monitors are both pivotal in the realm of cardiac diagnostics, but they serve slightly different purposes. ECG patches are small, adhesive devices that adhere to the skin and monitor heart rhythms over extended periods. These patches are typically used for short-term monitoring, offering a more comfortable and less obtrusive option for patients.

One notable application of ECG patches and holter monitors is in the management of atrial fibrillation (AFib), a common arrhythmia that can lead to stroke and other complications if left untreated. Globally, about 33 million people suffer from AFib. Approximately 6.1 million adults in the United States suffer from this condition, with approximately 200,000 new cases being reported annually. Around 1.1 million new cases of AF are reported worldwide every year. Atrial fibrillation becomes more common as people get older, impacting around 10% of individuals who are over 80 years of age. About half of patients with AF have high blood pressure as a significant factor, and diabetes impacts around 20-30% of individuals with the condition. These devices enable early detection and continuous monitoring of AFib, providing valuable data that can help guide treatment decisions and improve patient outcomes. By offering a non-invasive, user-friendly option for heart monitoring, these devices are transforming the way cardiovascular health is managed.

ECG Patch and Holter Monitor Market Dynamics

Drivers

-

Increasing Prevalence of Cardiovascular Diseases Driving the ECG Patch & Holter Monitor.

Cardiovascular diseases are a major reason for illness and death globally, and the rising numbers are pushing for better monitoring options. ECG patches and Holter monitors are essential in identifying, diagnosing, and treating these conditions in their early stages. These devices assist in detecting irregularities like arrhythmias and ischemic events that may need medical help by offering consistent and precise heart monitoring. As people get older, they are more susceptible to cardiovascular diseases due to the higher likelihood of developing heart conditions. This change in population characteristics is fueling the increasing need for ECG monitoring tools that offer extended and dependable monitoring of heart health. Furthermore, the presence of risk factors like high blood pressure, diabetes, and obesity, which are linked to heart conditions, also increases the demand for efficient monitoring options. The rising knowledge of cardiovascular health and the significance of early detection is also aiding in the growth of the market. Healthcare providers and patients are increasingly taking a proactive approach in searching for preventive measures and diagnostic tools to address cardiovascular health. The increasing recognition, as well as the necessity for ongoing monitoring, is pushing the use of ECG patches and Holter monitors.

-

Rising Adoption of Remote Patient Monitoring to Improve Care and Cutting Costs.

The use of remote patient monitoring has become popular because it improves patient care and lowers healthcare expenses. ECG patches and Holter monitors play a crucial role in remote patient monitoring by enabling ongoing observation of heart function, eliminating the need for frequent face-to-face appointments. This is especially advantageous for patients with long-term illnesses who need frequent check-ups but favor the ease of telemedicine. Both patients and healthcare systems experience advantages from using RPM. For patients, this translates to increased convenience, less time spent traveling, and improved availability of healthcare. Healthcare providers will experience enhanced patient care, decreased hospital readmissions, and the capacity to efficiently handle more patients. Incorporating ECG monitoring into RPM platforms supports the growing preference for customized healthcare and increases the need for more sophisticated monitoring equipment. Moreover, the COVID-19 crisis has sped up the implementation of remote monitoring tools, with healthcare providers aiming to reduce face-to-face contact and maintain uninterrupted patient care. The move to remote care has had a long-lasting effect on the market, with patients and providers acknowledging the importance of remote monitoring technologies.

Restraints

-

Technical Challenges and Device Limitations in ECG Patches and Holter Monitors.

Technical problems like signal interference, limited battery life, and challenges in maintaining constant skin contact can be encountered by ECG patches and Holter monitors. Interference caused by other electronic devices or environmental factors may impact the precision of ECG results, potentially resulting in diagnostic mistakes. The durability of battery life may be an issue, as long-term use of ECG patches might mean needing to recharge or replace them often. Regular battery upkeep can inconvenience users and affect their adherence to monitoring protocols. Furthermore, user experience and compliance may be impacted by device limitations such as discomfort, skin irritation, or challenges in applying and removing the patches. Making sure devices are comfortable and user-friendly is important for promoting patient compliance and collecting accurate data. Continuing research and development efforts are needed to address these technical challenges and enhance device performance and user experience. Businesses in the industry are focusing on improving sensor technology, extending battery life, and enhancing the design of ECG patches and Holter monitors to address these challenges.

ECG Patch and Holter Monitor Market Segment Analysis

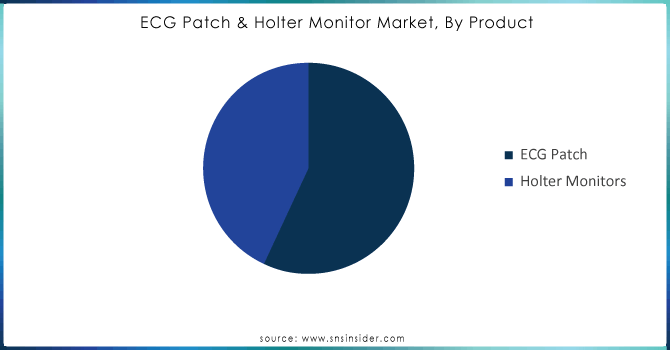

By Product

The ECG patch segment dominated with a market share of 58% in 2023. ECG patches are preferred due to their advanced technology, convenience, and comfort for patients. These patches are commonly placed on the skin to monitor heart activity continuously, providing healthcare providers with real-time information. The increase in chronic heart diseases and the requirement for monitoring patients from a distance have driven the need for ECG patches. For example, iRhythm Technologies provides the Zio Patch, enabling extended monitoring using a subtle, wearable gadget.

The holter monitors segment is rapidly expanding with faster CAGR during 2024-2032, because of their efficiency in detecting arrhythmias and other heart conditions for longer periods. Holter monitors are small gadgets that are worn for a period ranging from 24 to 48 hours and they offer uninterrupted ECG recordings. The rise in heart disease cases and improvements in Holter monitor technology are factors driving this expansion. GE Healthcare provides the MUSE Cardiology Information System which combines Holter monitoring with other diagnostic tools for improved cardiac care.

Need any customization research on ECG patch and holter monitor market - Enquiry Now

By Application

The diagnostics segment led the market with 60.45% market share in 2023. ECG patches are commonly utilized for ongoing monitoring, enabling precise identification of irregular heart rhythms, ischemic episodes, and other cardiac abnormalities. Holter monitors are important for diagnosing conditions that a standard ECG may not catch, as they record heart activity for an extended period, typically 24 to 48 hours. iRhythm Technologies offers the Zio Patch, a wearable ECG patch used for diagnostic purposes, which offers detailed data to accurately diagnose arrhythmias.

The monitoring segment is to experience the most rapid growth rate during 2024-2032 in the ECG Patch and Holter Monitor Market. ECG patches and Holter monitors in this area monitor heart activity in real-time, giving information that can notify healthcare professionals of any unusual changes. This proactive health management approach is growing in popularity for its benefits in early detection and intervention. For example, AliveCor's KardiaMobile provides a portable ECG device that constantly monitors heart health, aiding users in effectively managing their conditions. The rapid expansion of this sector is being fueled by advancements in wearable technology and increased health awareness, driven by the growing emphasis on remote patient monitoring and telemedicine.

By End User

The hospitals & clinics segment captured 49.34% market share in 2023 and dominated the market. This control is due to the elevated occurrence of heart conditions and the modern hospital facilities that enable the utilization of advanced monitoring equipment. Healthcare facilities frequently employ ECG patches and Holter monitors for continuous monitoring, diagnosis, and treatment of heart conditions. For example, Philips offers all-in-one ECG patch solutions for monitoring the hearts of patients in both hospital and non-hospital settings. These institutions' leading market position is driven by their ability to offer immediate medical interventions and their large number of patients.

The ambulatory facilities segment is accounted to grow at a faster CAGR during the forecast period. The rise is fueled by the growing popularity of outpatient treatment and the increasing need for easy, non-intrusive monitoring options. Outpatient clinics and diagnostic centers are more and more using ECG patches and Holter monitors because they are easy to carry and use. AliveCor and iRhythm Technologies both offer portable ECG monitoring devices suitable for use in ambulatory settings, with iRhythm's Zio XT patches being widely used for extended heart rhythm monitoring in outpatient environments.

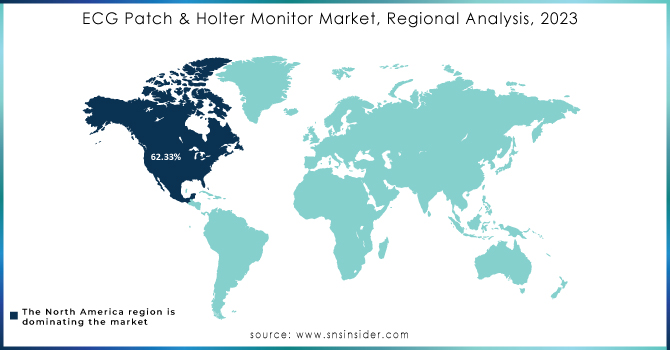

ECG Patch and Holter Monitor Market Regional Overview

North America dominated the ECG Patch and Holter Monitor Market in 2023 with a market share of 62.33%, due to its advanced healthcare system, high occurrence of heart diseases, and significant funding in medical technology. The United States is at the forefront of the market due to the widespread use of cutting-edge ECG and Holter monitoring solutions, driven by advancements in technology and a focus on preventive healthcare. Medtronic's Reveal LINQ and Abbott's Confirm Rx are significant offerings that help maintain the region's market leadership by facilitating effective patient monitoring and data gathering.

Asia Pacific is going to be the fastest-growing segment during the forecast period 2024-2032, due to increasing healthcare investments, growing awareness about cardiovascular diseases, and expanding healthcare infrastructure. Nations such as China and India are driving this growth thanks to their sizable population and rising healthcare spending. Philips Healthcare and GE Healthcare are growing in the region by providing advanced ECG monitoring solutions. The M-ECG from Philips and the MAC 5500 HD from GE Healthcare are designed to meet the increasing need for affordable and accessible cardiac monitoring technologies in the region.

Key Players

The major key players are Nissha Medical Technologies, Medtronic, Nihon Kohden Corporation, Koninklijke Philips N.V., GE Healthcare, Fukuda Denshi Co. Ltd., Spacelabs, AliveCor, Cardiac Insight Inc., iRhythm Technologies, VitalConnect, LifeSignals Inc., Bardy Diagnostics, Nasiff Associates Inc., Midmark Corporation, Lief Therapeutics Inc., Schiller AG, Hill-Rom, and other key players.

Recent Development

-

In April 2023, BioIntelliSense launched BioSticker which is a wearable biosensor that continuously monitors ECG, along with other vital signs such as temperature and respiratory rate. It is designed for both remote patient monitoring and clinical use.

-

In June 2023, The Zio XT by iRhythm Technologies is a continuous ECG monitoring patch that offers extended wear time of up to 14 days. It is designed for diagnosing arrhythmias and other cardiac conditions with minimal patient disruption.

-

In February 2024, Philips launched the Biosensor BX, a wearable Holter monitor that offers extended wear capabilities (up to 30 days). It integrates with the Philips cloud platform for real-time data analysis and physician access.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.60 Billion |

| Market Size by 2032 | USD 7.78 Billion |

| CAGR | CAGR of 19.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (ECG Patch, Holter Monitors) • By Application (Diagnostics, Monitoring) • By End User (Hospitals & Clinics, Ambulatory Facilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nissha Medical Technologies, Medtronic, Nihon Kohden Corporation, Koninklijke Philips N.V., GE Healthcare, Fukuda Denshi Co. Ltd., Spacelabs, AliveCor, Cardiac Insight Inc., iRhythm Technologies, VitalConnect, LifeSignals Inc., Bardy Diagnostics, Nasiff Associates Inc., Midmark Corporation, Lief Therapeutics Inc., Schiller AG, Hill-Rom |

| Key Drivers | • Increasing Prevalence of Cardiovascular Diseases Driving the ECG Patch & Holter Monitor. • Rising Adoption of Remote Patient Monitoring to Improve Care and Cutting Costs. |

| RESTRAINTS | • Technical Challenges and Device Limitations in ECG Patches and Holter Monitors. |