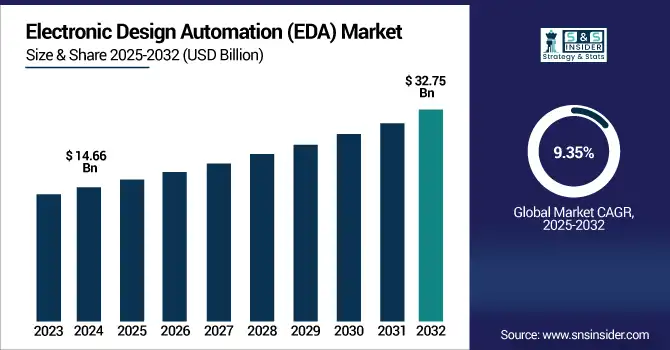

Electronic Design Automation (EDA) Market Size & Growth:

The Electronic Design Automation (EDA) Market Size was valued at USD 14.66 Billion in 2023 and is expected to reach USD 32.75 Billion by 2032 and grow at a CAGR of 9.35% over the forecast period 2024-2032.

The Electronic Design Automation Market has emerged as a cornerstone of innovation in areas such as semiconductors, automotive, and consumer electronics. As the electronic systems become more complex, designing, analyzing, and verifying the integrated circuits and systems have become more indispensable with EDA tools. Governments around the world are enforcing policies to build up the semiconductor industry, thus indirectly driving up the adoption of EDA.

Get more information on Electronic Design Automation (EDA) Market - Request Sample Report

For example, the U.S. CHIPS Act passed in 2023 provides considerable funds for the development of domestic semiconductor manufacturing and thus enhances the use of EDA tools for design optimization. Similarly, the European Union's "Digital Compass" focuses on enhancing the capabilities of chip production by 2030, thereby further driving the demand for EDA solutions. In Asia, China and India are also accelerating investments in the semiconductor ecosystem, which is being supplemented by government incentives and subsidies, creating enormous growth opportunities for EDA providers.

Technological advancement into AI-integrated tools in design and developing a cloud-based solution would entail the market in 2023 and would enable faster and more efficient design processes. Among the notable launches are Synopsys' AI-driven IC Compiler 3 introduced in 2023, which has optimized the design accuracy, improved time-to-market, and Cadence's Allegro X AI of 2024. These also optimize complex chip designs with reduced power consumption. Energy-efficient electronics have been on the higher demand scale, and these seem to be catering to that.

The Electronic Design Automation Market is also shifting toward automation and digital twins, which enables virtual prototyping and testing with minimal physical iterations. This approach greatly reduces development costs and accelerates innovation cycles. In the future, the EDA market offers significant opportunities in HPC systems, autonomous vehicles, and 5G-enabled devices. Industry experts predict robust growth in cloud-based EDA platforms because of their scalability, collaboration features, and cost-efficiency.

Along with increasing complexity and need for innovations across industries, EDA tools will continue to play a role in solving designs. The move for miniaturization, higher performance, and power efficiency drives the Electronic Design Automation Market to participate significantly in setting up the roadmap of the future.

Electronic Design Automation Market Dynamics

Key Drivers:

-

AI and machine learning are revolutionizing the future of electronic design automation through innovation.

AI and machine learning are revolutionizing EDA tools by automating complex repetitive tasks, helping designers gain more accurate designs. As an example, in 2023, for instance, AI-enhanced EDA tools helped reduce time-to-market for chip design compared to the traditional methods. Predictive analytics are also possible with AI-driven solutions that assist designers in identifying probable mistakes before those mistakes are caused.

Governments and industry leaders are increasingly funding the integration of AI in EDA; for example, India's Ministry of Science and Technology has committed $1.2 billion to AI in 2024, which includes funding for EDA tools. This trend underscores the critical role that AI will play in meeting the rising demand for complex chips for applications like autonomous vehicles and IoT devices.

-

Worldwide investments in semiconductor production increase the need for electronic design automation tools.

Globally, governments and private companies are heavily investing in semiconductor manufacturing. EDA tools have become in greater demand because of this investment. The U.S. CHIPS Act invested $52 billion in 2023 to enhance chip production within the country, thus directly increasing the demand for advanced design software.

India also committed $10 billion in incentives for semiconductor fabrication plants in 2024. Such investments ensure healthy adoption of EDA for cutting-edge semiconductor components in areas like 5G, aerospace, and defense. Overall, the world's commitment to enhancing chip manufacturing strengthens the trend of growth for the Electronic Design Automation Market.

Restrain:

-

Expensive EDA tools and their upkeep present obstacles for small businesses and new ventures.

High costs associated with EDA tools and their maintenance serve as a huge barrier to growth in the market. Advanced EDA tools are not feasible for smaller enterprises, due to the considerable up-front costs required. In fact, according to recent industry estimates, the typical yearly licensing cost of a fully comprehensive EDA package was well above $100,000 for the year 2023.

Finally, the need to hire more capable personnel for working with such complex tools drives the cost of doing business, thus making life tougher for any startups and small and medium-sized enterprise seeking to succeed in innovation-led sectors. The government and educational institutions are trying to counter this by providing subsidies and training programs.

Electronic Design Automation (EDA) Market Segmentation Analysis

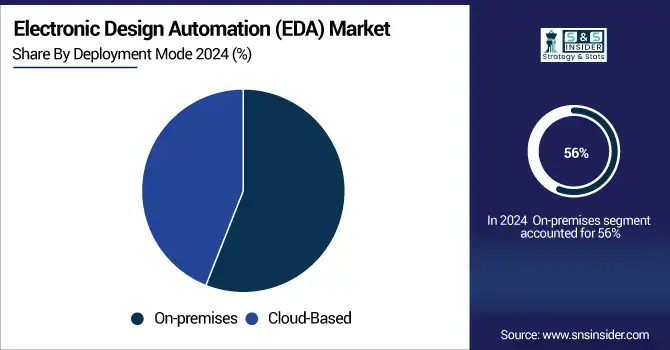

By Deployment Mode

The on-premises segment accounted for 56% of the market share in 2023. This is because the demand for secure and customized solutions is high, especially in industries such as aerospace and defense. On-premises EDA tools give more control over data, which is a requirement for organizations handling sensitive information.

However, the Electronic Design Automation Market is shifting towards cloud-based segment since it is expected to grow at the fastest CAGR of 9.86% during the forecast period from 2024 to 2032. This growth is driven by the increasing need for scalability, cost-efficiency, and remote accessibility. Leading providers such as Siemens and Cadence are launching cloud-native EDA platforms to meet this demand. With maturity in cloud technology, it is expected to penetrate every industry and reshape the EDA landscape.

By Application

Microprocessors & microcontrollers dominated the market in 2023, taking a considerable share of 54%. This can be attributed to the increasing requirement for compact and efficient processors in consumer electronics and automotive applications. The growth of the segment was also boosted by advanced microcontrollers designed for electric vehicles and IoT devices.

On the other hand, the Memory Management Units (MMUs) segment is likely to exhibit the fastest growth at a CAGR of 9.92% in the forecast period from 2024 to 2032. This is primarily due to the increasing requirement for efficient memory allocation in high-performance computing and AI-based applications. With increasing complexities in electronic systems, robust memory management solutions are in a great demand, making MMUs a hot spot for innovation and investment in the EDA market.

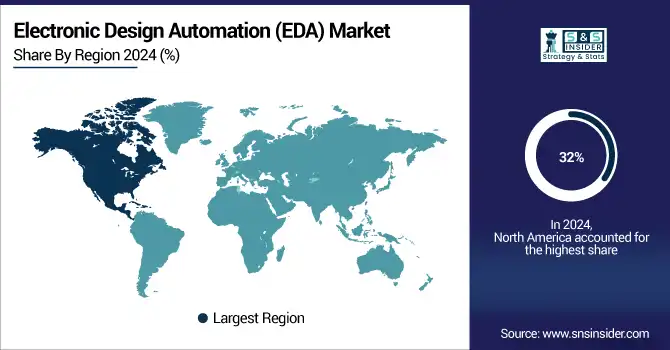

EDA (Electronic Design Automation) Market Regional Outlook

The Electronic Design Automation market is highly regional, with North America the leader of 2023, accounting for a 32% market share. This due to the advanced semiconductor ecosystem being supported by initiatives such as the U.S. CHIPS Act in the region. North America has also been further strengthened by the presence of leading EDA tool providers like Synopsys and Cadence.

On the other hand, the Asia Pacific region is expected to grow at the fastest CAGR of 9.69% from 2024 to 2032, due to huge investments in semiconductor manufacturing in countries like China, Taiwan, and India. Governments offering incentives and increasing demand for recently emergent technologies like 5G and AI in this region is also influencing the market positively. This emphasizes that regional policy influences and trends from the sector form the hub that propels changes across the worldwide EDA marketplace.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Electronic Design Automation Market are

-

Synopsys (Design Compiler, PrimeTime)

-

Cadence Design Systems (Virtuoso, Allegro)

-

Siemens EDA (Calibre, PADS)

-

ANSYS (HFSS, RedHawk)

-

Keysight Technologies (ADS, SystemVue)

-

Zuken (CR-8000, E3.series)

-

Altair Engineering (PollEx, HyperWorks)

-

Autodesk (Fusion 360, Eagle)

-

Altium (Altium Designer, CircuitStudio)

-

Mentor Graphics (ModelSim, Questa)

-

Silvaco (TCAD, SmartSpice)

-

AWR Corporation (Microwave Office, Visual System Simulator)

-

Magma Design Automation (Talc, Blast Fusion)

-

Dassault Systèmes (3DEXPERIENCE, CATIA)

-

National Instruments (Multisim, LabVIEW)

-

ARM Holdings (Physical IP, CoreSight)

-

Rambus (Design IP, Security IP)

-

Xilinx (Vivado, ISE Design Suite)

-

Intel (Quartus Prime, Pathfinder)

-

Broadcom (IP Licensing, ASIC Design Services)

Major Suppliers (Components, Technologies)

-

TSMC (Semiconductors, IC Fabrication Services)

-

GlobalFoundries (Wafer Manufacturing, Semiconductor Components)

-

Samsung Foundry (IC Components, Memory Solutions)

-

UMC (Specialty Wafer Fabrication, Foundry Services)

-

ASML (Lithography Systems, Semiconductor Equipment)

-

Applied Materials (Etching Equipment, Deposition Systems)

-

Lam Research (Plasma Etch Tools, Deposition Systems)

-

KLA Corporation (Yield Management, Inspection Tools)

-

Intel Foundry Services (Chip Manufacturing, Semiconductor IP)

-

Micron Technology (Memory Components, DRAM Solutions)

Major Clients

-

Apple

-

Samsung Electronics

-

NVIDIA

-

AMD

-

Qualcomm

-

Broadcom

-

Texas Instruments

-

Intel

-

TSMC

-

Micron Technology

Recent Trends

-

January 2025: Ansys Inc., and Synopsys Inc. announced that Ansys has entered a definitive agreement regarding the sale of its PowerArtist business to Keysight Technologies, Inc. Keysight Technologies is a leader in electronic, semiconductor and digital solutions. Synopsys Inc. will close acquisition subject to reviews by regulatory agencies and Synopsys' contemplated acquisition of Ansys, as described in previous releases, pending applicable regulatory approvals that are expected in the first half of 2025.

-

June 2024: Tata Electronics said that it had signed a memorandum of understanding with US chip design major Synopsys for collaboration in process technology and foundry design platform at India's first fab facility being built at Dholera.

-

October 2024: Zuken now released E3.series 2025, along with improvements intended to support design of wiring systems. From automatic assignment of area in sheet metal to simplification of part placement, this has more than 50 improvements both in functionality as well as in the COM interface.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.66 Billion |

| Market Size by 2032 | USD 32.75 Billion |

| CAGR | CAGR of 9.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (IC Physical Design & Verification, Semiconductor IP, Computer-Aided Engineering (CAE), PCB & MCM, Services), • By Deployment Mode (Cloud-Based, On-Premises), • By Application (Memory Management Units, Microprocessors & Microcontrollers, Others), • By End User (Consumer Electronics Industry, Automotive, Healthcare) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Synopsys, Cadence Design Systems, Siemens EDA, ANSYS, Keysight Technologies, Zuken, Altair Engineering, Autodesk, Altium, Mentor Graphics, Silvaco, AWR Corporation, Magma Design Automation, Dassault Systèmes, National Instruments, ARM Holdings, Rambus, Xilinx, Intel, Broadcom. |

| Key Drivers | • AI and machine learning are revolutionizing the future of electronic design automation through innovation. • Worldwide investments in semiconductor production increase the need for electronic design automation tools. |

| Restraints | • Expensive EDA tools and their upkeep present obstacles for small businesses and new ventures. |