Printed And Chipless RFID Market Size & Trends:

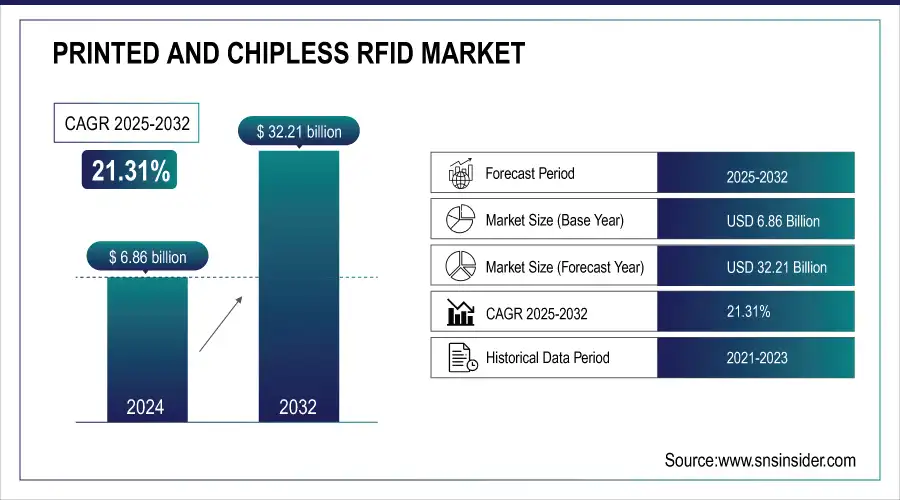

The Printed And Chipless RFID Market Size was valued at USD 6.86 billion in 2024 and is expected to reach USD 32.21 billion by 2032, growing at a CAGR of 21.31% over the forecast period 2025-2032.

To Get more information on Printed And Chipless RFID Market - Request Free Sample Report

Growing adoption of Printed and Chipless RFID across industries and demand for better tracking and inventory management solutions will drive growth across the Printed and Chipless RFID market. Adoption levels are increasing in industries such as retail, logistics, and healthcare, where RFID system increases supply chain visibility and improve operational efficiency.

Market Size and Forecast:

-

Market Size in 2024: USD 6.86 Billion

-

Market Size by 2032: USD 32.21 Billion

-

CAGR: 21.31% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Printed and Chipless RFID Market Trends

-

Rising demand for low-cost chipless RFID solutions to enable affordable high-volume tagging.

-

Growing integration of RFID with smart packaging for real-time tracking and consumer engagement.

-

Advancements in printed electronics are improving the cost-efficiency and scalability of RFID tags.

-

Increasing focus on sustainable and eco-friendly materials to meet green regulations.

-

Expanding adoption in retail and apparel to enhance inventory accuracy and reduce shrinkage.

-

Accelerated use of RFID in healthcare for asset tracking and patient safety compliance.

Printed And Chipless RFID Market Growth Drivers

-

Rising Demand for Cost-Effective High-Performance RFID Solutions Drives Growth Across Multiple Industries

Demand for low-cost high-performance RFID solutions in the industrial sector, including retail, health care, logistics, and other areas, is propelling the Printed and Chipless RFID market. With businesses looking for cost-effective solutions to follow inventory, logistics, and supply chain management, the trend for printed and Chipless RFID has been growing. Lower production costs than standard RFID tags, plus simple integration into existing systems, accelerates its market candidacy even further. In addition, the increasing trend of automation and IoT has fuelled the growth of RFID application segments, especially in industries that are striving to improve operational efficiency and data collection.

Printed And Chipless RFID Market Restraints

-

Challenges in Chipless RFID Include Limited Range Accuracy and Adoption Concerns Over Long-Term Reliability

The main challenge in Chipless RFID is the lower read range and accuracy than traditional RFID. Printed RFID does cost significantly less but suffers from poorer performance, especially in complex environments with high interference which restricts its adoption. Moreover, the technology is still relatively new, and manufacturers may struggle to ramp up production and ensure that it is as reliable and durable as traditional RFID tags. Potential adopters exhibit reluctance over Chipless solutions due to uncertainty about their sustainability and business value in the long term.

Printed And Chipless RFID Market Opportunities

-

Opportunities in Advanced RFID Technology and Untapped Markets Drive Growth in Retail and Logistics

One of the important opportunities in this market is the developmental potential of advanced printed and Chipless RFID technologies with enhanced functionality (e.g., wide read range, higher data security, and better accuracy). Smart packaging that includes RFID for product tracking and authentication skyrocketed in the innovative opportunity. Besides, with fast industrialization and modernization of the retail and logistics industry, there are also huge untapped opportunities for RFID adoption in APAC and Latin America. Such countries are expanding spaces for growth and generating additional revenues, for the RFID industry is eager to address the need for affordable, high-performing RFID solutions.

Printed And Chipless RFID Market Challenges:

-

Competition from UWB and Lack of Standardization Challenge Long-Term Growth of Chipless RFID Market

The competition for the adoption of UWB will be a potential issue too, UWB is just one of the cutting-edge tracking technologies, whether QR code, Bluetooth low energy (BLE) beacon, or GPS-based solutions, many may provide similar or lower cost, or higher preferable performances in select use cases over UWB. In addition, the absence of standardization in chip-less RFID technology adds anxiety which restricts the application of chip-less RFID technology in wide ranges. The end-user will think twice before investing in a solution that may not be viable across systems or for future upgrades. So, conquering these technical and market-related challenges will be vital for the long-term growth and expansion of the Printed and Chipless RFID market.

Printed And Chipless RFID Market Segment Analysis

By Type

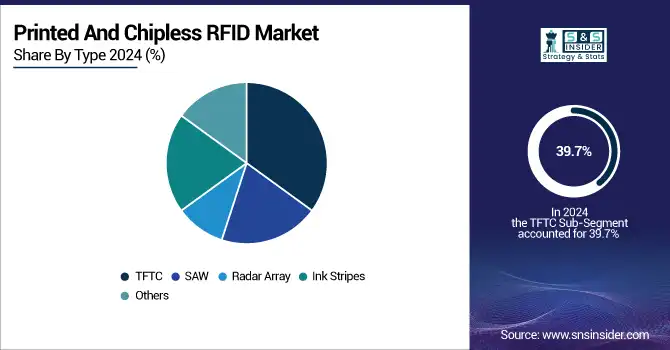

TFTC led the Printed and Chipless RFID market, accounting for a large revenue share of 39.7% in 2023. This is primarily because of its high accuracy and reliability, alongside ease of integration in several applications, be it inventory management, asset tracking, and logistics. TFTC technology strikes a balance between relatively low cost and high performance and is therefore widely considered the best answer for scalable RFID solutions in the industry. Union Equipment Company, the high adoption of these features in the retail, healthcare, and manufacturing sectors.

SAW RFID technology is expected to experience the fastest CAGR from 2024 to 2032. SAW RFID tags are becoming increasingly popular as they offer additional features like increased data storage capacity and reading distance relative to other RFID types. Their well-known reliability and capability of functioning in heat, cold, and other difficult environments make them a more appealing option for aerospace, automotive, and logistics sectors. Evidence of growing market demand for more robust, high-performance RFID solutions will make SAW a primary growth engine in the industry.

By Application

In 2023, the retail sector dominated the market share with 35.5%. The purchasing power behind RFID in retail is a push for better inventory management, supply chain efficiency, and customer experience. Many retailers have started implementing RFID solutions with the intent of automating stocktaking, tracking products efficiently, and reducing losses caused by theft or errors to a great extent. RFID real-time data gives retailers more control over their inventory and ensures that the desired products are available to end users in briefer timeframes. E-commerce growth is driving innovation needs in retail by pushing retailers to adopt systems that facilitate operational streamlining and improve accuracy, therefore increasing the implementation of RFID systems.

The aviation sector is projected to register the fastest CAGR during the forecast period of 2024 to 2032. A need to provide better safety, security, and operational efficiency for the aviation industry is boosting RFID technology adoption. They are now being implemented for asset tracking, baggage handling, maintenance management, and the identification of passengers. The rising emphasis on reducing delays and enhancing service quality at airports will continue to drive the growth of RFID technology in the airport market. Moreover, RFID enables high-accuracy traceability in aircraft maintenance & components, allowing airlines to manage safety and operational downtime through improved visibility and traceability of critical parts. This trend points towards a significant growth path for RFID in the aviation sector.

Printed And Chipless RFID Market Regional Analysis

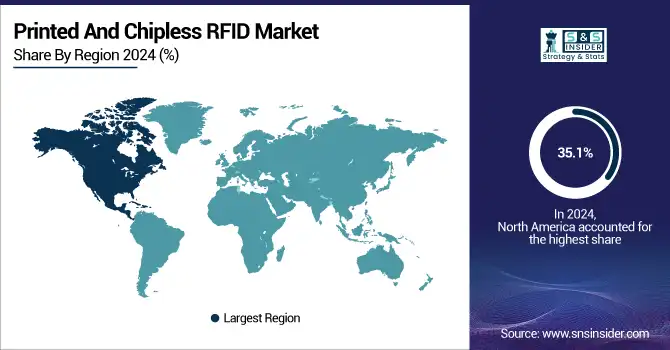

North America Printed and Chipless RFID Market Insights

North America dominated the market share of 35.1% in 2023. This dominance is driven by the presence of highly developed technological infrastructure, early acceptance of RFID technologies, and high demand from various sectors, including retail, healthcare, and logistics, in this region. Walmart is a prime example of such a company, investing heavily in RFID technology to increase the accuracy of its supply chain and inventory turnover. RFID Technologies are used for efficient warehouse automation by companies such as Amazon and they enhance operational efficiency and increase the supply delivery speed. Innovative practices encouraged by the region, along with a high concentration of core technology providers have made North America a hands-down leader in this space.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Printed and Chipless RFID Market Insights

Asia Pacific is anticipated to present the highest CAGR from 2024 to 2032, due to an upsurge in industrialization, technological transformation, and growing utilization of RFID applications in retail, manufacturing, and logistics industries. China and India are also investing a lot in RFID adoption in different sectors. Alibaba and other big ones in China are expediting their RFID use for smart logistics and product inventory in the huge e-commerce league. Japanese airlines including ANA have done so by implementing RFID baggage tracking that improves customer experience and minimizes mishandled bags as well. As the region becomes more urbanized, especially with the growing retail and logistics sectors, it is expected that the RFID market will see good growth in the next few years.

Europe Printed And Chipless RFID Market Insights

The Europe Printed And Chipless RFID Market is witnessing steady growth in 2025, driven by the region’s strong presence in healthcare, logistics, automotive, and electronics industries. Countries such as Germany, France, and the U.K. are leading adopters of RFID-enabled solutions, including digital ID and traceability systems, to ensure high quality, compliance, and operational efficiency. Increasing demand for supply chain transparency, coupled with the expansion of smart manufacturing and e-commerce sectors, is boosting investments in advanced RFID technologies. Furthermore, collaborations between healthcare providers, technology vendors, and research institutions are accelerating the adoption of automated and IoT-integrated RFID solutions across the region.

Latin America (LATAM) Printed And Chipless RFID Market Insights

The LATAM Printed And Chipless RFID Market is gradually expanding in 2025, supported by the region’s growing healthcare and logistics sectors. Countries like Brazil and Mexico are witnessing rising adoption of RFID solutions for medical device traceability, inventory management, and industrial automation. Local service providers are partnering with global technology companies to access advanced RFID tags, digital ID systems, and integration tools. Supportive government initiatives promoting digitalization in supply chains, along with investments in smart logistics infrastructure, are contributing to market growth across the region.

Middle East & Africa (MEA) Printed And Chipless RFID Market Insights

The MEA Printed And Chipless RFID Market is gaining traction in 2025, fueled by industrial diversification and increasing demand for secure, high-quality tracking solutions. Countries including the UAE, Saudi Arabia, and South Africa are deploying RFID-enabled traceability systems in healthcare, logistics, and manufacturing sectors. The establishment of advanced industrial hubs, combined with the drive to comply with international quality standards, is driving investments in state-of-the-art RFID infrastructure. Additionally, the growing presence of global RFID technology providers and partnerships with local firms are improving regional access to digital ID and automated traceability services, further supporting market expansion.

Printed And Chipless RFID Market Competitive Landscape

Avery Dennison

Avery Dennison is a global leader in materials science and digital identification solutions, specializing in labeling, RFID, and packaging innovations. The company serves diverse industries including healthcare, retail, logistics, and manufacturing, enabling enhanced supply chain visibility and product authentication.

-

In January 2025, Avery Dennison, in partnership with Becton Dickinson and Turck Vilant Systems, showcased an RFID-enabled digital ID solution for pre-filled syringe traceability at Pharmapack 2025.

Atlas RFIDstore

Atlas RFIDstore is a prominent provider of RFID hardware, software, and integrated solutions, supporting industries such as logistics, manufacturing, healthcare, and retail. The company focuses on delivering scalable RFID deployments, inventory visibility, and automation technologies to streamline operations.

-

In January 2025, Atlas RFIDstore partnered with Tageos to expand tag availability through a new RFID stocking program, offering over 10 million units.

Key Players

Some of the major players in the Printed And Chipless RFID Market are:

-

Alien Technology (ALN-9740 RFID Tag, Alien Squiggle Tag)

-

Avery Dennison (AD-223r6 RFID Tag, AD-372 UHF RFID Tag)

-

Impinj (Monza R6, Speedway Revolution)

-

NXP Semiconductors (Ucode 8, NTAG 424 DNA)

-

Zebra Technologies (Zebra ZT610, Zebra RFD8500)

-

SMARTRAC (Smart Cosmos, MicroX)

-

Smartrac Technology (Bullseye 2.0, Web UHF)

-

Pragmatic Semiconductor (Pragmatic RFID Tag, QR Code RFID Tag)

-

Stora Enso (ECOSENSE, RFID Paper)

-

Thinfilm Electronics (NFC OpenSense, NFC SpeedTap)

-

Tageos (RFID tags, OEM solutions)

-

KSW Microtec (UHF RFID tags, MICA)

-

SATO Holdings (CL4NX Plus, WS4)

-

Mühlbauer Group (MBCS, Chip Embedding)

-

Technovaa (Printed RFID Labels, UHF Inlays)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 6.86 Billion |

| Market Size by 2032 | USD 32.21 Billion |

| CAGR | CAGR of 21.31% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Ink Stripes, Radar Array, TFTC, SAW, Others) • By Application (Retail, Transport & logistics, Aviation, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Alien Technology, Avery Dennison, Impinj, NXP Semiconductors, Zebra Technologies, SMARTRAC, Smartrac Technology, Pragmatic Semiconductor, Stora Enso, Thinfilm Electronics, Tageos, KSW Microtec, SATO Holdings, Mühlbauer Group, Technovaa. |