Energy as a Service Market Report Scope & Overview:

Get More Information on Energy as a Service Market - Request Sample Report

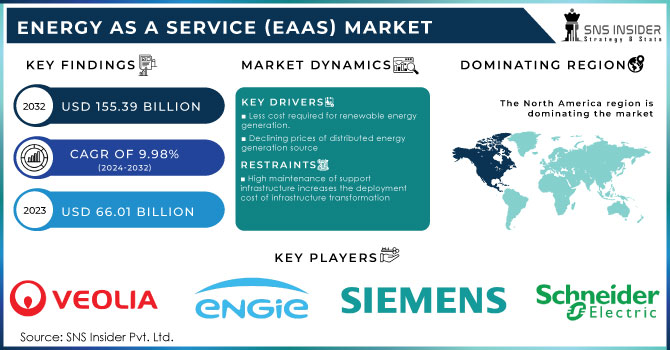

The Energy as a Service (EaaS) Market size was valued at 66.01 USD billion in 2023 and is expected to grow to 155.39 USD billion by 2032 and grow at a CAGR of 9.98% over the forecast period of 2024-2032.

Energy as a service (EaaS) is a type of service provider that offers customers to access energy and management services without any associated upfront costs through a contract with the organization. As a Software as a Service model, the consumer only pays for ongoing services without adding equipment and infrastructure charges. According to the customer’s requirement, these services are specifically customized, whether to reduce energy usage, be more sustainable or improve their bottom line.

Using EaaS it helps to reduce the burden of capital and performance on the client and also practices the sustainability. Energy as a service provides various types of services which include Energy Supply Services, Operational and Maintenance Services, Energy Efficiency and Optimization Services, and Others. Energy as a service is a form of renewable energy. This type of service is environment-friendly, and energy-efficient, and incurred a lower cost.

The main advantage of this service is the flexibility of choice regarding ownership and pricing according to the customer’s needs. According to the different power requirements of the customers, operators can customize the energy generation.

Modern energy as a service is important for the well-being of humans as well as the economic development of the country. Access to modern energy is essential for the provision of clean water, sanitation, and healthcare and for the provision of reliable and efficient heating, cooking, food, transport, lighting, and telecommunication services

Market Dynamics

Drivers

-

Less cost required for renewable energy generation.

-

Increasing utilization of energy across the globe

-

Declining prices of distributed energy generation source

-

Increasing demand for reducing energy costs from consumers

-

Rise in smart grid installation

Restrain

-

High maintenance of support infrastructure increases the deployment cost of infrastructure transformation

-

High capital investment

The energy as a service model is based on real-time information and analysis of data about the consumption of energy by the consumer as well as electricity market conditions which require high maintenance of support infrastructure which increases the cost of deployment of infrastructure transformation which increases the investment with hindering the market growth during the forecast period.

Opportunities

-

Increasing government investments in providing renewable sources

-

Growing government initiatives to curb carbon footprint management

-

Increasing utilization of energy-efficient technologies

-

Adoption of EaaS model over traditional model by key players

Challenges

-

Uncertainty about agreement structure.

Impact of COVID-19

The COVID-19 pandemic had a severe negative impact on the energy as a service market. The industries which were totally dependent on renewable energy sources for their operation were shut down completely or forced to function partially which causes decreases sales and revenue of their market. Because of this, there was a decline in the growth of energy as a service market by reducing the demand for renewable energy. In the post-COVID era, the energy-as-a-service model grow in importance to be a part of the smart energy community of its ability to reduce energy costs.

The energy investments in the initial stages of the pandemic have reduced significantly. Companies were already struggling to keep up with fixed costs and trying to survive the impact of COVID-19, any commitment to such huge capital investment is either put off, canceled, or delayed. Thus, the impact on the EaaS market was high in 2020. However, in 2021, annual global energy investment is set to rise bringing the total volume of investment back to pre-crisis levels.

Impact of Russia-Ukraine War:

The war between Russia and Ukraine in 2022 had a devastating impact on Ukraine's energy sector. The Russian attack caused a collapse in the industry, leading to a ripple effect that has been felt across the globe. The consequences of this conflict have been far-reaching, causing price volatility, supply shortages, security issues, and economic uncertainty. The International Energy Agency (IEA) has described this as the first truly global energy crisis, with impacts that will be felt for years to come. The effects of energy supply disruptions are cascading across everything from food prices to electricity to consumer sentiment.

Immediately following the invasion, energy prices skyrocketed worldwide, with a 20% increase for five months straight from February 28th to August 3rd. The surge in energy costs induced by the war in Ukraine is significantly hitting European firms' profits, increasing business risk, and even jeopardizing entire production sectors. This has put these firms at a competitive disadvantage compared to countries with lower energy costs. All these factors impacted the energy as a service market negatively.

Market segmentation

By Service Type

-

Energy Supply Services

-

Operational and Maintenance Services

-

Energy Efficiency and Optimization Services

-

Others

By End Users

-

Commercial

-

Industrial

Regional Analysis

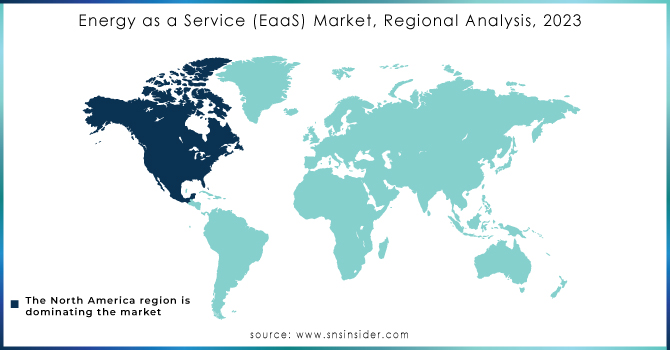

By region, The North America region dominated the market with the largest market share in 2022 and is estimated to show lucrative growth in the future. The rising demand for renewable energy increases the use of energy as a service in this region which propel the market significantly. Increasing demand from smart building vendors to cut down the cost of electricity generation and increase customer satisfaction, energy as a service is used. The government of this region is also investing in the consumption-based energy model which further drives the market.

The electrical transmission infrastructure of this region is unprepared for modern threats and natural hazards. But, EaaS would provide flexibility to use electricity without affecting modern threats and natural hazards. In this region, there is also rapid implementation of the distributed energy system which propels the market significantly.

Asia Pacific is expected to show significant growth with the largest growth rate during the forecast period. Nowadays due to the increasing deterioration of environmental conditions shifting the concentration of people towards using renewable energy. The presence of key players and a large customer base in this region would help to drive the market in the future.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are Schneider Electric, Siemens, Engie, Honeywell International Inc., Veolia, EDF, Johnson Controls, Bernhard, General Electric, Entegrity, Enel SpA, Ørsted A/S, NORESCO, LLC, Centrica plc, Wendel and other key players will be included in the final report.

Competitive Analysis:

-

Schneider Electric, a global leader in energy management and automation, has recently launched the EVlink Home Charger, a revolutionary product that makes at-home charging easier and more cost-effective. This new design incorporates anti-tripping functionality through its optional peak controller, allowing homeowners to run multiple devices on their home power system while charging their car simultaneously without any power supply failure.

Schneider Electric's EVlink range has recently welcomed the latest addition to its family - the charger. This launch couldn't have come at a better time, as the electric vehicle market has witnessed a remarkable surge in sales. In fact, 2022 has seen a 67% increase in electric vehicle sales compared to 2021, as Australian homeowners switch to electric vehicles to reduce carbon emissions.

| Report Attributes | Details |

| Market Size in 2023 | US$ 66.01 Bn |

| Market Size by 2032 | US$ 155.39 Bn |

| CAGR | CAGR of 9.98% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Energy Supply Services, Operational and Maintenance Services, Energy Efficiency and Optimization Services, and Others) • By End User (Commercial, Industrial) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schneider Electric; Siemens; Engie; Honeywell International Inc.; Veolia; EDF; Johnson Controls; Bernhard; General Electric; Entegrity; Enel SpA; Ørsted A/S; NORESCO, LLC; Centrica plc; Wendel |

| Key Drivers | • Less cost required for renewable power generation. • Increasing utilization of energy across the globe |

| Market Opportunities | • Increasing government investments in providing renewable sources • Growing government initiatives to curb carbon footprint |