Mobility as a Service Market Report Scope & Overview

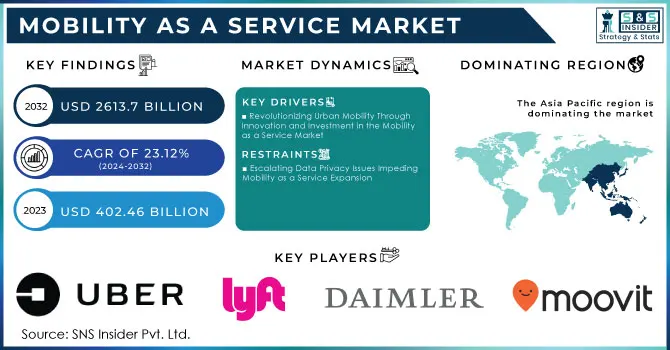

The Mobility as a Service Market Size was valued at USD 402.46 billion in 2023 and is expected to grow to USD 2613.7 billion by 2032 and grow at a CAGR of 23.12 % over the forecast period of 2024-2032. The MaaS Market is poised for remarkable growth, driven by urbanization, technological advancements, and a pressing need for sustainable transportation solutions. As global populations migrate to urban areas, the demand for integrated transportation systems that can alleviate traffic congestion and reduce carbon emissions has never been greater. According to projections, the Mobility as a Service market is expected to expand significantly, with the Asia Pacific region leading this surge due to its rapid urbanization and smart city initiatives. This region’s growing reliance on public transport, exemplified by cities like Hong Kong and Singapore, highlights the vital role of MaaS in shaping modern urban mobility. Public transportation serves as a crucial economic catalyst, enhancing the efficiency and accessibility of urban areas.

Get More Information on Mobility as a Service Market - Request Sample Report

Additionally, the increasing adoption of innovative technologies, such as real-time data analytics and mobile applications, facilitates seamless connections between various transport modes, including ride-hailing, bike-sharing, and public transit, making commuting more convenient and efficient. A study in Transportation Research revealed that increasing shared mobility services by 20% could reduce urban traffic congestion by 10%, further emphasizing the importance of Mobility as a Service. Furthermore, the growing focus on sustainability is driving the incorporation of electric vehicles (EVs) within Mobility as a Service frameworks, with e-Mobility services expected to surge by 25% in the next five years. Major players in the Mobility as a Service Market are actively developing comprehensive platforms to meet consumer demands for convenience, reliability, and sustainability. For instance, recent developments, such as ambitious ‘robotaxi’ service, illustrate the potential of autonomous vehicles to revolutionize urban transportation in the U.S. Moreover, investments in infrastructure, such as dedicated bus lanes and electric vehicle charging stations, are crucial to supporting the growth of Mobility as a Service. As cities strive to meet decarbonization goals, partnerships among key stakeholders, including public transportation authorities and private mobility providers, are essential to optimize Mobility as a Service offerings. Ultimately, the Mobility as a Service market stands at the forefront of transforming urban mobility, offering innovative solutions to enhance the commuting experience while addressing environmental challenges.

Mobility as a Service Market Dynamics

Drivers

-

Revolutionizing Urban Mobility Through Innovation and Investment in the Mobility as a Service Market

One of the major drivers for the Mobility as a Service (MaaS) market is the surge in innovative transport solutions aiming for more sustainable and efficient urban mobility, fueled by technological advancements and substantial funding. Companies like Eve, with the largest industry backlog of 2,900 electric Vertical Take-off and Landing (eVTOL) aircraft, anticipate around USD 14.5 billion in sales revenue. These eVTOLs, designed with eight dedicated propellers and dual electric motors, demonstrate enhanced performance, safety, and cost-effectiveness, which are essential for Mobility as a Service growth. Eve’s partnership with Embraer allows it to leverage Embraer’s extensive 55-year experience in aircraft design and certification, further underscoring reliability in urban air mobility (UAM) services—a vital component within Mobility as a Service solutions that align with urban decongestion goals. In addition, Ford’s innovative Hackney taxis offer another sustainable Mobility as a Service element, as the iconic taxi’s global perspective reveals a shift toward cleaner, more efficient city transport. Meanwhile, inDrive's expansion into Zambia illustrates the strong demand for Mobility as a Service offerings in emerging markets, while Joby Aviation’s recent USD 202 million fundraising signifies rising investor confidence in the future of urban air travel, another cornerstone of the Mobility as a Service ecosystem. Support for public transport also remains critical, with studies showing that 60% of Canadians still view it as the most reliable mode for urban commuting, highlighting a continued focus on integrating MaaS with traditional transit systems to streamline passenger experiences. Furthermore, the Plano Mais Produção financing initiative in Brazil promotes national innovation and job creation in mobility and decarbonization, underscoring the drive for localized MaaS solutions that create employment while reducing environmental impact. These trends demonstrate the sustained growth potential in Mobility as a Service, supported by innovative technologies, extensive supplier networks, and broad-based public and private sector investments globally.

Restraints

-

Escalating Data Privacy Issues Impeding Mobility as a Service Expansion

The Mobility as a Service (MaaS) market faces significant restraints stemming from data privacy concerns that impact user trust and regulatory compliance. As MaaS platforms heavily rely on collecting personal data to offer tailored transportation solutions, issues related to data security become increasingly pronounced. Organizations are shifting toward on-premises IT infrastructure due to heightened security concerns and the need for greater control over their data. This trend reflects a growing apprehension among consumers regarding how their information is managed, particularly in light of controversies like the Better Help situation, which highlighted severe data privacy issues and lackluster service quality. 90% of consumers believe that companies should be more forthcoming about their data collection practices, showcasing the demand for transparency in data usage. Additionally, the increasing focus on data privacy is further supported by studies revealing that 70% of consumers are concerned about how their personal information is handled. As companies navigate the complex regulatory landscape, including regulations like GDPR in Europe and CCPA in California, compliance becomes a costly challenge, especially for smaller players in the Mobility as a Service ecosystem. These regulations can limit the extent to which data can be used for personalization, hampering the ability to innovate and optimize service offerings. 60% of organizations have experienced data breaches, emphasizing the critical nature of data protection in gaining user trust. In summary, data privacy concerns and the consequent regulatory landscape pose a significant restraint on the MaaS market, underscoring the need for robust security measures, transparent practices, and a careful balance between user experience and privacy protection.

Mobility as a Service Market Segment Overview

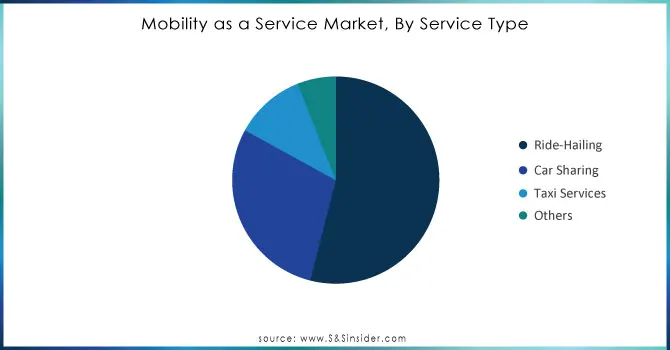

By Service Type

In 2023, the Ride-Hailing segment became the leading player in the Mobility as a Service (MaaS) market, accounting for approximately 54% of total revenue. This dominance stems from various key factors. Firstly, the demand for convenience has surged, as on-demand transportation allows users to access rides effortlessly through mobile apps, aligning with today’s fast-paced lifestyles. Secondly, advancements in technology, including mobile applications, GPS, and real-time data analytics, have greatly enhanced the ride-hailing experience, introducing features like dynamic pricing and route optimization that boost user satisfaction. Urbanization and traffic congestion have also contributed, with ride-hailing services providing a flexible alternative to car ownership, thus reducing road congestion and appealing to urban commuters. Major players, such as Uber and Lyft, are diversifying their services to include shared rides and electric vehicle options, catering to evolving consumer preferences for sustainability. Additionally, global expansion strategies have helped leading companies like Grab launch premium services like GrabCar Plus, meeting the demand for higher-quality rides. Strategic partnerships, such as Waymo’s collaboration with Uber to integrate autonomous vehicle technology, further enhance service offerings. Collectively, these factors ensure the continued growth and relevance of the Ride-Hailing segment in the MaaS landscape.

Need Any Customization Research On Mobility as a Service Market - Inquiry Now

By Application

In 2023, the Android platform emerged as the leading application segment in the Mobility as a Service (MaaS) market, capturing approximately 53% of the total share.

This dominance is largely due to the widespread adoption of Android devices, which constitute over 70% of the global smartphone market, making it easier for users to access a variety of mobility services such as ride-hailing, bike-sharing, and public transportation. Major companies like Uber and Lyft have made significant investments in enhancing their Android apps with features such as real-time ride tracking, in-app payments, and personalized ride recommendations, ultimately improving user satisfaction. Furthermore, the integration of services within Android applications has been pivotal, with companies like Google incorporating Google Maps for real-time navigation and transit options, positioning Android as a central hub for urban mobility. Additionally, as electric vehicles and sustainable transport options gain popularity, apps like Bird and Lime have adapted to include e-scooter rentals.

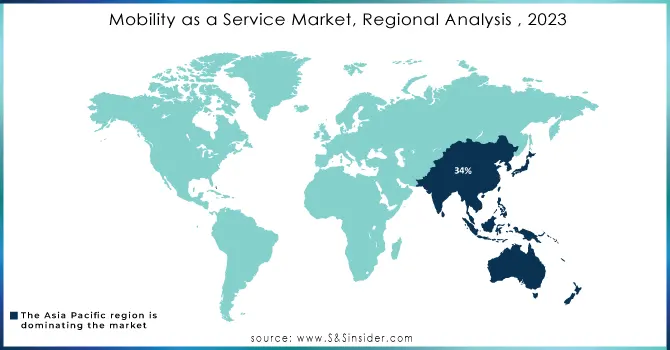

Mobility as a Service Market Regional Analysis

In 2023, the Asia-Pacific region emerged as the leader in the Mobility as a Service (MaaS) market, capturing around 34% of total revenue. This dominance is driven by rapid urbanization, significant technological advancements, and a commitment to sustainable transportation solutions. As urban populations grow, countries like China and India are investing in extensive infrastructure projects, including smart city initiatives that integrate various transport services into cohesive platforms, thereby enhancing connectivity for residents. Key players such as Grab have expanded their services beyond ride-hailing to include options like GrabBike and GrabMart, addressing diverse consumer needs and solidifying their market presence. In Japan, companies like LINE are also creating comprehensive Mobility as a Service platforms that encompass ride-hailing, public transit, and bike-sharing, offering seamless mobility solutions. Additionally, supportive government policies in countries like Japan and South Korea are fostering MaaS development, with initiatives promoting autonomous vehicles and integrated transport systems. Advanced technologies, including mobile applications and real-time data analytics, are further propelling the market by improving user experiences through features like dynamic pricing and multi-modal journey planning.

In 2023, North America distinguished itself as the fastest-growing region in the Mobility as a Service (MaaS) market, propelled by technological advancements, rising consumer demand for convenience, and a strong focus on sustainable transport solutions. The region boasts a robust digital infrastructure, characterized by high smartphone penetration and advanced internet connectivity, enabling the swift adoption of Mobility as a Service applications that provide access to various mobility services, such as ride-hailing, bike-sharing, and public transit. North American firms are leading the integration of cutting-edge technologies into Mobility as a Service solutions. Major players like Uber and Lyft have enhanced their platforms with features like real-time tracking, dynamic pricing, and seamless payment options. Moreover, the emergence of autonomous vehicles, with companies like Waymo at the forefront, is opening new possibilities for urban transportation. Supportive government policies in the U.S. and Canada foster Mobility as a Service initiatives, with local governments investing in smart city projects aimed at integrating transport solutions to alleviate congestion and reduce carbon emissions. As consumer preferences shift towards flexible, on-demand mobility options-particularly among younger generations-Mobility as a Service providers are adapting by introducing subscription models and multi-modal transport choices.

Key Players in Mobility as a Service Market

Some of the key players in Mobility as a Service with their product:

-

Uber (Ride-Hailing Platform)

-

Lyft (Ride-Hailing Service)

-

Daimler AG (Car2Go - Car Sharing Service)

-

BMW Group (ReachNow - Car Sharing and Mobility Services)

-

Ford Motor Company (FordPass - Mobility Solutions and App)

-

Grab (Ride-Hailing and Food Delivery Services)

-

Ola (Ride-Hailing and Shared Mobility)

-

Moovit (Public Transit App and MaaS Platform)

-

Citymapper (Journey Planning App)

-

TransLoc (Transit Scheduling and MaaS Solutions)

-

Transit (Transit App for Public Transportation)

-

Trafi (MaaS Solutions and Journey Planner)

-

Masabi (Ticketing-as-a-Service for Transit)

-

Keolis (Mobility Solutions and Public Transport Services)

-

SBB (Swiss Federal Railways) (Mobility-as-a-Service App for Public Transport)

-

FlixMobility (FlixBus - Intercity Bus Service)

-

BlaBlaCar (Carpooling Platform)

-

Via (On-Demand Transit Solutions)

-

ParkMobile (Parking Management and Reservation App)

-

Zūm (School Transportation and Ride Services)

List of companies that could be potential customers in the Mobility as a Service (MaaS) Market:

-

Amazon

-

Google

-

Apple

-

DHL

-

FedEx

-

Walmart

-

Airbnb

-

Siemens

-

Coca-Cola

-

Nestlé

Recent Development

-

In January 2024, May Mobility, an autonomous vehicle startup, launched a fully driverless transportation service in Arizona, providing residents with autonomous rides without a safety driver. This initiative highlights significant advancements in autonomous technology within the mobility sector.

-

March 2024: Asia Mobility Technologies launched the Trek app, the region's first multimodal mobility-as-a-service (MaaS) solution, which integrates journey planning and ticketing for the existing Trek Rides’ Demand-Responsive Transit (DRT) service alongside public transport, park & ride, and active transport options in Greater Kuala Lumpur.

-

February 2024: Smart mobility provider ACO Tech signed a Memorandum of Collaboration (MoC) with Geno and the Malaysia Automotive, Robotics & IoT Institute (MARii) to explore blockchain solutions for Malaysia’s electric vehicle (EV) infrastructure. This partnership will leverage smart contracts, digital traceability for supply chain management, tokenomics solutions, and privacy protection technologies to enhance ACO Tech’s E-Mobility Service Platform (EMSP) and establish a national EV-ready infrastructure through mobility as a service (MaaS) and blockchain as a service (BaaS).

-

January 2024: Bounce Infinity, an electric scooter manufacturer, teamed up with energy infrastructure provider SUN Mobility to roll out over 30,000 Bounce Infinity Scooters across key markets in India, starting with Bangalore and Hyderabad and expanding to Mumbai, Pune, and Delhi NCR in phases beginning in February. These scooters will be deployed under both Battery-as-a-Service (BaaS) and Mobility-as-a-Service (MaaS) models.

-

January 2024: GreenCell Mobility partnered with the Director of Urban Mobility to advance Electric Mobility-as-a-Service (eMaaS) by deploying 150 intra-city electric buses in Ayodhya, promoting sustainable and eco-friendly transportation.

-

January 2024: Athens announced a multimodal mobility-as-a-service pilot in collaboration with Transport for Athens (OASA), which operates metro, tram, trolleybus, and bus services in the city. The initiative includes upgrading the automated fare collection system to enable boarding with bank cards and mobile devices, supporting MaaS features that integrate with mobility partners, such as taxis, e-bike rentals, airlines, and ferry companies, according to Transport for Athens.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 402.46 Billion |

| Market Size by 2032 | USD 2613.7 Billion |

| CAGR | CAGR of 23.12% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Ride-Hailing, Car Sharing, Taxi Services, Others) • By Application Type (iOS, Android, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Uber, Lyft, Daimler AG, BMW Group, Ford Motor Company, Grab, Ola, Moovit, Citymapper, TransLoc, Transit, Trafi, Masabi, Keolis, SBB, FlixMobility, BlaBlaCar, Via, ParkMobile, and Zūm. |

| Key Drivers | • Revolutionizing Urban Mobility Through Innovation and Investment in the MaaS Market |

| RESTRAINTS | • Escalating Data Privacy Issues Impeding Mobility as a Service Expansion |