Offshore Lubricants Market Key Insights:

Get More Information on Offshore Lubricants Market - Request Sample Report

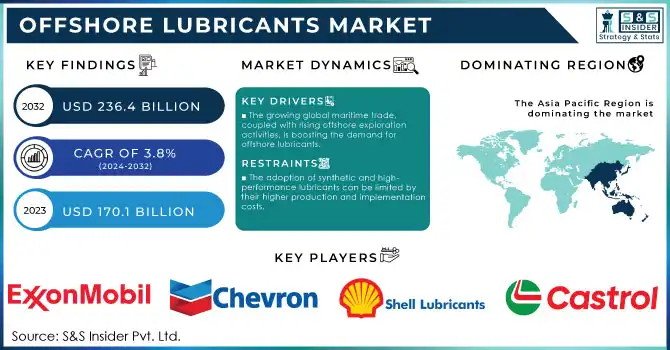

The Offshore Lubricants Market Size was valued at USD 170.1 Billion in 2023 and will reach USD 236.4 billion by 2032, growing at a CAGR of 3.8% over the forecast period of 2024-2032.

Growth of the offshore lubricants market is primarily attributed to increased energy exploration and production activities in offshore environments, complemented by rapid growth of oil and gas operations in deepwater and ultra-deepwater areas. As per the global offshore production forecast by the International Energy Agency (IEA), global offshore oil production will grow significant growth rate, providing a substantial opportunity for high-performance lubricants in various offshore applications. The global energy shift toward offshore sources has led governments and regulatory bodies worldwide to focus on sustainable offshore energy production. For instance, the U.S. Energy Information Administration (EIA) reported in 2023 that U.S. offshore oil production accounted for 16% of the total domestic oil output, with the Gulf of Mexico being a critical area for offshore production. Consequently, there has been an increase in the need for the development and use of lubricants that are not only able to survive extreme conditions found offshore, e.g., high temperature, high-pressure, and salinity, and also guarantee the fluctuation-free operation of devices employed in offshore oil rigs, support vessels, and subsea machines. In addition, restrictions imposed by several government-aided programs such as the Green Deal by the European Union and regulations imposed by the U.S. Bureau of Safety and Environmental Enforcement (BSEE), have focused on enhancing operational efficiency and reducing impact on the environment, thereby indirectly subjecting utilization of targeted type of lubricants in offshore energy production.

Increasing offshore oil and gas exploration, especially in offshore regions like the Gulf of Mexico, Arabian Sea, Caspian, and Red Sea, is expected to drive the offshore lubricants market. One significant factor is that there is an increasing demand for lubricants to minimize costs and increase the fitness of the tool. Moreover, increased demand from shipping & offshore sectors for environment-friendly lubricants also propelled demand for the market. To produce sustainable and non-toxic products, manufacturers are putting their focus on bio-based raw materials to manufacture bio-lubricants containing non-toxic and non-volatile compounds, and gases as well. In addition, growth in industrial need for bio-based and energy-efficient lubricants especially in developed economies is projected to boost the growth of the market.

Offshore Lubricants Market Dynamics

Drivers

-

The growing global maritime trade, coupled with rising offshore exploration activities, is boosting the demand for offshore lubricants.

-

The development of synthetic and biodegradable lubricants that can withstand extreme offshore conditions is driving market growth.

-

Stronger environmental regulations promoting eco-friendly lubricants, such as bio-based oils, are pushing the market toward sustainable solutions.

The Offshore Lubricants Market is experiencing growth due to increasing maritime traffic which is one of the significant factors driving the demand for offshore lubricants. With world trade growing, the demand for safe and efficient lubrication solutions on marine ships and offshore has also increased. In 2023, global maritime trade volumes were estimated to have grown by approximately 4.3%, with the International Maritime Organization (IMO) projecting continued growth in shipping traffic through 2024. This surge is attributed to several factors, including the world recovering from the coronavirus pandemic and higher consumer demand. Consequently, as shipping traffic increases, so does the demand for marine lubricants, particularly for offshore operations like deep-water drilling and wind energy platforms.

For example, offshore rigs require lubricants that can withstand extreme temperatures, pressure, and saline environments. With increasing marine activities, such as oil and gas exploration and the development of renewable energy projects like offshore wind farms, the demand for high-performance lubricants is further intensified. Moreover, as shipping activities continue to surge, the demand for bio-based lubricants is further propelled by escalating maritime environmental regulations that require the use of eco-friendly lubricants. The transition to bio-based lubricants and synthetic oils helps reduce the environmental impact, providing an added incentive for the industry to adopt advanced lubricant solutions.

Restraints:

-

Despite the demand for greener products, the disposal and management of offshore lubricants under strict environmental regulations can hinder market growth.

-

The adoption of synthetic and high-performance lubricants can be limited by their higher production and implementation costs.

High cost of advanced lubricants as a significant restraint in the offshore lubricants market. Synthetic and particularly high-performance lubricants require complex manufacturing processes to withstand the harsh environment in offshore locations. These lubricants usually necessitate costly raw materials and advanced technology, resulting in higher costs compared to conventional alternatives. The production cost is also further hiked due to the product formulation of eco-friendly lubricants and biodegradable formulations, as a result of strict market regulations. For many companies especially smaller companies and those in cost-sensitive industries, this price premium represents a large barrier, as it impedes their ability to make the initial investment and the ongoing purchasing expense. This can be especially detrimental in offshore environments such as oil and gas, where the pressure on operational budgets is to keep things efficient and cost-effective.

Offshore Lubricants Market Segment Analysis

By Application

The engine oil segment held a 71% share of the global offshore lubricants market revenue in 2023. Engine oils are essential for offshore vessels, machinery, and equipment to provide smooth engine running, improve fuel economy, and reduce wear and abrasion under severe marine conditions. The superiority of engine oil is credited to its vast application in offshore operations ranging from offshore drilling rigs, support vessels, and marine transport. In addition, there is rising use of high-performance engine oils due to stringent government regulations and updated lubricant formulations. Continued growth in offshore exploration and production activity, especially in high-demand areas like the North Sea, the Gulf of Mexico, and offshore fields in Brazil, is aiding the steady growth of the engine oil market.

On the other hand, the fastest growth over the forecast period is expected to be witnessed in the gear oil segment. Gear oils are critical in offshore drilling, vessels, and subsea operations with high torque and heavy loads requiring lubrication. Gear oil consumption is likely to rise due to increasing demand for offshore support vessels (OSVs) and the growing exploration of deepwater reserves. Gear oils is one of the fastest growing segments driven by the increasing complexity of offshore equipment, and the requirement for specialized lubricants that can withstand extreme conditions such as high loads and thermal stresses. Also, government regulations focusing on the stability and sustainability of offshore operations have further driven the demand for effective and strong gear oils operating in extreme settings. As the offshore sector expands, the demand for gear oils, especially those that offer superior protection against wear, corrosion, and heat, is set to rise significantly.

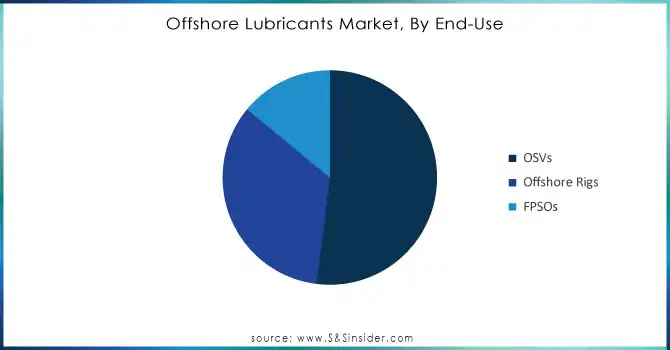

By End Use

The offshore lubricants market was led by the Offshore Support Vessels (OSVs) segment which accounted for 52% of the market share in 2023. Offshore support vessels play a key role in offshore oil and gas Exploration and Production (EP) activities due to their role in transporting and supplying different types of support vessels for crew logistics jobs. With the increase in offshore projects especially in oil-rich regions such as the North Sea and offshore fields in the Middle East, the number of OSV is rapidly increasing leading to the increasing demand for lubricants used in these vessels. The worldwide fleet of offshore support vessels (OSV) has appeared to grow continuously in response to rising offshore energy production demands, as detailed by the U.S. Maritime Administration (MARAD), and can potentially be heavily reliant on lubricants for the efficient functioning of these numerous marine engines through various applications to reduce wear and tear, decrease frictions thereby improving and increasing outputs. With the increasing severity of offshore oil and gas activities, high-performance lubricants are imperative for OSVs, which has contributed to the growth of the lubricants market in this end-use segment.

OSVs (Offshore Support Vessels) made up the vast majority of offshore lubricants demand in 2023 and will continue to lead in demand as offshore exploration and production increases around the world. More stringent environmental requirements like the IMO 2020 sulfur cap have led to a growing demand for high-performance and low-emission OSV lubricants. Such regulations are fuelling the production of ultra-modern lubricants that ensure not only lengthy functionality for the engines but also offer better fuel economy with adherence to global emissions standards furthering demand for specialty offshore lubricants in OSVs.

Need Any Customization Research On Offshore Lubricants Market - Inquiry Now

Offshore Lubricants Market Regional Overview

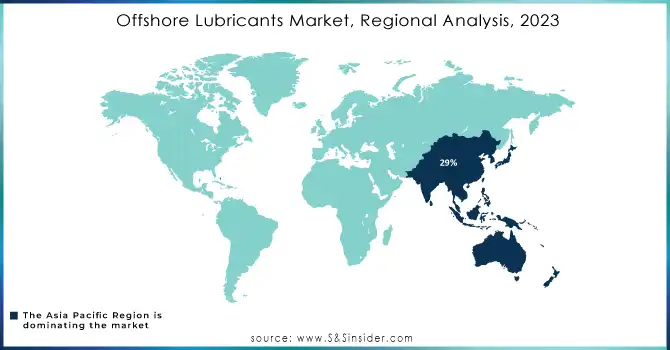

The Asia-Pacific region dominated the market and accounted for the largest share of the offshore lubricants market 29% in 2023, owing to high offshore oil and gas exploration activities in China, India, and Australia. The region has become a hub of offshore, with policies that favor government-led initiatives offshore, including deepwater oil fields and large offshore wind energy installations. With increasing offshore production platforms/drilling rigs/support vessels, the offshore lubricants demand in Asia-Pacific can expect sustainable growth. Especially China is increasing its offshore oil and gas exploration, which is supported by the government investment in deepwater drilling technology and infrastructure, thus further enhancing the growth of the market for high-performance lubricants in the region.

North America held a significant market share and is expected to boost offshore projects in the North American region specifically in the Gulf of Mexico. Promotion of regulatory frameworks as well as installation of key technological advancements over offshore production equipment are some of the channels contributing toward growth which in turn will have a direct influence on global Offshore Production Market value over the forecast period. According to the U.S. Bureau of Ocean Energy Management (BOEM), offshore lease sales were up 12% from last year, highlighting the growth curve in the region.

In contrast, the Middle East is anticipated to grow at the highest rate during the forecasted period. The region is home to some of the largest oil reserves in the world, and government initiatives to diversify energy production have accelerated offshore drilling and exploration projects. Additionally, the International Maritime Organization (IMO) notes that much of the Middle East is concentrating on renewing its offshore support vessel fleet, which also generates demand for lubricants. The increased exploration of offshore energy activities in the region is projected to drive the consumption of advanced lubes for critical equipment, maintaining the regional market share of offshore lubricants. With its expanding oil and gas infrastructure, the Middle East's market share in the offshore lubricants industry is set to grow substantially.

Key Players in Offshore Lubricants Market

Key Service Providers/Manufacturers in the Offshore Lubricants Market

-

ExxonMobil (Mobil SHC 600 Series, Mobil 1 Marine)

-

Chevron Corporation (Chevron Marine Lubricants, Chevron RPM Marine)

-

Shell Lubricants (Shell Alexia 40, Shell Omala S4 GX)

-

TotalEnergies (Total Rubia Marine, Total Azolla ZS)

-

BP (BP Vanellus Marine 15W-40, BP Energol HLP)

-

Castrol (Castrol Optigear Synthetic 3000, Castrol Tribol 302 N)

-

Valvoline (Valvoline Premium Blue Marine, Valvoline All Fleet 15W-40)

-

Lukoil (Lukoil Marine Oil, Lukoil VS 3000)

-

Fuchs Lubricants (Fuchs Renolin S, Fuchs Cassida Food Grade Oils)

-

Chevron Marine Products (Chevron Texaco Marine Lubricants, Chevron RPM Marine)

Users of Offshore Lubricants

-

ExxonMobil

-

Royal Dutch Shell

-

BP

-

Chevron Corporation

-

Halliburton

-

ConocoPhillips

-

Equinor

-

Repsol

-

Eni

-

CNOOC

Recent Developments

-

In May 2024, Gulf Marine Services (GMS) expanded its Singapore fleet by adding two marine barges and a supply vessel to address the growing demand for marine support services in the region. This marks the first step in a broader plan to expand their global fleet.

-

In June 2023, ExxonMobil launched a new series of advanced offshore lubricants that enhance fuel efficiency and cut environmental impact for offshore operations, particularly in the North Sea and Gulf of Mexico.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 170.1 Billion |

| Market Size by 2032 | USD 236.4 Billion |

| CAGR | CAGR of 3.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Engine Oil, Hydraulic Oil, Gear Oil, Grease, Others) • By End Use (Offshore Rigs, FPSOs, OSVs) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ExxonMobil, Chevron Corporation, Shell Lubricants, TotalEnergies, BP, Castrol, Valvoline, Lukoil, Fuchs Lubricants, Chevron Marine Products |

| Key Drivers | • The growing global maritime trade, coupled with rising offshore exploration activities, is boosting the demand for offshore lubricants. • The development of synthetic and biodegradable lubricants that can withstand extreme offshore conditions is driving market growth. |

| Restraints | • Despite the demand for greener products, the disposal and management of offshore lubricants under strict environmental regulations can hinder market growth. |