Refrigeration Coolers Market Size & Overview:

Get more information on Refrigeration Coolers Market - Request Sample Report

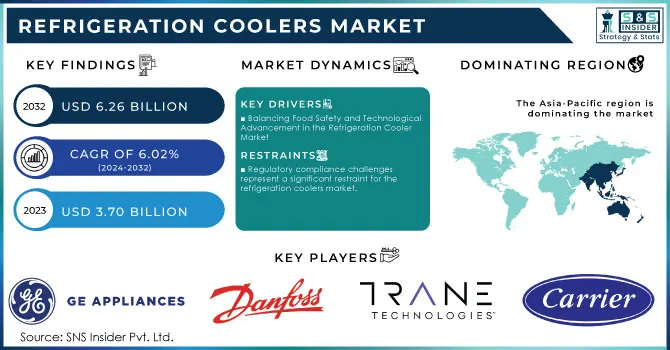

The Refrigeration Coolers Market Size was valued at USD 3.70 Billion in 2023 and is expected to reach USD 6.26 Billion by the end of 2032 at CAGR about 6.02% during the forecast period of 2024-2032.

The refrigeration coolers market is poised for significant growth, primarily fueled by the rising demand for processed foods and the necessity for efficient cold storage solutions. Recent developments, such as the Greater Boston Food Bank's expansion of its refrigeration capacity, underscore the increasing community needs. This expansion aligns with a broader trend of a 4% rise in demand for refrigerated storage across the food supply chain, highlighting the crucial role of refrigeration in food distribution and safety. Additionally, approximately 58% of the American diet now consists of ultra-processed foods, increasing the demand for reliable refrigeration systems to ensure food safety and prevent spoilage, especially as households increasingly choose frozen and pre-packaged meals. A report by Beko emphasizes the importance of refrigeration in maintaining the quality of processed foods, further driving the demand for advanced refrigeration solutions. The BBC also notes that the global shift toward plant-based diets and convenience foods is heightening the need for effective refrigeration to preserve food quality. As sustainability gains traction, the refrigeration sector is witnessing a shift toward energy-efficient technologies, with anticipated increases in investments. In summary, the refrigeration coolers market is well-positioned for rapid growth, driven by evolving consumer preferences, stricter food safety regulations, and technological advancements.

A trend in the refrigeration coolers market is the growing consumer demand for energy-efficient systems, capable of reducing energy consumption by 20-50%. This focus is crucial for both homeowners and businesses aiming to lower operational costs while minimizing their environmental impact. Approximately 47% of consumers are willing to pay a premium for products stored in eco-friendly refrigeration units, signaling a shift toward sustainability. In the retail sector, around 75% of grocery stores are investing in advanced refrigeration technologies to enhance food safety and quality. This increasing emphasis on energy efficiency and compliance with stricter regulations is expected to drive innovation and significant market growth in the coming years.

Refrigeration Coolers Market Dynamics

Drivers

-

Balancing Food Safety and Technological Advancement in the Refrigeration Cooler Market

As food safety regulations tighten, businesses are compelled to invest in advanced refrigeration systems to prevent food spoilage and ensure the safe distribution of perishable goods. According to the U.S. Food and Drug Administration (FDA), proper refrigeration is essential for maintaining food safety, as improper storage can lead to bacterial growth and foodborne illnesses. The FDA states that keeping food at a safe temperature is vital, as the temperature danger zone between 40°F and 140°F allows bacteria to thrive. Reports indicate that maintaining optimal temperature conditions has led to a surge in demand for innovative refrigeration technologies that can effectively monitor and manage food storage environments. A recent article highlights that approximately 20% of food is wasted due to spoilage, emphasizing the need for effective refrigeration solutions to preserve food quality. Companies are increasingly recognizing the importance of walk-in coolers, which play a crucial role in food safety, with studies showing that proper maintenance can prevent contamination and extend the shelf life of products. The USDA emphasizes the necessity of keeping food at safe temperatures during emergencies, further highlighting the reliance on robust refrigeration systems. As consumer awareness of food safety rises, many consumers are willing to pay a premium for products stored in eco-friendly refrigeration units. This trend is supported by articles discussing the maintenance of walk-in coolers as essential for food safety and quality assurance. The increased focus on food safety, alongside the alarming statistic that approximately 48 million people get sick from foodborne illnesses each year in the U.S., drives significant demand for advanced refrigeration solutions. This compelling need for effective refrigeration systems ultimately positions the refrigeration coolers market for substantial growth.

Restraints

-

Regulatory compliance challenges represent a significant restraint for the refrigeration coolers market.

The industry is confronted with stringent regulations concerning energy efficiency and refrigerant usage, leading to substantial costs for businesses striving to meet these standards. Smaller companies often find navigating this complex regulatory landscape particularly burdensome, as they may lack the specialized knowledge and resources needed to manage compliance effectively. Reports indicate that these additional operational costs can severely influence profitability and competitive positioning for smaller enterprises. Furthermore, regulatory frameworks are subject to frequent updates, creating ongoing compliance challenges for companies that must stay current with evolving standards. Industry analyses reveal that the financial burden of adhering to these regulations can escalate, especially as businesses are increasingly pressured to invest in eco-friendly technologies aimed at reducing environmental impact. The growing focus on sustainability practices necessitates that companies allocate significant resources toward compliance initiatives, further increasing operational expenses. As regulations continue to tighten, the refrigeration sector faces heightened pressure to balance compliance with operational efficiency, which could hinder growth, particularly for small to medium enterprises that may not possess the infrastructure to adapt swiftly. These challenges highlight the necessity of developing robust compliance strategies to effectively navigate the regulatory landscape.

Refrigeration Coolers Market Segmentation Overview

by Component

In 2023, the refrigeration coolers market saw a significant contribution from various components, with condensers leading, capturing around 57% of the market share. This prominence stems from the crucial function condensers serve in the refrigeration cycle, facilitating the heat exchange process that allows refrigerants to release heat and transition from gas to liquid. Condensers are essential for the efficiency and performance of refrigeration systems, and their design significantly affects energy consumption. With a growing emphasis on energy efficiency and sustainability, manufacturers are innovating to create more efficient condenser designs, fueling market growth. Notable companies like Carrier Global Corporation and Daikin Industries are spearheading advancements in condenser technologies that enhance energy efficiency while minimizing environmental impact. The segment's expansion is further driven by the increasing demand for advanced refrigeration technologies, especially in the food and beverage sector, where optimal storage conditions are critical. For instance, Thermo King, a subsidiary of Ingersoll Rand, has improved its refrigeration solutions through IoT integration and smart technologies for real-time temperature monitoring. Additionally, Blue Star Limited has rolled out eco-friendly refrigerant solutions and innovative condenser designs that adhere to stringent environmental regulations, highlighting the industry's shift toward sustainability.

by Application

In 2023, the refrigeration coolers market saw substantial growth from the commercial application segment, which captured approximately 62% of total revenue. This prominence is largely attributed to the widespread deployment of refrigeration coolers in various commercial environments, such as supermarkets, restaurants, and convenience stores, where optimal temperature control for perishable goods is critical. The expansion of the commercial sector is closely linked to the rising consumer demand for fresh and frozen food products, coupled with an increased emphasis on food safety and quality. Supermarkets and grocery chains are heavily investing in advanced refrigeration technologies to enhance product storage and display, ensuring freshness for consumers. Additionally, the shift toward healthier eating and organic options has heightened the need for efficient refrigeration solutions, prompting retailers to offer a diverse selection of fresh produce and dairy items. Companies like Linde and Emerson Electric Co. have acknowledged this trend and are innovating refrigeration solutions tailored for commercial use. Linde has upgraded its cooling systems with eco-friendly refrigerants and energy-efficient designs, helping businesses reduce their carbon footprints and improve operational efficiency. Meanwhile, Emerson Electric Co. has launched its E2 system, integrating IoT capabilities for real-time monitoring and analytics, which allows retailers to optimize their refrigeration practices and uphold food safety standards.

Refrigeration Coolers Market Regional Outlook

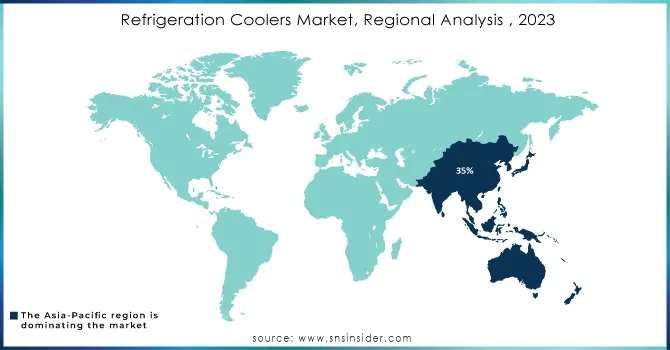

In 2023, the Asia-Pacific region solidified its position as the leading market for refrigeration coolers, capturing around 35% of the total revenue. This dominance is driven by rapid urbanization, increasing disposable incomes, and a growing demand for refrigerated products across sectors such as food and beverage, pharmaceuticals, and logistics. The burgeoning population and evolving consumer preferences have heightened the need for fresh and frozen foods, prompting supermarkets, convenience stores, and restaurants to expand their refrigeration capabilities. Additionally, the rise of e-commerce in the grocery sector has intensified the demand for efficient cold chain logistics, ensuring safe delivery of perishables. Countries like China and India are at the forefront of this growth. In China, rapid industrialization and a shift toward modern retail formats have spurred significant investments in advanced refrigeration technologies. Meanwhile, India is projected to offer the highest salary increases among Asia-Pacific countries, with specific sectors, including food processing and logistics, driving demand for commercial refrigeration. The expanding food processing and cold storage industries in India are crucial for meeting the rising need for efficient refrigeration. Furthermore, the region's focus on sustainability and energy efficiency is becoming increasingly prominent. Companies are investing in innovative refrigeration solutions, such as cold room coolers and condensers that minimize environmental impact.

In 2023, North America emerged as the fastest-growing region in the refrigeration coolers market, driven by several key factors that emphasize innovation, technological advancements, and a shift toward sustainability. The region's focus on energy-efficient solutions has led to significant investments in modern refrigeration technologies, particularly in commercial and industrial applications. As consumers increasingly demand fresher and higher-quality food products, retailers, supermarkets, and food service providers are upgrading their refrigeration systems to meet these expectations. The rising awareness of food safety regulations further bolsters the demand for reliable refrigeration solutions. Regulatory bodies in the U.S. and Canada have implemented stringent guidelines to ensure proper food handling and storage, prompting businesses to invest in advanced refrigeration coolers that comply with these standards. Additionally, the e-commerce boom has fueled the need for efficient cold chain logistics, driving growth in the demand for refrigeration coolers that maintain optimal temperatures during the transportation and storage of perishable goods.

Need Any Customization Research On Refrigeration Coolers Market - Inquiry Now

Key Players

Some of the major key players in Refrigeration Coolers Market with product:

-

Carrier Global Corporation (Commercial refrigeration units, chillers)

-

Trane Technologies (Refrigerated display cases, air conditioning systems)

-

Danfoss A/S (Compressors, valves, and electronic controls)

-

Emerson Electric Co. (Refrigeration controls, compressors, transcritical systems)

-

Johnson Controls International (HVAC systems, chillers, refrigeration solutions)

-

GE Appliances (Refrigerators, freezers, cooling units)

-

Whirlpool Corporation (Refrigerators, ice makers, cooling appliances)

-

LG Electronics (Commercial refrigerators, freezer solutions)

-

Samsung Electronics (Refrigerators, freezers, smart cooling solutions)

-

Hitachi, Ltd. (Air conditioning systems, commercial refrigeration)

-

Daikin Industries, Ltd. (Air conditioning units, chillers, heat pumps)

-

Mitsubishi Electric Corporation (VRF systems, commercial refrigeration solutions)

-

Frigidaire (Refrigerators, freezers, cooling appliances)

-

Sub-Zero Group, Inc. (Luxury refrigerators, wine coolers)

-

Blue Star Limited (Commercial refrigeration, air conditioning systems)

-

Panasonic Corporation (Refrigerators, cooling systems, compressors)

-

Electrolux AB (Refrigerators, freezers, cooling appliances)

-

AHT Cooling Systems GmbH (Commercial refrigerators, freezers)

-

Beverage-Air Corporation (Refrigerated display cases, ice cream freezers)

-

Kigali Refrigeration (Custom refrigeration solutions, display cases)

List of suppliers in the refrigeration coolers market:

-

Carrier Global Corporation

-

Trane Technologies

-

Danfoss A/S

-

Emerson Electric Co.

-

Johnson Controls International

-

GE Appliances

-

Whirlpool Corporation

-

LG Electronics

-

Daikin Industries, Ltd.

-

Mitsubishi Electric Corporation

Recent Development

-

In April 2024, Electrolux Announces New Eco-Friendly Refrigeration Technology, Electrolux, a major appliance manufacturer, announced the development of a new, more environmentally friendly refrigeration technology that utilizes a natural refrigerant with lower global warming potential. This technology is expected to be incorporated into their future refrigerator models.

-

In March 2024, Samsung and LG Collaborate on Smart Refrigerator Standards, Industry giants Samsung and LG announced a collaboration to develop common standards for smart refrigerator features. This collaboration aims to improve interoperability between smart refrigerators and other smart home devices, regardless of brand.

-

In January 2024, Carrier Acquires a global provider of heating, ventilation, and air conditioning (HVAC) solutions, announced the acquisition of a leading cold chain logistics provider. This move strengthens Carrier's position in the cold chain market and expands its offerings for temperature-controlled storage and transportation solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.70 Billion |

| Market Size by 2032 | USD 6.26 Billion |

| CAGR | CAGR of 6.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Evaporators and Air Coolers, Condensers) • By Applications (Commercial, Industrial) • By Refrigerant (HFC/HFO, NH3, CO2, Glycol, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carrier Global Corporation, Trane Technologies, Danfoss A/S, Emerson Electric Co., Johnson Controls International, GE Appliances, Whirlpool Corporation, LG Electronics, Samsung Electronics, Hitachi, Ltd., Daikin Industries, Ltd., Mitsubishi Electric Corporation, Frigidaire, Sub-Zero Group, Inc., Blue Star Limited, Panasonic Corporation, Electrolux AB, AHT Cooling Systems GmbH, Beverage-Air Corporation, Kigali Refrigeration. |

| Key Drivers | • Balancing Food Safety and Technological Advancement in the Refrigeration Cooler Market |

| RESTRAINTS | • Regulatory compliance challenges represent a significant restraint for the refrigeration coolers market. |