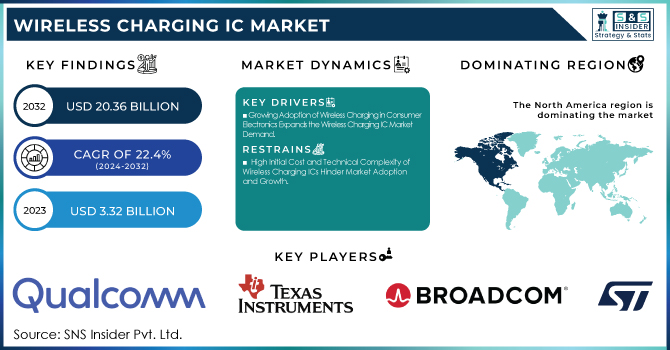

Wireless Charging IC Market Size & Growth:

The Wireless Charging IC Market Size was valued at USD 3.32 Billion in 2023 and is expected to reach USD 20.36 Billion by 2032 and grow at a CAGR of 22.4% over the forecast period 2024-2032. In this market adoption rates across different sectors and growth in specific wireless charging standards (Qi, AirFuel). This also provides key drivers like growing demand for wire-free convenience and the growth of smartphone usage. The data about average selling price of wireless charging ICs, supply chain dynamics, and investment pattern in R&D for innovative IC solutions are also useful.

To get more information on Wireless Charging IC Market - Request Free Sample Report

Wireless Charging IC Market Dynamics

Key Driver:

-

Growing Adoption of Wireless Charging in Consumer Electronics Expands the Wireless Charging IC Market Demand

The increasing integration of wireless charging technology in smartphones, tablets, laptops, and wearables is driving the growth of the Wireless Charging IC Market. Consumers are increasingly looking for convenience and simplicity, which is why wireless charging is preferred over traditional wired charging. With more consumer electronics brands adopting this technology, the demand for efficient and cost-effective wireless charging ICs has increased. This trend is expected to continue as wireless charging becomes a standard feature in a wide range of devices, further driving the market's expansion.

Restraint:

-

High Initial Cost and Technical Complexity of Wireless Charging ICs Hinder Market Adoption and Growth

Despite the growing demand for wireless charging solutions, the high initial cost and technical complexity of wireless charging ICs act as significant restraints for market growth. Development and production of advanced charging ICs involve significant investments in R&D and manufacturing processes. Moreover, high power efficiency and compatibility with a wide variety of devices make it even more cumbersome and expensive. This makes wireless charging solutions too expensive for certain market sections, thereby rendering these solutions less practical to be opted for by many budget-conscious industries and regions.

Opportunity:

-

Growing Electric Vehicle Market Presents New Opportunities for Wireless Charging ICs in Automotive Sector

The rapid growth of electric vehicles (EVs) presents a significant opportunity for the Wireless Charging IC Market. With more car manufacturers in the vanguard of finding wireless charging solutions for EVs, a strong need has also been shown for high-performance, advanced wireless charging ICs that would deliver fast, safe, and efficient charging. This trend will grow as governments crack down on stricter emissions and people seek cleaner, convenient charging methods. Wireless charging infrastructure development for EVs will most certainly increase opportunities in this market area for wireless charging IC manufacturers in the automotive segment.

Challenge:

-

Limited Standardization of Wireless Charging Technology Poses a Challenge to Market Growth and Compatibility

One of the key challenges facing the Wireless Charging IC Market is the lack of standardization across wireless charging technologies. Multiple competing standards, such as Qi and AirFuel, cause compatibility issues and hinder the wide adoption of wireless charging. Devices from different manufacturers often fail to work seamlessly with each other, which undermines consumer confidence and limits the growth potential of the market. The industry needs to work towards establishing universal standards for wireless charging to ensure compatibility across various devices and systems, fostering greater market acceptance and encouraging innovation.

Wireless Charging IC Market Segments Analysis

By Type

In 2023, the Receiver IC segment of the Wireless Charging IC Market held the largest revenue share, accounting for 64%. This is the enabling segment, and with wireless charging capability, widespread adoption is envisioned for consumer electronics like smartphones and wearables to automotive applications. Power conversion efficiency and heat dissipation directly translate to charging speed and device lifespan for these ICs.

The Transmitter IC segment is witnessing the largest CAGR of 23.37% within the forecasted period, driven by advances in power transfer efficiency and the growing demand for faster wireless charging solutions. This growth is attributed to innovations in transmitter ICs that can deliver higher power levels to support multiple device types and rapid charging.

The increasing integration of wireless charging technology in automotive applications, such as wireless EV chargers, drives the growth in this segment. With the future expansion of the charging infrastructure and the push towards universal standards, the Transmitter IC segment shall play a highly critical role for the future developments of the Wireless Charging IC Market.

By Power Range

In 2023, the Mid-Range 16-50W segment dominated the Wireless Charging IC Market, accounting for 43% of the total revenue. This power range is the most appealing for consumer electronics, such as smartphones, tablets, wearables, and accessories, as it optimally balances charging speed with efficiency. Companies like Qualcomm and NXP Semiconductors have led the advancement in this segment. Qualcomm's Quick Charge 4+ as well as NXP's offerings of efficient power delivery solutions in this range have driven rapid adoption.

The High-Range >51W segment is projected to experience the largest CAGR of 24.07% within the forecasted period, reflecting a significant shift toward faster charging technologies. This power range is particularly relevant for applications in electric vehicles (EVs), industrial machinery, and high-end consumer electronics, which require higher power transfer for faster charging. Companies like MediaTek and Broadcom are heavily investing in this segment, and MediaTek recently announced a high-power wireless charging solution designed for EVs, which enables ultra-fast, efficient charging.

By Charging Method

In 2023, the Electromagnetic Induction segment dominated the Wireless Charging IC Market, commanding 60% of the total revenue. This method is widely used in consumer electronics-including smartphones, wearables, and home appliances-because it has become reliable and efficient. Electromagnetic induction utilizes a magnetic field to transfer energy between coils in the transmitter and receiver, which makes it safe to charge quickly and efficiently.

The Microwave segment is experiencing the highest CAGR of 27.79% within the forecasted period, driven by its ability to transmit power over longer distances with high efficiency. While electromagnetic induction is limited to a limited distance between the transmitter and receiver, microwave-based wireless charging may offer energy transfer over a longer distance. A growing demand for different industries for untethered and long-range charging solutions is fostering rapid growth within the Microwave segment of the Wireless Charging IC Market.

By Application

In 2023, the Consumer Electronics segment led the Wireless Charging IC Market with a 46% revenue share, driven by the increasing demand for convenience and faster charging in smartphones, tablets, laptops, and wearables. Consumer electronics is one of the most prominent adopters of wireless charging technology, mainly because of the rapid growth of Qi-compatible devices. Some of the key players in this segment are Qualcomm, NXP Semiconductors, and Broadcom, who have greatly contributed to these segments by developing advanced wireless charging ICs that improve the speed, efficiency, and safety of charging.

The Automotive segment is poised to experience the highest CAGR of 24.52% within the forecasted period, as the automotive industry sees the increasing integration of wireless charging technology in electric vehicles (EVs) and infrastructure. Wireless charging solutions in automobiles eliminate the need for physical plugs, offer convenience, and contribute to the burgeoning trend of smart, connected vehicles.

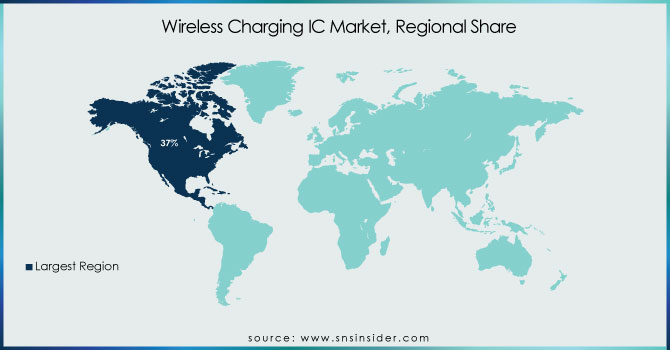

Wireless Charging IC Market Regional Overview

In 2023, the North America region dominated the Wireless Charging IC Market, holding a significant market share of approximately 37%. This dominance can be attributed to the region's early adoption of wireless charging technologies, high disposable income, and the presence of major tech companies driving innovation.

For example, companies like Qualcomm and Apple are based in North America and are key players in the wireless charging industry, with Apple incorporating wireless charging into its flagship iPhones and Qualcomm developing advanced charging solutions.

The Asia Pacific region is the fastest-growing region in the Wireless Charging IC Market, with an estimated CAGR of 23.89% during the forecast period. This rapid growth is driven by the booming consumer electronics market, especially in countries like China, South Korea, and Japan, where large-scale adoption of smartphones, wearables, and other devices is widespread. The region's robust manufacturing capabilities and the growing focus on technological innovations, along with government policies promoting green energy solutions, are key factors driving the market's growth in Asia Pacific. The demand for faster, more efficient wireless charging technology is rising in Asia Pacific. This means that the Asia Pacific region is likely to become the global market leader in the growth rate of wireless charging ICs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Wireless Charging IC Market are:

-

Qualcomm Technologies, Inc. (Qualcomm® Wireless Power ICs, Qualcomm Quick Charge™ Technology)

-

Texas Instruments Incorporated (TI Wireless Power Transmitters, TI Wireless Power Receivers)

-

NXP Semiconductors (NXP MWCT Wireless Charging Controllers, NXP Qi Wireless Charging Solutions)

-

Broadcom (Broadcom Wireless Power ICs, Broadcom RF Wireless Charging Solutions)

-

STMicroelectronics (STWBC Wireless Charging Transmitter IC, STWLC Wireless Charging Receiver IC)

-

Infineon Technologies AG (Infineon WLC Wireless Charging ICs, Infineon OPTIGA™ Wireless Power Solutions)

-

ROHM Co., Ltd. (ROHM Qi Wireless Charging ICs, ROHM Wireless Power Transmitters)

-

MediaTek (MediaTek Pump Express Wireless Charging ICs, MediaTek Inductive Charging Solutions)

-

Semtech (Semtech LinkCharge Wireless Power ICs, Semtech Inductive Wireless Charging Solutions)

-

Analog Devices, Inc. (ADI LTC4125 Wireless Power Transmitter, ADI LTC4120 Wireless Power Receiver)

-

Cirrus Logic, Inc. (Cirrus Logic Wireless Charging ICs, Cirrus Logic High-Efficiency Wireless Power Solutions)

-

ChargerLab (ChargerLab Wireless Charging Modules, ChargerLab Power Management ICs)

-

Wireless Power Consortium (WPC Qi Wireless Charging ICs, WPC Wireless Power Standards)

-

Microchip Technology Inc. (Microchip Wireless Power Controllers, Microchip Inductive Charging Solutions)

-

Premier Farnell Limited (Premier Farnell Wireless Charging Development Kits, Premier Farnell Power Management ICs)

-

indie Semiconductor (indie Wireless Charging ICs, indie Semiconductor Power Management Solutions)

-

EDOM Technology (EDOM Wireless Power Solutions, EDOM Inductive Charging ICs)

Recent Trends

-

In May 2024, STMicroelectronics introduced a 50W Qi-compatible wireless charging solution comprising the STEVAL-WBC2TX50 transmitter and STEVAL-WLC98RX receiver boards. The receiver board featured Adaptive Rectifier Configuration (ARC), which extended charging distance by up to 50%, allowing for more flexible configurations and the use of lower-cost coils.

-

In April 2024, Qualcomm unveiled the Snapdragon Ride Flex SoC, a cost-effective solution targeting the Indian automotive market. Designed to handle tasks ranging from digital dashboards to advanced driver-assistance systems (ADAS) and automated driving capabilities, this integrated system offered automakers a unified, software-defined vehicle architecture with scalable performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.32 Billion |

| Market Size by 2032 | USD 20.36 Billion |

| CAGR | CAGR of 22.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Receiver IC, Transmitter IC) • By Power Range (Low Range - 15W, Mid-Range - 16-50W, High Range - >51W) • By Charging Method (Electromagnetic Induction, Electrolytic Coupling, Microwave [1GHz, 5GHz, 10GHz, 50GHz, 100GHz, 300GHz], Others) • By Application (Consumer Electronics, Automotive, Industrial, Medical, Telecom, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm Technologies, Inc., Texas Instruments Incorporated, NXP Semiconductors, Broadcom, STMicroelectronics, Infineon Technologies AG, ROHM Co., Ltd., MediaTek, Semtech, Analog Devices, Inc., Cirrus Logic, Inc., ChargerLab, Wireless Power Consortium, Microchip Technology Inc., Premier Farnell Limited, indie Semiconductor, EDOM Technology. |