Flare Monitoring Market Size & Growth:

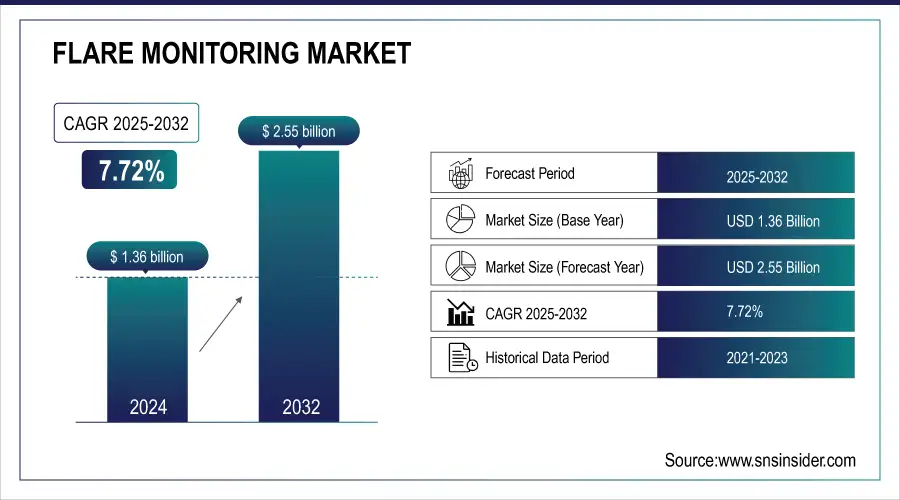

The Flare Monitoring Market Size was valued at USD 1.36 billion in 2024 and is expected to reach USD 2.55 billion by 2032, growing at a CAGR of 7.72% over the forecast period 2025-2032. Flare monitoring market expansion around the world has led in part to the increased acceptance of AI and IoT-based monitoring systems, rising investments for carbon capture and flare gas recovery, and the growing enactment of zero-flaring initiatives. At the same time, satellite-based flare detection and other remote sensing technologies are further increasing global demand for automated emissions monitoring solutions.

In December 2023, the EPA released modernized air emissions standards containing stricter thresholds for flares used in the oil and gas sector to curtail methane emissions. As a result, companies are investing in highly developed flare monitoring systems to comply with the regulations and to mitigate the environmental impact. After the EPA ruling, Flotek Industries said it has seen an uptick in demand for its flare monitoring services, projecting "substantial growth" in 2025.

Market Size and Forecast:

-

Flare Monitoring Market Size in 2024: USD 1.36 Billion

-

Flare Monitoring Market Size by 2032: USD 2.55Billion

-

CAGR: 7.72% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

To Get more information on Flare Monitoring Market - Request Free Sample Report

Key Flare Monitoring Market Trends

-

Growing emphasis on environmental compliance and emission reduction is driving demand for advanced flare monitoring systems.

-

Integration of infrared and ultrasonic technologies is enhancing detection accuracy and real-time monitoring capabilities.

-

Rising adoption of automation and IoT-based solutions enables continuous remote monitoring and data analytics.

-

Increasing investments in oil & gas exploration and refinery operations are creating significant opportunities for flare monitoring solutions.

-

Stricter global regulations on air pollution and greenhouse gas emissions are pushing industries toward efficient flare management systems.

-

Development of AI-driven and predictive maintenance tools is improving operational efficiency and minimizing downtime.

U.S. Flare Monitoring Market

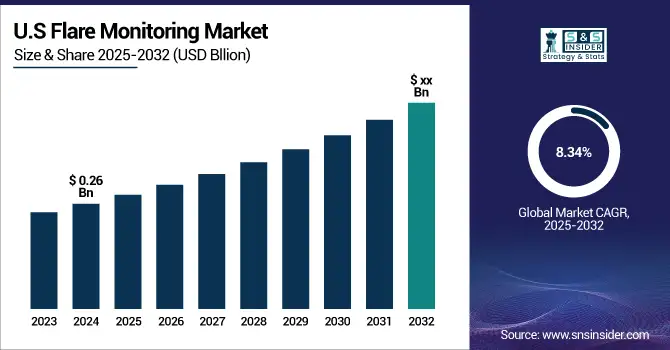

U.S. Flare Monitoring Market size was valued at USD 0.26 Billion in 2024 and the total Flare Monitoring revenue is expected to grow at a CAGR of 8.34% from 2025 to 2032. Extensive use of thermal cameras, optical gas imaging, and mass spectrometry-based flow monitoring systems are being employed, owing to stringent EPA regulations in the U.S., thus driving the market for flare monitoring in this region as well as refineries, petrochemical plants, and oil & gas facilities.

Flare Monitoring Market Growth Drivers

-

Advanced Flare Monitoring Driven by Regulations AI IoT Innovations and Rising Demand for Emission Control

Reducing greenhouse gas emissions and enhancing air quality by reducing flaring is likely to drive target market growth owing to the stringent environmental regulations. Due to the detailed emission monitoring norms enacted by governments and regulating bodies like the EPA and the European Commission, industrial sectors such as oil & gas, petrochemicals, and chemicals are beginning to employ advanced flare monitoring systems. Moreover, the innovations in infrared (IR) and thermal imaging cameras along with the rise of AI & IoT-based solutions development are improving the precision and effectiveness of flare monitoring systems. The market decline can be in terms of a higher focus on operational safety, a decrease in operational costs, or consumers' inclination towards real-time data analysis which in turn drives the industrial process. Alongside the global energy demand ongoing boom, the expansion of refineries and gas processing plants brings demand for Continuous Emission Monitoring (CEM) to the highest level.

Flare Monitoring Market Restraints

-

Technical Challenges Traditional Systems and Regulatory Variability Limit Global Adoption of Flare Monitoring Solutions

Technical complexities for the flaring process or flaring systems are one of the most significant restraints for the growth of the market. Although newer, automated solutions are now available, many refineries and chemical plants continue to use traditional flare-monitoring techniques that are still in use today. Lack of awareness, and know-how to operate sophisticated monitoring technologies, also impede adoption, especially in developing parts of the world. This variability of flare gas compositions and environmental conditions with high temperatures and heavy weather exacerbates the flare monitoring accuracies and reliabilities. Regional differences in regulatory compliance have led to inconsistencies in implementation and adoption.

Flare Monitoring Market Opportunities

-

Remote Monitoring AI Cloud Integration and Industrial Growth Drive Opportunities in the Flare Monitoring Market

The increasing need for remote flare monitoring solutions creating real-time tracking of emissions and predictive maintenance is likely to give major opportunity to the growth of the Flare Monitoring Market. Sustainable energy and carbon-neutral approaches are driving industry leaders to push for complex monitoring systems to reduce their environmental footprint. Moreover, the industrialization and establishment of infrastructures in the Asia-Pacific and the Middle East are fuelling the demand with the need of devices that can monitor flares easily and effectively. A lucrative opportunity lies in offering cloud computing integrations along with AI-powered analytics which help in proactive resource regulation compliance and powerful decision-making.

Flare Monitoring Market Challenges:

-

Real-Time Monitoring Standardization Data Management and Cybersecurity Challenges Impact Flare Monitoring Adoption

One of the major issues in the market is the lack of accurate and real-time monitoring in remote or offshore places where data is difficult to transmit constantly. Standardization across industries and governing regulatory bodies is limited, making system compatibility and integration difficult and preventing the widespread adoption of advanced systems for flare monitoring. Moreover, with large typical emission data in the scope of 1000s of operational and material variables, the average industrial operator faces data management and analysis challenges as they require large processing and analytics capabilities. Another issue of increasing importance in the context of IoT-enabled flare monitoring systems is cybersecurity: cyber threats could seriously jeopardize operational safety and regulatory compliance. Overcoming these hurdles is key to long-term market growth.

Flare Monitoring Market Segment Analysis

By Mounting Method

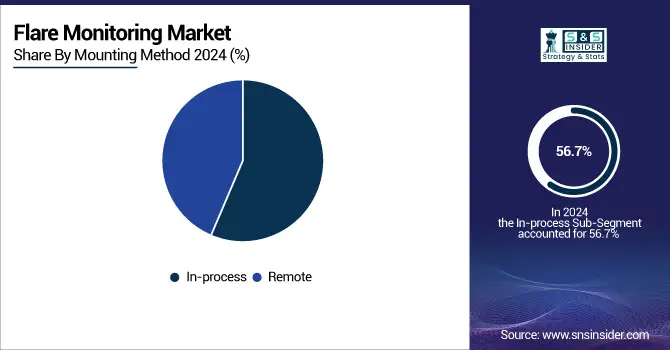

In 2024, the in-process flare monitoring segment held the largest market share of 56.7% owing to the high adoption of in-process flare monitoring in real-time combustion efficiency assessment in refineries, petrochemical plants, and industrial facilities. In the method, continuous monitoring of emissions from the flare stack is ensured, which allows for meeting stringent environmental regulations and high operational safety. Demand for in-process monitoring systems such as infrared (IR) and gas analyzers is strongly supported by the reliability, accuracy, and convenience of monitoring the process in real time.

The Remote flare monitoring segment is projected to be the fastest-growing segment from 2024 to 2032, due to advancements in satellite-based and drone-based monitoring technologies. The growing need for real-time but non-intrusive monitoring solutions for offshore oil rigs and remote industrial sites is supporting the adoption. Moreover, the coupling of AI and IoT for predictive analytics is another factor encouraging the demand for remote monitoring systems.

By Industry

The flare monitoring market was dominated by refineries in 2024, holding a 30.3% share against emissions regulations driving continuous real-time monitoring. Flare emissions are among the highest emissions from the import and exportation of crude oil often following refining processes, and advanced monitoring systems are critical to regulatory compliance and efficiency of operations. This segment has been steady in market leadership due to in-process and remote flare monitoring technologies such as infrared (IR) cameras and gas analyzers.

The segment of onshore oil & gas production sites is anticipated to register the highest growth rate, or CAGR, during the period 2024 - 2032 due to rising global energy needs and growing exploration activities across the globe. This is driving the adoption of AI-enabled remote monitoring solutions, especially in these remote and high-risk locations where timely emissions monitoring is crucial. This segment is also driven by government policies targeting methane and sustainable oil & gas terms.

Flare Monitoring Market Regional Analysis

North America Flare Monitoring Market Insights

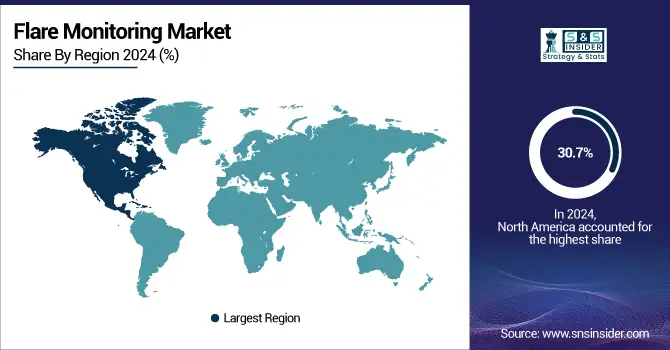

North America accounted for the largest share of 30.7% in the flare monitoring market due to strict regulations from the Environmental Protection Agency (EPA) in the US and the Canadian Environmental Protection Act (CEPA) in Canada as of 2024. In the region, the lengthy history of oil & gas, petrochemical, and chemical deliverance makes it essential to pay robust attention to low emission standards, hence these segments are the key investors in technologically advanced in-process and remote flare monitoring solutions. For instance, the adoption of AI-driven and IoT-based flare monitoring systems is witnessing high growth in North America, particularly in the U.S. and Canada. Companies such as ExxonMobil and Chevron have introduced advanced flare-monitoring technologies into the refinery business. The third option has already been employed by ExxonMobil, which has IR and gas analyzer-based flare gas combustion monitoring in place to provide optimal combustion of flare gas in real-time and target environmental footprint reduction.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Flare Monitoring Market Insights

The Asia-Pacific region is predicted to expand at the highest CAGR between 2025 and 2032 owing to industrialization, rising need for energy, and emission-control rules in China, India, and Indonesia. The Wave of Environmental Change: Governments are tightening the screws of environmental laws, which is prompting industries to continue raising the bar for flare monitoring technologies. For instance, in India, Real-time Remote Flare Monitoring Solutions have been installed by Reliance Industries Limited (RIL), overseen by its refineries to ensure compliance and efficient operations. Also, the China National Petroleum Corporation (CNPC) has recently been putting up resources developing AI-based monitoring systems to help them better track emissions at its oil & gas facilities.

Europe Flare Monitoring Market Insights

The Europe Flare Monitoring Market is poised for steady growth in 2024, driven by stringent environmental regulations and the region’s focus on industrial emission control. Countries such as Germany, the U.K., and Norway are leading the adoption of advanced flare monitoring systems in refineries and petrochemical plants. Growing emphasis on sustainable energy transition, coupled with government-backed initiatives for pollution control, is encouraging industries to deploy continuous monitoring technologies. Additionally, the integration of IoT and AI-based flare detection systems is enhancing operational efficiency and compliance tracking across the region.

Latin America (LATAM) Flare Monitoring Market Insights

The LATAM Flare Monitoring Market is experiencing moderate growth in 2024, supported by the expansion of oil & gas exploration activities in countries like Brazil, Mexico, and Argentina. Increasing awareness of environmental impact and tightening emission norms are prompting industries to adopt automated flare monitoring solutions. Investments in refining infrastructure modernization and energy sustainability projects are further boosting market adoption. Additionally, collaborations between regional energy authorities and technology providers are driving the deployment of cost-effective and reliable monitoring systems across the region.

Middle East & Africa (MEA) Flare Monitoring Market Insights

The MEA Flare Monitoring Market is witnessing robust growth in 2024, fueled by large-scale oil and gas operations in countries such as Saudi Arabia, the UAE, and South Africa. Governments are actively implementing regulations to minimize gas flaring and environmental emissions, creating strong demand for continuous monitoring solutions. Rapid digital transformation, expansion of refinery capacities, and the integration of infrared and thermal imaging technologies are supporting technological advancements. Furthermore, increasing partnerships between energy companies and monitoring solution providers are fostering regional market growth and ensuring compliance with global sustainability goals.

Competitive Landscape for Flare Monitoring Market

TotalEnergies

TotalEnergies is a leading global energy company committed to achieving carbon neutrality by 2050 through advancements in renewable energy, emissions monitoring, and sustainable operations. The company focuses on deploying digital and automated technologies to minimize methane emissions and enhance environmental performance across its oil and gas assets.

-

-

In November 2024, TotalEnergies announced the deployment of continuous, real-time methane emissions detection equipment across all its operated upstream assets by 2025, reinforcing its commitment to achieving near-zero methane emissions by 2030.

-

Honeywell International Inc.

Honeywell is a diversified technology and manufacturing leader providing innovative solutions in energy efficiency, industrial automation, and emissions management. The company is at the forefront of developing advanced flare monitoring and environmental control systems for the oil & gas industry.

-

-

In August 2024, Honeywell launched its Emissions Management Suite an integrated, end-to-end monitoring solution designed for offshore oil & gas platforms and marine vessels enabling real-time emissions detection, data analytics, and regulatory reporting to support sustainability initiatives.

-

Flare Monitoring Market Key Players

-

Providence Photonics

-

Zeeco

-

Kuva Systems

-

Andium

-

Encino Environmental Services

-

Flare Industries

-

John Zink Hamworthy Combustion

-

Honeywell

-

ABB

-

Siemens

-

Emerson

-

Schneider Electric

-

Thermo Fisher Scientific

-

MSA Safety

-

AMETEK

-

Broadley-James Corporation

-

Tekelek

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.36 Billion |

| Market Size by 2032 | USD 2.55 Billion |

| CAGR | CAGR of 7.72% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Mounting Method (In-process, Remote) • By Industry (Refineries, Petrochemicals, Onshore Oil & Gas Production Sites, Landfills, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Flotek Industries, Providence Photonics, Zeeco, CleanFlare, Kuva Systems, Andium, TotalEnergies, Encino Environmental Services, Flare Industries, John Zink Hamworthy Combustion, Honeywell, ABB, Siemens, Emerson, Schneider Electric. |