Blockchain Devices Market Size:

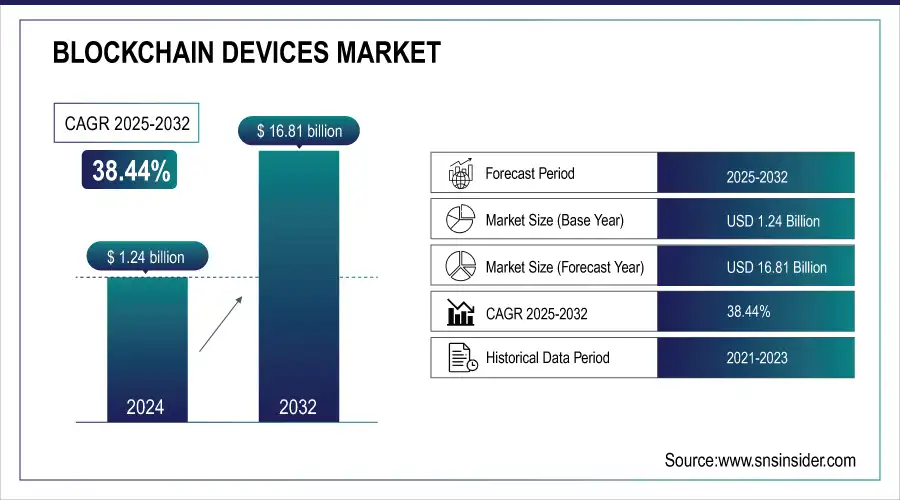

The Blockchain Devices Market Size was valued at USD 1.24 Billion in 2024 and is expected to grow at a CAGR of 38.44% to reach USD 16.81 Billion by 2032.

Get more information on Blockchain Devices Market - Request Sample Report

The Blockchain Devices Market experienced an extraordinary growth over 2024 and 2025, stimulated by the joint forces of a government policy orientation, emerging innovation in technology, and growing acceptability across industry domains. Everywhere around the globe, governments have actively taken up adoption of blockchain and introduced policies towards further integration within financial systems, supply chains, and digital identification. For example, in 2023, the European Union launched the European Blockchain Services Infrastructure initiative with the aim of improving interoperability and developing or promoting the use of blockchain technology across member states. Both the United States and China put significant amounts of money into the research and development of blockchain technologies, further reinforcing efforts toward tech leadership positions. In the Asia-Pacific region, India launched the National Blockchain Strategy, pointing to governance and citizen services as key catalysts for blockchain adoption.

Technological advancements in blockchain devices have ignited further growth in the market. The launch of secure hardware wallets in 2023 incorporated biometric authentication and multi-signature functionality, which indicated emphasis on security. Decentralized storage solutions and IoT-enabled blockchain devices emerged popular in 2024, especially for integration with the development of smart cities and other cutting-edge technologies. The innovation in blockchain-enabled IoT devices has been very promising in sectors like energy management and connected healthcare. Quantum-resistant blockchain devices are now emerging with developments that are countering vulnerabilities, thus securing them for a longer period of time. For instance, Solana Introduces Quantum-Resistant Vault for Crypto Security. The crypto world has just gotten a little more futuristic because Solana developers have released a new quantum-resistant vault. This feature was branded the "Solana Winternitz Vault." The vault's goal is to safeguard user funds by protecting it from potential risks presented by quantum computers.

The future prospects for the Blockchain Devices Market are promising, as connectivity is expected to advance, government-backed blockchain platforms and cross-border digital currency systems will redefine the market landscape. As global organizations and governments prioritize digital transformation, the demand for blockchain devices is going to surge, making them integral to the evolution of the digital economy.

Key Blockchain Devices Trends:

-

Growing adoption of blockchain-based solutions by governments for transparency, efficiency, and fraud prevention.

-

Implementation of blockchain-enabled land registration and e-governance reducing fraud and administrative delays.

-

Rising demand for secure hardware wallets, decentralized storage, and identity verification systems.

-

Increasing reliance on blockchain devices in decentralized finance (DeFi) and cryptocurrency transactions.

-

Adoption of blockchain devices by financial institutions for faster, tamper-proof cross-border transactions.

Blockchain Devices Growth Drivers:

-

Increasing state-level adoption of blockchain solutions.

Increasingly governments worldwide have opted for blockchain-based solutions to deliver more transparent and efficient, also more secure and secure solutions within their sectors. In 2024, Indian State implemented blockchain-enabled land registration services in several States which resulted in reducing fraud up to 85% and administrative delay. Moreover, Dubai blockchain-powered eGovt conducted most of the transactions via the digital channels saving resources drastically.

This growing governmental interest fosters a strong demand for blockchain devices, including secure hardware wallets, decentralized storage solutions, and identity verification systems. These are devices that will make processes streamlined and securely data-managed activities, focusing on digitization and fraud prevention goals pursued by governments. Demand for specialized devices is a sure bet, exponentially growing as public institutions continue to embrace blockchain technology.

-

Increased adoption of blockchain devices for financial applications.

Blockchain gadgets have gained paramount importance in the financial applications revolving around decentralized finance (DeFi), cryptocurrency-based transactions, and digital identity management. Recent research in 2024 shows that most of the global cryptocurrency users rely on hardware wallets when doing financial transactions. Additionally, financial institutions have adopted blockchain devices for faster and tamper-proof cross-border transactions, reducing settlement times. As more individuals and businesses adopt blockchain for financial security and efficiency, demand for these devices will remain a key driver in the market.

Blockchain Devices Restraints:

-

High initial costs of blockchain devices hinder widespread adoption.

One of the significant barriers to the adoption of blockchain devices is the high initial cost of these devices. In the case of SMEs and individuals in developing regions, this could be a serious barrier. Hardware wallets can be as expensive as USD 100 or more, and enterprise-grade blockchain devices such as decentralized storage nodes can cost thousands of dollars. This cost burden is further magnified by the need for the users to learn and use supplementary software that would often need expert training.

The World Bank recently published in 2024, a research where it discovered that low-income countries SMEs mentioned the costs as a hindrance in their adoption of blockchain solutions. This means blockchain technology has its own limitations toward making access democratized for the utilization of decentralized, secure systems. The key issue is cost, and so it is time that industry players began to think along the lines of cost optimization or perhaps subsidized programs, government grants to make this sort of product affordable and available for everyone.

Blockchain Devices Segment Analysis:

By Connectivity

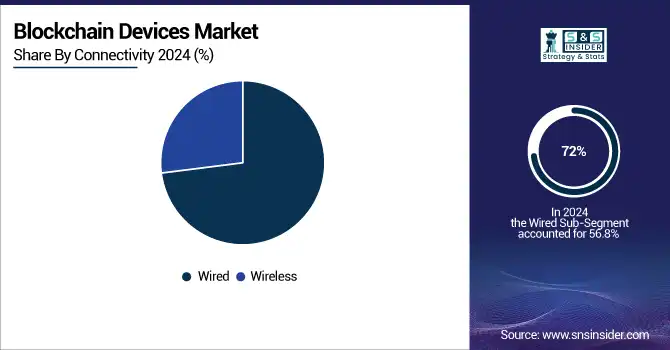

Wired segment dominated the Blockchain Devices Market in 2024 with 72% market share. The growth of wired devices can be attributed to the reliability and security of their connections, which is very important for enterprise-grade applications such as supply chain management and large-scale financial transactions. They also have faster data transfer rates and lower latency, making them ideal for high-stakes operations.

The Wireless segment is projected to grow at the fastest CAGR of 38.90% during the forecast period of 2025-2032. This growth is driven by rising demand for mobility and IoT with blockchain devices. Wireless connectivity also allows blockchain operations to be managed easily through smartphones and other portable devices catering to tech-savvy individuals and decentralized applications. Advanced wireless standards like Wi-Fi 6 and 5G further accelerate growth in this segment, enabling faster and more secure device operations.

By Application

The Corporate segment dominated the market in 2024 and covered 79% of the share. Enterprise blockchain are becoming increasingly used in securing financial transactions, digital identity management, and supply chain processes. ERP has also seen improvement in operation by the use of blockchain integration that has significantly minimized fraud cases. For example, multinational corporations, such as IBM and Walmart, have used blockchain devices to attain near real-time tracking in their supply chains and thus reduced inefficiencies by more than 50%.

The Personal segment is expected to grow at the highest CAGR of 38.99% from 2025 to 2032. This is attributed to the fast-growing popularity of cryptocurrency trading and increasing awareness of personal data security. In 2024, approximately 34% of cryptocurrency users worldwide used hardware wallets, which is expected to double by 2030. User-friendly and low-cost devices are driving innovation in this segment, including biometric authentication and mobile application integration. This trend presents the possibility that blockchain devices can become a mass consumer technology.

Blockchain Devices Regional Analysis:

North America Blockchain Devices Insights

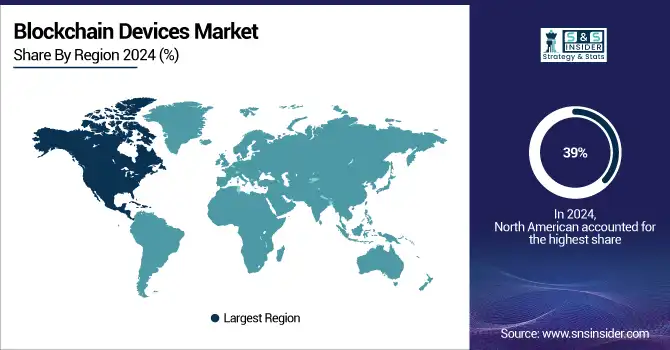

In 2024, the North America had a highest market share, reaching 39%. The dominant role of North America is linked to the top positions of this region by the significant players in blockchain technology, with beneficial government policy, and important investments in the R&D sectors. The USA and Canada have also taken the first place in sectors, such as financial and medical institutions, introducing and adopting blockchain innovations in their workflow.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific Blockchain Devices Insights

The Asia Pacific region is expected to lead the market at the highest CAGR of 39.09% during the forecast period of 2025-2032. The growth in the region is driven by fast-paced digital transformation in countries like China, India, and Singapore. Government initiatives such as China's Blockchain Service Network (BSN) and India's National Blockchain Strategy have spurred investments in blockchain infrastructure and devices. These countries' burgeoning start-ups and the rising adoption of cryptocurrency further emphasize the massive opportunity for blockchain devices within the region.

Europe Blockchain Devices Insights

Europe is a key market for blockchain devices, driven by strong regulatory frameworks, digital transformation initiatives, and growing adoption of decentralized finance. Countries like Germany, Switzerland, and the U.K. are leading in cryptocurrency usage and blockchain integration, fueling demand for secure hardware wallets, identity solutions, and enterprise-focused blockchain applications.

Latin America (LATAM) and Middle East & Africa (MEA) Blockchain Devices Insights

LATAM and MEA markets are experiencing steady growth in blockchain devices, supported by rising cryptocurrency adoption, remittance-driven economies, and government-led digitization efforts. Countries such as Brazil, Mexico, the UAE, and South Africa are embracing secure wallets, decentralized applications, and blockchain-enabled services, enhancing financial inclusion and streamlining cross-border transactions across these emerging regions.

Blockchain Devices Key Players:

Some of the major players in the Blockchain Devices Market are

-

Ledger (Nano X, Nano S Plus)

-

Trezor (Model T, One)

-

HTC (Exodus 1, Exodus 1s)

-

Samsung (KlaytnPhone, Galaxy Blockchain)

-

Bitmain (Antminer S19, Antminer T19)

-

Pundi X (XPOS, XWallet)

-

SIRIN Labs (FINNEY, Secure Comms)

-

Canaan (AvalonMiner, AI Chips)

-

ELLIPAL (Titan, Titan Mini)

-

Coldcard (Mk4, COLDCARD Wallet)

-

Binance (Binance Card, Trust Wallet)

-

SecuX (V20, W20)

-

KeepKey (Hardware Wallet)

-

Tangem (Tangem Cards, Crypto Storage)

-

Bitfi (Bitfi Wallet)

-

OpenDime (Bitcoin Stick, Cold Storage Device)

-

SafePal (S1 Wallet, Mobile App)

-

IBM (Blockchain Platform, Supply Chain Solutions)

-

Intel (Blockchain Solutions, Chipsets)

-

Microsoft (Azure Blockchain, Developer Tools)

Major Suppliers (Components, Technologies)

-

Taiwan Semiconductor Manufacturing Company (Chipsets, Microprocessors)

-

Samsung Foundry (Memory Chips, Processors)

-

SK Hynix (Flash Memory, DRAM)

-

NXP Semiconductors (NFC Chips, IoT Components)

-

Infineon Technologies (Security Chips, Cryptography Modules)

-

STMicroelectronics (Microcontrollers, Integrated Circuits)

-

Micron Technology (Memory Solutions)

-

Texas Instruments (Sensors, Analog Devices)

-

Advanced Micro Devices (GPUs, Processors)

-

NVIDIA (Graphics Processing Units)

Competitive Landscape for Blockchain Devices:

Trezor is a pioneer in blockchain devices, recognized for introducing the world’s first hardware wallet. The company focuses on providing secure, user-friendly solutions for cryptocurrency storage and transaction verification. With products like Trezor One and Model T, it emphasizes privacy, open-source security, and accessibility, making it a trusted choice in blockchain ecosystems.

-

June 2024: Trezor, a maker of crypto hardware wallets, announced a new family of products in three items during the BTC Prague 2024: the Trezor Safe 5 hardware wallet, a bitcoin-only version and the "Trezor Expert" onboarding service.

Ledger is a global leader in blockchain devices, specializing in secure hardware wallets such as Nano X and Nano S Plus. The company provides advanced solutions for safeguarding digital assets, enabling secure transactions, and managing decentralized applications. With strong security architecture and wide adoption, Ledger plays a vital role in blockchain device innovation.

-

May 2024: French startup Ledger, which has been most prominent for its secure crypto hardware wallets, is shipping new wallets nearly 18 months after announcing the latest Ledger Stax devices. The new wallet features an E Ink display and has been designed in partnership with Tony Fadell, one of the main designers behind the iPod.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.24 Billion |

| Market Size by 2032 | USD 16.81 Billion |

| CAGR | CAGR of 38.44% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Connectivity (Wired, Wireless) • By Component (Crypto Hardware Wallets, Blockchain Smartphones, Crypto ATMs, Blockchain IoT Gateways, POS Devices, Other) • By Application (Corporate, Personal) • By End-User (Consumer, BFSI, Government, Retail & E-commerce, Transportation & Logistics, Travel & Hospitality, Automotive, IT & Telecommunication, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Ledger, Trezor, HTC, Samsung, Bitmain, Pundi X, SIRIN Labs, Canaan, ELLIPAL, Coldcard, Binance, SecuX, KeepKey, Tangem, Bitfi, OpenDime, SafePal, IBM, Intel, Microsoft. |