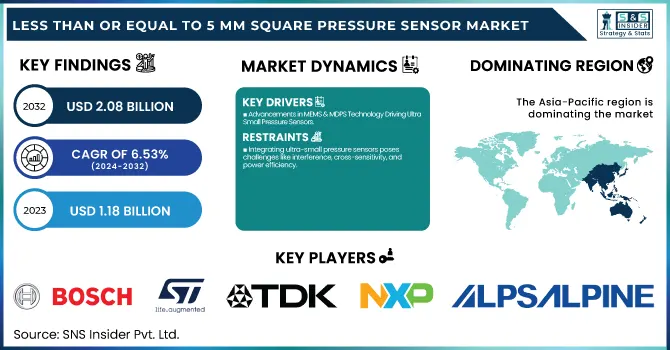

Less Than or Equal To 5 Mm Square Pressure Sensor Market Size:

The Less Than or Equal to 5 Mm Square Pressure Sensor Market size was valued at USD 1.18 Billion in 2023, and expected to reach USD 2.08 Billion by 2032, growing at a CAGR of 6.53% during 2024-2032. A key driver for market growth is the increasing demand for miniaturized sensors in wearable and medical devices. As healthcare and consumer electronics industries push for compact, high-precision sensing solutions, ultra-small pressure sensors are becoming essential for implantable medical devices, smartwatches, and fitness trackers.

To Get more information on Less Than or Equal to 5 Mm Square Pressure Sensor Market - Request Free Sample Report

Additionally, advancements in MEMS technology and AI-driven sensor integration are enhancing performance while reducing power consumption. The market is also influenced by rising investments in R&D, a well-optimized supply chain, and increased adoption across automotive, industrial, and IoT applications.

Less Than or Equal To 5 Mm Square Pressure Sensor Market Dynamics:

Drivers:

-

Advancements in MEMS & MDPS Technology Driving Ultra-Small Pressure Sensors

The rapid advancement of Micro-Electro-Mechanical Systems (MEMS), nano-sensor technology, and Microsized Differential Pressure Sensors (MDPSs) is driving the growth of the ≤5 mm² pressure sensor market, enabling higher sensitivity, lower power consumption, and superior performance. MDPSs have emerged as critical components in biomedicine, aerospace, blast damage assessment, and fire safety systems, emphasizing their engineering and medical significance. These sensors typically operate within pressure ranges below 10 kPa, necessitating exceptional sensitivity, high resolution, and compact form factors. Among different sensor types, piezoresistive MDPSs are preferred over capacitive sensors due to their superior linearity and chip miniaturization potential. To enhance performance, innovative designs like the beam-membrane-island sensor have been developed, achieving 66 μV/V/kPa sensitivity and a natural frequency of 11.3 kHz, making them particularly effective in medical ventilators and fire residual pressure monitors. Additionally, advancements in silicon and quartz-based resonant pressure sensors (RPSs) have led to an accuracy of ±0.01%FS, ensuring high temperature stability and precision, further reinforcing their importance in high-accuracy applications.

Restraints:

-

Integrating ultra-small pressure sensors poses challenges like interference, cross-sensitivity, and power efficiency.

Integrating ultra-small pressure sensors into complex systems such as medical devices and aerospace applications presents significant challenges. These sensors must operate in environments with high electromagnetic interference, leading to signal distortion and reduced accuracy. Cross-sensitivity to temperature, humidity, and mechanical stress further complicates their performance, requiring advanced compensation techniques. Additionally, power efficiency remains a major concern, as these sensors often function in battery-operated or energy-harvesting systems where minimal power consumption is crucial. Ensuring stable operation while maintaining high sensitivity and resolution demands sophisticated design strategies, including optimized signal processing and shielding methods. Overcoming these integration hurdles is essential for maximizing the reliability and efficiency of ultra-small pressure sensors in critical applications.

Opportunities:

-

IoT and Smart Systems Driving Growth in Ultra-Small Pressure Sensors

The increasing integration of ultra-small pressure sensors in IoT devices, smart wearables, and industrial automation presents a major growth opportunity for the market. These sensors enable real-time monitoring, predictive maintenance, and enhanced connectivity across various applications, including healthcare, environmental monitoring, and precision manufacturing. In smart wearables, they improve health tracking by providing accurate biometric data, while in industrial automation, they enhance operational efficiency by detecting pressure variations in critical systems. The expansion of Industry 4.0 and the demand for compact, high-performance sensors further drive adoption. Additionally, advancements in wireless sensor networks and AI-driven analytics are enhancing data processing capabilities, making these sensors indispensable for next-generation IoT solutions. As industries continue to shift toward automation and connected ecosystems, the demand for ultra-small pressure sensors is expected to grow significantly.

Challenges:

-

High Manufacturing Costs and Design Complexity Restraining Sensor Market Growth

The production of high-temperature pressure sensors and force/torque sensors faces significant cost challenges due to advanced fabrication techniques and intricate designs. The need for precision engineering, complex geometries, and high-performance materials—such as Silicon-On-Insulator (SOI) for pressure sensors and multi-component structures for 6-DOF force/torque sensors—drives up manufacturing expenses. Additionally, customization requirements for robotic applications, particularly in joint-integrated torque sensors, add to design complexity and production costs. While simplified geometries and cost-effective alternatives are being explored, achieving high sensitivity, durability, and performance without escalating expenses remains a critical market restraint, limiting broader adoption in robotics, automation, and industrial applications.

Less Than or Equal To 5 Mm Square Pressure Sensor Market Segment Analysis:

By Product

In 2023, the Absolute Pressure Sensor segment held the largest revenue share in Less Than or Equal To 5 Mm Square Pressure Sensor Market of approximately 55%, driven by its high precision, reliability, and broad applicability across industries. These sensors measure pressure relative to a perfect vacuum, making them essential for altitude sensing, industrial automation, weather monitoring, and medical devices. Their ability to deliver accurate, stable readings despite environmental fluctuations has fueled adoption in automotive applications (e.g., engine management systems), aerospace, and HVAC systems. Additionally, advancements in MEMS technology have enhanced their miniaturization, power efficiency, and sensitivity, further strengthening their market dominance.

The Differential Pressure Sensor segment is projected to be the fastest-growing in the Less Than or Equal To 5 Mm Square Pressure Sensor Market from 2024 to 2032, driven by rising demand in HVAC systems, medical devices, industrial automation, and smart monitoring applications. These sensors are essential for precise airflow measurement, fluid level monitoring, and filtration system efficiency, making them critical in biomedical applications (e.g., ventilators and respiratory monitoring), automotive systems, and industrial process control. Technological advancements in MEMS and nano-sensor technology have significantly improved their sensitivity, miniaturization, and integration capabilities, further propelling market expansion. Increasing emphasis on energy efficiency, predictive maintenance, and IoT-enabled monitoring will continue to boost adoption across various sectors.

By Type

The Wired segment dominated the Less Than or Equal To 5 Mm Square Pressure Sensor Market in 2023, accounting for approximately 59% of revenue, due to their enhanced reliability due to the constant power supply, as well as technology that creates a more stable signal transmission, thus boosting demand in various applications such as medical devices, industrial automation, and automotive. When real-time uninterrupted data is necessary, these sensors are used in many applications in critical environments such as invasive medical monitoring, aerospace systems, and industrial process control. Compared to wireless alternatives, wired sensors provide low latency, improved security, and immunity to electromagnetic interference (EMI) making them the first choice for high-precision applications. Continued improvements in miniaturization and MEMS technology is only further cementing their market leadership going forward.

The Wireless segment is the fastest-growing in the Less Than or Equal To 5 Mm Square Pressure Sensor Market from 2024 to 2032, driven to increase in HVAC systems, medical devices, industrial automation and smart monitoring system. These sensors are crucial for accurate airflow/mass flow determination, fluid level monitoring, and filtration system effectiveness, and may be fundamental in biomedical applications (ventilators and respiratory monitoring), automotive systems, and industrial process management. MEMS and nano-sensor technology advancements have markedly enhanced their sensitivity, miniaturization, and integration potential, thereby driving the growth of the market. The increasing focus on energy efficiency, predictive maintenance and IoT-enabled monitoring will further catalyze adoption across sectors.

By Technology

The piezo resistive segment dominated the Less Than or Equal To 5 Mm Square Pressure Sensor Market, accounting for approximately 50% of total revenue in 2023. This dominance is driven by high sensitivity, accuracy, and reliability in various applications, including medical devices, industrial automation, automotive, and consumer electronics. Piezo resistive sensors leverage silicon-based MEMS technology, offering compact size, low power consumption, and cost-effectiveness, making them ideal for ultra-small pressure sensing. Their ability to provide precise pressure measurements across a wide range of environments, including harsh conditions like extreme temperatures and high pressures, enhances their adoption. Increasing demand for miniaturized, high-performance pressure sensors in wearable health monitoring, smart devices, and IoT applications further strengthens their market position, ensuring continued growth.

The capacitive segment is projected to be the fastest-growing category in the Less Than or Equal To 5 Mm Square Pressure Sensor Market t from 2024 to 2032. With the requirement of high sensitivity, low energy consumption and better stability than other sensing technology, this trend is Ongoing. They are preferable for the wearables, medical devices, automotive applications and industrial automation as they have excellent performance in low-pressure ranges and can work in miniaturized designs. Driven by increasing need for high precision sensor in IoT, consumer electronics and aerospace industries is further driving adoption. Furthermore, the development in MEMS technology and the demand for energy-efficient and ultra-small sensor solutions shall be a significant driving force for innovation and market growth both during the forecast period.

By Application

The consumer electronics segment dominated the Less Than or Equal To 5 Mm Square Pressure Sensor Market, accounting for 41% of total revenue in 2023. The increasing integration of miniature pressure sensors in smartphones, wearables, tablets, and IoT devices has driven significant market growth. These sensors enable altitude detection, touch sensitivity, and enhanced user experiences, making them essential for next-generation electronic devices. The demand for compact, energy-efficient, and high-performance sensors is rising, fueled by advancements in MEMS technology and the growing trend of smart and connected devices. Additionally, expanding applications in virtual reality (VR), augmented reality (AR), and gaming devices further boost the adoption of these sensors, solidifying consumer electronics as the market's dominant segment.

The medical segment is the fastest-growing in the ≤5 mm² Pressure Sensor Market from 2024 to 2032, driven by the rising adoption of miniature sensors in wearable health devices, patient monitoring systems, and minimally invasive medical procedures. With the ability to measure blood pressure, respiratory rate, and intraocular pressure, these sensors allow for real-time surveillance of vital signs and improved early detection and personalized treatment of diseases. These factors, including the rising prevalence of chronic diseases as well as demand for home-based healthcare solutions, are driving the growth of this market. Moreover, innovations in MEMS technology and the demand for smaller, efficient medical devices are propelling the adoption. This rapid growth of the medical segment can also be attributed to various regulatory approvals and increasing investments in smart healthcare innovations.

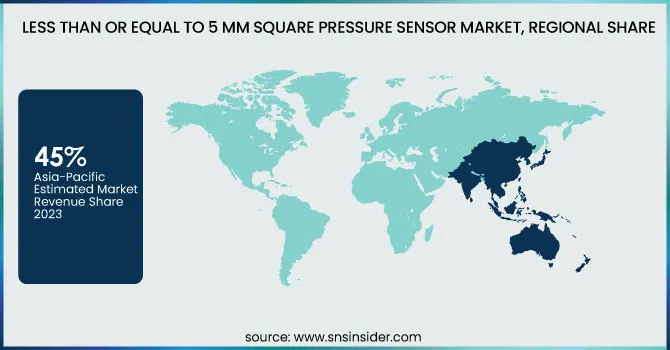

Less Than or Equal To 5 Mm Square Pressure Sensor Market Regional Analysis:

Asia-Pacific dominated the Less Than or Equal To 5 Mm Square Pressure Sensor Market in 2023, accounting for 45% of total revenue, due to the increasing consumer electronics, automotive, and healthcare sectors. The increase in demand for miniaturized sensors in smartphones, wearables and IoT devices, in conjunction with government activities promoting industrial automation and advancements in healthcare, has contributed to the expansion of the market. Countries such as China, Japan and South Korea are at the forefront of sensor manufacturing and R&D, greatly benefiting from robust semiconductor production capabilities. The dominance of the region is also attributed to the high adoption of MEMS-based sensors in various medical and automotive applications and increased investments in smart infrastructure. In addition, favorable policies as well as a robust electronics supply chain continue to cement Asia-Pacific’s dominance over this market.

North America is projected to hold a significant share in the Less Than or Equal To 5 Mm Square Pressure Sensor Market from 2024 to 2032, driven to high demand in the healthcare and aerospace, as well as consumer electronics industries. Some of the major growth drivers are the presence of leading sensor manufacturers, advanced research and development capabilities in the region, and the implementation of IoT and AI technologies. This has expanded the market, as miniaturized pressure sensors are increasingly incorporated in medical devices, smart wearables, and industrial automation. This growth is further driven by the increasing trend toward autonomous vehicles and connected devices. United States and Canada are expected to dominate the market owing to their strong semiconductor industry and government investments toward smart infrastructure which will ensure steady growth of the market in forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Players in Less Than or Equal To 5 Mm Square Pressure Sensor Market along with their product:

-

Robert Bosch GmbH (Germany) – Automotive and industrial pressure sensors

-

STMicroelectronics (Switzerland) – MEMS-based pressure sensors for consumer electronics and automotive applications

-

TDK Corporation (Japan) – Capacitive and piezoresistive pressure sensors for industrial and medical use

-

NXP Semiconductors (Netherlands) – Automotive-grade and industrial pressure sensors

-

ALPS ALPINE CO., LTD (Japan) – MEMS pressure sensors for automotive and consumer electronics

-

Althen Sensors and Controls (Germany) – High-precision industrial and aerospace pressure sensors

-

Phoenix Sensors (USA) – Wireless and IoT-integrated pressure sensors

-

Goertek (China) – Miniature MEMS pressure sensors for smart devices and wearables

-

ROHM Co., Ltd. (Japan) – Digital and analog pressure sensors for automotive and medical applications

-

Honeywell International Inc. (USA) – Industrial and aerospace pressure sensors

-

Sensata Technologies (USA) – Automotive and industrial pressure sensors

-

Infineon Technologies (Germany) – MEMS-based pressure sensors for automotive and industrial use

-

TE Connectivity (Switzerland) – Pressure sensors for industrial automation and medical applications

-

Murata Manufacturing Co., Ltd. (Japan) – MEMS and piezoresistive pressure sensors for various applications

-

OMRON Corporation (Japan) – High-precision pressure sensors for healthcare and industrial automation

List of key suppliers that provide raw materials and components for the pressure sensor market:

Raw Material Suppliers

-

BASF SE

-

Dow Inc.

-

DuPont

-

3M Company

-

Shin-Etsu Chemical Co., Ltd.

-

Wacker Chemie AG

-

Mitsui Chemicals, Inc.

Semiconductor & MEMS Component Suppliers

-

Siltronic AG

-

Soitec

-

ROHM Semiconductor

-

Texas Instruments

-

Analog Devices, Inc.

-

ON Semiconductor

-

Infineon Technologies

MEMS Fabrication & Foundry Services

-

TSMC

-

GlobalFoundries

-

UMC

-

X-FAB Silicon Foundries

Metal & Ceramic Component Suppliers

-

H.C. Starck

Recent Development:

-

Mar 4, 2025: STMicroelectronics launched the STM32WBA6 series of wireless microcontrollers, expanding the IoT bandwidth with increased memory, security and multi-protocol support in smart home, healthcare and industrial usage. Anaheim, CA, January 15, 2023 – Embedding 802.11 is rapidly becoming a necessary standard for the 2.4GHz wireless market.

-

January 17, 2025: The Omron Platinum BP5450 is out top home blood pressure monitor; there's an ever-increasing need for accurate and user-friendly health-monitoring devices. It is indicative of a growing market movement towards smart, connected healthcare projects.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.18 Billion |

| Market Size by 2032 | USD 2.08 Billion |

| CAGR | CAGR of 6.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Absolute Pressure Sensor, Differential Pressure Sensor, Gauge Pressure Sensor) • By Type (Wired, Wireless) • By Technology (Piezo resistive, Capacitive, Resonant Solid State, Others) • By Application(Automotive, Oil & Gas, Consumer Electronics, Medical, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Robert Bosch GmbH (Germany), STMicroelectronics (Switzerland), TDK Corporation (Japan), NXP Semiconductors (Netherlands), ALPS ALPINE CO., LTD (Japan), Althen Sensors and Controls (Germany), Phoenix Sensors (USA), Goertek (China), ROHM Co., Ltd. (Japan), Honeywell International Inc. (USA), Sensata Technologies (USA), Infineon Technologies (Germany), TE Connectivity (Switzerland), Murata Manufacturing Co., Ltd. (Japan), OMRON Corporation (Japan). |