Laser Diode Market Report Scope & Overview:

The Laser Diode Market was valued at USD 7.28 billion in 2024 and is expected to reach USD 19.94 billion by 2032, growing at a CAGR of 13.42% from 2025-2032.

The Laser Diode Market growth is driven by rising demand for high-performance optical communication, advanced medical devices, and precision manufacturing tools. Expanding applications in LiDAR, defense, and consumer electronics, coupled with technological advancements in miniaturization and energy efficiency, are fueling adoption. Additionally, the increasing deployment of 5G networks and smart sensing systems supports sustained market expansion.

To Get more information on Laser Diode Market - Request Free Sample Report

Laser Diode Market Size and Forecast

-

Market Size in 2024: USD 7.28 Billion

-

Market Size by 2032: USD 91.73 Billion

-

CAGR: 4.76% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Laser Diode Market Trends

-

Rising demand for high-speed data communication, sensing, and laser-based manufacturing is driving the laser diode market.

-

Growing adoption in telecommunications, consumer electronics, healthcare, and automotive LIDAR applications is boosting growth.

-

Expansion of optical storage, barcode scanning, and printing systems is fueling market demand.

-

Advancements in high-power, compact, and energy-efficient laser diode designs are enhancing performance and reliability.

-

Increasing focus on miniaturization and integration in portable and wearable devices is shaping market trends.

-

Collaborations between semiconductor manufacturers, telecom providers, and automotive OEMs are accelerating innovation and commercialization.

-

Growing adoption of laser diodes in medical procedures, industrial cutting, and defense applications is supporting global market expansion.

Laser Diode Market Growth Drivers:

• Laser Diode Market Growth Driven by Consumer Trends in Communication Healthcare and Consumer Electronics Expansion

The Laser Diode Market is driven by big consumer trends powered by the recent advances in technology with enormous demand for miniaturized, high-efficiency laser solutions in price sensitive applications. One of the key factors fueling growth is the rise of laser diodes in communication systems connecting the dots in fiber-optic networks and data centers. Also, growth is being bolstered by the medical and healthcare sectors with applications such as microsurgery, diagnostics, and imaging systems. Moreover, the growth of consumer electronics such as smartphones, smart TVs and gaming systems are fueling the demand for laser diodes as they perform better than regular displays and sensors.

Laser Diode Market Restraints:

• Restrain in Laser Diode Market Integration Sensitivity and Regulatory Issues Impacting Growth and Adoption

The major restrain in laser diode market is its integration and compatibility to existing systems. Standardization presents a challenge for most high-tech industries as many laser diodes must function within specific wavelength and power ranges. Moreover, laser diodes are extremely sensitive to environmental factors like temperature and humidity, which can have an impact on function and lifespan. This high-power density, however, asks for sophisticated thermal management solutions which makes the design complex. Moreover, regulations and laser exposure safety concerns for medical, industrial, and defense applications prevent rapid dissemination.

Laser Diode Market Opportunities:

• Laser Diode Market Opportunities Surge with Autonomous Vehicles Industrial Defense and Emerging Technologies Innovation

The growth in utilization of laser diodes in autonomous vehicles in the automotive sector for LiDAR, lighting system drives lucrative opportunities in the market. Industrial applications, particularly those that require precise laser cutting and engraving in manufacturing processes, also represent a large opportunity. Spending on defense and innovation on military technologies will stimulate additional growth yet again. Furthermore, with the emergence of applications such as 3D printing, optical storage, and quantum computing that call for further adoption of laser diodes, these lasers are well-positioned to be a vehicle for ongoing innovation and growth in the coming years.

Laser Diode Market Challenges:

• Laser Diode Market Faces Challenges in Innovation Efficiency Supply Chain Disruptions and Material Limitations

The fast-paced nature of technology and the continuous need for lasers innovation and upgrade poses as one of the challenges in the market. Shifting away from older lighting and display technologies to laser-based systems requires substantial R&D and specialists who can manage the technology. The other is the restricted efficiencies of some laser diode materials, which limits performance at high powers. But production can also be thrown into uncertainty by supply chain disruptions and the dependence on components made from rare materials such as gallium and indium. Hit hurdles need to be overcome but that requires a strategic partnership, breaking ground in material science, and continued R&D advancement.

Laser Diode Market Segment Analysis

By Wavelength, Red Laser Diodes dominated with ~35.1% share in 2024; Blue Laser Diodes fastest growing (CAGR)

In 2024, red laser diodes held a substantial share of 35.1% in the global laser diode market as they are widely used in barcode scanners, laser pointers, optical storage devices, and several medical applications. They are also favored for consumer electronics and industrial applications due to their cost-effectiveness, energy efficiency, and stability. Improvements in holography and display technologies have also increased the need for these tools.

Blue laser diodes are projected to witness the highest CAGR from 2025 to2032. Having a shorter wavelength leads to better data storage density and higher precision during manufacturing and medical processes. Additionally, increasing target penetration of laser furious type projection systems and automotive LiDAR applications also fuels their market growth.

By Diode Doping Material, Gallium Aluminum Arsenide (GaAlAs) dominated with ~39.6% share in 2024; Gallium Arsenide (GaAs) fastest growing (CAGR)

Gallium Aluminum Arsenide (GaAlAs) led the way in 2024 boasting a 39.6% share owing to its widespread use in infrared and red laser diodes, essential components for optical communication, medical devices, and consumer electronics. The product has made its market leadership extremely strong due to its advantages like high efficiency, low power consumption and, reliability in diverse applications. The demand for GaAlAs-based laser diodes is further propelled by the application of these diodes in CD/DVD players, barcode scanners, and fiber-optic systems.

The Gallium Arsenide (GaAs) segment is anticipated to record the fastest compound annual growth rate during 2025 - 2032. Due to their better thermal stability and higher electron mobility than other distinctive materials, GaAs-structured laser diodes provide valuable potential applications to next-generation telecommunications, LiDAR, and also industrial laser packaging systems. Furthermore, its increasing demand in advanced medical imaging and defense applications is papering its robust market growth.

By Technology, Quantum Cascade Laser Diodes dominated with ~37.4% share in 2024; Distributed Feedback (DFB) Laser Diodes fastest growing (CAGR)

In 2024, the Quantum Cascade Laser diodes accounted for the largest share of 37.4% in the market owing to their efficient performance in the mid-infrared range which covers some of the most useful applications such as gas sensing, spectroscopy, and defense systems. And their potential in operating across several wavelengths and not needing cryogenic cooling is perfect for both industrial and scientific applications. Moreover, their excellent efficiency and tunability have made them widely used in the environmental monitoring and security domain.

The Distributed Feedback laser diodes segment is projected to expand at the fastest CAGR from 2025 to 2032 owing to increasing demand for long wavelength light for telecommunication, data center, and high-speed optical network applications, during the forecast period. Due to their stability in the wavelength and narrow linewidth, these are very important in fiber-optic communication and advanced sensing applications. In addition, the implementation of 5G technology and quantum communication is accelerating the uptake of DFB lasers making the market growth fast paced.

By Application, Medical & Healthcare dominated with ~35.7% share in 2024; Military & Defense fastest growing (CAGR).

In 2023, the medical & healthcare sector dominated the market with 35.7% share in 2024, it is owing to the laser diode use in surgeries, dermatology, ophthalmology, & diagnostic imaging. This has spurred a consistent demand due to their precision, lower invasiveness, and necessity to perform such procedures as laser therapy, vision correction, and dental uses. Moreover, market growth also drove by the growing demand for no or minimal invasive treatment options and development in medical laser technology.

The military & defense segment is projected to witness the highest CAGR during the period from 2025 to 2032, owing to the rising use for laser targeting, range finding, and directed-energy weapons. High-power laser diodes are also witnessing high demand as the need for high-end surveillance, communication, and countermeasure systems grows. Moreover, defense modernization and the emergence of next-generation laser-based weapon technology are also spurring market growth in this segment.

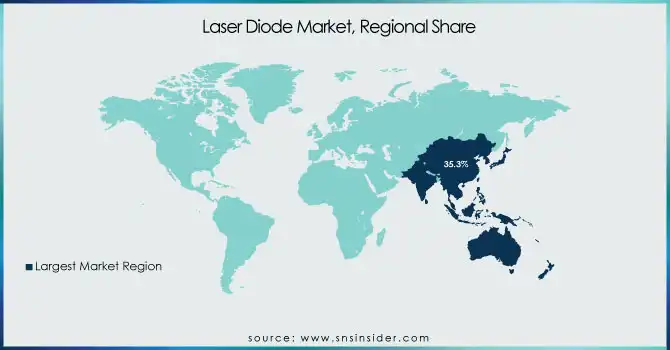

Laser Diode Market Regional Analysis

Asia Pacific Laser Diode Market Insights

The Asia Pacific region held the largest share of the market in 2024 at 35.3% and is projected to record the fastest CAGR during the forecast period of 2024 to 2032 due rapid industrial development, rising technological innovations, and the growing demand for laser diodes from various end-user industry verticals. China, Japan, and South Korea are leading the way for the innovation and development of the LED or laser diode, due to large investments by these countries in telecommunications, consumer electronics, and automotive industries. The burgeoning fiber-optic networks and 5G infrastructure in China; the inventive medical laser technologies in Japan and strong semiconductor market in South Korea, for example, all drive demand for laser diodes.

North America Laser Diode Market Insights

The North America Laser Diode Market is experiencing strong growth due to increasing adoption in telecommunications, defense, and medical sectors. Rising demand for high-speed optical networks, laser-based medical treatments, and LiDAR systems in autonomous vehicles is fueling market expansion. Moreover, technological innovations and significant R&D investments by leading manufacturers are further strengthening regional market growth.

Europe Laser Diode Market Insights

The Europe Laser Diode Market is growing steadily driven by advancements in industrial automation, automotive LiDAR, and medical laser applications. Expanding demand for precision manufacturing and optical communication solutions supports market expansion. Additionally, strong government initiatives for renewable energy, research in photonics, and increasing adoption of laser technologies in healthcare and defense sectors enhance regional growth.

Middle East & Africa and Latin America Laser Diode Market Insights

The Middle East & Africa and Latin America Laser Diode Market is witnessing gradual growth driven by rising investments in telecommunications, industrial automation, and healthcare infrastructure. Expanding adoption of laser-based medical treatments, optical communication, and defense technologies is enhancing demand. Moreover, increasing smart city projects and digital transformation initiatives are creating new opportunities for regional market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Laser Diode Market Competitive Landscape:

IPG Photonics Corporation

IPG Photonics Corporation is a global leader in high-performance fiber laser and amplifier technologies for industrial, medical, and communications applications. The company specializes in high-power lasers for materials processing, cutting, welding, and additive manufacturing, continuously innovating to improve efficiency and system integration. With a strong focus on automation, compact design, and cost optimization, IPG Photonics supports industries transitioning toward sustainable and high-precision manufacturing solutions.

-

2025: Released high-power lasers built on a new RI platform, leveraging next-generation laser pump diodes to reduce floor space by 60% and lower total cost of ownership for manufacturing systems.

-

2024: Completed the acquisition of cleanLASER, enhancing its portfolio in laser-cleaning and manufacturing solutions by integrating advanced diode-pumped and fiber-laser technologies.

Lumentum Holdings Inc.

Lumentum Holdings Inc. designs and manufactures optical and photonic products used in communications, industrial, and consumer markets. The company’s innovations span laser diodes, optical components, and subsystems that enable high-speed data transmission, precision manufacturing, and sensing technologies. Lumentum’s focus on scalable, high-performance photonic solutions supports the rapid growth of cloud, AI, and data networking infrastructure worldwide.

-

2024: Unveiled breakthrough innovations and demonstrations in photonic technologies for cloud, AI, and networking at OFC 2024, featuring advanced laser diode components and modules.

Nichia Corporation

Nichia Corporation, a pioneer in LED and laser diode technology, develops advanced optoelectronic devices for applications in automotive, display, and industrial manufacturing. The company emphasizes R&D excellence in semiconductor materials and laser processing technologies, collaborating globally to expand innovation in next-generation photonics. Nichia continues to drive advancements in efficient and high-precision light sources that power mobility and production systems.

-

2024: Opened a laser-processing solution laboratory in Kariya City, Japan, jointly with Furukawa Electric Co., Ltd., accelerating development of next-generation laser diodes for mobility and production.

-

2025: Signed an expanded patent cross-license agreement with ams OSRAM covering LED and laser-diode innovations, strengthening intellectual property collaboration in photonics and laser diode technology.

ams OSRAM AG

ams OSRAM AG is a leading provider of optical solutions, combining sensor and light technologies to enable advanced illumination, visualization, and sensing systems. The company’s portfolio includes LEDs, laser diodes, and photonic sensors that serve automotive, industrial, and consumer markets. ams OSRAM focuses on sustainable innovation, miniaturization, and precision in light-based technologies for mobility, smart devices, and high-speed data communications.

-

2023: Introduced new-generation blue and green single-mode laser diodes (PLT3 and PLT5), featuring reduced operating current and narrower beam-quality tolerances for portable sensing systems.

-

2025: Signed an expanded patent cross-license agreement with Nichia Corporation covering LED and laser-diode innovations, reinforcing strategic collaboration in photonics and laser diode technology.

Key Players

Some of the major players in the Laser Diode Market are:

• IPG Photonics (High-Power Fiber Lasers, Diode Laser Systems)

• Jenoptik (High-Power Diode Lasers, Solid-State Lasers)

• Nichia Corporation (Blue Laser Diodes, UV Laser Diodes)

• Osram Opto Semiconductors (High-Power Laser Diodes, Infrared Laser Diodes)

• Sony Corporation (Blue-Violet Laser Diodes, Red Laser Diodes)

• Sharp Corporation (Green Laser Diodes, Blue Laser Diodes)

• Panasonic Corporation (Blue Laser Diodes, Red Laser Diodes)

• Mitsubishi Electric (High-Power Red Laser Diodes, Infrared Laser Diodes)

• ROHM Semiconductor (Blue-Violet Laser Diodes, Red Laser Diodes)

• Sumitomo Electric Industries (High-Power Laser Diodes, Fiber-Coupled Laser Diodes)

• Thorlabs (Single-Mode Laser Diodes, Multimode Laser Diodes)

• Coherent Inc. (High-Power Diode Lasers, Fiber-Coupled Laser Diodes)

• Finisar Corporation (VCSELs, DFB Laser Diodes)

• Lumentum Holdings (High-Power Laser Diodes, Tunable Laser Diodes)

• II-VI Incorporated (Pump Laser Diodes, High-Power Laser Diodes)

• nLIGHT (High-Power Semiconductor Lasers, Fiber-Coupled Laser Diodes)

• Trumpf (High-Power Diode Lasers, Disk Lasers)

• Hamamatsu Photonics (Quantum Cascade Lasers, VCSELs)

• Furukawa Electric (Pump Laser Diodes, High-Power Laser Diodes)

• Bookham Technology (now part of Lumentum) (High-Power Laser Diodes, Tunable Laser Diodes)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 7.28 Billion |

| Market Size by 2032 | USD 19.94 Billion |

| CAGR | CAGR of 13.42% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Wavelength (Infrared Laser Diodes, Red Laser Diodes, Blue Laser Diodes, Blue Violet Laser Diodes, Green Laser Diodes, Ultraviolet Laser Diodes) • By Diode Doping Material (Gallium Aluminum Arsenide (GaAIAs), Gallium Arsenide (GaAs), Gallium Indium Arsenic Antimony (GaInAsSb), Aluminum Gallium Indium Phosphide (AIGaInP), Indium Gallium Nitride (InGaN), Gallium Nitride (GaN), Others) • By Technology (Double Hetero Structure Laser Diodes, Quantum Well Laser Diodes, Quantum Cascade Laser Diodes, Distributed Feedback Laser Diodes, SCH Laser Diodes, Vertical Cavity Surface Emitting Laser (VCSEL) Diodes, Vertical External Cavity Surface Emitting Laser (VECSEL) Diodes) • By Application (Telecommunication, Industrial, Medical & Healthcare, Military & Defense, Consumer Electronics, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IPG Photonics, Jenoptik, Nichia Corporation, Osram Opto Semiconductors, Sony Corporation, Sharp Corporation, Panasonic Corporation, Mitsubishi Electric, ROHM Semiconductor, Sumitomo Electric Industries, Thorlabs, Coherent Inc., Finisar Corporation, Lumentum Holdings, II-VI Incorporated, nLIGHT, Trumpf, Hamamatsu Photonics, Furukawa Electric, Bookham Technology. |