Track Geometry Measurement System Market Size & Overview:

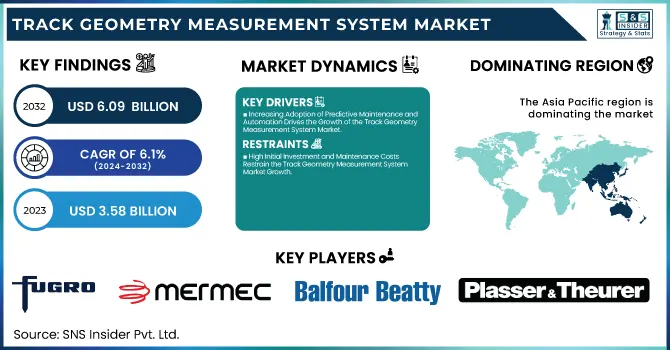

The Track Geometry Measurement System Market Size was valued at USD 3.58 Billion in 2023 and is expected to reach USD 6.09 Billion by 2032 and grow at a CAGR of 6.1% over the forecast period 2024-2032. The Market is expanding due to rising demand for advanced rail infrastructure monitoring. TGMS enhances safety, reduces maintenance costs, and improves efficiency through real-time track analysis. The shift to predictive maintenance, along with IoT, AI, and laser-based technologies, has accelerated adoption in high-speed railways, metros, and freight corridors. Government-led railway modernization and stricter safety regulations further drive growth. The rise of contactless and autonomous TGMS improves accuracy and efficiency. Automated, high-speed measurement vehicles are replacing manual inspections, cutting costs and time. As smart rail networks evolve, TGMS remains crucial for safe, efficient rail operations.

To Get more information on Track Geometry Measurement System Market - Request Free Sample Report

Track Geometry Measurement System (TGMS) Market Dynamics

Key Drivers:

-

Increasing Adoption of Predictive Maintenance and Automation Drives the Growth of the Track Geometry Measurement System Market

The growing need for predictive maintenance and automation in rail infrastructure is a significant driver of the Track Geometry Measurement System (TGMS) Market. Rail operators and governments are investing in advanced monitoring technologies to ensure railway safety, reduce maintenance costs, and enhance operational efficiency. Traditional manual inspections are being replaced by automated, contactless measurement systems that provide real-time data on track conditions, alignment, and irregularities. The integration of AI, IoT, and laser-based sensors has further enhanced TGMS capabilities, allowing for faster, more accurate, and predictive diagnostics. The rising global railway infrastructure projects and the expansion of high-speed rail networks have fueled the demand for automated TGMS solutions. Additionally, stringent railway safety regulations and the growing adoption of digital twin technology in railway asset management are accelerating market growth. As rail networks modernize, TGMS is becoming an essential tool for preventive track maintenance and enhanced safety.

Restrain:

-

High Initial Investment and Maintenance Costs Restrain the Track Geometry Measurement System Market Growth

The Track Geometry Measurement System (TGMS) Market is the high initial investment and maintenance costs associated with these systems. Advanced contactless TGMS solutions, laser-based sensors, and AI-driven monitoring technologies require significant financial investments in procurement, installation, and calibration. Additionally, the integration of IoT, GPS, and AI-based analytics platforms increases operational costs, making adoption challenging for developing regions and small railway operators. Regular maintenance and software updates are necessary to ensure accurate measurements and system reliability, adding to overall expenses. Many railway authorities, especially in emerging economies, still rely on manual track inspections due to budget constraints, limiting the market expansion. Despite long-term benefits like reduced maintenance costs and improved railway safety, the upfront financial burden often delays adoption. Overcoming these challenges requires cost-effective solutions, government subsidies, and financing programs to encourage the widespread implementation of TGMS technology.

Opportunities:

-

Emerging Smart Rail Networks and Digital Twin Technology Create New Growth Opportunities in the TGMS Market

The increasing adoption of smart rail networks and digital twin technology is creating significant growth opportunities in the Track Geometry Measurement System (TGMS) Market. Governments and private rail operators are investing in next-generation railway infrastructure, integrating AI-powered TGMS solutions with digital twins for real-time monitoring and predictive analytics. Digital twin technology allows rail operators to simulate track conditions, predict failures, and optimize maintenance schedules, reducing unplanned downtime and improving efficiency. The demand for autonomous, high-speed measurement vehicles is also increasing, particularly in high-speed rail corridors and metro systems.

Additionally, the expansion of urban mass transit systems in densely populated regions presents further growth potential. With rising investments in AI-driven rail monitoring and automation, TGMS providers have opportunities to develop scalable, cloud-based solutions that offer enhanced data insights, remote monitoring capabilities, and better cost-effectiveness, further driving market expansion.

Challenges:

-

Integration Challenges and Data Management Complexities Hinder the Widespread Adoption of TGMS Solutions

One of the key challenges in the Track Geometry Measurement System (TGMS) Market is the complexity of integration and data management. TGMS solutions generate vast amounts of real-time track geometry data, requiring advanced data processing, storage, and analytics capabilities. Many railway operators struggle with legacy infrastructure, making it difficult to integrate modern AI-driven TGMS solutions with existing railway management systems.

Additionally, the lack of standardized data formats and interoperability issues across different railway networks hinders seamless deployment. Managing big data analytics, cloud integration, and cybersecurity concerns further complicates adoption. The transition from manual to fully automated TGMS solutions requires extensive training and technical expertise, adding to implementation challenges. To address these issues, industry stakeholders must focus on developing interoperable TGMS solutions, improving data management frameworks, and enhancing cybersecurity measures to ensure seamless integration and long-term reliability of track monitoring systems.

TGMS Market Segments Analysis

By Component

The Hardware segment accounted for the largest revenue share of 50% in 2023 in the Track Geometry Measurement System (TGMS) Market, driven by the increasing adoption of advanced sensors, laser-based measurement systems, and GPS-integrated track monitoring devices. Rail operators and infrastructure firms are prioritizing the deployment of high-precision track inspection hardware to enhance safety and operational efficiency.

Additionally, Siemens and Goldschmidt Thermit Group have introduced AI-powered smart sensors capable of detecting rail defects, misalignment, and track wear at high speeds. The growing demand for automated, contactless TGMS solutions has significantly boosted investments in ruggedized hardware that can operate in extreme conditions. With global railway expansion and modernization projects increasing, the hardware segment remains a critical component in ensuring efficient railway maintenance and reducing derailment risks.

The Services segment is expected to grow at the highest CAGR of 7.20% in the Track Geometry Measurement System (TGMS) Market, driven by the rising adoption of predictive maintenance solutions, cloud-based data analytics, and AI-driven inspection services. Rail operators are increasingly outsourcing track monitoring, maintenance, and data analysis services to specialized firms, reducing the burden of in-house infrastructure management.

Additionally, Fugro and MER MEC are offering end-to-end TGMS services, including track condition assessment, rail geometry analysis, and AI-enhanced reporting for railway authorities. The shift toward subscription-based and cloud-integrated track inspection services is further fueling market growth, allowing operators to leverage real-time insights for proactive maintenance. With rail networks expanding globally, the demand for cost-effective, AI-powered TGMS services is expected to rise, enabling safer and more efficient railway operations.

By Railway Type

The Mass Transit Railways segment accounted for the largest revenue share of 35% in 2023 in the Track Geometry Measurement System Market, driven by the increasing need for efficient urban transportation, rising passenger traffic, and growing investments in metro and light rail networks. As cities expand and urban congestion worsens, governments and private entities are focusing on mass transit infrastructure modernization, which requires advanced track monitoring and maintenance solutions.

Additionally, Fugro and Bentley Systems have launched cloud-based rail asset management solutions that enable real-time data analysis, reducing maintenance costs and minimizing service disruptions. The integration of IoT, AI, and autonomous inspection vehicles is further driving the adoption in smart metro rail projects. With the rise of high-capacity metro systems and light rail expansions worldwide, the demand for track geometry measurement solutions will continue to grow, ensuring safe, reliable, and efficient mass transit operations.

The Heavy Haul Railways segment is projected to grow at the highest CAGR of 7.4% in the Track Geometry Measurement System (TGMS) Market, fueled by the increasing demand for freight rail transport, rising bulk commodity shipments, and the need for improved track safety and efficiency. Heavy haul railways, which transport coal, minerals, oil, and agricultural goods, operate under extreme load conditions, requiring advanced TGMS solutions to monitor track wear, detect anomalies, and prevent derailments.

Additionally, MER MEC and Fugro have developed AI-powered predictive maintenance platforms that utilize satellite data and automated track inspection vehicles to detect infrastructure weaknesses before failures occur. The increasing adoption of autonomous track inspection trains and smart rail technologies is driving market growth, as heavy haul rail operators seek to minimize downtime, enhance safety, and optimize freight transport efficiency. With global freight rail expansion and technological advancements in predictive maintenance, the heavy haul TGMS market is set for significant growth.

By Operation

The Contact segment accounted for the largest revenue share of 57% in 2023 in the Track Geometry Measurement System (TGMS) Market, driven by the continued reliance on traditional wheel-rail interface measurement techniques for track maintenance and inspection. Contact-based TGMS solutions, such as mechanical track recording vehicles, chord-based measurements, and inertial measurement systems, provide high-accuracy data on track alignment, gauge, curvature, and surface irregularities.

Additionally, Goldschmidt Thermit Group and MER MEC have introduced dynamic track monitoring solutions, integrating automated wheel-rail interaction analysis to improve predictive maintenance planning. The cost-effectiveness, reliability, and high durability of contact-based TGMS continue to drive their adoption in mass transit, freight, and high-speed rail operations. While contact-based systems remain dominant, advancements in AI-driven data analytics and hybrid measurement solutions are enhancing their efficiency.

The Contactless segment is projected to grow at the highest CAGR of 6.97% in the Track Geometry Measurement System (TGMS) Market, driven by the increasing demand for non-intrusive, high-speed, and automated rail inspection technologies. Contactless TGMS solutions, such as laser-based LiDAR, inertial-based measurements, and optical 3D scanning, provide real-time, high-accuracy data without physical interaction with the track, reducing wear and tear while enabling continuous monitoring at high speeds.

Additionally, Fugro and EGIS have introduced autonomous rail drones and aerial monitoring solutions, leveraging LiDAR and infrared imaging for real-time track condition assessment. The rising adoption of IoT, AI-driven predictive analytics, and digital twin technologies is further boosting the demand for contactless TGMS in high-speed rail, metro, and freight applications. Railway operators seek to reduce manual inspections and enhance operational efficiency.

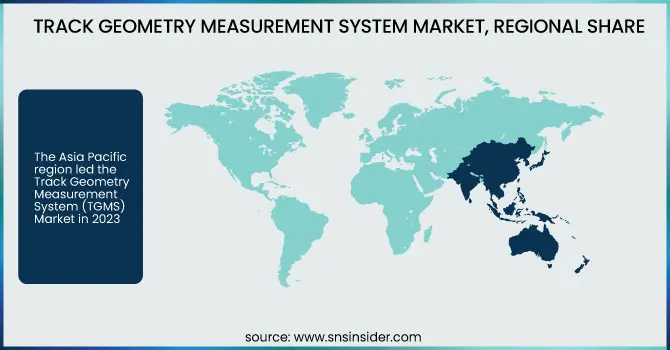

Track Geometry Measurement System Market Regional Analysis

The Asia Pacific region led the Track Geometry Measurement System (TGMS) Market in 2023, accounting for the largest market share, driven by rapid railway infrastructure development and government investments in railway modernization. Countries like China, India, and Japan are heavily investing in high-speed rail, metro expansions, and freight corridor projects, increasing the demand for automated track inspection and predictive maintenance technologies. China’s extensive high-speed railway network, spanning over 40,000 km, has driven significant adoption of TGMS solutions, with companies like China Railway Group and CRRC Corporation integrating laser-based, LiDAR, and inertial measurement systems for track monitoring. Similarly, India’s Dedicated Freight Corridor (DFC) and metro expansions have boosted the adoption of high-precision TGMS solutions for maintaining track efficiency and safety. With governments pushing for digital transformation and smart rail networks, Asia Pacific is expected to maintain its dominance in the TGMS market, supporting railway safety and operational efficiency.

The North American region is experiencing the highest CAGR in the Track Geometry Measurement System Market, driven by increasing investments in railway modernization, freight rail automation, and smart railway infrastructure. The estimated CAGR for North America in the forecast period is projected to be above 7.6%, fueled by rising demand for advanced track inspection technologies and AI-driven predictive maintenance systems. The U.S. and Canada are leading the adoption of contactless TGMS solutions, integrating satellite-based track monitoring, LiDAR, and drone-based inspection systems to improve rail safety. The U.S. Federal Railroad Administration (FRA) has implemented strict safety regulations, driving rail operators like Union Pacific and Canadian National Railway to adopt automated TGMS for efficient track condition assessment. Additionally, the rising expansion of metro rail systems in cities like New York, Los Angeles, and Toronto is further accelerating TGMS adoption, making North America the fastest-growing region in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Track Geometry Measurement System Market are:

-

Fugro (RILA Track Measurement System, Track Data Analysis Software)

-

MER MEC (Gravita Track Recording Vehicle, PANTOBOT 3D Overhead Line Inspection)

-

Balfour Beatty (OMNI Vision Track Inspection, Track Geometry Services)

-

Plasser & Theurer (EM-SAT 120 Track Geometry Measurement System, Track Recording Cars)

-

Siemens (Rail Infrastructure Monitoring System, Smart Track Condition Monitoring)

-

R. Bance & Co. (Track Inspection Gauges, Portable Rail Measurement Devices)

-

Bentley Systems (OpenRail Designer, Rail Asset Inspection Software)

-

Goldschmidt Thermit Group (TrackScan Compact, Rail Straightness Measurement System)

-

EGIS (Rail Track Condition Assessment, Digital Track Inspection Solutions)

-

DMA (Laser-based Track Geometry Systems, Real-time Rail Profile Monitoring)

-

Deutzer Technische Kohle (Rail Wear Measurement Tools, Contactless Track Inspection)

-

KZV, Spol. Sro (Track Alignment Measurement Systems, Ultrasonic Rail Testing)

-

Vista Instrumentation (High-Precision Rail Monitoring Sensors, Optical Track Inspection System)

-

ZG Optique (Laser Rail Profile Scanner, Optical Track Alignment Measurement)

Recent Trends

• In February 2024, Fugro unveiled a contactless mobile Track Geometry Measurement System (TGMS) integrated with IoT technology, allowing real-time data collection and analysis. This innovation significantly enhances railway track inspection efficiency, minimizes maintenance downtime, and improves safety by delivering high-precision measurement data for predictive maintenance and infrastructure monitoring.

• In November 2023, MER MEC introduced a high-speed Track Geometry Measurement System capable of operating at speeds of up to 400 km/h. This advanced TGMS improves measurement accuracy, supports high-speed rail networks, and enhances infrastructure monitoring efficiency, enabling more reliable and effective railway maintenance operations.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.58 Billion |

| Market Size by 2032 | USD 6.09 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Railway Type (Heavy Haul Railways, High-Speed Railways, Light Railways, Mass Transit Railways) • By Operation (Contact, Contactless [Inertial Based, Chord Based]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Fugro, MER MEC, Balfour Beatty, Plasser & Theurer, Siemens, R. Bance & Co., Bentley Systems, Goldschmidt Thermit Group, EGIS, DMA, Deutzer Technische Kohle, KZV Spol. Sro, Vista Instrumentation, ZG Optique. |