Internet of Things in Healthcare Market Size & Trends:

Get more information on Internet Of Things In Healthcare Market - Request Sample Report

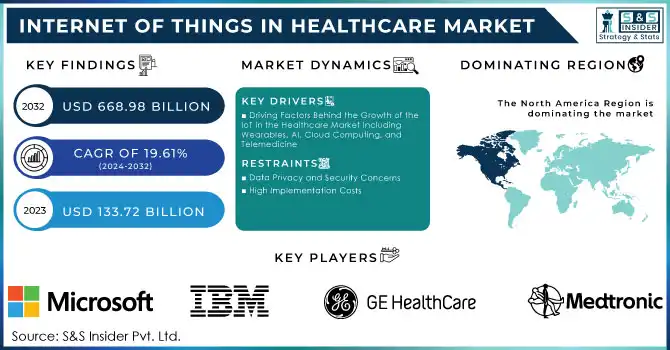

The Internet of Things in Healthcare Market Size was valued at USD 133.72 billion in 2023 and is expected to reach USD 668.98 billion by 2032 and grow at a CAGR of 19.61% over the forecast period 2024-2032.

The Internet of Things (IoT) in healthcare is rapidly transforming the medical field, driven by the proliferation of connected devices and advanced data analytics. One of the key enablers of this transformation is the increasing adoption of wearable health devices that continuously monitor patients’ vital signs. For instance, wearables like Fitbit and Apple Watch not only track physical activity but also measure heart rate, blood oxygen levels, and even ECGs. As the demand for such devices grows, these tools are offering new opportunities for chronic disease management, early detection, and real-time patient feedback. Research indicates that by 2025, the number of wearable connected devices will exceed 1.2 billion globally, underscoring the scale of this shift in healthcare delivery.

AI integration into IoT systems is enhancing the power of these devices, using machine learning algorithms to analyze large datasets generated by IoT devices. For example, predictive analytics powered by AI can help hospitals detect patient deterioration before it becomes critical, reducing readmission rates and improving patient outcomes. Hospitals using AI-driven analytics have reported reductions in readmissions and better management of chronic conditions. Additionally, AI is becoming an indispensable tool for personalized care by identifying patterns and making tailored treatment recommendations. AI's integration into healthcare systems is increasing the efficiency of diagnosis and improving accuracy, contributing to better clinical decisions and fewer errors. Furthermore, the role of cloud computing in IoT healthcare systems cannot be overstated. The cloud provides scalable storage and computing power, ensuring that patient data from diverse IoT devices can be securely stored, processed, and accessed from multiple healthcare settings. Cloud-based platforms, such as Amazon Web Services (AWS) and Microsoft Azure, support real-time data sharing between hospitals, clinics, and remote patient care providers, facilitating collaborative care and enabling healthcare professionals to work with up-to-date patient data.

However, as the number of connected devices and the volume of health data increases, cybersecurity remains a critical concern. Healthcare systems are increasingly vulnerable to cyberattacks due to the widespread use of IoT devices. Experts from Healthcare IT News emphasize the importance of implementing robust cybersecurity protocols to safeguard patient data and ensure compliance with privacy regulations like HIPAA. This growing focus on data security reflects the need to protect sensitive health information amidst rapid digitalization.

In conclusion, the IoT in healthcare is revolutionizing patient care by making it more efficient, accessible, and personalized. The synergy between AI, Big Data, IoT, and cloud computing is reshaping how healthcare systems operate, from real-time monitoring and diagnostics to secure data sharing. However, to fully harness these benefits, healthcare providers must address the accompanying challenges, particularly in terms of cybersecurity.

Market Dynamics

Drivers

-

Driving Factors Behind the Growth of the IoT in the Healthcare Market Including Wearables, AI, Cloud Computing, and Telemedicine

The Internet of Things (IoT) in the healthcare market is driven by several factors that are transforming the industry. A primary driver is the increasing adoption of wearable health devices. According to studies, the number of connected devices is expected to surpass 1.2 billion units by 2025, reflecting the growing demand for remote patient monitoring, especially for chronic conditions like diabetes and cardiovascular diseases. These devices allow for continuous, real-time tracking of vital health metrics, improving patient care, and reducing hospital visits.

Another major driver is the advancement in AI and data analytics. IoT devices generate vast amounts of data, and AI is playing a pivotal role in analyzing this data to offer predictive insights and personalized care. Research published by PubMed suggests that AI algorithms can reduce hospital readmission rates by predicting patient deterioration, thus improving clinical outcomes and saving healthcare costs.

The integration of cloud computing with IoT devices is also propelling market growth. Cloud platforms provide scalable storage solutions and facilitate the seamless sharing of patient data across healthcare providers, enabling more collaborative care and improving workflow efficiency. The cloud-based architecture is essential for enabling interoperability between diverse healthcare systems.

Lastly, telemedicine growth is accelerating the use of IoT technologies. With the rise of remote consultations, IoT devices provide physicians with real-time data from patients, enhancing decision-making and reducing the need for in-person visits. The World Health Organization reports that telemedicine adoption has surged globally, particularly in rural and underserved areas, as a result of the COVID-19 pandemic.

Restraints

-

Data Privacy and Security Concerns

The increasing use of IoT devices in healthcare generates vast amounts of sensitive patient data, raising concerns about data breaches and cyberattacks. As healthcare systems become more interconnected, the risk of unauthorized access and misuse of data grows, leading to the need for stronger cybersecurity measures and compliance with regulations like HIPAA.

-

High Implementation Costs

The initial setup and maintenance of IoT healthcare systems, including wearable devices, sensors, and cloud infrastructure, can be costly. These expenses may pose a challenge for smaller healthcare providers or those in developing regions, where budgets for such advanced technologies are limited.

Key Segmentation

By Component

In 2023, Devices emerged as the dominant component in the IoT healthcare market, accounting for over 45.0% of the market share. The growing adoption of connected medical devices, including wearables, sensors, and diagnostic equipment, contributed significantly to this dominance. These devices enable real-time monitoring, providing valuable data for patient management, chronic disease monitoring, and personalized healthcare. The increasing demand for home healthcare and remote patient monitoring also bolstered the growth of this segment. Devices like smart thermometers, pulse oximeters, glucose monitors, and ECG monitors are becoming more sophisticated, further fueling their dominance.

The Services segment is anticipated to grow at the fastest rate within the IoT healthcare market. This includes installation, maintenance, and consulting services related to IoT devices and systems. The need for technical support and expert guidance for implementing IoT solutions across healthcare providers is on the rise. With healthcare providers increasingly leveraging IoT systems to manage large volumes of data, the service sector is expected to expand rapidly, with a growth rate projected at over 20% CAGR over the next few years.

By Application

In 2023, Telemedicine dominated the Application segment of the IoT healthcare market, accounting for more than 30.0% of the market share. The rise of telehealth services, accelerated by the COVID-19 pandemic and the need for remote care, significantly boosted the adoption of IoT-powered telemedicine solutions. IoT devices like remote patient monitoring systems and wearable health trackers play a key role in telemedicine by transmitting patient data to healthcare providers for virtual consultations. This segment is expected to maintain its strong dominance due to the growing preference for remote healthcare services.

The Patient Monitoring Application is the fastest-growing segment in the IoT healthcare market. The demand for real-time monitoring of patients with chronic conditions, elderly patients, and post-surgical recovery has surged. Devices such as continuous glucose monitors (CGM), wearable ECG monitors, and blood pressure monitors are becoming increasingly popular. The global shift towards preventive healthcare and chronic disease management is expected to propel this segment, with an anticipated growth rate of 18% CAGR in the coming years.

By End-User

The hospital's end-user segment was the leader in 2023, holding a market share of around 40.0%. IoT solutions in hospitals are used for a variety of purposes including patient monitoring, asset tracking, inventory management, and workflow optimization. The integration of IoT in hospitals enhances operational efficiency, reduces costs, and improves patient care. The increasing need for streamlined healthcare management systems in hospitals contributes significantly to this segment's dominance.

The Clinics segment is projected to grow the fastest in the IoT healthcare market, with an expected growth rate of 22% CAGR. The rise of connected health solutions in outpatient care and the increasing adoption of IoT devices by smaller healthcare facilities such as clinics are key drivers for this growth. Clinics are increasingly adopting IoT technologies for patient monitoring, managing chronic diseases, and improving care coordination. This trend is expected to accelerate due to the rising number of outpatient visits and the need for efficient care delivery systems in smaller healthcare settings.

Need any customization research on Internet of Things in Healthcare Market - Enquiry Now

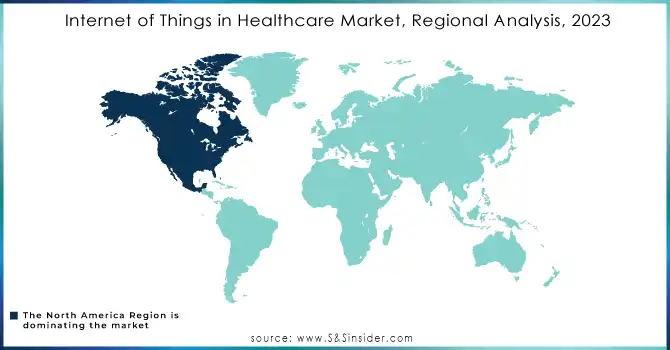

Regional Analysis

North America dominated the Internet of Things in the healthcare market in 2023, primarily driven by the U.S., where the adoption of IoT devices in healthcare is well-established. The U.S. healthcare system’s shift towards digital health, along with the country’s high healthcare expenditure, has created a robust environment for IoT solutions. The integration of wearables and AI in remote patient monitoring and chronic disease management is particularly prominent. Additionally, North America benefits from substantial investments in healthcare technology and supportive regulatory frameworks, including the Health Insurance Portability and Accountability Act (HIPAA), which ensures data privacy and security for IoT devices.

In Europe, the IoT healthcare market is also growing rapidly, driven by the increasing focus on telemedicine and remote patient monitoring. Countries like Germany, the UK, and France have invested heavily in digital health initiatives, leading to the widespread adoption of IoT-based solutions. The European Union’s Digital Health Strategy further enhances the growth potential of IoT by promoting interoperable systems and data-sharing frameworks. However, challenges related to data protection regulations, such as the General Data Protection Regulation (GDPR), have prompted stringent compliance requirements for IoT Applications in healthcare.

Asia-Pacific is expected to witness the fastest growth due to rising healthcare needs, increasing investment in healthcare infrastructure, and a rapidly growing tech-savvy population. Countries like China and India are embracing IoT to address challenges like urbanization and aging populations. Additionally, telemedicine growth during the COVID-19 pandemic has accelerated the use of IoT solutions across the region. However, cost concerns and infrastructure limitations remain significant challenges.

Key Players

-

Cisco - Cisco IoT healthcare solutions

-

IBM - Watson Health, IoT-enabled solutions

-

GE Healthcare - Edison Platform, IoT-enabled medical devices

-

Microsoft - Azure IoT for healthcare

-

SAP - SAP Leonardo IoT solutions for healthcare

-

Medtronic - IoT-enabled cardiac and diabetes devices

-

Royal Philips - Philips HealthSuite, Connected Care solutions

-

Resideo Technologies - IoT-based healthcare devices

-

Securitas - IoT security for healthcare facilities

-

Bosch - IoT-based health monitoring systems

-

Armis - IoT security platform for healthcare

-

Oracle - Cloud-based IoT healthcare solutions

-

PTC - ThingWorx IoT platform for healthcare

-

Huawei - IoT-enabled healthcare wearables

-

Siemens - Siemens Healthineers, IoT solutions for healthcare

-

R-Style Lab - IoT Application development for healthcare

-

HQSoftware - Custom IoT healthcare solutions

-

Oxagile - IoT healthcare software for remote monitoring

-

Softweb Solutions - IoT-based healthcare solutions

-

OSP Labs - IoT healthcare Applications s

-

Comarch SA - IoT-driven healthcare platforms

-

Telit - IoT connectivity solutions for healthcare

-

Kore Wireless - IoT connectivity for healthcare devices

-

ScienceSoft - IoT-powered healthcare monitoring systems

-

Intel - IoT solutions for healthcare devices and cloud

-

AgaMatrix - IoT-enabled glucose monitoring devices

-

Welch Allyn - IoT-connected vital sign monitors

-

AliveCor - IoT-enabled ECG monitors

-

Sensely - IoT-powered virtual healthcare assistants

-

Clover Health - IoT-driven health platform

Recent Development

-

In September 2023, Infosys announced an expansion of its strategic partnership with NVIDIA Corporation. This collaboration aims to leverage generative AI technologies and expertise to enhance productivity across various industries, including healthcare.

-

In January 2023, HARMAN, a subsidiary of Samsung, launched a new digital healthcare platform designed specifically for businesses in the healthcare and life sciences sectors. The platform aims to help companies improve customer experiences by integrating advanced healthcare solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 133.72 billion |

| Market Size by 2032 | US$ 668.98 billion |

| CAGR | CAGR of 19.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component [Devices, Software (Remote Device Management, Data Analytics, Compliance and Security, Asset Performance Management, Others (Data Storage, Electronic Health Record), Services] • By Application [Telemedicine, Patient Monitoring, Operations and Workflow Management, Remote Scanning, Sample Management, Others] • By End-User [Laboratory Research, Hospitals, Clinics, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco, IBM, GE Healthcare, Microsoft, SAP, Medtronic, Royal Philips, Resideo Technologies, Securitas, Bosch, Armis, Oracle, PTC, Huawei, Siemens, R-Style Lab, HQSoftware, Oxagile, Softweb Solutions, OSP Labs, Comarch SA, Telit, Kore Wireless, ScienceSoft, Intel, AgaMatrix, Welch Allyn, AliveCor, Sensely, Clover Health |

| Key Drivers | • Driving Factors Behind the Growth of the IoT in the Healthcare Market Including Wearables, AI, Cloud Computing, and Telemedicine |

| Restraints | • Data Privacy and Security Concerns • High Implementation Costs |